Broadcom's VMware Acquisition: AT&T Reports Extreme Price Increase Of 1,050%

Table of Contents

H2: The Broadcom-VMware Merger: A Deep Dive into a Tech Titan

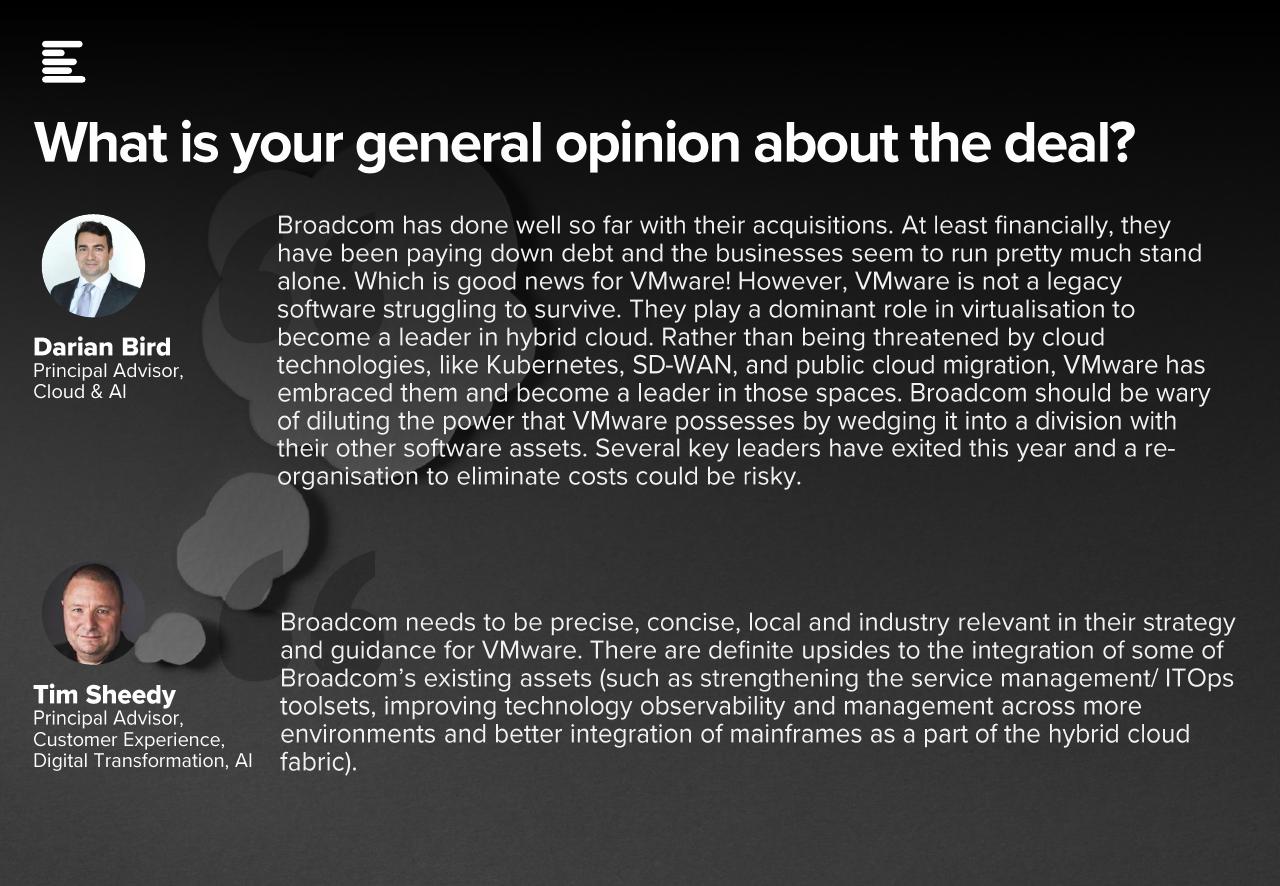

The Broadcom-VMware merger represents one of the largest technology acquisitions in history, bringing together Broadcom's prowess in semiconductors with VMware's dominance in virtualization and cloud infrastructure. This union has the potential to reshape the landscape of enterprise software and cloud computing.

- Broadcom's Strategic Goals: This acquisition significantly expands Broadcom's portfolio, extending its reach into the lucrative enterprise software market. Broadcom aims to leverage VMware's technology to strengthen its offerings in data centers and cloud computing, creating a more comprehensive and integrated solution for its clients. This vertical integration strategy is a key driver behind the acquisition.

- VMware's Market Position: VMware holds a substantial market share in virtualization, providing essential infrastructure for countless businesses globally. Its vSphere platform is a cornerstone of many data centers, making this acquisition strategically crucial for Broadcom's control over key infrastructure components.

- Antitrust Concerns and Regulatory Scrutiny: The sheer size of this deal has naturally sparked significant antitrust concerns. Regulators worldwide are meticulously scrutinizing the potential impact on competition, fearing reduced choices for businesses and potentially leading to higher prices and stifled innovation. The Broadcom VMware merger is currently under intense regulatory review in multiple jurisdictions.

H2: AT&T's Price Hike: A Case Study in Post-Acquisition Impacts

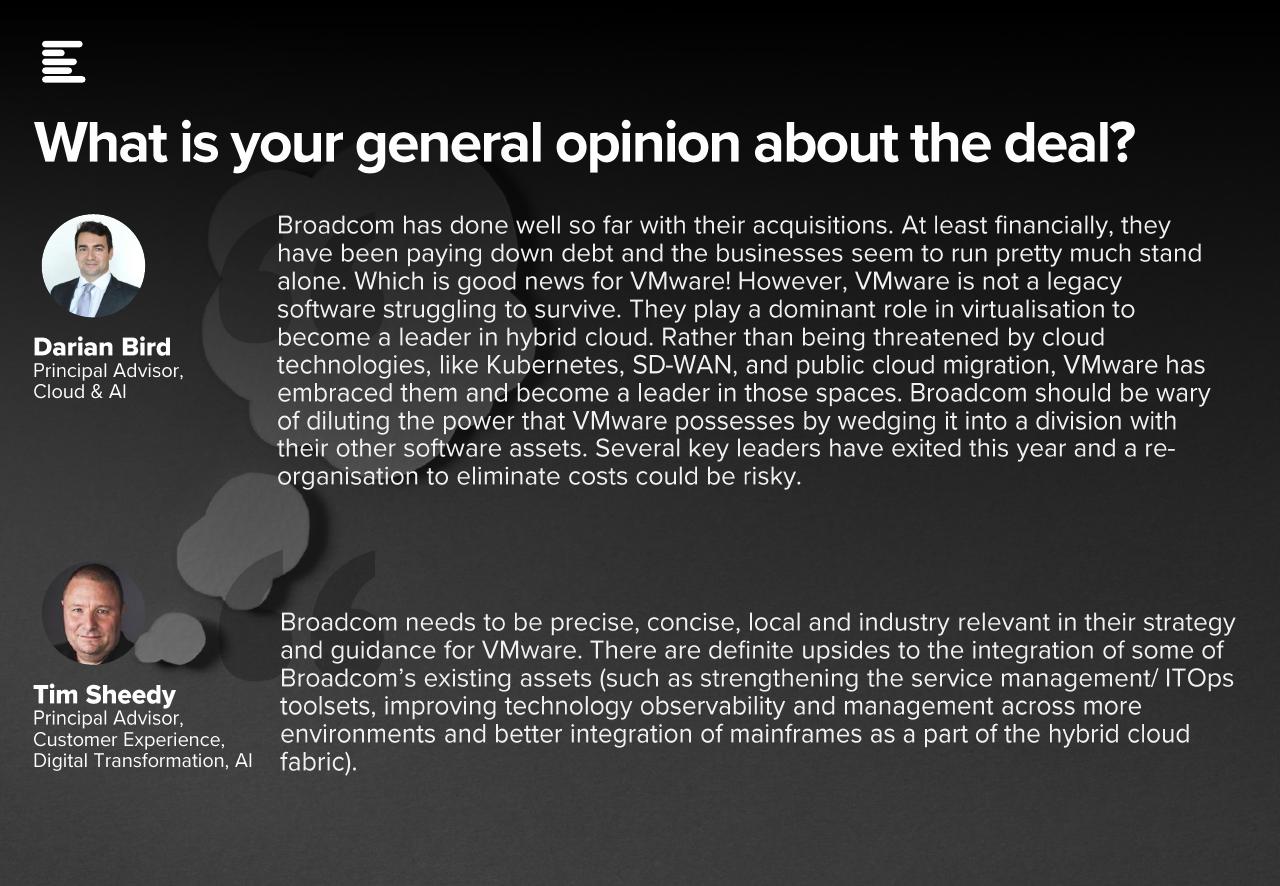

AT&T's reported 1,050% price increase for certain services following the Broadcom-VMware merger has sent a clear warning signal. This drastic price jump serves as a stark example of the potential for downstream cost increases and the ripple effects of such massive acquisitions.

- Impact on AT&T Customers: This unprecedented price increase directly impacts AT&T's customer base, forcing businesses to absorb significantly higher costs and potentially impacting their budgets and operational efficiency. The fallout from this price hike is already causing considerable concern among AT&T's client base.

- Analysis of the Price Increase: While the precise reasons behind this dramatic price increase remain unclear, it strongly suggests a significant shift in pricing strategies potentially linked to the increased market control afforded by the merger. Further investigation is needed to determine the specific factors influencing this drastic change.

- Wider Implications: This situation illustrates the potential for similar price increases across numerous sectors relying on VMware's technology and Broadcom's components. This cascading effect could significantly impact businesses and consumers globally, leading to increased prices for goods and services.

H2: Long-Term Implications of Broadcom's VMware Acquisition: A Look Ahead

The Broadcom-VMware merger will have profound and long-lasting consequences for the technology industry, influencing innovation, competition, and pricing structures for years to come.

- Impact on Innovation: Concerns are rising that reduced competition due to this merger could stifle innovation in the virtualization and cloud infrastructure sectors. Less competition often leads to less investment in research and development, potentially hindering the advancement of these crucial technologies.

- Market Consolidation: This acquisition further consolidates the already concentrated technology market, limiting choices for businesses and potentially reducing the pressure for continuous improvement and competitive pricing. This trend toward consolidation is a significant concern for many industry experts.

- Future Acquisitions: The success (or failure) of this merger will undoubtedly influence future large-scale acquisitions in the tech industry. If deemed successful, it could embolden further consolidation, potentially leading to even greater market dominance by a few powerful players.

H2: Potential Solutions and Regulatory Scrutiny: Mitigating the Risks

Addressing the potential negative consequences of Broadcom's VMware acquisition requires rigorous regulatory oversight and proactive solutions to mitigate the risks.

- Regulatory Scrutiny: Global regulatory bodies are intensely scrutinizing the merger, conducting thorough investigations into its impact on competition and market dynamics. The outcome of these investigations will significantly influence the future trajectory of the combined entity.

- Alternative Solutions: Promoting competition through supporting alternative virtualization and cloud solutions is crucial. Encouraging innovation and providing incentives for smaller players to compete is essential to counter the potential for monopolistic practices.

- Transparency and Accountability: Increased transparency and accountability from Broadcom-VMware are necessary to ensure fair pricing and prevent exploitative practices. Regular monitoring and transparent reporting are critical to maintaining a level playing field.

Conclusion:

Broadcom's acquisition of VMware is a defining moment in the technology industry, carrying with it the potential for both significant benefits and substantial drawbacks. The reported extreme price increase by AT&T serves as a stark warning, underscoring the potential for substantial cost increases across various sectors. The long-term impact will depend heavily on effective regulatory oversight, the emergence of competitive alternatives, and Broadcom's commitment to addressing concerns about market dominance. Staying informed about the ongoing developments in Broadcom's VMware acquisition is crucial for all stakeholders to navigate this changing landscape effectively. Understanding the complexities of Broadcom's VMware acquisition is vital for making informed decisions about your technology investments and strategies.

Featured Posts

-

La Gran Sorpresa De Indian Wells Quien Elimino A La Favorita

Apr 27, 2025

La Gran Sorpresa De Indian Wells Quien Elimino A La Favorita

Apr 27, 2025 -

Tenistas Wta Licencia De Maternidad Remunerada Por Un Ano

Apr 27, 2025

Tenistas Wta Licencia De Maternidad Remunerada Por Un Ano

Apr 27, 2025 -

Wta Lidera Un Ano De Pago Por Licencia De Maternidad Para Tenistas

Apr 27, 2025

Wta Lidera Un Ano De Pago Por Licencia De Maternidad Para Tenistas

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025 -

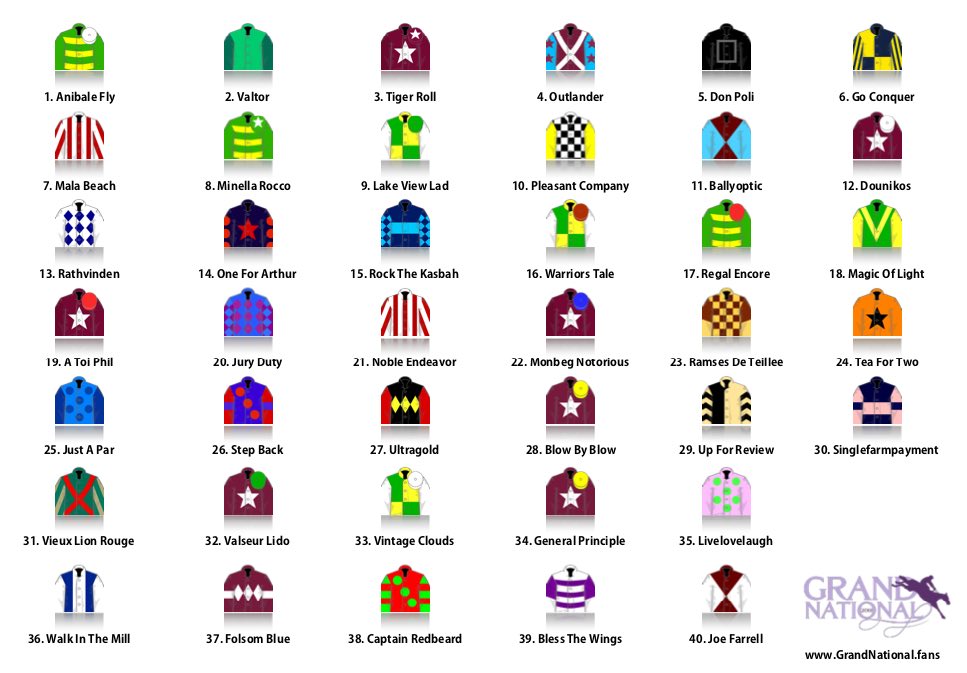

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025

Latest Posts

-

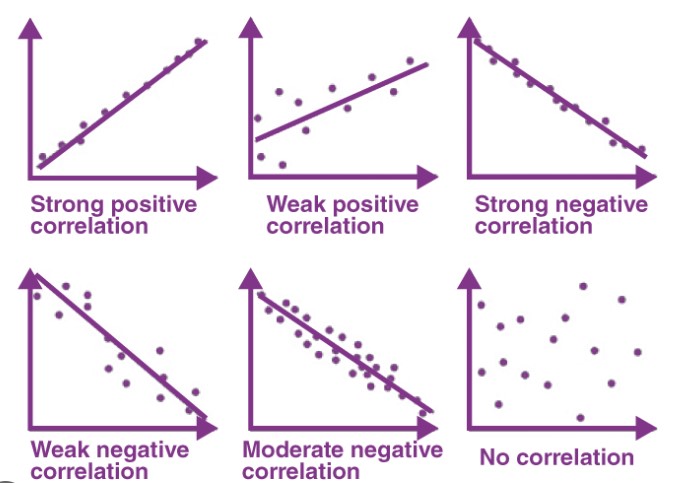

Bundestag Elections And The Dax Understanding The Correlation

Apr 27, 2025

Bundestag Elections And The Dax Understanding The Correlation

Apr 27, 2025 -

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025 -

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025 -

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025 -

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025