U.S. Investment In Canada: A Call For Diversification

Table of Contents

The Current Landscape of U.S. Investment in Canada

Historically, U.S. investment in Canada has been heavily concentrated in a few key sectors. Energy, particularly oil and gas, has long been a dominant area, attracting significant capital from American investors. Real estate investment, both residential and commercial, has also been a popular choice, driven by strong demand and relatively stable returns. However, this concentration presents significant risks.

-

Vulnerability to Sector-Specific Downturns: Over-reliance on energy leaves U.S. investors vulnerable to fluctuations in oil prices. A downturn in the energy sector can significantly impact the overall portfolio performance, creating substantial losses. Similarly, real estate markets are cyclical, and overexposure can lead to significant losses during market corrections.

-

Reduced Overall Portfolio Resilience: A lack of diversification reduces the resilience of the investment portfolio. When one sector underperforms, the entire portfolio suffers. A well-diversified portfolio, on the other hand, can weather such storms more effectively, ensuring consistent returns even during market volatility.

-

Missed Opportunities in High-Growth Sectors: Concentrating on traditional sectors leads to missed opportunities in high-growth sectors showing immense potential. This means potentially missing out on significant returns and long-term growth.

Bullet points:

- Energy sector dominance: Estimates suggest that energy has historically accounted for upwards of 30% of total U.S. investment in Canada.

- Real estate investment trends: While real estate remains attractive, certain markets are becoming saturated, and risks associated with rising interest rates and potential market corrections need careful consideration.

- Limited exposure to other sectors: Sectors like technology, agriculture, and renewable energy, which offer significant potential for growth, often receive comparatively less attention from U.S. investors.

Exploring Opportunities for Diversification

Diversifying U.S. investment in Canada opens doors to numerous opportunities offering higher potential returns and mitigating the risks associated with concentration in a few sectors.

The Burgeoning Canadian Technology Sector

Canada boasts a thriving technology sector, with vibrant hubs in Toronto, Montreal, and Vancouver. These cities are home to a growing number of innovative startups and established tech giants. Specific sub-sectors, such as artificial intelligence (AI), fintech, and cleantech, offer particularly exciting investment prospects.

Bullet points:

- Examples of successful Canadian tech companies: Shopify, Lightspeed Commerce, and several other unicorns represent the potential for high returns.

- Government incentives and support for tech startups: Various government programs provide financial and regulatory support to tech entrepreneurs, creating a favorable investment climate.

- Risks and challenges in the tech sector: As with any high-growth sector, there are risks associated with early-stage investments and intense competition. Thorough due diligence is crucial.

Investing in Canadian Renewable Energy

Canada possesses significant potential in renewable energy, with abundant resources for solar, wind, and hydro power. Government policies actively support the development of renewable energy infrastructure, creating attractive investment opportunities. This sector not only offers strong financial returns but also aligns with Environmental, Social, and Governance (ESG) investment goals, appealing to investors increasingly focused on sustainability.

Bullet points:

- Key players in the Canadian renewable energy market: Several prominent companies are driving innovation and growth in this space.

- Investment opportunities in renewable energy infrastructure: Investments in wind farms, solar projects, and hydroelectric dams represent significant long-term opportunities.

- Government incentives and tax credits for renewable energy investments: Federal and provincial governments offer various incentives to encourage investments in renewable energy.

Beyond Tech and Energy: Other Diversification Avenues

Beyond technology and renewable energy, other sectors offer attractive diversification opportunities for U.S. investors in Canada. The agricultural sector, fueled by global food security concerns, and the healthcare sector, driven by an aging population, represent promising areas. Advanced manufacturing, benefiting from technological advancements, also presents exciting investment possibilities.

Bullet points:

- Examples of companies in each sector showing strong growth: Research into specific companies within these sectors can reveal high-potential investment opportunities.

- Factors influencing growth in each sector: Identifying key drivers of growth within each sector allows for a more informed investment decision.

- Potential risks associated with investing in each sector: Thorough due diligence and risk assessment are critical for successful investment.

Strategies for Effective Diversification

Building a diversified investment portfolio in Canada requires a strategic approach. Thorough due diligence on each investment is paramount, encompassing market research, financial analysis, and assessment of risk factors. Working with a professional financial advisor experienced in Canadian investments is highly recommended. They can provide valuable insights, assist with asset allocation, and develop a tailored strategy to meet individual investment goals.

Bullet points:

- Asset allocation strategies: Diversifying investments across various asset classes, including stocks, bonds, and real estate, helps to reduce overall portfolio risk.

- Risk management techniques: Implementing effective risk management strategies, such as diversification and hedging, are crucial for mitigating potential losses.

- Importance of long-term investment horizons: Investing in Canada requires a long-term perspective. The potential for substantial returns often requires patience and a commitment to long-term growth.

Conclusion

Diversifying U.S. investment in Canada beyond traditional sectors like energy and real estate is crucial for maximizing returns and minimizing risk. The Canadian economy offers a wealth of opportunities in high-growth sectors like technology, renewable energy, agriculture, and healthcare. By exploring these promising areas and implementing effective diversification strategies, U.S. investors can build robust and resilient portfolios. Don't miss out on the vast opportunities for profitable and diversified U.S. investment in Canada. Explore the potential of emerging sectors and build a robust investment portfolio today. Contact a financial advisor specializing in Canadian investments to learn more about creating a diversified strategy for U.S. investment in Canada and unlock the full potential of this dynamic market.

Featured Posts

-

Is A Coco Sequel A Good Idea Pixars Potential Misstep

May 29, 2025

Is A Coco Sequel A Good Idea Pixars Potential Misstep

May 29, 2025 -

I Pad Gets Whats App The Long Awaited Arrival

May 29, 2025

I Pad Gets Whats App The Long Awaited Arrival

May 29, 2025 -

100 Forintos Erme Ritkasagkereses Es Ertekeles

May 29, 2025

100 Forintos Erme Ritkasagkereses Es Ertekeles

May 29, 2025 -

Schutters Aangehouden Na Schietincident Tijdens Paasweekend Venlo

May 29, 2025

Schutters Aangehouden Na Schietincident Tijdens Paasweekend Venlo

May 29, 2025 -

I Lost My Job Heres How And Why Aussie Woman

May 29, 2025

I Lost My Job Heres How And Why Aussie Woman

May 29, 2025

Latest Posts

-

Wohnraumnotloesung Deutsche Gemeinde Bietet Kostenlose Unterkuenfte An

May 31, 2025

Wohnraumnotloesung Deutsche Gemeinde Bietet Kostenlose Unterkuenfte An

May 31, 2025 -

Umzug Nach Deutschland Diese Stadt Bietet Kostenlose Unterkuenfte

May 31, 2025

Umzug Nach Deutschland Diese Stadt Bietet Kostenlose Unterkuenfte

May 31, 2025 -

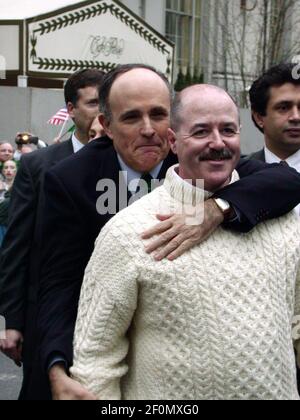

Bernard Kerik Ex Nypd Commissioner Undergoes Hospital Treatment

May 31, 2025

Bernard Kerik Ex Nypd Commissioner Undergoes Hospital Treatment

May 31, 2025 -

Ex Nypd Commissioner Kerik Hospitalized Full Recovery Expected

May 31, 2025

Ex Nypd Commissioner Kerik Hospitalized Full Recovery Expected

May 31, 2025 -

Former Nypd Commissioner Bernard Kerik Hospitalized Update On His Condition

May 31, 2025

Former Nypd Commissioner Bernard Kerik Hospitalized Update On His Condition

May 31, 2025