Uber Stock: A Comprehensive Investment Analysis

Table of Contents

Uber's Business Model and Market Position

Uber's success hinges on its multifaceted business model and its position within the rapidly evolving transportation and delivery sectors. Let's examine these key aspects:

Ridesharing Dominance

Uber's global reach is a significant competitive advantage. While precise market share figures fluctuate, Uber generally holds a leading position in many major cities worldwide, particularly in the ridesharing sector. This dominance stems from several factors:

- Global Market Share Statistics: While exact numbers vary by region and are subject to constant change due to competition, Uber consistently ranks as a major player with significant market share in numerous countries. Independent research firms regularly publish reports on this data, which should be consulted for the most up-to-date information.

- Key Features Differentiating Uber from Competitors: Uber's success is not solely dependent on its ridesharing service. Features like Uber Pool (carpooling), Uber Black (luxury rides), and its robust rider and driver apps provide key differentiators.

- Analysis of Geographic Market Penetration: Uber's strategic expansion into both developed and emerging markets demonstrates its ambition for global dominance. However, navigating local regulations and competition in each market presents unique challenges.

- Discussion of Network Effects and their Impact on Profitability: The more riders and drivers use the Uber platform, the more valuable the service becomes for both sides. This network effect is a substantial barrier to entry for competitors and contributes significantly to Uber's potential for profitability.

Diversification Beyond Ridesharing

Uber's strategic diversification is a key factor in its long-term growth strategy. Expanding beyond its core ridesharing business mitigates risks associated with reliance on a single service:

- Revenue Breakdown Across Different Business Segments: A significant portion of Uber's revenue comes from Uber Eats, its food delivery service. This diversification helps balance revenue streams and reduces reliance on the fluctuating demand for rides.

- Market Analysis of Each Segment's Competitive Landscape: Each segment – ridesharing, food delivery, freight – faces its own distinct competitive landscape. Understanding the dynamics of each market is vital for evaluating Uber's overall prospects.

- Growth Projections for Each Diversified Business Unit: Uber projects continued growth across all its business units. However, realizing these projections depends on several factors, including regulatory changes, economic conditions, and technological advancements.

- Synergies Between Different Uber Services: The various services offered by Uber create synergies. For example, a driver could pick up a passenger and then deliver food orders using the same trip. These synergies enhance efficiency and profitability.

Financial Performance and Growth Prospects

Understanding Uber's financial performance is crucial for evaluating its investment potential. Analyzing key metrics provides insight into its past, present, and future potential:

Revenue and Profitability

Uber's revenue growth has been impressive, but achieving consistent profitability has been a challenge:

- Year-over-Year Revenue Growth Analysis: Uber's financial reports reveal substantial year-over-year revenue growth, driven by both increasing user numbers and expansion into new markets and services. Investors should carefully analyze this trend.

- Profit Margin Analysis: Uber's profit margins have historically been thin due to high operating expenses, including driver payments, marketing costs, and regulatory compliance.

- Key Expense Drivers and Strategies for Cost Reduction: Analyzing Uber's operating expenses provides valuable insights into its cost structure and its plans to increase efficiency and profitability.

- Debt Levels and Financial Health: Assessing Uber's debt levels and overall financial health is essential. High debt can significantly impact the company's ability to weather economic downturns.

Future Growth Drivers

Several factors could drive significant future growth for Uber:

- Emerging Markets with High Growth Potential: Expanding into emerging markets with significant populations and increasing disposable income presents tremendous growth potential.

- Impact of Autonomous Vehicle Technology on Profitability: The development and implementation of autonomous vehicle technology could significantly impact Uber's profitability by reducing operating costs associated with drivers. However, this also presents significant technological and regulatory hurdles.

- Potential Partnerships and Acquisitions: Strategic partnerships and acquisitions can accelerate growth and enhance Uber's competitive positioning.

- Long-Term Revenue Projections and Assumptions: Analyzing Uber's long-term revenue projections and the underlying assumptions is crucial for understanding the potential returns on investment.

Risks and Challenges Facing Uber

Despite its growth potential, Uber faces significant challenges:

Regulatory Hurdles

Navigating the complex regulatory landscape is a major hurdle for Uber:

- Legal Battles and Their Financial Impact: Uber has faced numerous legal battles concerning driver classification, data privacy, and safety regulations, impacting its profitability and operational efficiency.

- Impact of Changing Regulations on Operations: Constantly evolving regulations in different jurisdictions create uncertainty and require Uber to adapt its business model continuously.

- Strategies for Navigating Regulatory Complexities: Understanding Uber's strategies for addressing and mitigating regulatory risks is crucial.

Competitive Landscape

The competitive landscape in transportation and delivery services is intensely competitive:

- Competitive Pricing Strategies and Their Impact on Profitability: Intense competition often leads to price wars, squeezing profit margins.

- Technological Innovation by Competitors: Competitors are constantly innovating, introducing new services and technologies that could erode Uber's market share.

- Market Share Erosion Risk: The risk of losing market share to competitors is significant, especially in the highly dynamic ridesharing and delivery sectors.

Economic Factors

Macroeconomic factors can significantly impact Uber's performance:

- Sensitivity Analysis to Changes in Fuel Prices: Fuel price fluctuations directly affect Uber's operating costs and profitability.

- Impact of Economic Recession on Demand: Economic downturns often lead to decreased consumer spending, reducing demand for ridesharing and delivery services.

- Strategies for Mitigating Economic Risks: Assessing Uber's strategies for mitigating the risks associated with economic downturns is crucial.

Conclusion

This comprehensive analysis of Uber stock reveals a company with significant growth potential but also facing substantial challenges. While its diversification strategy and strong market position in ridesharing are positives, regulatory hurdles and intense competition pose considerable risks. Ultimately, the decision to invest in Uber stock requires careful consideration of these factors and your individual investment risk tolerance. Before investing in Uber stock, conduct thorough due diligence and consider seeking professional financial advice. Remember to thoroughly research Uber stock, including its latest financial reports and news, before making any investment decisions. Analyzing the Uber stock price in relation to these factors is key to a successful investment strategy. Remember that past performance is not indicative of future results.

Featured Posts

-

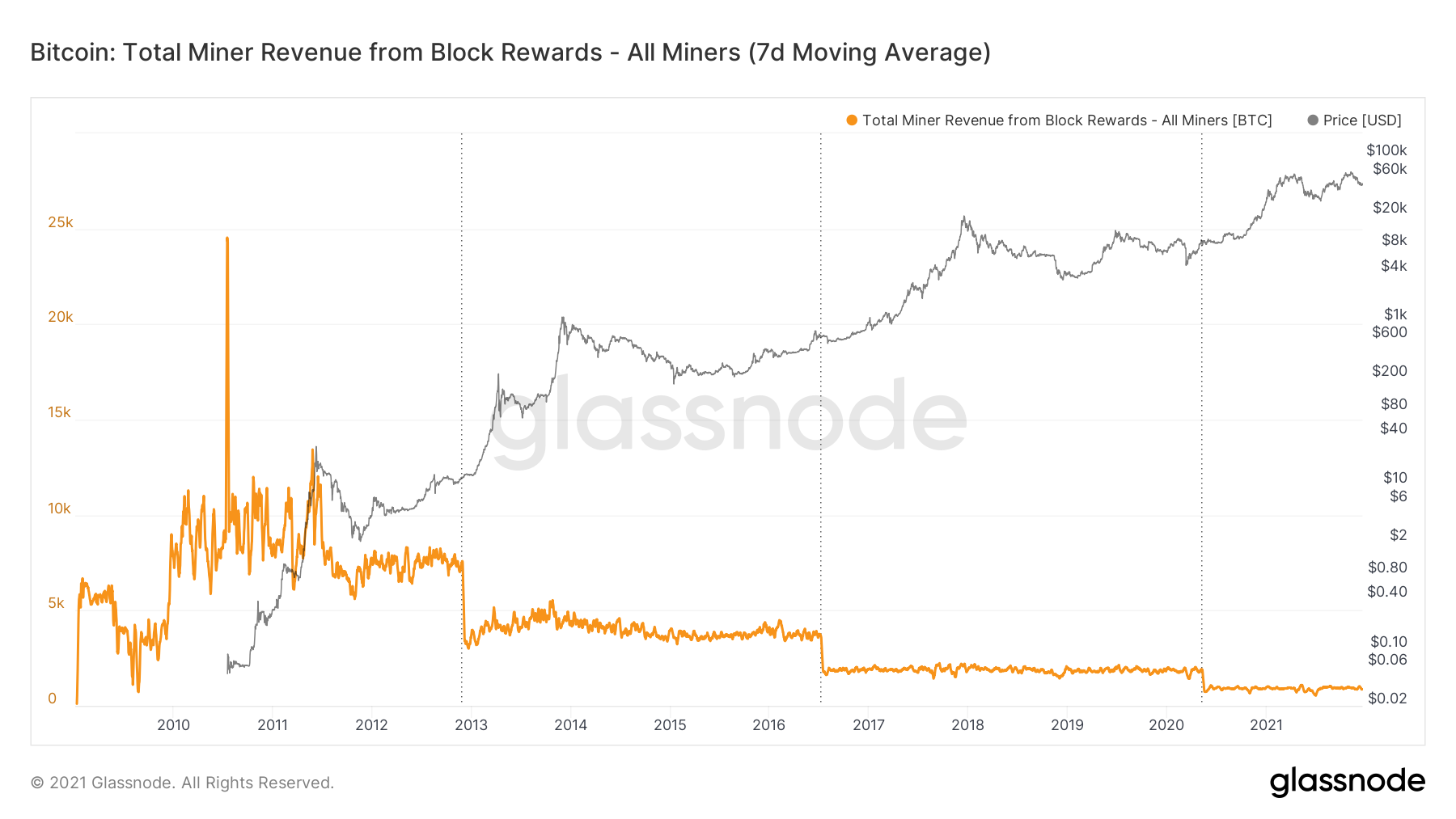

Why Bitcoin Miner Revenue Surged This Week

May 08, 2025

Why Bitcoin Miner Revenue Surged This Week

May 08, 2025 -

Psg Celesat E Suksesit Ne Pjesen E Pare Te Ndeshkimit

May 08, 2025

Psg Celesat E Suksesit Ne Pjesen E Pare Te Ndeshkimit

May 08, 2025 -

Minecraft Superman A 5 Minute Preview From A Thailand Theater

May 08, 2025

Minecraft Superman A 5 Minute Preview From A Thailand Theater

May 08, 2025 -

Can Investing In Xrp Ripple Help You Achieve Your Financial Goals

May 08, 2025

Can Investing In Xrp Ripple Help You Achieve Your Financial Goals

May 08, 2025 -

Unveiling A Rogue One Legend A New Star Wars Series

May 08, 2025

Unveiling A Rogue One Legend A New Star Wars Series

May 08, 2025

Latest Posts

-

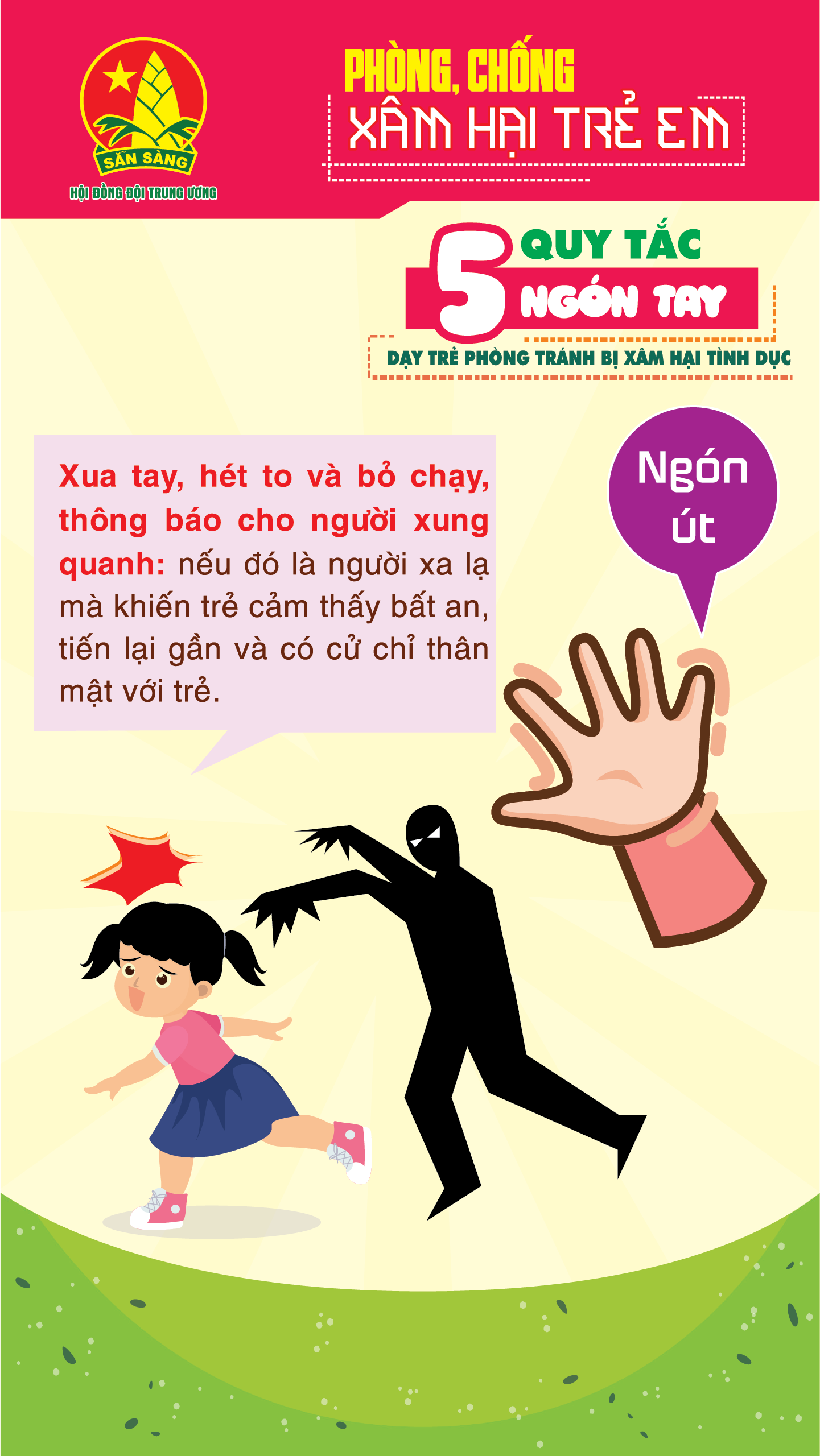

Bao Hanh Tre Em Tien Giang De Nghi Xu Ly Nghiem Khac Va Cai Thien An Toan Giu Tre

May 09, 2025

Bao Hanh Tre Em Tien Giang De Nghi Xu Ly Nghiem Khac Va Cai Thien An Toan Giu Tre

May 09, 2025 -

State Suspends Nc Daycare License Impact On Children And Families

May 09, 2025

State Suspends Nc Daycare License Impact On Children And Families

May 09, 2025 -

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025 -

Nc Daycare License Suspended Details On The States Decision

May 09, 2025

Nc Daycare License Suspended Details On The States Decision

May 09, 2025 -

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025