Trump's Tariffs Trigger 2% Drop In Amsterdam Stock Exchange

Table of Contents

Direct Impact of Tariffs on Dutch Businesses

The Trump administration's tariffs directly affected several key sectors of the Dutch economy, leading to decreased exports and increased import costs. This had a tangible impact on the AEX index, reflecting the financial struggles faced by numerous Dutch companies.

- Agriculture: Dutch agricultural exports, renowned globally for their quality, faced significant challenges due to increased tariffs imposed by the US. Dairy products and horticultural goods were particularly affected, leading to reduced profits and impacting the share prices of related companies.

- Technology: The technology sector, a significant contributor to the Dutch economy, also experienced difficulties. Increased import costs for components and raw materials, coupled with reduced export opportunities to the US market, squeezed profit margins and weighed on investor confidence in tech companies listed on the AEX.

Specific examples include:

- FrieslandCampina: This dairy giant, a major player on the AEX, reported a decrease in profits due to reduced US exports.

- ASML Holding: Although less directly affected by tariffs on finished goods, ASML, a leading semiconductor equipment manufacturer, faced challenges due to indirect impacts on its supply chain and customer demand.

Keywords: Dutch economy, export impact, import costs, tariff consequences, AEX index.

Investor Sentiment and Market Volatility

The announcement and implementation of Trump's tariffs created a climate of uncertainty and fear among investors, triggering a sell-off in the Amsterdam Stock Exchange. This negative investor sentiment directly translated into increased selling pressure, driving down the AEX index.

- Uncertainty and Fear: The unpredictable nature of the trade war fueled concerns about future economic prospects, leading investors to seek safer investment options.

- Selling Pressure: As investors sought to reduce their exposure to risk, they sold off stocks, contributing to the market decline.

- Amplified Negativity: Media coverage played a crucial role in amplifying the negative sentiment, further exacerbating the sell-off. Negative news headlines created a self-fulfilling prophecy, as more investors reacted to perceived risks. Increased trading volume during this period underscored the heightened market activity driven by fear.

Keywords: investor confidence, market uncertainty, stock market volatility, trading volume, AEX performance.

Global Economic Spillover Effects

The US-initiated trade war didn't remain confined to bilateral relations. The interconnected nature of global finance meant that the negative impacts rippled across international markets, influencing the AEX indirectly.

- Interconnected Markets: The global economy is highly interconnected. Negative news from one major market, such as a significant drop in US stock indices due to trade war anxieties, can quickly spread to others.

- Market Contagion: The fear and uncertainty surrounding the trade war created a sense of market contagion, where negative sentiment spread rapidly from one exchange to another.

- Similar Drops Globally: Many global stock exchanges experienced similar drops during the same period, reflecting the widespread concern about the potential for a global economic slowdown.

Keywords: global trade, interconnected markets, economic uncertainty, international finance, market contagion.

The Role of the Euro

The fluctuating Euro/Dollar exchange rate further complicated the situation for Dutch companies. The weakening of the Euro against the Dollar amplified the impact of tariffs on import costs for Dutch businesses purchasing goods from the US, while strengthening the Dollar made Dutch exports to the US less competitive.

Keywords: EUR/USD exchange rate, currency fluctuations, foreign exchange market.

Conclusion: Understanding the Ripple Effects of Trump's Tariffs on the Amsterdam Stock Exchange

The 2% drop in the AEX was a multifaceted event, stemming from a combination of factors: the direct impact of tariffs on key Dutch industries, the resulting negative investor sentiment and market volatility, and the broader global economic spillover effects. This event highlighted the interconnected nature of the global economy and the significant consequences of protectionist trade policies. Understanding these ripple effects is crucial for navigating the complexities of international finance and making informed investment decisions. Stay informed about the ongoing impact of Trump's tariffs and their potential consequences on the Amsterdam Stock Exchange by following [link to relevant financial news source or your website]. Keywords: Trump tariffs impact, Amsterdam Stock Exchange analysis, market outlook.

Featured Posts

-

Trade War Fears Trigger 7 Plunge In Amsterdam Stock Market

May 24, 2025

Trade War Fears Trigger 7 Plunge In Amsterdam Stock Market

May 24, 2025 -

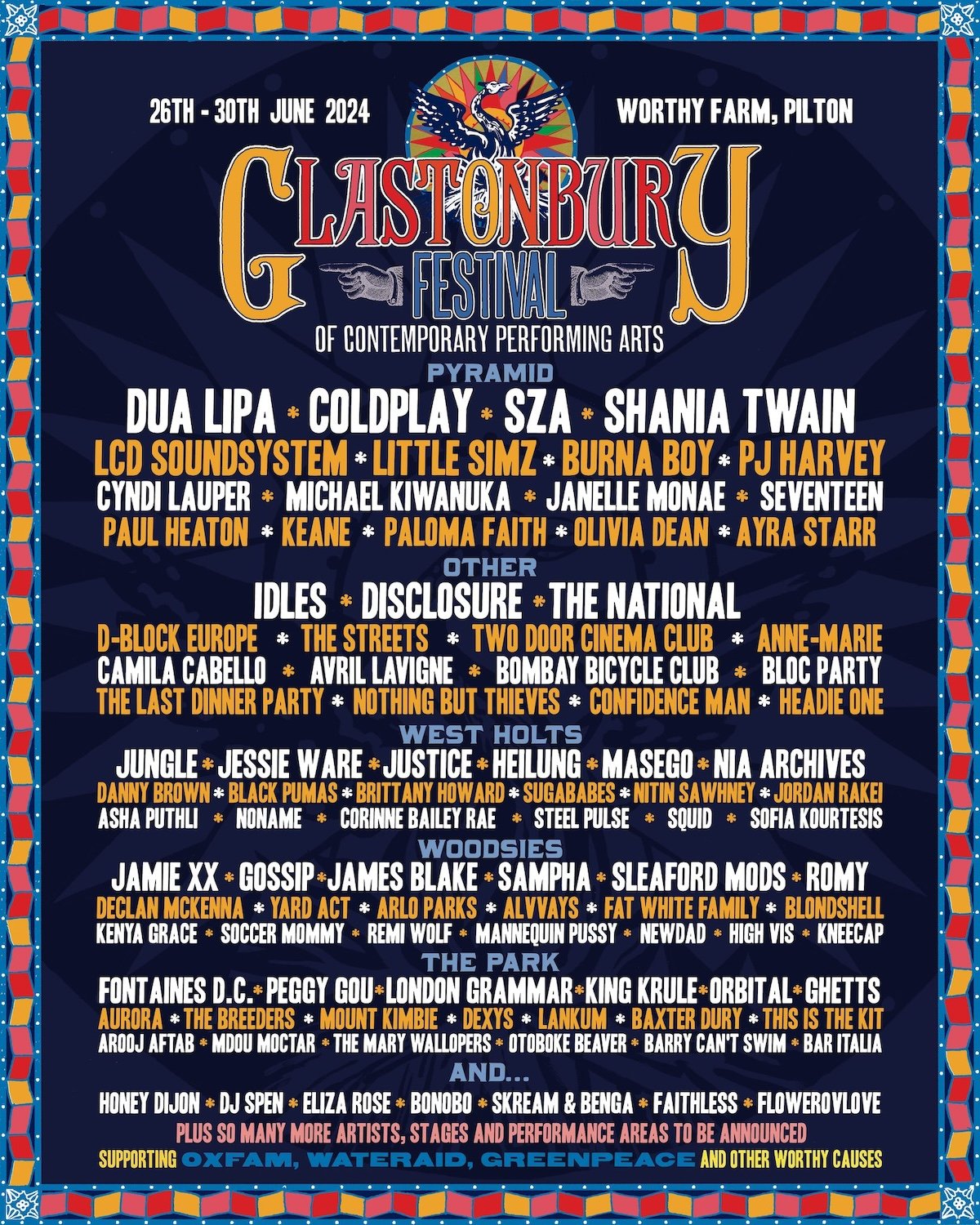

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025 -

Nrw Eis Ranking Essen Enthuellt Den Ueberraschenden Sieger

May 24, 2025

Nrw Eis Ranking Essen Enthuellt Den Ueberraschenden Sieger

May 24, 2025 -

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025 -

1 08 Euro Live Markt Analyse Kapitaalmarktrente Ontwikkeling

May 24, 2025

1 08 Euro Live Markt Analyse Kapitaalmarktrente Ontwikkeling

May 24, 2025

Latest Posts

-

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025 -

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025 -

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025 -

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025 -

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025