Trump's Trade War And The Impact On European Stock Market Strategies

Table of Contents

The Direct Impact of Tariffs on European Businesses

The imposition of tariffs by the US directly affected several key European sectors, leading to significant market fluctuations. The automotive industry, for example, faced substantial challenges due to tariffs on imported vehicles and parts. Similarly, the agricultural sector, particularly in countries like France and Germany, experienced a decline in exports to the US.

- Specific examples of tariff-affected sectors: Automotive, agricultural products (e.g., cheese, wine), steel, aluminum.

- Stock market performance data before/after tariffs: A comparative analysis of relevant stock indices (e.g., DAX, CAC 40, FTSE 100) reveals significant drops in the value of companies heavily reliant on US exports following the implementation of tariffs. For instance, German automotive manufacturers saw substantial share price reductions.

- Analysis of supply chain disruptions: The tariffs disrupted established supply chains, forcing European companies to re-evaluate their sourcing strategies and seek alternative markets, increasing costs and impacting profitability. This ripple effect propagated across various sectors, impacting European stock valuations across the board. Companies heavily dependent on US supply chains faced considerable challenges in maintaining production levels and profitability.

Uncertainty and Investor Sentiment in the European Stock Market

Trump's unpredictable trade policies created significant volatility in the European stock market. The constant threat of new tariffs or trade restrictions fueled uncertainty, impacting investor confidence and driving risk aversion. This resulted in a period of heightened market fluctuations, as investors reacted to each new development.

- Examples of market volatility indices: The VIX (Volatility Index) for European markets experienced a notable increase during periods of heightened trade tensions, reflecting heightened investor anxiety.

- Investor survey data reflecting confidence levels: Surveys conducted during this period revealed a decline in investor confidence in the European market, as uncertainty regarding future trade relations weighed heavily on investment decisions. Many investors adopted a wait-and-see approach, delaying investment decisions.

- Descriptions of hedging strategies: To mitigate risk, investors increasingly employed hedging strategies, such as using derivatives to protect against potential losses resulting from market fluctuations caused by the trade war. Diversification across asset classes and geographical regions also became a key element of risk management.

Geopolitical Implications and Shifting Trade Alliances

Trump's trade war prompted the EU to reassess its relationship with other trading partners and accelerate the pursuit of new trade agreements. The uncertainty created by US trade policy incentivized the EU to diversify its trading relationships, reducing its dependence on the US market.

- Examples of new trade agreements pursued by the EU: The EU intensified negotiations with countries in Asia, Africa, and South America, seeking to create new trade alliances and reduce reliance on the US market. This shift in focus created new opportunities for European businesses and influenced stock market performance in related sectors.

- Analysis of the impact on specific European industries: Industries that benefited from the EU's focus on new trade partners included those exporting to the newly opened markets, leading to an improvement in their stock market performance.

- Data on shifts in trade flows: Trade data from this period demonstrates a shift in trade flows away from the US towards other regions, reflecting the EU's efforts to diversify its trading partners. This diversification proved to be a key factor influencing the resilience of the European economy.

Adapting Stock Market Strategies to Navigate the Trade War's Aftermath

Navigating the aftermath of Trump's trade war required a significant adaptation of stock market strategies. Risk management became paramount, requiring a more nuanced approach to investment decisions.

- Examples of diversification strategies: Diversification across sectors, geographies, and asset classes became crucial to mitigate risks associated with ongoing trade uncertainties. Investing in companies less dependent on US trade proved beneficial.

- Steps involved in fundamental analysis: Thorough fundamental analysis of individual companies became even more important, focusing on identifying undervalued companies with strong fundamentals and less exposure to trade disputes.

- Specific sectors identified as having long-term growth potential: Sectors less affected by the trade war, such as technology, pharmaceuticals, and renewable energy, demonstrated greater resilience and presented opportunities for long-term growth.

Conclusion

Trump's trade war presented unprecedented challenges to European stock market strategies. The imposition of tariffs directly impacted several key sectors, creating market volatility and uncertainty. Investors responded by adapting their strategies, focusing on risk management, diversification, and a deeper understanding of geopolitical shifts. The long-term effects are still unfolding, highlighting the need for continuous monitoring and adaptable investment approaches.

Call to Action: Understanding the lasting impact of Trump's trade war is crucial for effective European stock market strategies. Stay informed on global trade developments and adapt your investment approach accordingly. Learn more about navigating the complexities of the post-trade-war landscape and develop robust strategies to protect and grow your portfolio in the face of future economic uncertainty. Effective management of European stock market investments requires ongoing adaptation in response to changing global trade dynamics.

Featured Posts

-

Mission Impossible The Final Reckoning Ignoring Two Sequels

Apr 26, 2025

Mission Impossible The Final Reckoning Ignoring Two Sequels

Apr 26, 2025 -

The End Of Ryujinx Nintendo Contact Leads To Emulator Development Cessation

Apr 26, 2025

The End Of Ryujinx Nintendo Contact Leads To Emulator Development Cessation

Apr 26, 2025 -

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025 -

Ajax Vs Az Heightened Security For High Risk Match

Apr 26, 2025

Ajax Vs Az Heightened Security For High Risk Match

Apr 26, 2025 -

Severe Rail Disruptions In The Randstad Amsterdam Track Failures Cause Chaos

Apr 26, 2025

Severe Rail Disruptions In The Randstad Amsterdam Track Failures Cause Chaos

Apr 26, 2025

Latest Posts

-

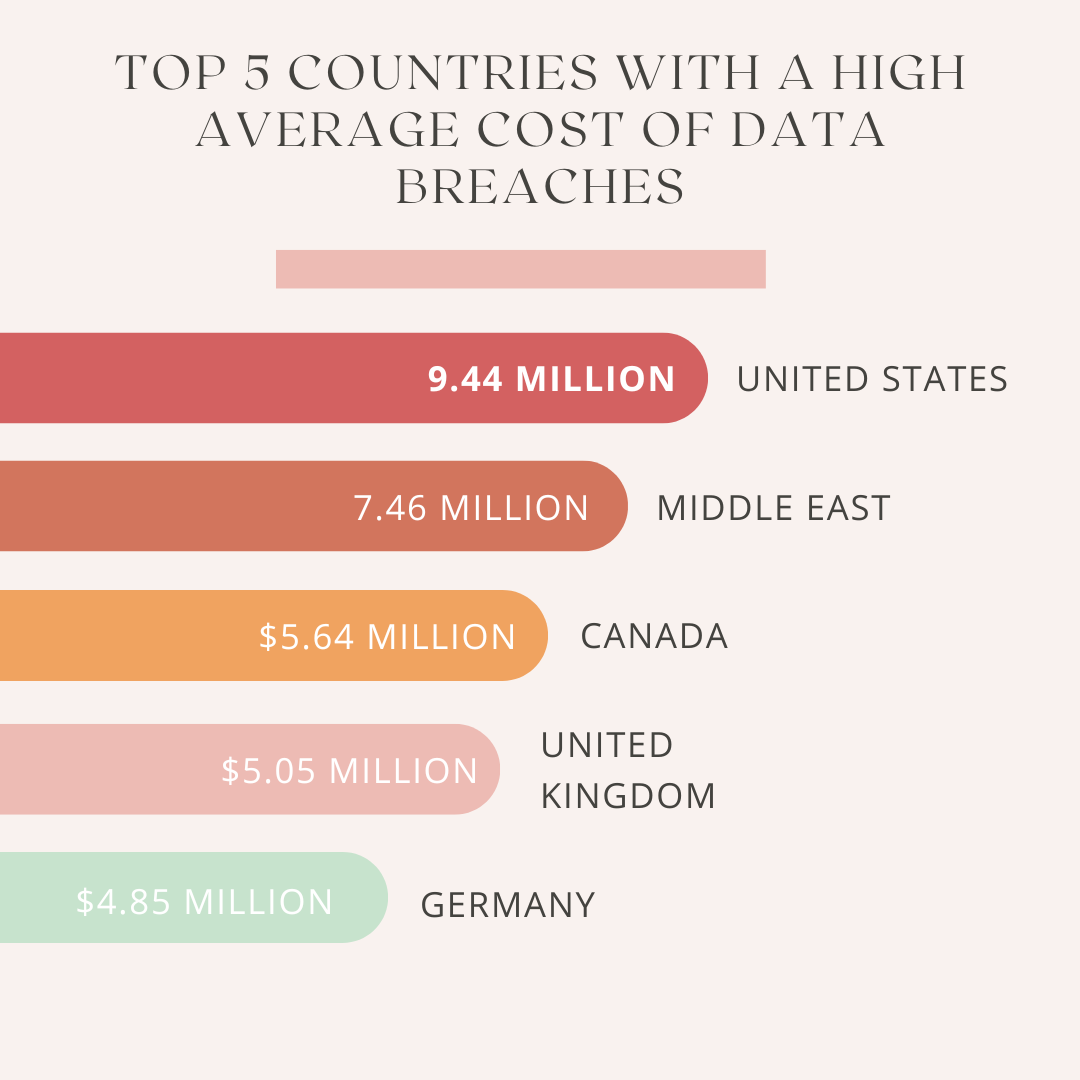

Fbi Investigation Major Office365 Data Breach Results In Significant Financial Losses

Apr 27, 2025

Fbi Investigation Major Office365 Data Breach Results In Significant Financial Losses

Apr 27, 2025 -

Millions Stolen Inside The Office365 Executive Email Hacking Scheme

Apr 27, 2025

Millions Stolen Inside The Office365 Executive Email Hacking Scheme

Apr 27, 2025 -

Office365 Executive Email Compromise Nets Millions For Hacker Say Federal Authorities

Apr 27, 2025

Office365 Executive Email Compromise Nets Millions For Hacker Say Federal Authorities

Apr 27, 2025 -

Exec Office365 Breach Millions Made Through Email Hacks Fbi Reveals

Apr 27, 2025

Exec Office365 Breach Millions Made Through Email Hacks Fbi Reveals

Apr 27, 2025 -

Ohio Derailment Aftermath Persistent Toxic Chemicals In Local Buildings

Apr 27, 2025

Ohio Derailment Aftermath Persistent Toxic Chemicals In Local Buildings

Apr 27, 2025