UK Inflation Data Drives Pound Higher, BOE Rate Cut Bets Diminish

Table of Contents

Lower-Than-Expected Inflation Figures

The UK's latest inflation figures surprised analysts and market watchers alike. The Consumer Price Index (CPI) and Retail Price Index (RPI), key indicators of inflation, came in lower than predicted, signaling a potential cooling of inflationary pressures within the UK economy.

- CPI: The CPI figure for [Insert Month and Year] was [Insert Percentage], significantly lower than the predicted [Insert Predicted Percentage] and down from [Insert Previous Month's Percentage].

- RPI: The RPI for [Insert Month and Year] stood at [Insert Percentage], also below market forecasts of [Insert Predicted Percentage].

- Contributing Factors: Several factors contributed to this unexpectedly low inflation. Easing energy prices, following a period of substantial increases, played a significant role. Furthermore, improvements in global supply chains have reduced the cost of imported goods, while weaker consumer demand has also dampened inflationary pressures.

Impact on the Pound Sterling

The Pound Sterling reacted immediately and positively to the release of the lower-than-expected inflation data.

- GBP/USD: The GBP/USD exchange rate saw a [Insert Percentage]% increase, rising from [Insert Starting Value] to [Insert Ending Value].

- GBP/EUR: Similarly, the GBP/EUR exchange rate strengthened by [Insert Percentage]%, climbing from [Insert Starting Value] to [Insert Ending Value]. [Insert Chart showing GBP performance against USD and EUR]

This strengthening is primarily attributed to the reduced expectations of further BOE rate cuts. Lower inflation reduces the pressure on the BOE to further stimulate the economy through lower interest rates. This increased market confidence in the UK's economic outlook directly translates into a stronger Pound. Market analysts have commented on the positive surprise, highlighting the increased attractiveness of the Pound as a result.

Diminished Expectations of BOE Rate Cuts

The lower-than-expected inflation figures significantly alter the BOE's monetary policy outlook. The likelihood of further interest rate cuts has diminished, and some analysts are even speculating about the possibility of future rate hikes, depending on the trajectory of future inflation data.

- Market Predictions: Market predictions for the next BOE interest rate decision are now leaning towards [Insert Market Prediction – e.g., a hold, or a small increase].

- BOE Stance: The BOE's current stance is likely to be more data-dependent, closely monitoring inflation figures and economic growth before making any further decisions regarding interest rates.

- Consequences: The consequences of further rate cuts or hikes are significant. Lower rates stimulate borrowing and economic activity but risk fueling inflation; higher rates curb inflation but can slow down economic growth.

Implications for Investors and Businesses

The rise of the Pound has significant implications for UK businesses engaged in international trade.

- Exporters: UK exporters will face reduced competitiveness as their goods become more expensive in foreign markets. This could lead to decreased export volumes and potentially impact their profitability.

- Importers: Conversely, importers will benefit from cheaper imports, potentially reducing their costs and boosting their profit margins.

- Investment Decisions: Businesses will need to reassess their investment strategies, taking into account the fluctuations in the exchange rate and their exposure to foreign exchange risk.

- Tourism: The stronger Pound may negatively impact tourism as it makes the UK more expensive for foreign visitors.

Conclusion: UK Inflation Data and the Pound's Future

Lower-than-expected UK inflation data has driven the Pound Sterling higher, significantly reducing market expectations of further BOE interest rate cuts. This has created positive ripples across currency markets, although the impact on UK businesses is mixed, benefiting importers while potentially hurting exporters. The future remains uncertain, however. Currency markets are inherently volatile, and unforeseen economic developments could easily shift the current positive trend. It's crucial to monitor the evolving situation closely.

To stay informed about the impact of UK inflation data on the Pound Sterling, regularly check reputable financial news sources. Understanding the implications of UK inflation and BOE interest rates is vital for making informed investment and business decisions. Stay vigilant and adapt your strategies accordingly.

Featured Posts

-

Shpani A Slavi Pobeda Vo Ln Khrvatska Porazena Po Penali

May 23, 2025

Shpani A Slavi Pobeda Vo Ln Khrvatska Porazena Po Penali

May 23, 2025 -

The Karate Kids Enduring Legacy Impact And Cultural Influence

May 23, 2025

The Karate Kids Enduring Legacy Impact And Cultural Influence

May 23, 2025 -

Convocatoria De Instituto Cambios Y Novedades Para El Partido Contra Lanus

May 23, 2025

Convocatoria De Instituto Cambios Y Novedades Para El Partido Contra Lanus

May 23, 2025 -

Noussair Mazraoui Manchester Uniteds Best Signing In Years

May 23, 2025

Noussair Mazraoui Manchester Uniteds Best Signing In Years

May 23, 2025 -

Sses Financial Strategy Shift 3 Billion Spending Reduction Explained

May 23, 2025

Sses Financial Strategy Shift 3 Billion Spending Reduction Explained

May 23, 2025

Latest Posts

-

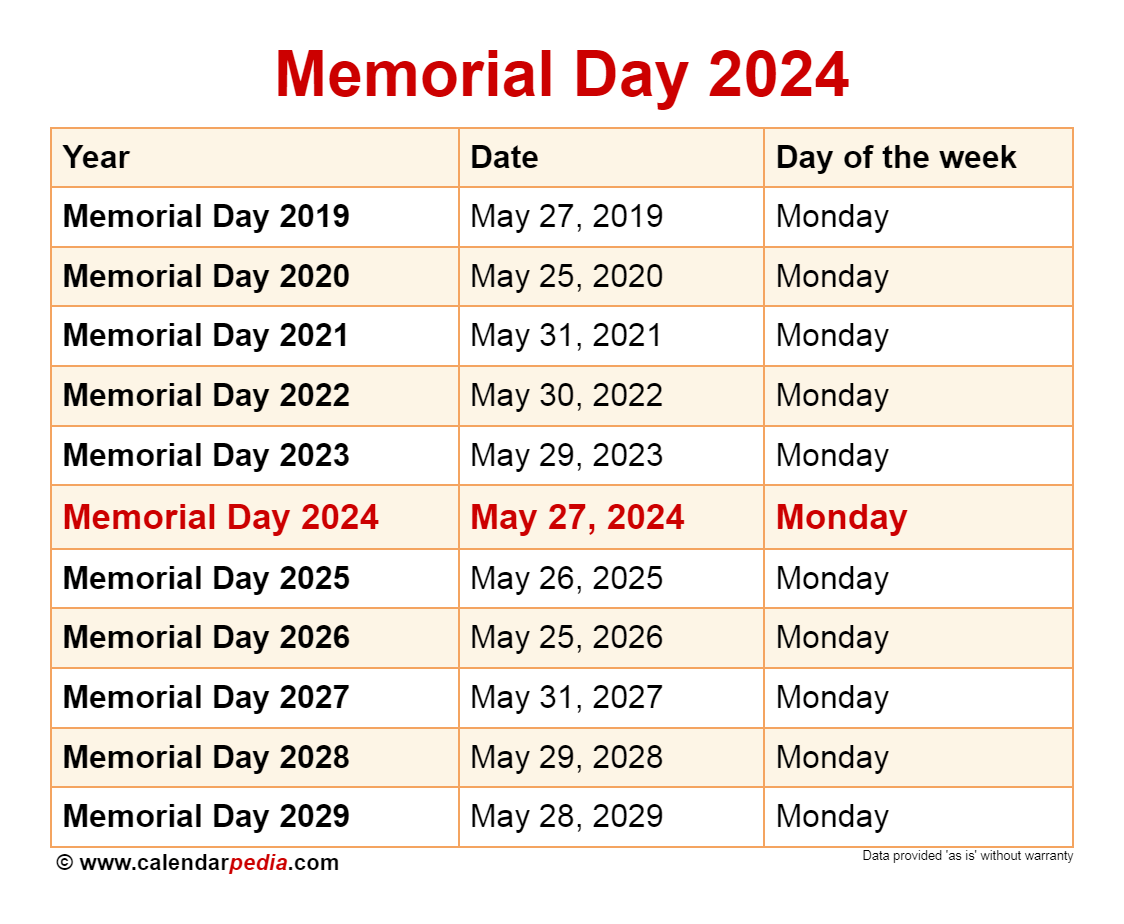

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025 -

Review Neal Mc Donough In The Last Rodeo

May 23, 2025

Review Neal Mc Donough In The Last Rodeo

May 23, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025 -

Exploring Neal Mc Donoughs Character In The Last Rodeo

May 23, 2025

Exploring Neal Mc Donoughs Character In The Last Rodeo

May 23, 2025