Turkish Desan Considers Mangalia Shipyard Acquisition

Table of Contents

The Turkish shipbuilding giant, Desan Shipyard, is reportedly considering a significant acquisition: the Mangalia Shipyard in Romania. This potential deal carries substantial implications for both companies, the wider maritime industry, and the geopolitical landscape of the Black Sea region. The strategic benefits are undeniable, but challenges undoubtedly exist. Let's delve into the potential implications of this major development.

Desan Shipyard's Current Position and Expansion Strategy

Desan Shipyard is a leading player in the Turkish shipbuilding industry, renowned for its naval capabilities and expertise in constructing a variety of vessels. Its expansion strategy involves a clear focus on international growth and increasing its global market share. This potential acquisition aligns perfectly with this ambitious goal.

- Key projects undertaken by Desan: Desan has been involved in numerous significant projects, including the construction of several naval vessels for the Turkish Navy and the building of commercial ships for international clients. These projects demonstrate the shipyard's technical capabilities and its ability to handle complex shipbuilding contracts.

- Desan's market share in Turkey and internationally: Desan holds a considerable market share within Turkey and is actively seeking to expand its presence in international markets. The Mangalia acquisition would undoubtedly bolster its global reach.

- The company’s stated goals for future growth: Desan’s publicly stated goals include diversification into new market segments and geographic expansion, making the Mangalia acquisition a natural step in their strategic plan.

- Desan's existing international partnerships: Desan already collaborates with various international partners, showcasing its experience in navigating the complexities of global business.

Mangalia Shipyard's Current State and Potential

The Mangalia Shipyard, while possessing significant potential, currently faces challenges. Its infrastructure requires modernization, and recent financial difficulties have hampered its operational capacity. However, its strategic location on the Black Sea coast and its existing infrastructure offer a compelling foundation for revitalization.

- The shipyard's current operational status: Currently, the Mangalia Shipyard operates at a reduced capacity. The acquisition would allow for a significant injection of capital and expertise to improve operational efficiency.

- Its existing facilities and capabilities: Despite needing upgrades, the shipyard possesses considerable infrastructure, including dry docks and various workshops. These assets can be modernized and expanded upon.

- Its geographic advantages and market access: Mangalia's location provides convenient access to crucial shipping routes in the Black Sea, offering significant logistical advantages.

- The potential for modernization and expansion: With investment, the Mangalia Shipyard has the potential to become a significant player in the regional shipbuilding market.

- Any existing contracts or ongoing projects: While details are limited, understanding any existing commitments at Mangalia is crucial for a successful acquisition and integration.

Strategic Implications of the Acquisition

The acquisition of the Mangalia Shipyard by Desan presents a range of strategic advantages for both parties. For Desan, it offers significant expansion into a new geographic market, access to skilled labor, and potential cost synergies. For Romania, it represents a boost to the national economy and the shipbuilding industry.

- Potential cost savings and efficiency gains: Combining operations could lead to significant cost reductions through economies of scale and improved efficiency.

- Expansion of Desan's geographic reach and market access: The acquisition provides access to new markets within the EU and the Black Sea region.

- Potential for technological collaboration and innovation: Combining expertise could lead to technological advancements and innovation in shipbuilding.

- Impact on the Romanian shipbuilding industry: The acquisition could stimulate growth and modernization within the Romanian shipbuilding sector.

- Geopolitical implications of the acquisition: The deal might reshape the geopolitical dynamics of the Black Sea region, increasing Turkey's influence in the area.

Potential Challenges and Risks

While the potential benefits are considerable, the acquisition also presents several challenges and risks:

- Acquisition challenges: Negotiating the terms of the acquisition and securing necessary regulatory approvals could prove challenging.

- Regulatory hurdles: Compliance with Romanian and EU regulations will be crucial.

- Financial risks: The financial health of the Mangalia Shipyard requires careful evaluation.

- Integration challenges: Integrating two different company cultures and operational systems requires a well-defined strategy and execution.

- Competition: The acquisition will need to navigate the competitive landscape of the Black Sea region.

Conclusion

The potential acquisition of the Mangalia Shipyard by Turkish Desan represents a significant development in the maritime industry. While challenges exist, the strategic benefits for both companies and the wider region are substantial. The potential for cost savings, market expansion, and technological advancement make this a compelling strategic move. However, careful consideration of the risks and challenges is paramount for successful integration and realizing the full potential of this shipyard acquisition. Keep an eye on this developing story to learn more about the potential impact of this significant Turkish Desan shipyard acquisition. Follow reputable news sources and industry publications for updates.

Featured Posts

-

Nfl Draft 2024 Shedeur Sanders And The Giants A Potential Match

Apr 26, 2025

Nfl Draft 2024 Shedeur Sanders And The Giants A Potential Match

Apr 26, 2025 -

Nepo Babies Take Over The Oscars After Party A Look At The Controversy

Apr 26, 2025

Nepo Babies Take Over The Oscars After Party A Look At The Controversy

Apr 26, 2025 -

Scientists Unearth Car Inside Sunken Wwii Vessel

Apr 26, 2025

Scientists Unearth Car Inside Sunken Wwii Vessel

Apr 26, 2025 -

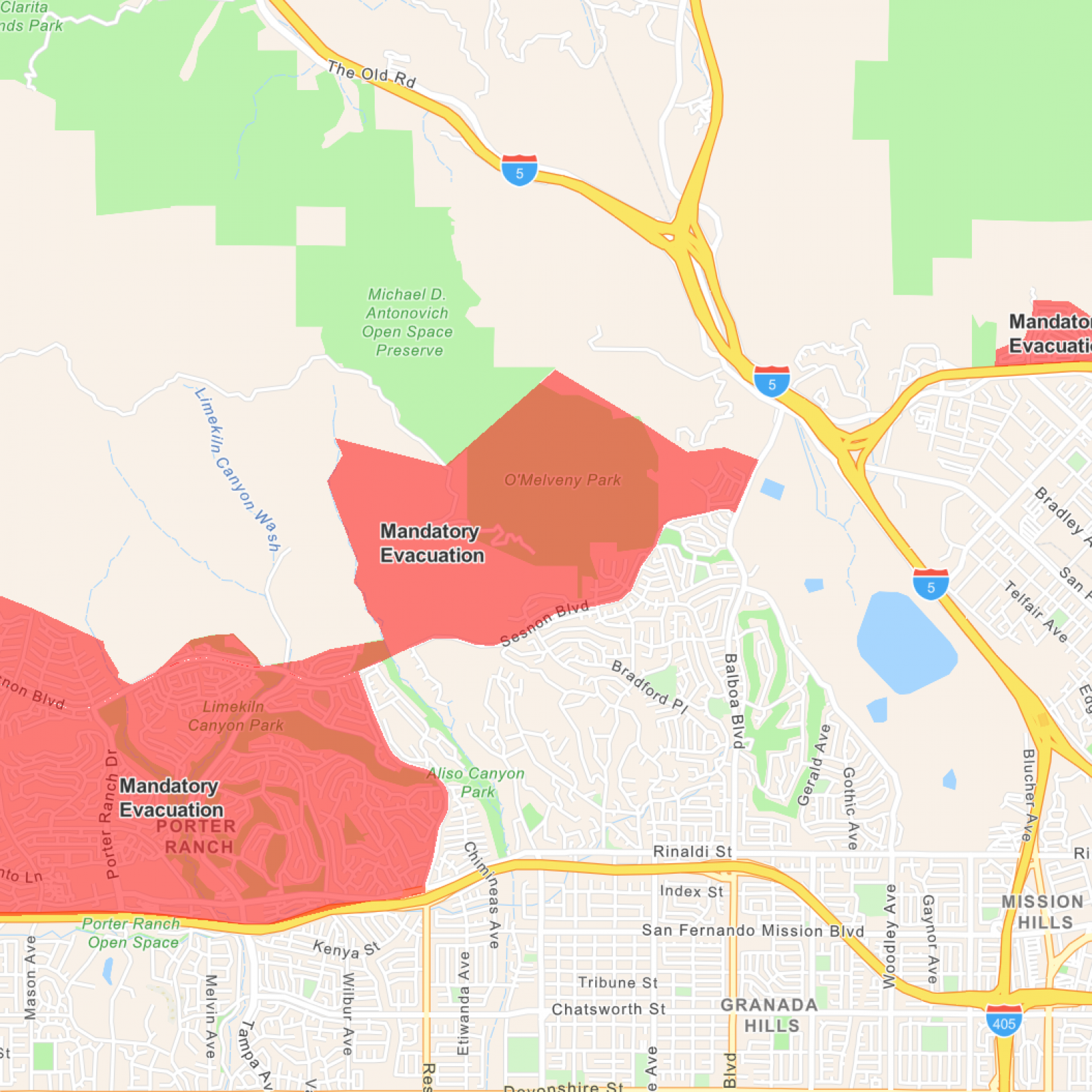

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 26, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 26, 2025 -

Paris Nice 2024 Jorgensons Successful Title Defense

Apr 26, 2025

Paris Nice 2024 Jorgensons Successful Title Defense

Apr 26, 2025

Latest Posts

-

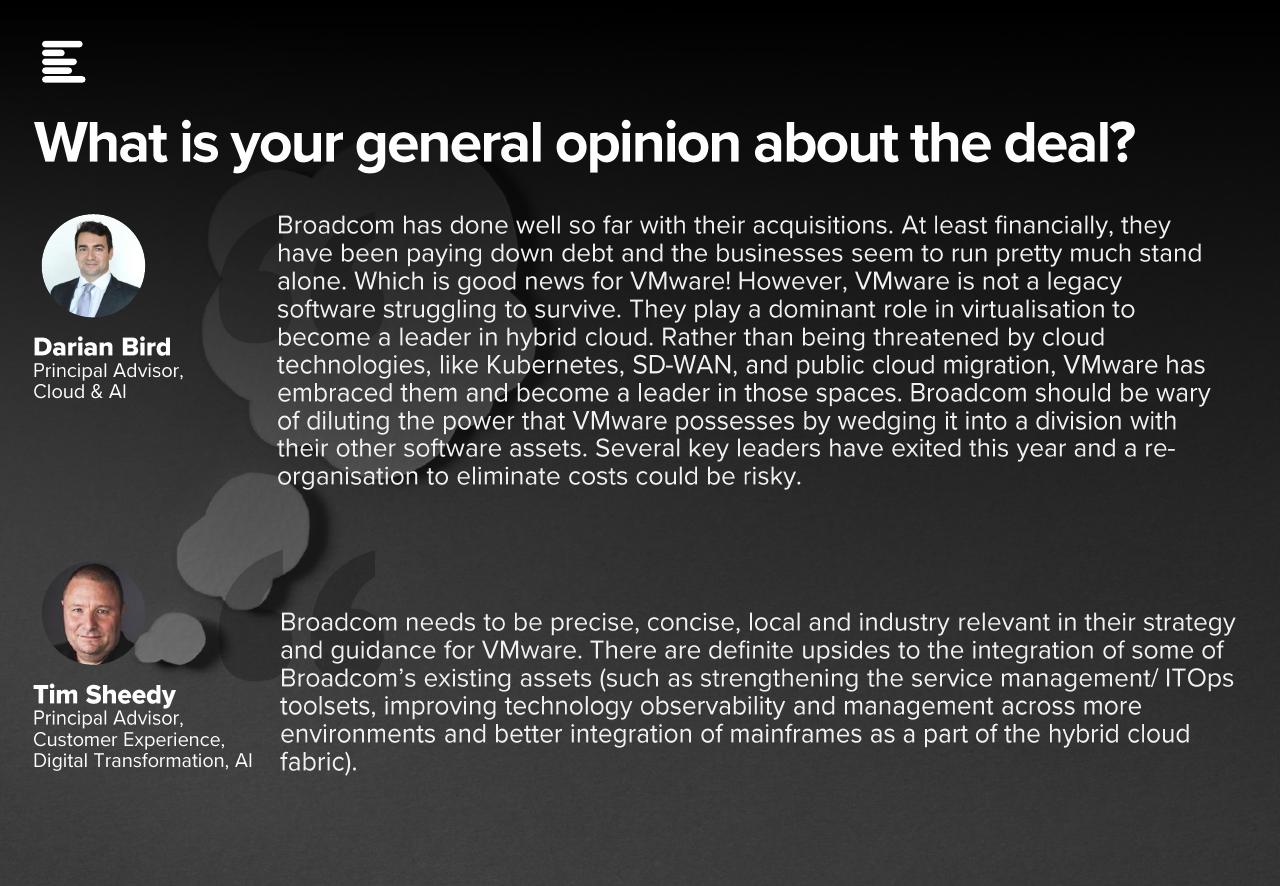

Broadcoms V Mware Acquisition At And T Reports Extreme Price Increase Of 1 050

Apr 27, 2025

Broadcoms V Mware Acquisition At And T Reports Extreme Price Increase Of 1 050

Apr 27, 2025 -

1 050 V Mware Price Hike At And Ts Concerns Over Broadcoms Acquisition

Apr 27, 2025

1 050 V Mware Price Hike At And Ts Concerns Over Broadcoms Acquisition

Apr 27, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

Apr 27, 2025

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

Apr 27, 2025 -

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025 -

Trumps Trade Deal Prediction 3 4 Weeks Away

Apr 27, 2025

Trumps Trade Deal Prediction 3 4 Weeks Away

Apr 27, 2025