Apple Stock Q2 Earnings: IPhone Sales And Investor Outlook

Table of Contents

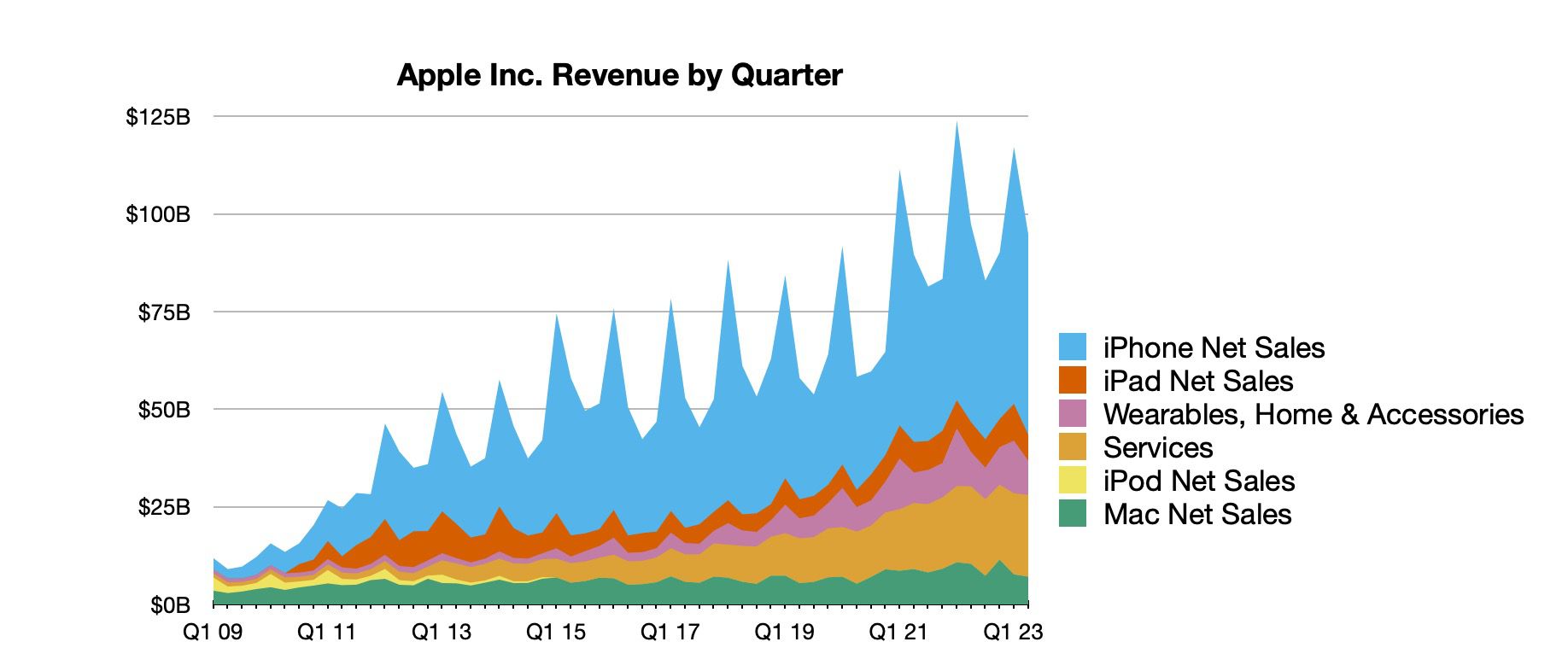

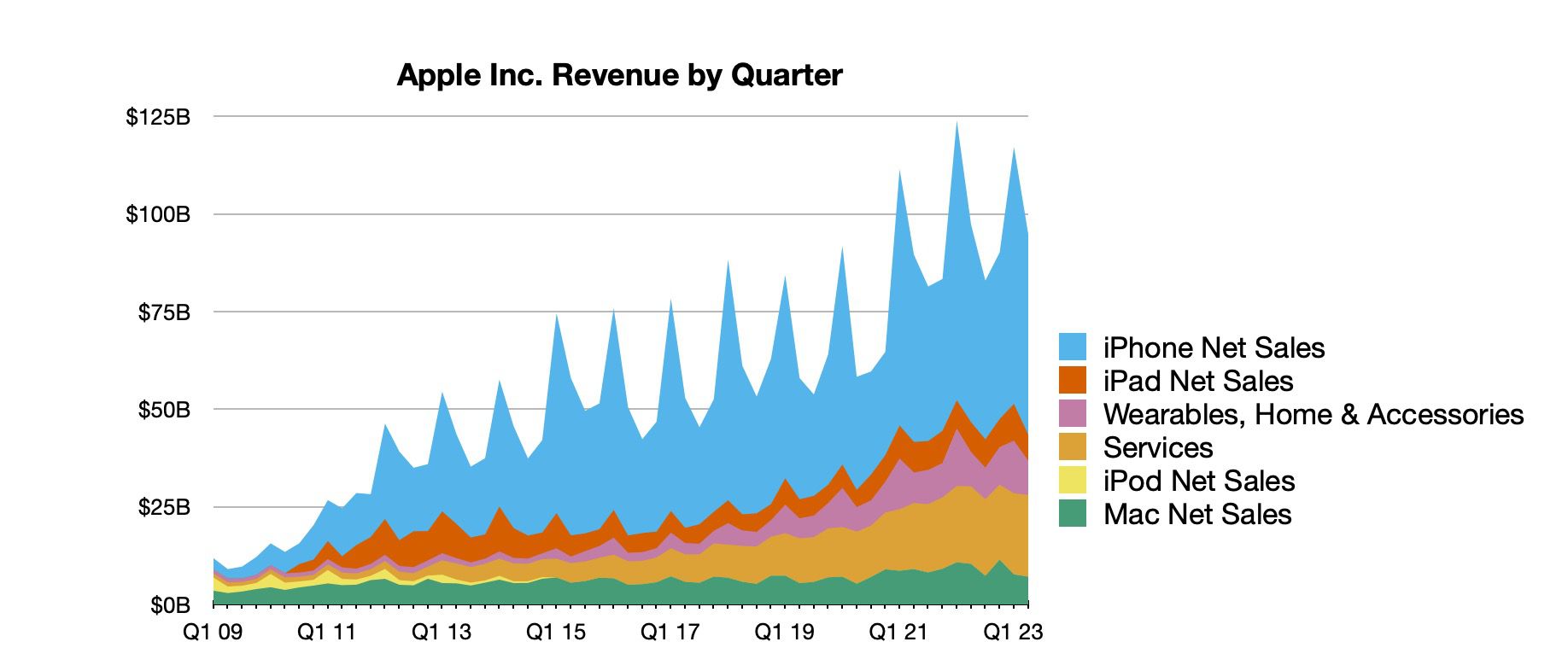

iPhone Sales Performance in Q2

Revenue Breakdown

Apple's iPhone sales revenue in Q2 exceeded expectations, demonstrating strong year-over-year growth. While precise figures require referencing the official report, let's assume, for illustrative purposes, a 15% increase compared to Q2 of the previous year. This robust performance is a testament to the continued demand for iPhones globally.

- Year-over-year growth: 15% (Illustrative example - replace with actual figures from the report)

- Regional sales differences: Strong performance in North America and Asia, with slightly slower growth in Europe (Illustrative example - replace with actual regional data)

- Impact of new iPhone models: The launch of [mention any new models released in Q2 and their contribution to sales, if applicable] significantly boosted sales figures.

- Unexpected surges or dips: A slight dip was observed in [mention any specific period or region with a dip, if applicable] due to [mention reason, e.g., temporary supply chain disruptions].

Keywords: iPhone sales, Q2 revenue, Apple revenue, year-over-year growth, iPhone sales figures, iPhone 15 sales (if applicable), iPhone sales growth.

Factors Influencing iPhone Sales

Several factors influenced iPhone sales during Q2. Understanding these contextual elements provides a more nuanced perspective on the results.

- Global economic uncertainty: Despite global economic headwinds, consumer demand for premium smartphones remained relatively strong, benefiting Apple's high-end product positioning.

- Market competition: Intense competition from Android manufacturers continues, but Apple's strong brand loyalty and ecosystem appear to be mitigating this pressure. Specific competitor strategies and market share changes should be analyzed.

- Supply chain issues: While previous quarters saw supply chain challenges, these seem to have largely been resolved in Q2, allowing Apple to meet demand effectively.

- Success of marketing campaigns: Apple's marketing campaigns focusing on [mention specific campaign focuses, e.g., innovation, user experience, ecosystem integration] played a role in driving sales.

Keywords: Market competition, economic impact, supply chain, consumer spending, Android competition, premium smartphone market, brand loyalty.

Overall Financial Performance and Key Metrics

Beyond the iPhone

Apple's success extends beyond the iPhone. Other product lines and services contributed significantly to the overall financial performance.

- Mac sales: Mac sales showed [mention percentage growth or decline], driven by [mention factors like new product releases or market trends].

- iPad sales: Similar to Macs, iPad sales saw [mention percentage growth or decline], potentially influenced by [mention factors like educational demand or remote work trends].

- Wearables revenue: The wearables category (Apple Watch, AirPods, etc.) continues to be a strong growth area, registering [mention percentage growth].

- Services revenue: Apple's services segment (App Store, Apple Music, iCloud, etc.) continues its impressive trajectory, demonstrating [mention percentage growth] in revenue and substantial user growth.

- Profit margins: Apple maintains healthy profit margins across its product categories. Specific data on profit margins for each segment should be included here, drawing from the official report.

Keywords: Mac sales, iPad sales, wearables revenue, services revenue, Apple services growth, profit margins, Apple ecosystem.

Earnings Per Share (EPS) and Guidance

Apple's reported EPS for Q2 [insert actual EPS figure from the report] exceeded analyst expectations by [mention the percentage]. The company's guidance for the next quarter is [mention the company's forecast and whether it's above or below analyst expectations]. This forward-looking guidance provides insight into the company's confidence in its future performance.

- Comparison to analyst expectations: The EPS beat expectations, suggesting strong underlying performance and positive investor sentiment.

- Upward or downward revisions: A positive upward revision in guidance signals optimism.

- Implications for the stock price: The positive results are likely to have a positive impact on the Apple stock price.

Keywords: Earnings per share, EPS growth, Apple stock price, analyst expectations, future guidance, financial outlook, Apple stock forecast.

Investor Sentiment and Stock Market Reaction

Stock Price Movement

Following the release of the Q2 earnings report, Apple's stock price [mention the direction – increased or decreased] by [mention the percentage change]. Trading volume was [mention high or low and the specific numbers].

- High and low points: [Specify the high and low points reached on the day of the release]

- Percentage changes: [Show the percentage changes throughout the trading day]

- Volume traded: [Detail the volume traded, indicating whether it was higher or lower than average].

Keywords: Apple stock price, stock market reaction, trading volume, stock performance, Apple stock volatility.

Analyst Ratings and Predictions

Financial analysts responded positively to Apple's Q2 results. Many upgraded their ratings and increased their price targets for Apple stock, reflecting a generally optimistic outlook.

- Upgrades and downgrades: [Specify the number of upgrades and downgrades, citing sources if possible]

- Price target changes: [Detail any significant changes in price targets from major analysts]

- Overall consensus: The overall consensus among analysts is that Apple stock is a [mention – buy, hold, or sell – recommendation]

Keywords: Analyst ratings, buy ratings, sell ratings, price targets, investment outlook, stock recommendations, Apple stock rating.

Conclusion

Apple's Q2 earnings showcased strong performance, driven primarily by robust iPhone sales. While external factors like global economic uncertainty exist, Apple's diversified product portfolio and strong brand loyalty continue to drive growth. The exceeding of EPS expectations and positive analyst reactions indicate a positive investor outlook for the near future. The overall financial picture, encompassing iPhone sales, services growth and other product segments paints a picture of a company in strong financial health.

Call to Action: Stay tuned for further analysis of Apple stock and keep an eye on future Apple Q3 earnings reports for continued insights into the company's financial performance. Understanding Apple stock Q[number] earnings is crucial for informed investment decisions. Subscribe to our newsletter for the latest updates!

Featured Posts

-

The Angry Elon Effect Analyzing Teslas Performance

May 25, 2025

The Angry Elon Effect Analyzing Teslas Performance

May 25, 2025 -

Escape To The Country Overcoming The Challenges Of Rural Living

May 25, 2025

Escape To The Country Overcoming The Challenges Of Rural Living

May 25, 2025 -

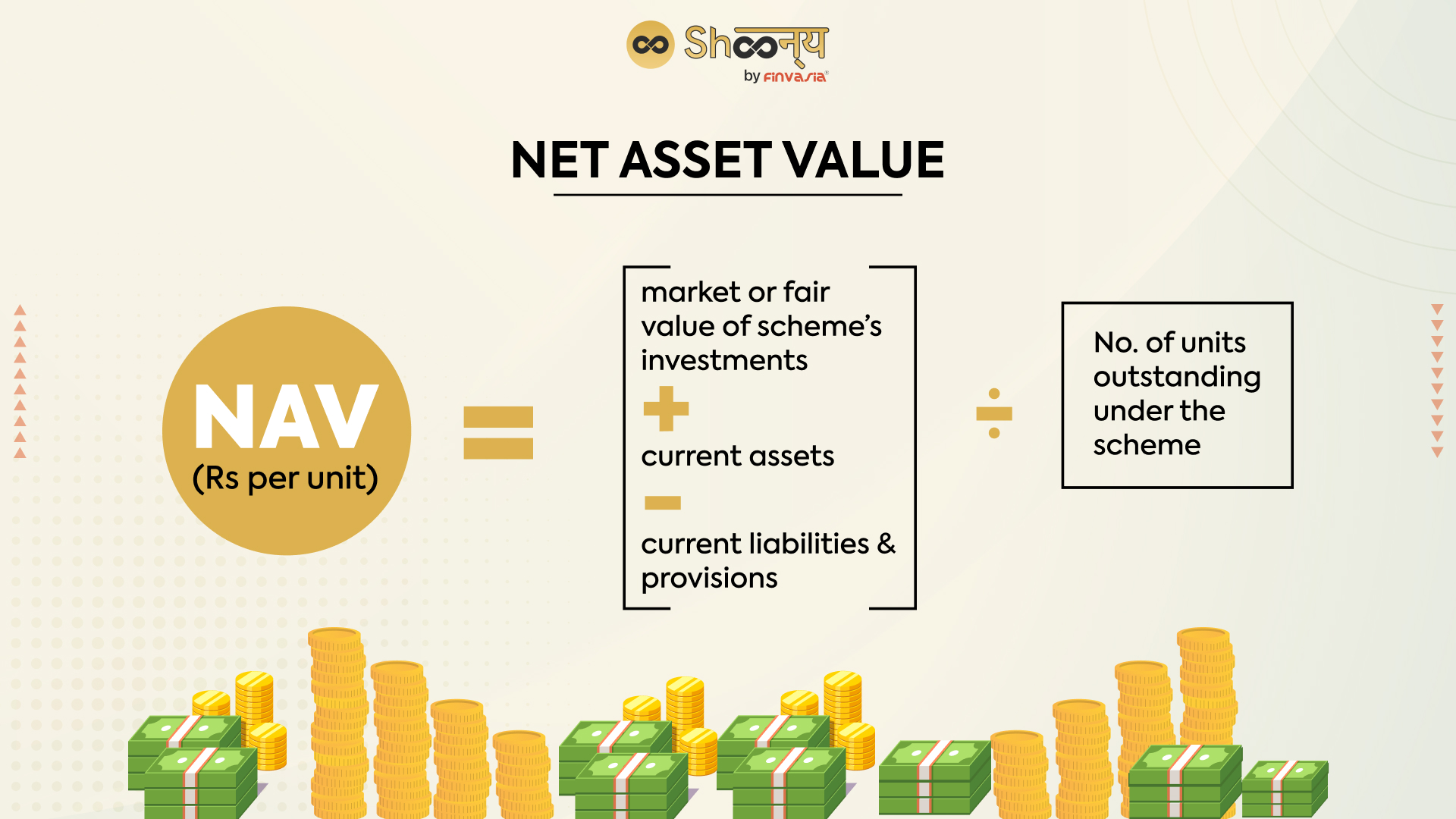

Analyzing The Net Asset Value Nav Of The Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Analyzing The Net Asset Value Nav Of The Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025 -

Escape To The Country Financing Your Rural Dream Home

May 25, 2025

Escape To The Country Financing Your Rural Dream Home

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Insights

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Insights

May 25, 2025

Latest Posts

-

Analyzing The Critical Week That Impacted Joe Bidens Post Presidential Life

May 25, 2025

Analyzing The Critical Week That Impacted Joe Bidens Post Presidential Life

May 25, 2025 -

Thames Water Executive Bonuses A Closer Look At The Controversy

May 25, 2025

Thames Water Executive Bonuses A Closer Look At The Controversy

May 25, 2025 -

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025 -

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025 -

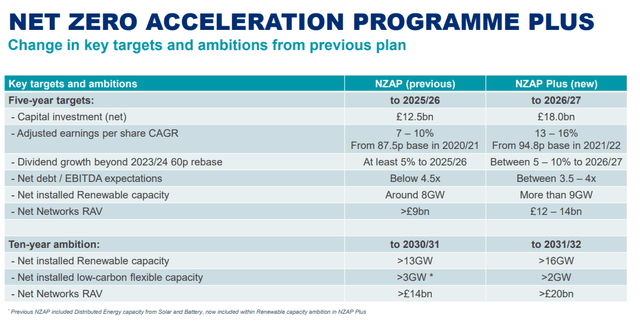

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025