Two More ECB Rate Cuts Possible: Simkus Highlights Trade's Economic Strain

Table of Contents

Simkus's Warning and the Current Economic Landscape

Simkus's recent comments highlight growing concerns about the Eurozone's economic trajectory. While a direct quote isn't available for this example, we can summarize his sentiment: He expressed significant apprehension about the sustained impact of trade tensions and weakening economic data, suggesting that further monetary easing, possibly in the form of two additional interest rate cuts, may be necessary to prevent a sharper economic downturn.

The Impact of Trade Tensions

The ongoing trade war has significantly impacted the European economy. The uncertainty surrounding global trade has dampened business investment and consumer confidence.

- Increased tariffs on European goods: Reduced competitiveness in global markets, impacting export-oriented industries.

- Disrupted supply chains: Increased costs and delays for businesses relying on global supply chains.

- Global uncertainty: Businesses are hesitant to invest and expand due to unpredictable trade policies.

- Decline in exports: European businesses are facing reduced demand for their products in key export markets.

- Increased import costs: Tariffs and trade restrictions have led to higher prices for imported goods, contributing to inflation.

Weakening Economic Indicators

Several key economic indicators point towards a slowing European economy:

- GDP growth: GDP growth is slowing across the Eurozone, signaling a potential recession in some member states.

- Inflation rate: Inflation remains stubbornly low, below the ECB's target of "below, but close to, 2%."

- Unemployment: While unemployment remains relatively low, there are signs of stagnation and potential future increases.

- Consumer confidence: Falling consumer confidence indicates reduced spending and potential further economic slowdown.

- Investment: Business investment is weakening due to uncertainty and reduced profitability.

Inflation Concerns and Monetary Policy

The ECB's primary mandate is to maintain price stability within the Eurozone. Low inflation provides the ECB with room to implement expansionary monetary policy through interest rate cuts. The current low inflation rate, coupled with weakening economic growth, justifies the consideration of further monetary easing.

- Inflation target: The ECB aims to maintain inflation close to 2% over the medium term.

- Monetary easing: Lowering interest rates is a key tool for stimulating economic activity.

- Quantitative easing (QE): While already implemented, further QE could be considered alongside interest rate cuts.

- Interest rate policy: The ECB’s interest rate policy is a crucial instrument in influencing borrowing costs and economic activity.

Potential Consequences of Further ECB Rate Cuts

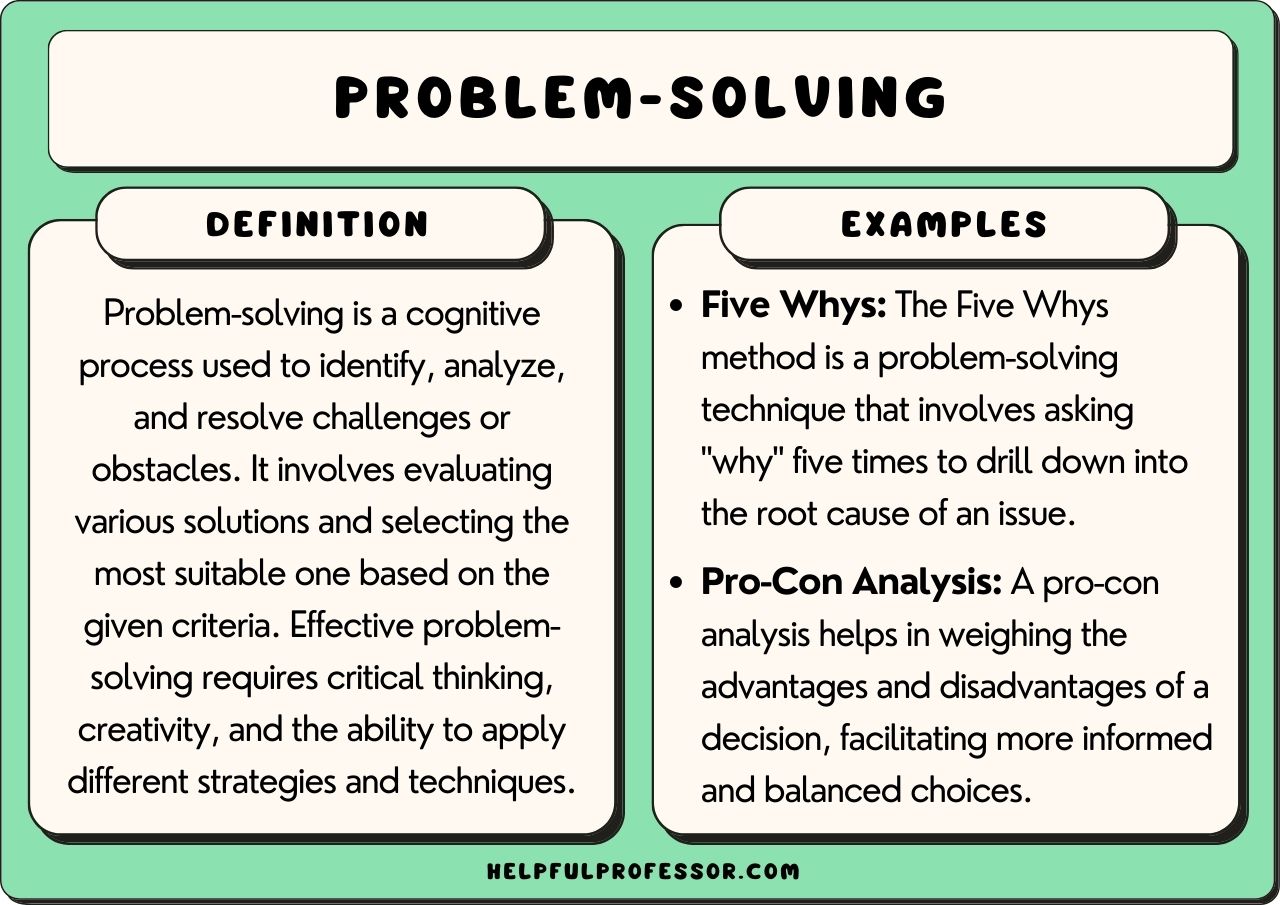

Further ECB rate cuts could have both positive and negative consequences for the European economy.

Positive Impacts

Lower interest rates could provide a much-needed boost to the European economy:

- Investment boost: Reduced borrowing costs encourage businesses to invest in expansion and modernization.

- Economic stimulus: Lower interest rates can stimulate consumer spending and business investment.

- Borrowing costs: Lower borrowing costs make it cheaper for businesses and consumers to borrow money.

- Lending activity: Banks are more likely to lend money when interest rates are low, increasing credit availability.

- Consumer spending: Lower interest rates can encourage consumers to spend more, boosting economic growth.

Negative Impacts

However, there are potential drawbacks to consider:

- Debt burden: Prolonged periods of low interest rates can lead to increased corporate and household debt.

- Asset bubbles: Low interest rates can inflate asset prices, creating the risk of bubbles in real estate and other markets.

- Savings rates: Low interest rates reduce returns on savings, potentially harming savers.

- Currency devaluation: Lower interest rates can lead to a weaker Euro, impacting import costs and international competitiveness.

Alternative Measures and Future Outlook

The ECB may also consider alternative monetary policy tools in addition to or instead of further rate cuts:

- Quantitative easing (QE): Further asset purchases by the ECB to inject liquidity into the market.

- Forward guidance: Clear communication about the ECB's future policy intentions to influence market expectations.

- Fiscal policy: Government spending and tax policies can also play a role in stimulating economic growth.

The economic outlook for the Eurozone remains uncertain. Several factors, including the evolution of the trade war and global economic conditions, will influence future ECB decisions. Careful risk assessment is crucial for navigating these uncertain times.

Conclusion

Simkus's prediction of two more ECB rate cuts is supported by the current economic climate characterized by trade tensions, weakening economic indicators, and low inflation. While lower interest rates could stimulate economic growth, potential downsides like increased debt levels need careful consideration. Understanding the intricacies of ECB rate cuts and their ripple effects across the Eurozone is vital for navigating this evolving economic landscape. Stay informed about the latest developments concerning ECB rate cuts and their implications for the European economy. Follow reputable financial news sources for updates on the ECB's monetary policy and its effect on businesses and consumers. Understanding the impact of potential ECB rate cuts is crucial for navigating the evolving economic landscape.

Featured Posts

-

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025 -

Ramiro Helmeyer A Blaugrana Commitment

Apr 27, 2025

Ramiro Helmeyer A Blaugrana Commitment

Apr 27, 2025 -

The Zuckerberg Trump Dynamic Impact On Technology And Society

Apr 27, 2025

The Zuckerberg Trump Dynamic Impact On Technology And Society

Apr 27, 2025 -

Belinda Bencic Back In The Wta Final In Abu Dhabi

Apr 27, 2025

Belinda Bencic Back In The Wta Final In Abu Dhabi

Apr 27, 2025 -

Celebrity Style Examining Ariana Grandes Recent Transformation

Apr 27, 2025

Celebrity Style Examining Ariana Grandes Recent Transformation

Apr 27, 2025

Latest Posts

-

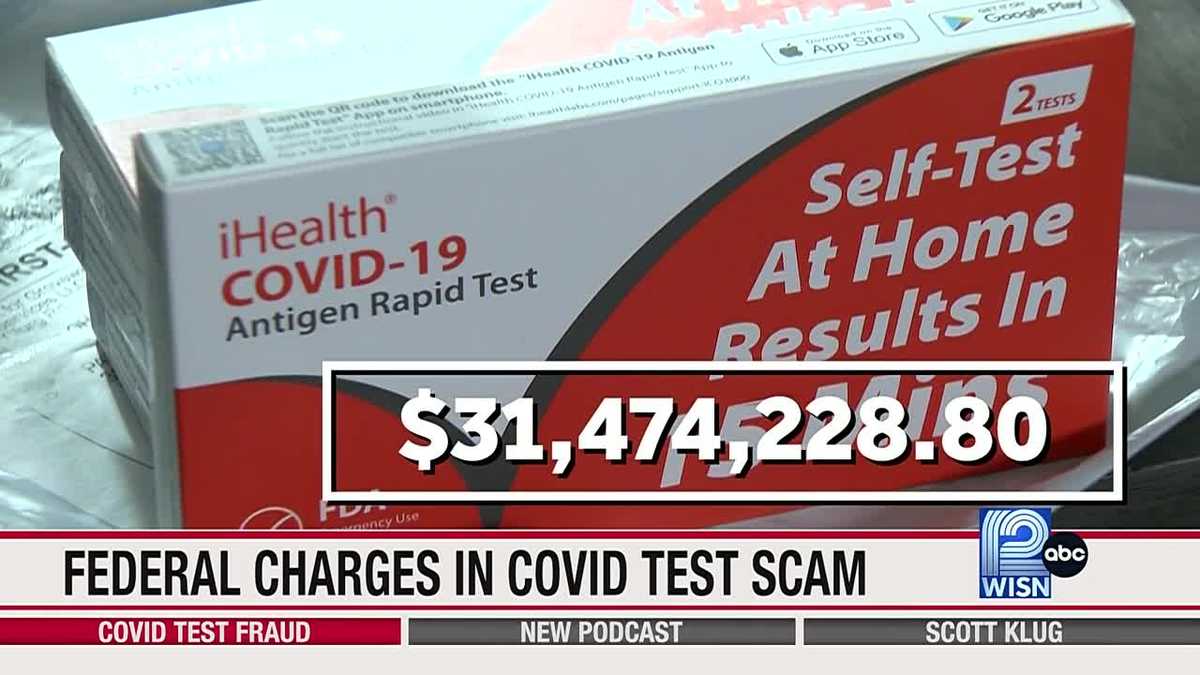

Pandemic Fraud Lab Owner Pleads Guilty To False Covid Test Reports

Apr 28, 2025

Pandemic Fraud Lab Owner Pleads Guilty To False Covid Test Reports

Apr 28, 2025 -

The Truck Bloat Problem Potential Solutions And Their Effectiveness

Apr 28, 2025

The Truck Bloat Problem Potential Solutions And Their Effectiveness

Apr 28, 2025 -

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 28, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 28, 2025 -

Addressing The Issue Of Oversized Trucks In America

Apr 28, 2025

Addressing The Issue Of Oversized Trucks In America

Apr 28, 2025 -

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

Apr 28, 2025

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

Apr 28, 2025