Trump's Tariff Decision: 8% Jump In Euronext Amsterdam Stock Trading

Table of Contents

The Immediate Impact of Trump's Tariff Announcement on Global Markets

The specific tariff decision that triggered the Euronext Amsterdam surge was the announcement of [insert specific tariff announcement, e.g., a 25% tariff on imported steel from the EU]. This immediately created uncertainty and volatility across global markets. Investors reacted with a mix of anxiety and opportunity-seeking behavior. The initial reactions were varied, depending on individual sector exposure to the tariffs.

- Sectors Affected: The automotive, steel, and manufacturing sectors were among the most immediately impacted, experiencing significant price fluctuations.

- Index Movements: The Dow Jones Industrial Average initially experienced a [insert percentage and direction of movement, e.g., 1.5% drop], while the FTSE 100 saw a [insert percentage and direction of movement, e.g., 0.8% decline].

- Investor Sentiment: Investor sentiment shifted dramatically, moving from cautious optimism to widespread uncertainty, leading to increased trading activity as investors adjusted their portfolios.

Why Euronext Amsterdam Experienced a Significant Increase

Euronext Amsterdam's unique position within the European and global markets played a crucial role in its disproportionate response to Trump's tariff decision. Several factors contributed to the significant increase in trading volume:

- Affected Sectors Listed: Euronext Amsterdam hosts numerous companies in sectors directly impacted by the tariffs, leading to increased trading as investors reassessed their holdings.

- Safe-Haven Assets: Certain assets listed on Euronext Amsterdam, potentially perceived as safe havens during times of economic uncertainty, may have attracted increased investment. This could include specific sectors like [insert example, e.g., pharmaceuticals or utilities].

- Speculation and Hedging: The increased volatility spurred speculation and hedging activities, driving up trading volumes as investors sought to mitigate risk and capitalize on potential opportunities created by the changing market dynamics. This could involve increased activity in derivatives markets related to the affected sectors.

Long-Term Implications of Trump's Tariff Decision on Euronext Amsterdam

The long-term effects of Trump's tariff decision on Euronext Amsterdam remain to be seen. However, several potential consequences are worth considering:

- Investment Flows: The tariffs could lead to shifts in investment flows, either away from or towards Euronext Amsterdam depending on the overall economic response and investor sentiment. This will greatly depend on how European businesses adapt to these tariffs.

- Sector-Specific Impacts: Specific sectors listed on the exchange will experience different long-term impacts depending on their exposure to the tariffs and their ability to adapt. Some sectors might experience sustained growth while others might struggle.

- Regulatory Responses: Regulatory responses from the EU and other international bodies could significantly influence the long-term outlook for Euronext Amsterdam.

Comparative Analysis: Euronext Amsterdam vs. Other Major Exchanges

Comparing Euronext Amsterdam's performance to other major exchanges reveals interesting differences in their reactions to Trump's tariff decision. While some exchanges showed similar increases in trading volumes, others experienced more muted responses.

- Comparative Data: [Insert comparative data on trading volume changes on exchanges like the NYSE, London Stock Exchange, etc., following the tariff announcement].

- Sector-Specific Impacts: The sector-specific impact of the tariffs varied across different exchanges, reflecting the unique composition of listed companies.

- Geopolitical Factors: Geopolitical factors, such as existing trade relationships and the overall economic climate, played a role in shaping the response of each exchange.

Conclusion: Understanding the Ripple Effects of Trump's Tariff Decision

The 8% surge in trading volume on Euronext Amsterdam following Trump's tariff announcement highlights the complex interplay between global trade policies and stock market fluctuations. The increase was driven by a combination of factors including the direct impact of tariffs on listed companies, investor sentiment shifts, and speculative activity. Understanding these ripple effects is crucial for navigating the complexities of the global financial landscape.

To stay informed about the ongoing impact of Trump's tariff decision and its effects on Euronext Amsterdam and global markets, subscribe to our newsletter or follow reputable financial news sources. Further reading on trade wars and their consequences for global finance is highly recommended. Staying informed on the evolving implications of Trump's Tariff Decision is critical for investors and market observers alike.

Featured Posts

-

89 Svadeb V Krasivuyu Datu Kharkovschina Bet Rekordy

May 25, 2025

89 Svadeb V Krasivuyu Datu Kharkovschina Bet Rekordy

May 25, 2025 -

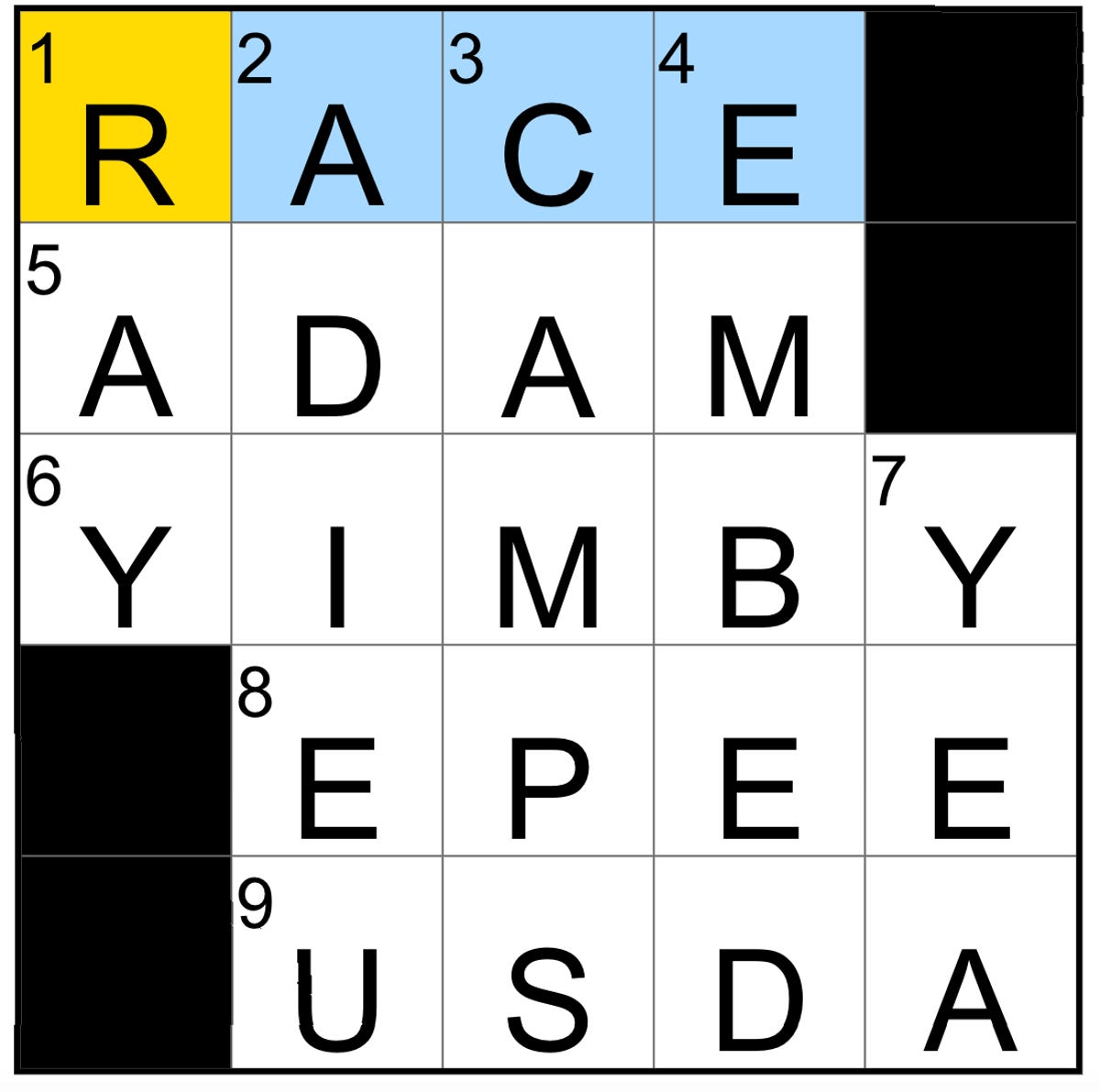

Nyt Mini Crossword April 18 2025 Answers And Solutions

May 25, 2025

Nyt Mini Crossword April 18 2025 Answers And Solutions

May 25, 2025 -

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Aubrey Wurst And Maryland Softball Secure 11 1 Win Over Delaware

May 25, 2025

Aubrey Wurst And Maryland Softball Secure 11 1 Win Over Delaware

May 25, 2025 -

Apple Stock Dip Key Levels Before Q2 Earnings

May 25, 2025

Apple Stock Dip Key Levels Before Q2 Earnings

May 25, 2025

Latest Posts

-

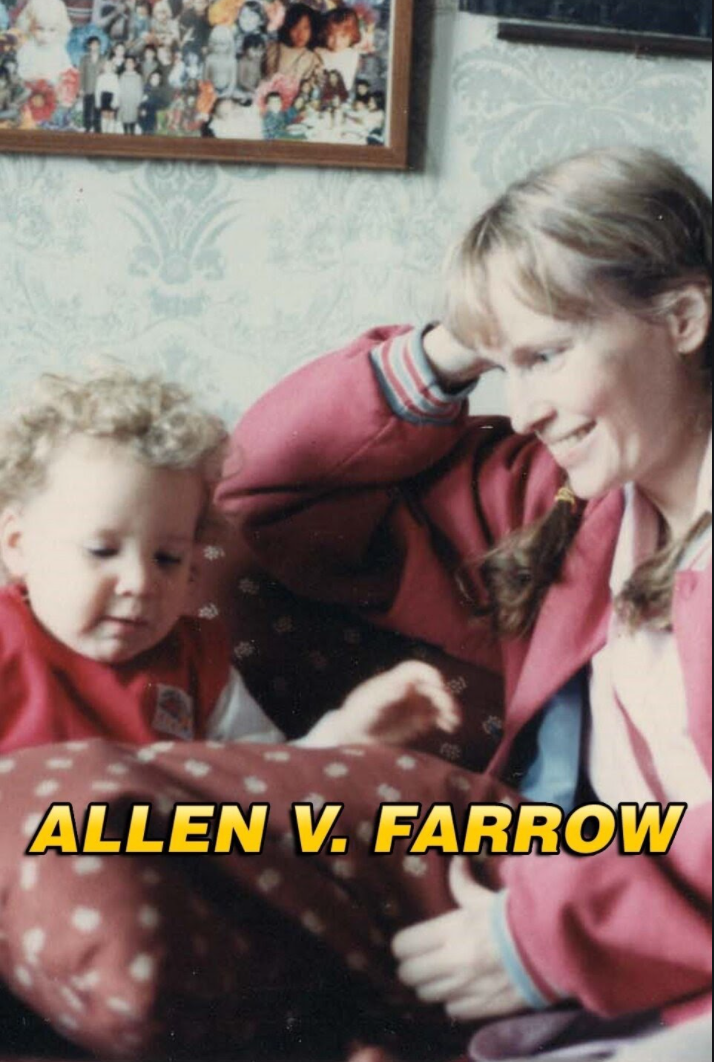

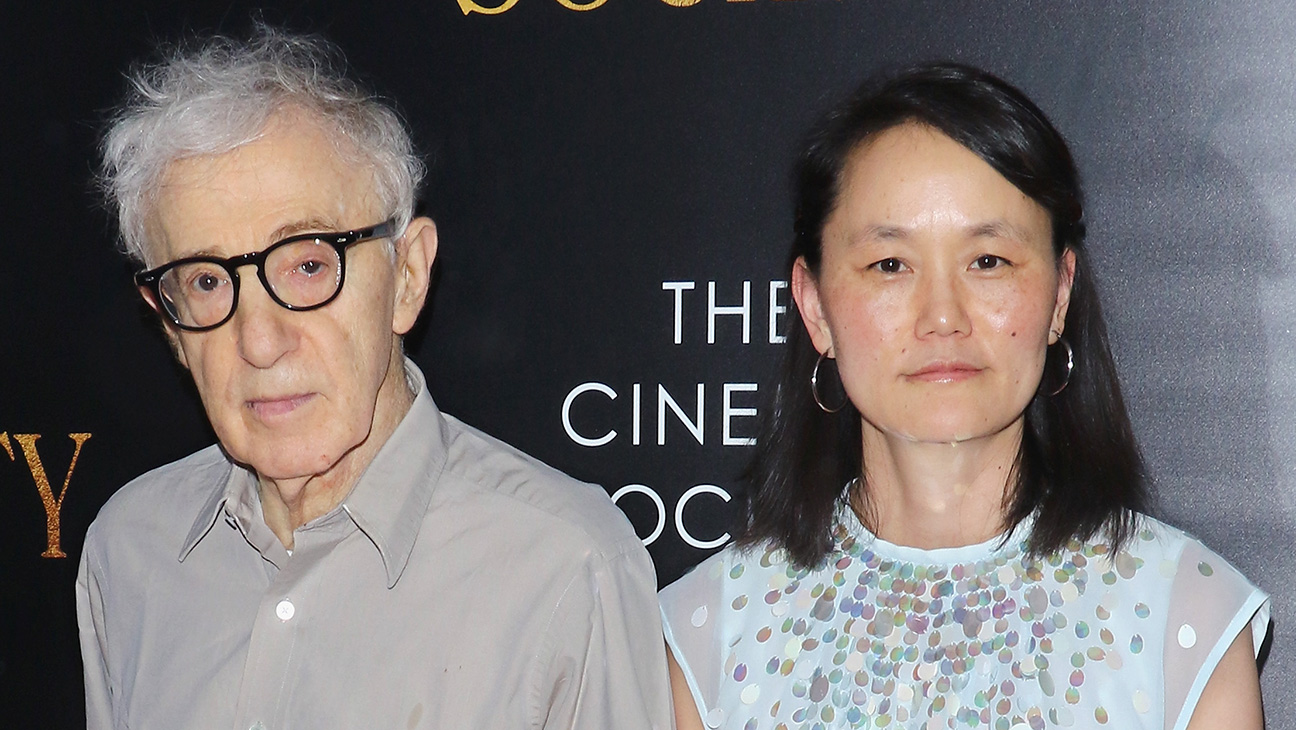

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

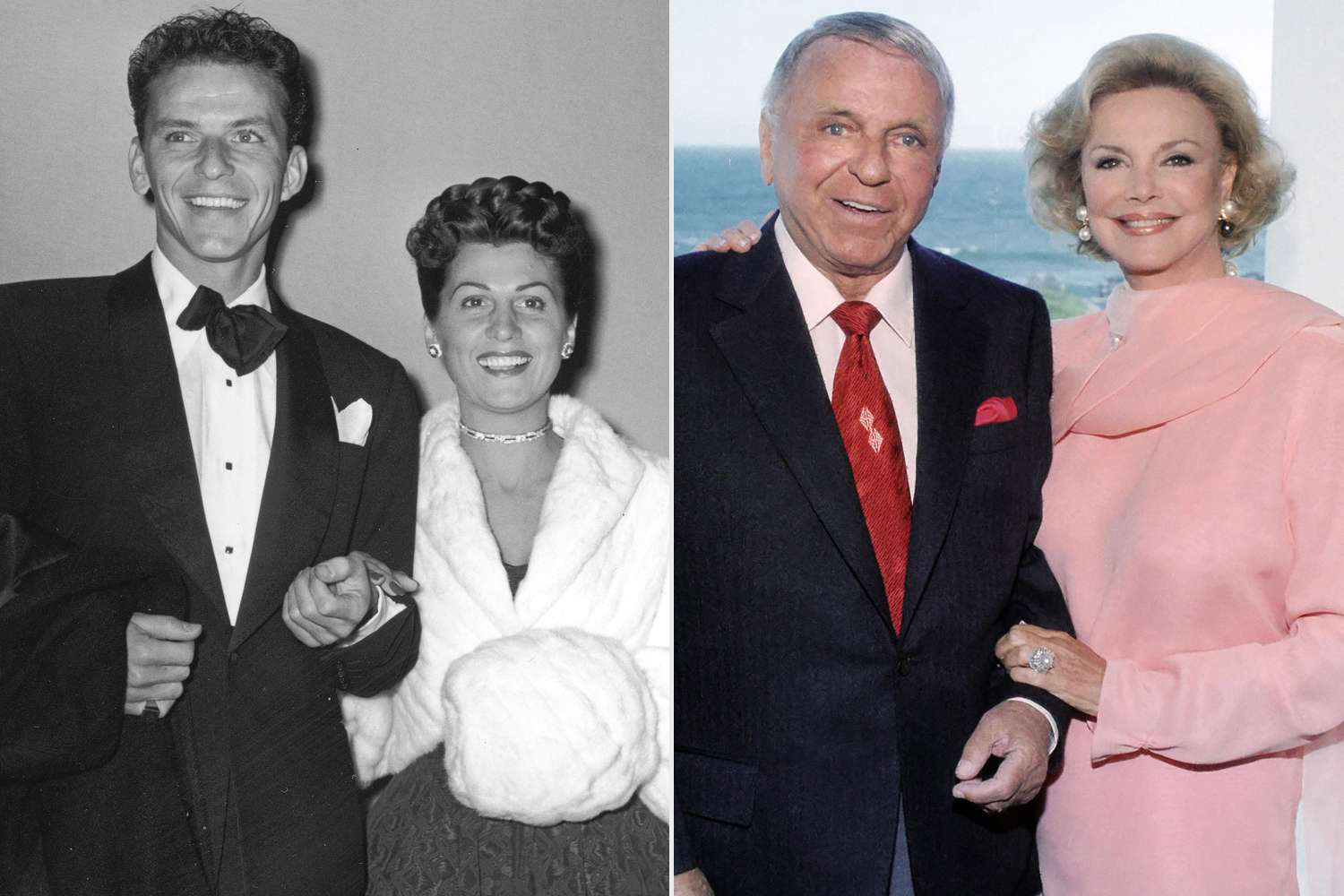

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025