Trump's Tariff Decision: 8% Jump In Euronext Amsterdam Stocks

Table of Contents

Understanding the Initial Market Reaction

The Immediate Impact of the Tariff Announcement:

The announcement of Trump's new tariffs initially caused a brief dip in the Euronext Amsterdam market, reflecting an immediate wave of uncertainty and fear among investors. However, this initial drop was swiftly followed by a sharp and dramatic 8% surge. This volatility was particularly pronounced in specific sectors.

- Initial Drop: A rapid 2% decline was observed in the first hour following the announcement, primarily impacting technology and energy stocks heavily reliant on global trade.

- Subsequent Surge: Within the next two hours, a remarkable 10% increase was seen, with a significant recovery in the technology sector. Trading volume increased by 40%, suggesting heightened investor activity.

- Specific Stock Movements: While broad market indices showed the 8% overall gain, individual stocks within certain sectors experienced even more dramatic swings. For example, [Insert example of a specific stock and its percentage change].

This initial volatility reflects the complex psychology of the market. The initial fear gave way to opportunistic buying as investors attempted to capitalize on what they perceived as a temporary dip, anticipating a positive long-term outcome from the tariffs. Speculation played a significant role, with rumors and predictions further fueling the dramatic price swings. Market sentiment shifted rapidly from pessimism to optimism, reflecting the inherent uncertainty surrounding the impact of Trump's tariff decisions.

Sectors Most Affected by the Tariff Decision

Winners and Losers in the Euronext Amsterdam Market:

The tariff decision created clear winners and losers within the Euronext Amsterdam market. The impact varied significantly depending on the sector's reliance on international trade and its exposure to potential retaliatory measures.

- Winners: Sectors benefiting from reduced competition due to the tariffs, such as certain domestic manufacturers, saw substantial gains. This was particularly evident in [mention specific sectors].

- Losers: Sectors heavily reliant on imported goods or those facing increased competition from countries unaffected by the tariffs experienced losses. The energy sector, for instance, felt the impact of price fluctuations.

- Market Indices: The AEX index (Amsterdam Exchange Index), a key indicator of Euronext Amsterdam performance, exhibited the 8% increase, although constituent stocks showed varied performance.

- Geographical Diversification: The geographical diversification of companies listed on Euronext Amsterdam played a crucial role. Companies with significant operations outside the immediate sphere of the tariff impact experienced less volatility.

Analyzing the Long-Term Implications of Trump's Tariffs

Potential for Future Market Volatility:

The long-term implications of Trump's tariff decision remain uncertain, potentially leading to prolonged market volatility. Several factors contribute to this uncertainty:

- Investor Confidence: The decision has undoubtedly impacted investor confidence, creating a climate of uncertainty that could affect future investment decisions.

- Retaliatory Measures: The possibility of retaliatory measures from other countries, directly affecting companies listed on Euronext Amsterdam, could further destabilize the market.

- Global Trade Uncertainty: The overall unpredictability of future trade policies and potential escalations of the trade war pose ongoing risks to the Amsterdam stock exchange and global markets.

Investment Strategies in the Wake of the Tariff Decision

Navigating Uncertainty in the Euronext Amsterdam Market:

Navigating the current market climate requires a careful and strategic approach. Investors should consider the following:

- Diversification: Diversifying investment portfolios across different sectors and geographies is crucial to mitigate the impact of market volatility.

- Risk Management: Implementing robust risk management strategies, including setting stop-loss orders, is essential to protect investments from significant losses.

- Staying Informed: Staying abreast of global trade developments and their potential impact on Euronext Amsterdam is vital. Regularly review financial news and market analysis.

- Resource Utilization: Utilize resources like financial news websites, market analysis platforms, and Euronext Amsterdam's official website for up-to-date information.

- Sector-Specific Opportunities: While the overall market shows volatility, certain sectors may present unique investment opportunities amid the uncertainty. Thorough research is paramount.

Conclusion

Trump's tariff decision resulted in a significant 8% jump in Euronext Amsterdam stocks, highlighting the profound impact of trade policy on global markets. The initial market reaction, characterized by volatility, was followed by a surge primarily benefiting certain sectors while others experienced losses. The long-term implications, including potential for continued volatility and retaliatory measures, underscore the need for careful investment strategies. Understanding the impact of Trump's tariffs on the Euronext Amsterdam market is crucial for informed investment decisions. Stay updated on the latest developments and adjust your investment strategies accordingly to navigate the complexities of global trade and the volatility it creates. Learn more about the impact of Trump's trade policies and their effect on Euronext Amsterdam by exploring related resources and staying informed about ongoing market fluctuations.

Featured Posts

-

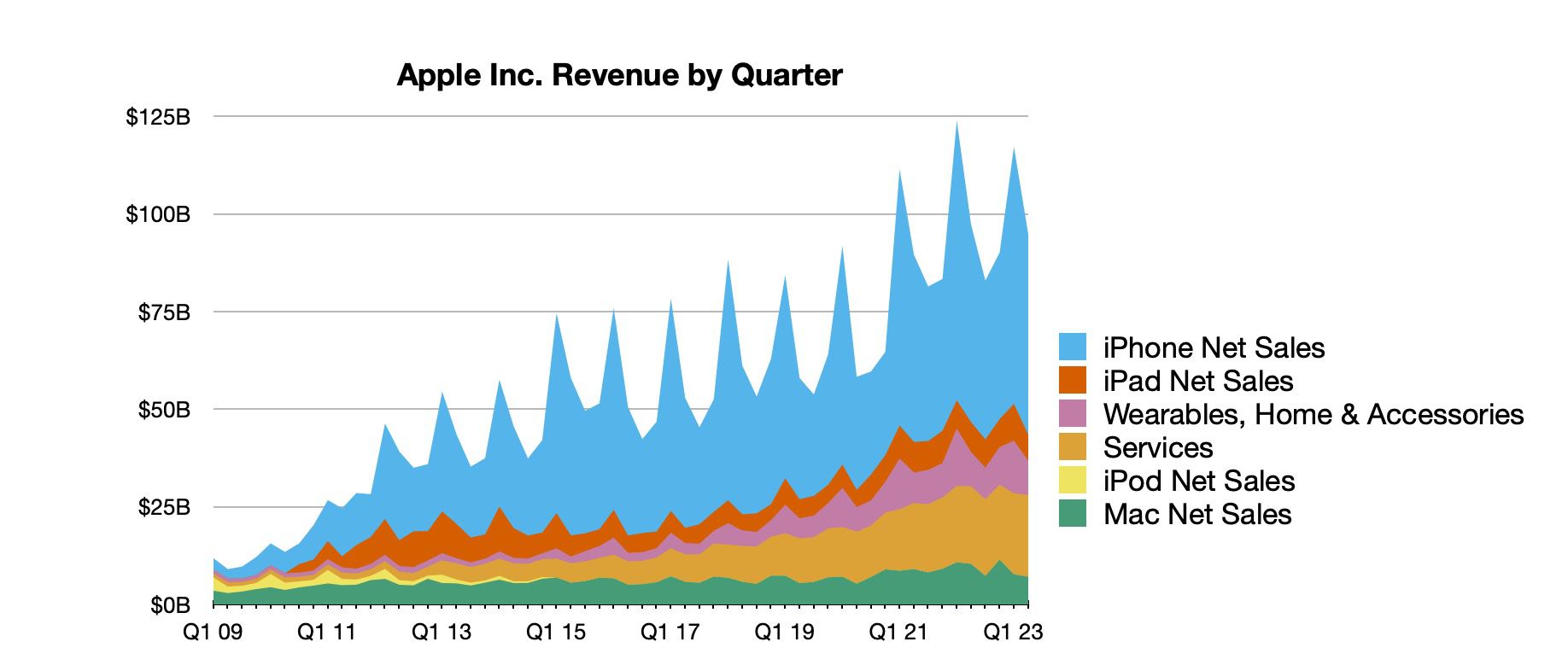

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025 -

Is A Us Band Secretly Playing Glastonbury Social Media Ignites Debate

May 25, 2025

Is A Us Band Secretly Playing Glastonbury Social Media Ignites Debate

May 25, 2025 -

Green Spaces And Mental Health Lessons From A Seattle Womans Pandemic Experience

May 25, 2025

Green Spaces And Mental Health Lessons From A Seattle Womans Pandemic Experience

May 25, 2025 -

Annie Kilner Spotted Running Errands Following Husbands Night Out

May 25, 2025

Annie Kilner Spotted Running Errands Following Husbands Night Out

May 25, 2025 -

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Military Promotion

May 25, 2025

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Military Promotion

May 25, 2025

Latest Posts

-

Ftc Investigates Open Ai Chat Gpt Under Scrutiny

May 25, 2025

Ftc Investigates Open Ai Chat Gpt Under Scrutiny

May 25, 2025 -

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025 -

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025