UK Inflation Report Spurs Pound Rally: BOE Rate Cut Bets Diminish

Table of Contents

Key Findings of the UK Inflation Report

The UK inflation report unveiled some surprising figures that significantly impacted market expectations.

Unexpected Slowdown in Inflation

The report revealed an unexpected slowdown in inflation. Instead of the anticipated rise, the Consumer Price Index (CPI) showed a decrease, falling from X% to Y% (replace X and Y with actual figures from a recent report). Similarly, the Retail Price Index (RPI) also experienced a decline. This contrasts sharply with previous months and significantly undercuts earlier forecasts. Core inflation (excluding volatile energy and food prices) also showed a more moderate increase than predicted. This unexpected slowdown is the primary catalyst for the subsequent pound rally and diminished expectations of a BOE rate cut.

- CPI: Decreased from X% to Y%

- RPI: Decreased from A% to B% (replace A and B with actual figures)

- Core Inflation: Moderated increase, lower than anticipated.

The unexpected nature of this slowdown suggests a potential turning point in the UK's inflationary pressures, prompting a reassessment of the economic outlook.

Impact on Consumer Spending and Business Confidence

Lower inflation could positively impact consumer spending and business confidence. Reduced prices, particularly for essential goods, might free up more disposable income for consumers, leading to increased spending and boosting economic activity. Businesses, witnessing improved consumer demand and reduced input costs, may also become more confident in investing, further stimulating economic growth.

- Increased consumer spending: Lower prices lead to increased purchasing power.

- Improved business confidence: Reduced input costs and increased demand.

- Potential for economic growth: A virtuous cycle of increased spending and investment.

However, it's crucial to acknowledge potential downsides. A sudden drop in inflation could signal weakening demand, potentially leading to a broader economic slowdown. Further analysis is needed to determine the sustainability of this positive trend.

Analysis of Underlying Inflationary Pressures

The deceleration in inflation can be attributed to several factors. Easing energy prices, following a period of high volatility, have played a significant role. Supply chain disruptions, while still present, have shown signs of easing, reducing the pressure on input costs for businesses. Furthermore, weaker-than-anticipated consumer demand may have also contributed to the slowdown.

- Easing energy prices: Reduced energy costs translate to lower prices across various sectors.

- Supply chain improvements: Reduced bottlenecks lead to lower production costs.

- Weakening demand: Lower consumer demand can dampen inflationary pressures.

The sustainability of this decline in inflationary pressures remains a key area of concern and will be closely monitored by the BOE and market analysts alike.

The Pound's Response to the Inflation Report

The UK inflation report's positive surprises triggered a significant strengthening of the pound against major global currencies.

Strength of the Pound Against Major Currencies

Following the release of the report, the pound experienced a noticeable rally. GBP/USD (Pound Sterling against the US Dollar) saw a significant increase, while GBP/EUR (Pound Sterling against the Euro) also strengthened considerably. (Insert specific percentage changes here based on actual market data). This appreciation reflects the increased confidence in the UK economy and its reduced reliance on aggressive monetary easing.

- GBP/USD: Increased by X% (replace X with actual percentage change)

- GBP/EUR: Increased by Y% (replace Y with actual percentage change)

- Impact on imports and exports: A stronger pound makes imports cheaper but exports more expensive.

The movement in exchange rates has significant implications for both UK businesses and international investors.

Impact on UK Businesses and Investors

The stronger pound presents a double-edged sword for UK businesses. While it makes imports cheaper, reducing production costs for some businesses, it simultaneously makes UK exports less competitive in international markets. For investors, a stronger pound might decrease the attractiveness of UK assets to foreign investors seeking higher returns in other currencies. However, it also increases the value of sterling-denominated assets for domestic investors.

- Impact on export competitiveness: A stronger pound makes UK goods more expensive for foreign buyers.

- Attractiveness of UK assets: A stronger pound might reduce the appeal of UK assets to foreign investors.

- Potential risks and opportunities: Businesses need to adapt their strategies to navigate these changing conditions.

Diminished Expectations of a BOE Rate Cut

The unexpected inflation figures have led to a significant reassessment of the BOE's likely course of action.

Shift in Market Sentiment

Prior to the report, market analysts widely anticipated a further reduction in interest rates by the BOE, given the persistent inflationary pressures. However, the data revealed in the report dramatically shifted this sentiment. Interest rate futures, which reflect market expectations, now point towards a lower probability of an imminent rate cut, and some even suggest a potential pause or even a future rate hike.

- Previous predictions for rate cuts: Widely anticipated due to inflationary concerns.

- Current market expectations: Significantly reduced likelihood of a rate cut.

- Interest rate futures: Market indicators reflect a shift in expectations.

This change reflects the market’s evolving perception of the UK's economic outlook.

Potential Implications for Monetary Policy

The improved inflation figures provide the BOE with more flexibility in its monetary policy decisions. The central bank might now opt to maintain interest rates at their current level, closely observing the economic data before making any further adjustments. A rate hike remains a possibility depending on the sustained trend in inflation and economic growth. This uncertainty highlights the need for continued monitoring of economic indicators.

- Potential scenarios for future interest rate decisions: Pause, further cuts, or even a rate hike are now all potential outcomes.

- Impact on lending rates: BOE decisions directly impact borrowing costs for individuals and businesses.

- Economic growth outlook: The BOE's monetary policy directly influences the UK's economic trajectory.

Conclusion

The latest UK inflation report delivered a surprising slowdown in inflation, triggering a significant pound rally and diminishing expectations of an imminent BOE rate cut. The unexpected decrease in CPI and RPI, coupled with a moderation in core inflation, significantly altered market sentiment and boosted the pound against major currencies. While this presents opportunities, it also poses challenges for UK businesses navigating the complexities of international trade and fluctuating exchange rates. Understanding UK inflation and its effects on the pound is crucial for investors and businesses operating within the UK.

Call to Action: Stay informed about future developments in the UK economy and their impact on the pound by regularly checking for updates on UK inflation reports and Bank of England announcements. Continue to monitor the impact of this significant UK inflation report and its potential long-term consequences. Understanding UK inflation and its implications is crucial for navigating the complexities of the UK economy.

Featured Posts

-

Relx Succes Ai Strategie Overwint Economische Onzekerheid

May 25, 2025

Relx Succes Ai Strategie Overwint Economische Onzekerheid

May 25, 2025 -

De Zaraz Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 25, 2025

De Zaraz Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 25, 2025 -

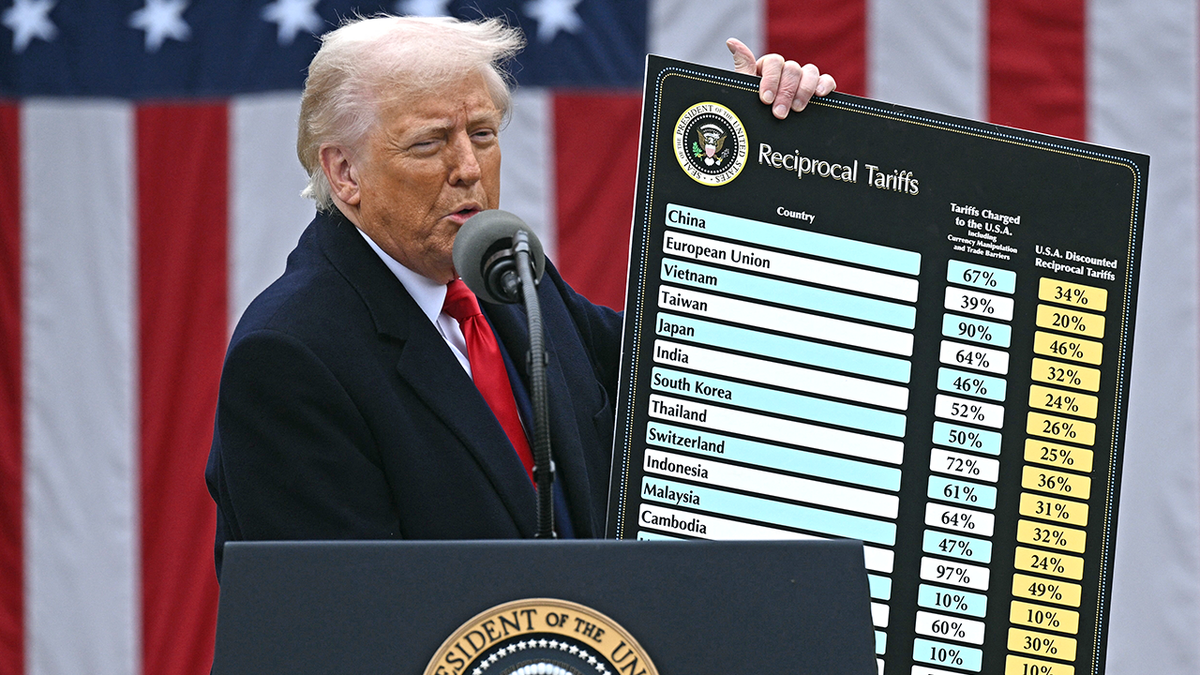

Stock Market Volatility Amsterdam Exchange Down 2 Post Trump Tariff Announcement

May 25, 2025

Stock Market Volatility Amsterdam Exchange Down 2 Post Trump Tariff Announcement

May 25, 2025 -

Trump Approves Nippon U S Steel Deal Implications For The Industry

May 25, 2025

Trump Approves Nippon U S Steel Deal Implications For The Industry

May 25, 2025 -

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025

Latest Posts

-

Mercedes F1 Toto Wolffs Hints On George Russells Future

May 25, 2025

Mercedes F1 Toto Wolffs Hints On George Russells Future

May 25, 2025 -

Wolff Drops Another Clue About Russells F1 Future With Mercedes

May 25, 2025

Wolff Drops Another Clue About Russells F1 Future With Mercedes

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025 -

Shooting At Southern Vacation Spot Sparks Safety Debate And Fact Checking

May 25, 2025

Shooting At Southern Vacation Spot Sparks Safety Debate And Fact Checking

May 25, 2025 -

Recent Shooting At Southern Vacation Destination Sparks Safety Debate

May 25, 2025

Recent Shooting At Southern Vacation Destination Sparks Safety Debate

May 25, 2025