Trump's Tariff Threat: Commercial Aircraft And Engines At Risk

Table of Contents

Boeing's Vulnerability to Trump's Tariffs

Boeing, a cornerstone of the American aerospace industry, found itself deeply entangled in the web of Trump's tariff policies. The increased costs and retaliatory measures significantly impacted its operations and competitiveness.

Increased Costs of Imported Parts

Tariffs imposed on imported parts, crucial for Boeing's aircraft production, drastically increased manufacturing costs. These tariffs targeted components sourced from various countries, including Canada and members of the European Union.

- Aluminum and titanium: Significant portions of these essential materials were imported, leading to substantial price increases. Estimates suggest a potential cost increase of several hundred dollars per aircraft.

- Advanced composites: Carbon fiber and other composite materials, vital for modern aircraft design, also faced increased import duties, further escalating production expenses.

- Electronic components: Numerous electronic components sourced from various countries were affected, impacting the overall cost of assembly and potentially delaying production schedules.

These increased costs directly affected Boeing's competitiveness in the global market, making its aircraft less attractive compared to its main competitor, Airbus.

Retaliatory Tariffs from Trading Partners

Trump's tariffs weren't met with passive acceptance. Trading partners retaliated with their own tariffs, impacting Boeing's sales and market share.

- European Union tariffs: The EU imposed retaliatory tariffs on various Boeing aircraft models, impacting sales in a key market. This reduced Boeing's market share and revenue, further exacerbating the financial strain caused by increased production costs.

- Canadian tariffs: Similarly, Canada imposed retaliatory tariffs, further reducing Boeing's access to the North American market and damaging its overall market position.

- Loss of market share: The combined effect of increased production costs and retaliatory tariffs significantly reduced Boeing's competitiveness, leading to a loss of market share to Airbus, which benefited from less restrictive trade environments.

The Impact on Engine Manufacturers

The impact of Trump's tariff threat wasn't limited to airframe manufacturers like Boeing. Engine manufacturers, such as GE Aviation and Rolls-Royce, also faced significant challenges. Their complex global supply chains were particularly vulnerable.

Disruption of Global Supply Chains

Engine manufacturing relies on a sophisticated network of international suppliers. Trump's tariffs created significant disruptions in these already intricate supply chains.

- Titanium sourcing: The imposition of tariffs on titanium imports from specific countries hampered the availability of this critical material for engine components.

- Precision machining: Many engine parts require specialized machining, often outsourced internationally. Tariffs increased the cost of these services, impacting production efficiency and profitability.

- Supply chain delays: Tariffs caused delays in the delivery of essential components, impacting overall engine production schedules and potentially leading to project delays for airlines.

Increased Prices and Reduced Competitiveness

The increased costs of production were inevitably passed on to airlines, impacting airfares and overall profitability.

- Higher engine costs: Airlines faced higher prices for new engines and maintenance services, directly affecting their operating budgets and profitability.

- Reduced airline profitability: The reduced profitability of airlines could lead to decreased aircraft orders, impacting the demand for both airframes and engines, further affecting the aviation industry.

- Industry consolidation: The challenging economic climate caused by increased tariffs could potentially lead to consolidation or restructuring within the engine manufacturing sector.

The Broader Economic Consequences

Trump's tariff policies had far-reaching consequences, extending beyond the aircraft and engine industries. The economic ripple effects were significant.

Job Losses and Economic Uncertainty

The combined effect of reduced production, decreased investment, and increased costs led to job losses across the aviation industry and related sectors.

- Manufacturing jobs: Reduced aircraft and engine production resulted in direct job losses in manufacturing plants across the globe.

- Supply chain jobs: Disruptions to supply chains further impacted jobs in related industries, including component manufacturing and logistics.

- Aerospace engineering jobs: Reduced investment in research and development potentially impacted job opportunities for engineers and other highly skilled professionals.

Impact on Air Travel and the Global Economy

Higher airfares, reduced air travel, and disruptions to global trade significantly impacted the global economy.

- Reduced tourism: Higher airfares negatively impacted international tourism, affecting local economies reliant on tourism revenue.

- Disrupted trade: Delays in air freight and increased costs hampered international trade, further damaging global economic growth.

- Global economic slowdown: The overall impact on various sectors contributed to a potential slowdown in global economic growth, exacerbating existing economic challenges.

The Lasting Shadow of Trump's Tariff Threat on Commercial Aviation

Trump's tariff policies had a profound and lasting negative impact on the commercial aircraft and engine industry. The increased costs, retaliatory tariffs, and disruptions to global supply chains significantly affected Boeing, engine manufacturers, and the broader global economy. These protectionist trade measures clearly posed a significant risk to the sector's stability and competitiveness. Analyzing the ongoing effects of Trump's tariff policies is crucial for understanding the risks of protectionist trade measures on commercial aviation and mitigating future threats to the commercial aircraft industry through sound trade practices. Learn more about the impact of trade policies on global industries and advocate for policies that promote free and fair trade.

Featured Posts

-

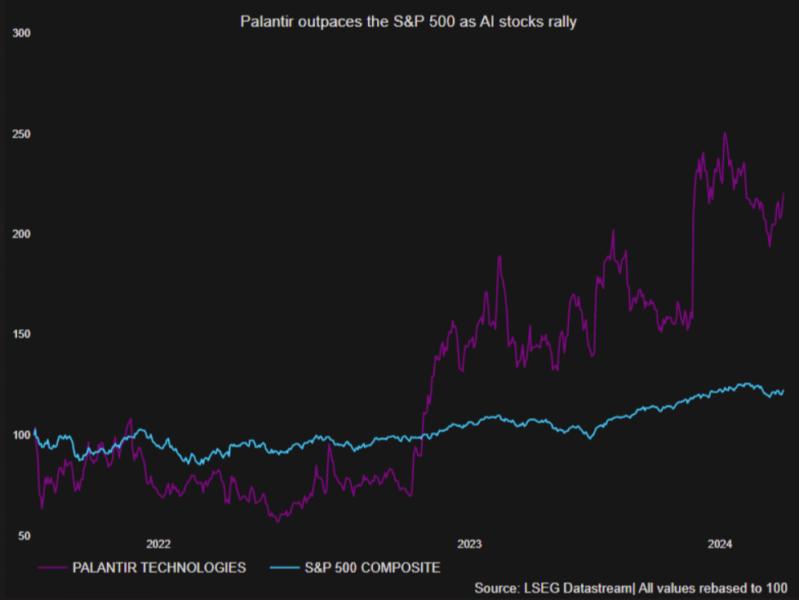

Is Palantir Stock A Good Investment In 2024 A Detailed Look

May 10, 2025

Is Palantir Stock A Good Investment In 2024 A Detailed Look

May 10, 2025 -

Nyt Strands Today April 1 2025 Clues And Hints

May 10, 2025

Nyt Strands Today April 1 2025 Clues And Hints

May 10, 2025 -

West Ham Face 25m Financial Challenge Potential Solutions Explored

May 10, 2025

West Ham Face 25m Financial Challenge Potential Solutions Explored

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Defeat And Future Strategies

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Defeat And Future Strategies

May 10, 2025 -

How Will West Ham Overcome Their 25m Financial Problem

May 10, 2025

How Will West Ham Overcome Their 25m Financial Problem

May 10, 2025