UK Inflation Slows: Impact On BOE Rate Cuts And The Pound Sterling

Table of Contents

Declining UK Inflation: A Detailed Look

The latest inflation figures and their significance:

The Office for National Statistics (ONS) recently released data showing a continued slowdown in UK inflation. The Consumer Price Index (CPI) fell to X% in [Month, Year], down from Y% in the previous month and significantly lower than the Z% recorded a year ago. The Retail Price Index (RPI), another key inflation measure, also showed a similar decline. This decrease is significant because it marks a substantial shift from the high inflation rates seen earlier in the year.

-

Key contributing factors to the slowdown:

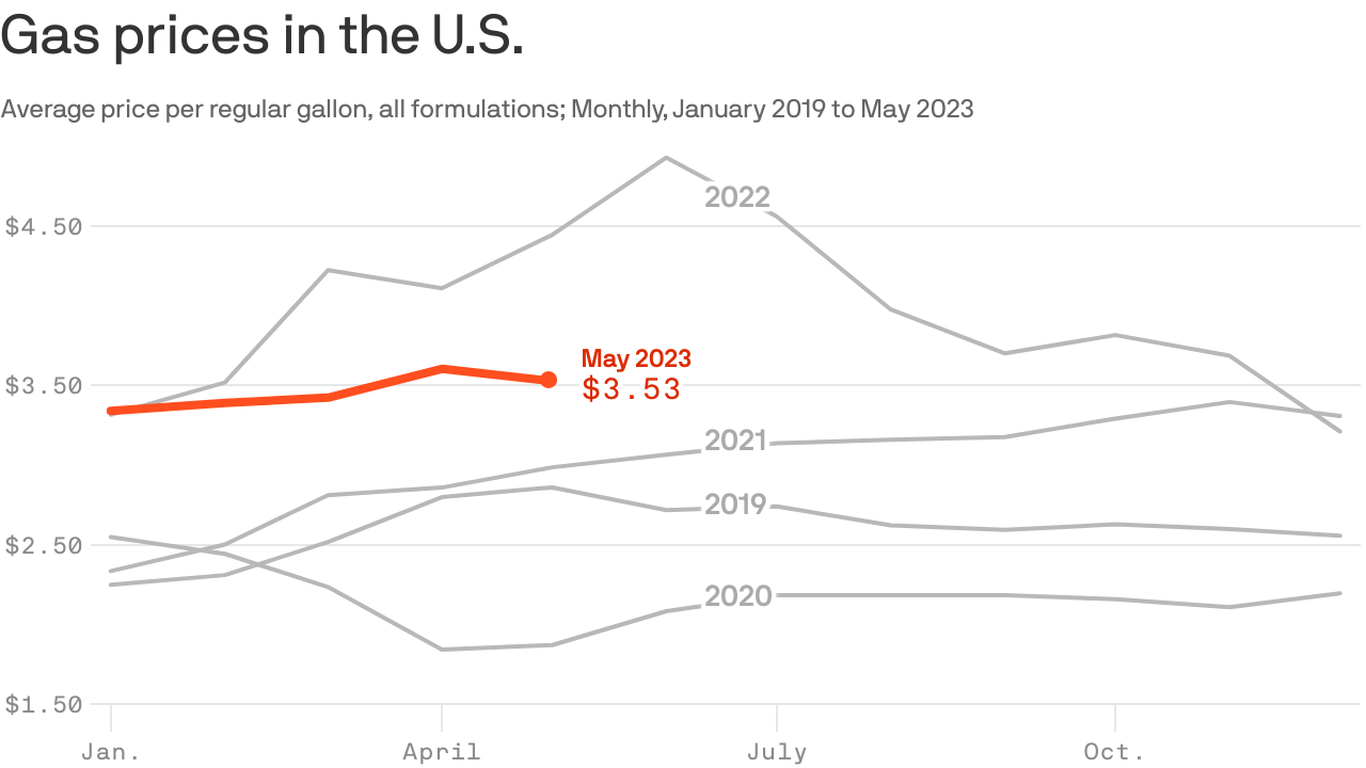

- Falling energy prices, reflecting global trends in oil and gas markets.

- Easing supply chain pressures, leading to reduced production costs for many goods.

- A moderation in demand, potentially driven by the cost-of-living crisis impacting consumer spending.

-

Comparison with inflation rates in other major economies: The UK's inflation rate, while slowing, remains higher than that of some other major economies like the Eurozone or the US, indicating that the UK's economic recovery is still facing challenges. This comparison is crucial for understanding the relative strength of the UK economy compared to its global peers.

Underlying inflationary pressures:

While the headline inflation figures are encouraging, it's crucial to examine underlying inflationary pressures to determine whether the decline is sustainable. Core inflation, which excludes volatile components like food and energy, provides a better indication of persistent price increases. Currently, core inflation remains at [Percentage]%, suggesting that underlying price pressures still exist.

-

Factors that might contribute to persistent inflation:

- Strong wage growth, potentially leading to higher production costs and consumer demand.

- Rising import costs, especially given the UK's reliance on global supply chains.

- Persistent supply-side bottlenecks in certain sectors.

-

Analysis of different inflation forecasts from reputable economic institutions: The Bank of England, the International Monetary Fund (IMF), and other institutions provide various inflation forecasts. Understanding these differing viewpoints helps to gauge the level of uncertainty and potential risks in the future inflation trajectory.

The Bank of England (BOE) and Potential Rate Cuts

The BOE's response to slowing inflation:

The slowing UK inflation significantly influences the BOE's monetary policy decisions. The BOE's primary mandate is to maintain price stability, typically targeting an inflation rate of 2%. The recent data suggests that the BOE might adjust its course, potentially slowing or halting further interest rate hikes.

- Discussion of the current base interest rate and potential future adjustments: The current base interest rate is [Percentage]%, reflecting the BOE's previous attempts to curb inflation. The future direction of interest rates remains uncertain, depending on how underlying inflation evolves and the overall health of the economy.

- Mention the BOE's inflation target and its implications: The BOE's 2% inflation target remains a crucial benchmark against which its policy decisions are assessed. The deviation of inflation from the target directly impacts the BOE's strategies and communication.

Market expectations and speculation:

Financial markets are closely monitoring UK inflation data and the BOE's response. Speculation abounds regarding the likelihood and timing of potential rate cuts. Investor sentiment significantly impacts the GBP and other asset prices.

- Discuss potential scenarios, including the possibility of further rate hikes or pauses: The market anticipates various scenarios. A sustained decline in inflation might lead to rate cuts, while persistent underlying pressures could necessitate further rate hikes or a prolonged pause.

- Mention the impact of global economic events on BOE decision-making: Global economic developments, such as changes in global interest rates or geopolitical instability, also play a role in influencing the BOE's policy decisions.

The Impact on the Pound Sterling (GBP)

Correlation between UK inflation and the GBP:

A crucial relationship exists between UK inflation and the value of the Pound Sterling. Generally, higher inflation erodes the purchasing power of a currency, leading to its depreciation against other currencies. Conversely, lower inflation can support the currency's value.

- Discuss how lower inflation may affect the GBP's value against other major currencies (e.g., USD, EUR): A sustained decrease in UK inflation could strengthen the GBP compared to currencies experiencing higher inflation rates. This effect, however, is influenced by numerous other factors such as international trade balances, and global investment trends.

- Include relevant charts or graphs illustrating the GBP's recent performance: Visual representations of the GBP's exchange rate against other major currencies clearly illustrate the impact of inflation changes and other market forces.

Investor sentiment and foreign investment:

Changes in UK inflation and the BOE's response directly influence investor sentiment and foreign direct investment (FDI) into the UK. Positive inflation news tends to boost investor confidence and attract more FDI.

- Discuss the potential effects on the UK's current account balance: The GBP exchange rate influences the UK's current account balance; a stronger Pound could improve the balance by making imports cheaper and exports relatively more expensive.

- Mention any potential risks associated with changes in the GBP's exchange rate: Volatility in the GBP exchange rate carries risks for businesses engaged in international trade and for UK-based investors with foreign currency exposure.

Conclusion

The slowdown in UK inflation has significant implications for the Bank of England's monetary policy and the Pound Sterling. Lower inflation increases the likelihood of BOE rate cuts, which in turn could impact the GBP's exchange rate and overall investor sentiment. The interconnectedness of these factors highlights the complexity of navigating economic changes. To stay informed about developments in UK inflation and its effects on the economy, regularly consult reliable economic news sources. Subscribe to our newsletter for updates on UK inflation and related market analyses. Stay informed to make well-informed decisions in this dynamic economic landscape.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc What You Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc What You Need To Know

May 24, 2025 -

Luchshie Goroskopy I Predskazaniya Astrologicheskiy Prognoz

May 24, 2025

Luchshie Goroskopy I Predskazaniya Astrologicheskiy Prognoz

May 24, 2025 -

Dazi E Borse L Unione Europea Risponde Alla Crisi Con Misure Senza Precedenti

May 24, 2025

Dazi E Borse L Unione Europea Risponde Alla Crisi Con Misure Senza Precedenti

May 24, 2025 -

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025 -

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025

Latest Posts

-

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And New Look

May 24, 2025

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And New Look

May 24, 2025 -

Cheaper Gas This Memorial Day Weekend What To Expect

May 24, 2025

Cheaper Gas This Memorial Day Weekend What To Expect

May 24, 2025 -

Gas Prices Plunge Memorial Day Weekend Travel Could Be Cheaper

May 24, 2025

Gas Prices Plunge Memorial Day Weekend Travel Could Be Cheaper

May 24, 2025 -

Tulsa King Season 3 Is Neal Mc Donough Back Sylvester Stallones New Look And Latest Updates

May 24, 2025

Tulsa King Season 3 Is Neal Mc Donough Back Sylvester Stallones New Look And Latest Updates

May 24, 2025 -

Record Low Gas Prices Predicted For Memorial Day Weekend

May 24, 2025

Record Low Gas Prices Predicted For Memorial Day Weekend

May 24, 2025