U.S. Tariff Delay Triggers 8% Stock Market Rise On Euronext Amsterdam

Table of Contents

The Impact of the U.S. Tariff Delay on European Markets

The delayed U.S. tariffs primarily targeted specific sectors, including steel, aluminum, and certain agricultural products. These tariffs, originally intended to protect American industries, had created considerable pressure on European businesses competing in these same markets. The delay, however, offered a significant reprieve. This "Tariff Delay Impact" immediately translated into benefits for European companies:

- Increased demand for European products: With the threat of higher tariffs reduced, many U.S. buyers shifted their orders to European suppliers, leading to increased demand and boosting production.

- Reduced pressure on European businesses: The lessened competitive threat allowed European firms to focus on growth and innovation rather than solely defending market share against subsidized American competitors.

- Improved market competitiveness: The delay leveled the playing field, creating a more balanced competitive environment for European businesses to operate within.

- Positive investor sentiment towards European stocks: The improved prospects for European businesses spurred a wave of positive investor sentiment, driving up stock prices across the continent. This was particularly evident in the outsized reaction of Euronext Amsterdam.

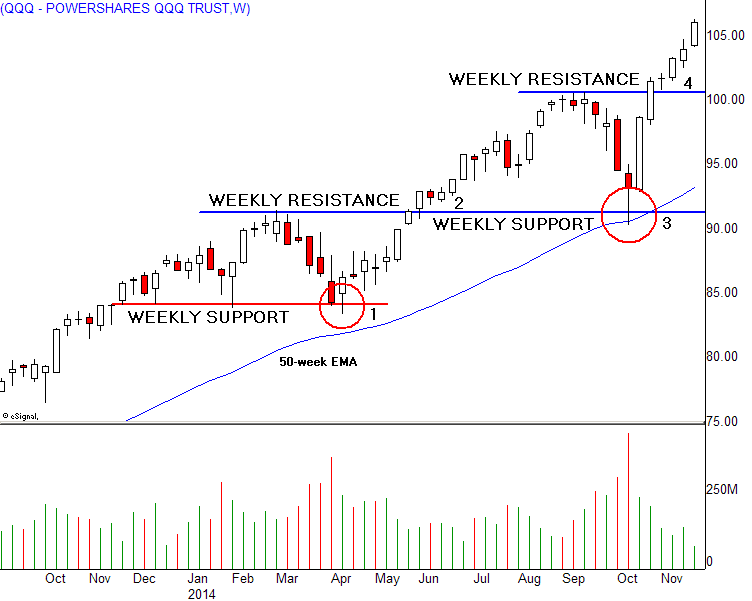

Euronext Amsterdam's Outsized Reaction

While the U.S. Tariff Delay positively impacted European markets overall, Euronext Amsterdam's 8% surge was particularly noteworthy. Several factors contributed to this outsized reaction:

- High concentration of specific industries sensitive to U.S. tariffs: Euronext Amsterdam has a high concentration of companies operating in sectors directly impacted by the delayed tariffs. This meant a more pronounced effect compared to exchanges with more diversified portfolios.

- Increased trading volume on Euronext Amsterdam: The news of the tariff delay fueled significant trading activity, further driving up prices.

- Positive market sentiment driving up stock prices: The overall optimistic market sentiment, fueled by the tariff delay news, disproportionately affected Euronext Amsterdam due to its specific market composition.

- Analysis of specific company performances: Individual company performances within specific sectors (e.g., steel manufacturers, agricultural exporters) demonstrated the direct correlation between the tariff delay and increased stock valuations.

Long-Term Implications and Future Outlook

While the immediate impact of the U.S. Tariff Delay was undeniably positive for Euronext Amsterdam, the long-term implications remain uncertain. The future of U.S. trade policy continues to be a source of uncertainty for global markets.

- Potential for sustained growth in certain sectors: If the tariff delay translates into a more permanent shift in trade dynamics, certain sectors could experience sustained growth.

- Risks of future tariff implementations: The possibility of future tariff implementations remains a significant risk, potentially reversing the current positive trend.

- Importance of diversification in investment strategies: The volatility highlighted by this event underscores the need for investors to maintain well-diversified portfolios.

- Opportunities for long-term investment in European markets: Despite the uncertainty, the current situation presents potential long-term opportunities for investors willing to navigate the complexities of global trade.

Expert Opinions and Market Analysis

Leading financial analysts have weighed in on the market reaction to the U.S. Tariff Delay. Many believe that the event highlights the interconnected nature of global markets and the significant influence of US trade policy on global investment strategies. For instance, [insert quote from a reputable financial analyst], illustrating the widespread positive sentiment surrounding the delay. Reports from institutions like [insert name of financial institution] further support the analysis, showing [insert relevant market data]. This consensus underscores the importance of monitoring U.S. trade policy developments for their significant impact on global market performance.

Understanding the Ripple Effect of the U.S. Tariff Delay on Euronext Amsterdam

The substantial rise in Euronext Amsterdam’s stock market following the U.S. tariff delay demonstrates the significant and immediate impact of international trade policy on global financial markets. This event serves as a strong reminder of the interconnectedness of global economies and the need for investors to closely monitor geopolitical factors. Staying informed about future U.S. trade policy decisions and their potential effect on Euronext Amsterdam and other global markets is crucial. We strongly encourage readers to monitor the situation closely, conduct thorough research into the specific effects of this U.S. tariff delay on their individual investment portfolios, and consider subscribing to reputable market updates or consulting a financial advisor to make informed decisions regarding investments impacted by U.S. tariff news and Euronext Amsterdam stock market activity.

Featured Posts

-

Apple Stock Dips Below Key Levels Before Q2 Earnings Report

May 24, 2025

Apple Stock Dips Below Key Levels Before Q2 Earnings Report

May 24, 2025 -

Complete Guide Nyt Mini Crossword For Tuesday April 8 2025

May 24, 2025

Complete Guide Nyt Mini Crossword For Tuesday April 8 2025

May 24, 2025 -

Paris Economic Slowdown Luxury Goods Sector Impact March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Goods Sector Impact March 7 2025

May 24, 2025 -

Analiz Svadeb Na Kharkovschine 600 Brakov Za Mesyats Prichiny Rosta

May 24, 2025

Analiz Svadeb Na Kharkovschine 600 Brakov Za Mesyats Prichiny Rosta

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What Investors Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What Investors Need To Know

May 24, 2025

Latest Posts

-

Anchor Brewing Companys Closure A Legacy In Beer Ends

May 24, 2025

Anchor Brewing Companys Closure A Legacy In Beer Ends

May 24, 2025 -

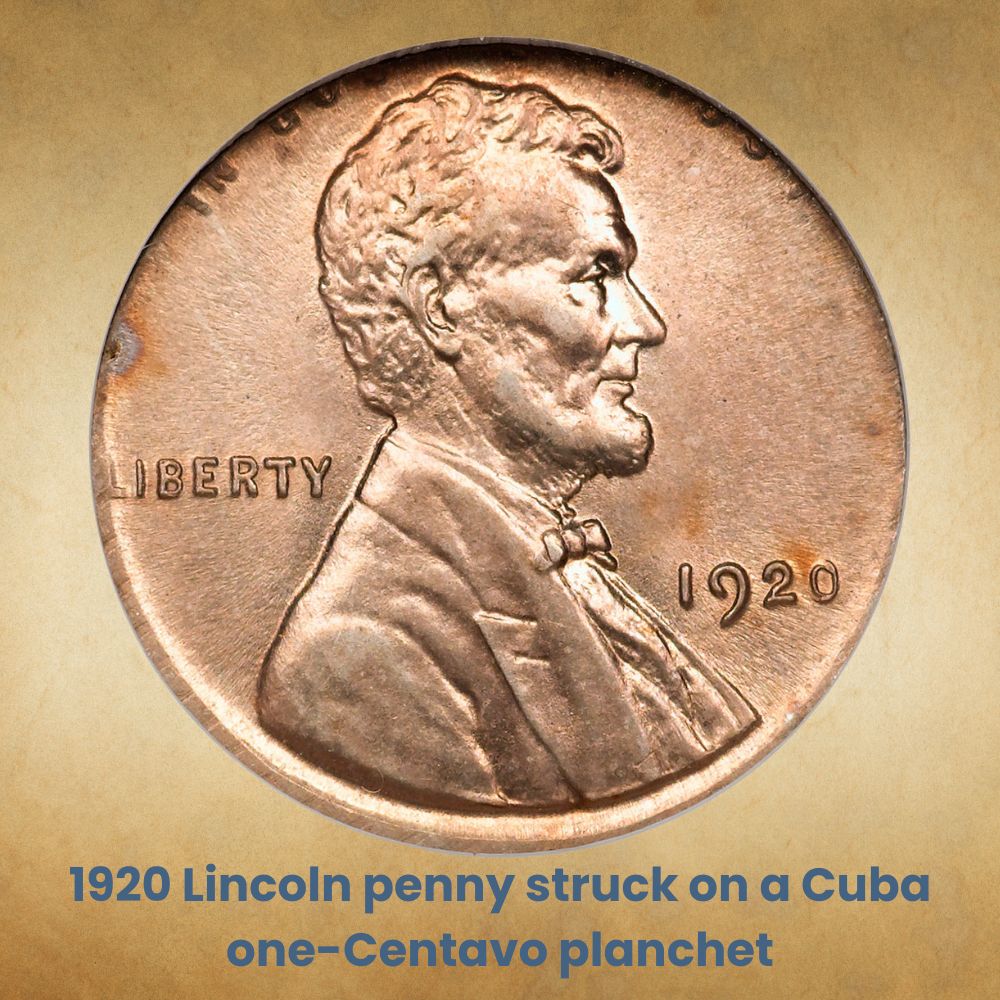

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025 -

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025