Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: What You Need To Know

Table of Contents

What is the Amundi MSCI All Country World UCITS ETF USD Acc?

The Amundi MSCI All Country World UCITS ETF USD Acc is a globally diversified ETF designed to track the MSCI All Country World Index. This index represents a broad range of large and mid-cap equities from developed and emerging markets across the globe. Investing in this ETF provides:

- Global Exposure: Access to a vast portfolio of international companies, reducing reliance on any single market's performance.

- Diversification: Spreading investment risk across numerous sectors and geographies, mitigating potential losses.

- Low Cost: Generally, ETFs have lower expense ratios than actively managed mutual funds, meaning more of your investment works for you.

- Transparency: The ETF's holdings are clearly defined and publicly available, providing transparency into your investment.

This makes it an attractive option for investors seeking broad global market exposure through a low-cost, diversified investment vehicle. Keywords: global ETF, world index ETF, diversified ETF, low-cost ETF.

How is the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc Calculated?

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is calculated daily by Amundi, the ETF provider. The process involves:

- Asset Valuation: Determining the market value of all the underlying assets held within the ETF. This includes the current market price of each stock in the portfolio.

- Total Asset Value: Summing the market value of all underlying assets to arrive at the total portfolio value.

- Liabilities Deduction: Subtracting the ETF's liabilities (such as management fees and expenses) from the total asset value.

- NAV Calculation: Dividing the net asset value (total assets minus liabilities) by the total number of outstanding ETF shares. This results in the NAV per share.

Amundi employs rigorous valuation methodologies to ensure accuracy. The frequency of NAV calculation is typically daily, reflecting the changes in the underlying assets' values. Keywords: ETF valuation, asset valuation, daily NAV, ETF pricing.

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Several factors can significantly influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

- Market Fluctuations: Changes in the stock market directly impact the value of the underlying assets, causing the NAV to rise or fall. Market volatility can lead to substantial NAV fluctuations.

- Currency Exchange Rates: As the ETF is denominated in USD (USD Acc), fluctuations in exchange rates between the USD and other currencies affect the value of the non-USD assets held within the portfolio.

- Dividend Distributions: When underlying companies pay dividends, the NAV typically decreases by the amount of dividends distributed, although this is often reinvested.

- Index Rebalancing: The MSCI All Country World Index is periodically rebalanced, which can slightly affect the ETF's composition and, consequently, its NAV.

Keywords: market volatility, currency risk, dividend reinvestment, NAV fluctuations.

Where to Find the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Accessing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Reliable sources include:

- Amundi's Website: The official website is a primary source for real-time and historical NAV data.

- Financial News Websites: Many reputable financial news sites publish ETF data, including NAVs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, you can typically access real-time NAV information directly through your account.

It is essential to check the NAV before buying or selling shares to understand the current market value. Remember there might be a slight lag between the official NAV calculation and the ETF's trading price. Keywords: real-time NAV, historical NAV data, ETF data providers, brokerage accounts.

Using NAV to Make Informed Investment Decisions

Understanding the NAV allows investors to make more informed decisions:

- Performance Assessment: Comparing the NAV over time provides insights into the ETF's performance.

- NAV vs. Share Price: The difference between the NAV and the ETF's market price can indicate potential buying or selling opportunities (though trading costs and slippage should be considered).

- Risk Management: Monitoring NAV fluctuations helps assess the risk associated with the investment and adjust the portfolio accordingly.

- Portfolio Diversification: NAV data contributes to a comprehensive understanding of the portfolio's overall value and risk profile.

Keywords: investment strategy, portfolio management, risk assessment, ETF performance.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi MSCI All Country World UCITS ETF USD Acc Investment

Understanding the Net Asset Value (NAV) of your Amundi MSCI All Country World UCITS ETF USD Acc investment is key to effective portfolio management. Regularly monitoring the NAV, coupled with an awareness of the factors that influence it, allows for informed decisions regarding buying, selling, and overall investment strategy. Utilize the resources mentioned above to access NAV data and keep track of your investment's performance. Stay informed about the Net Asset Value (NAV) of your Amundi MSCI All Country World UCITS ETF USD Acc investment for optimal portfolio management. Regularly check the NAV and understand its implications for your investment strategy.

Featured Posts

-

Navigating Bbc Radio 1 Big Weekend 2025 Ticket Applications Sefton Park

May 24, 2025

Navigating Bbc Radio 1 Big Weekend 2025 Ticket Applications Sefton Park

May 24, 2025 -

The Kyle Walker Annie Kilner Story A Look At Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Story A Look At Recent Events

May 24, 2025 -

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Na Chotirokh Peremozhtsiv

May 24, 2025

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Na Chotirokh Peremozhtsiv

May 24, 2025 -

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025 -

The Allure Of A Country Escape Benefits And Considerations

May 24, 2025

The Allure Of A Country Escape Benefits And Considerations

May 24, 2025

Latest Posts

-

Dreyfus Affair French Lawmakers Push For Posthumous Promotion

May 24, 2025

Dreyfus Affair French Lawmakers Push For Posthumous Promotion

May 24, 2025 -

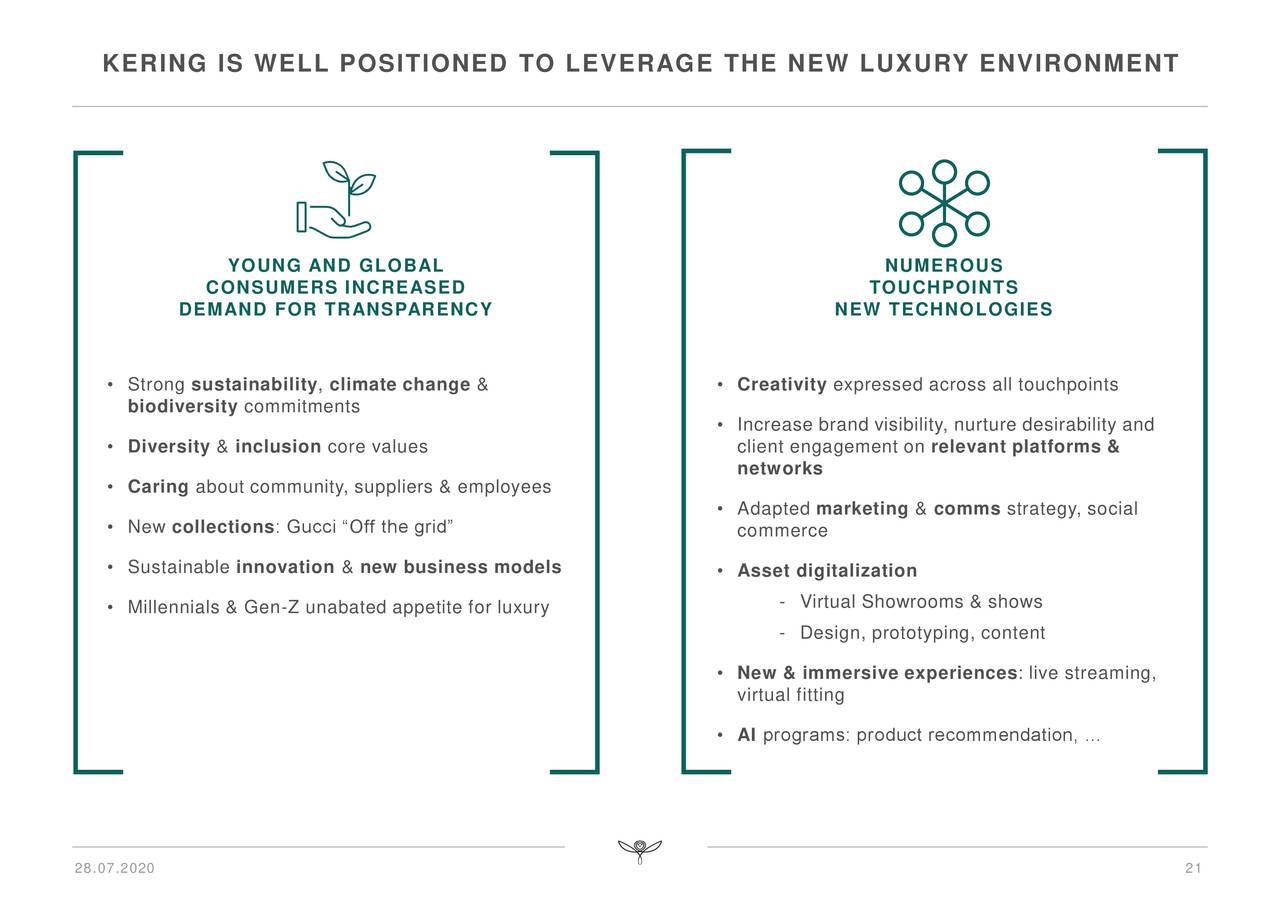

Kering Stock Drops 6 On Weak First Quarter Results

May 24, 2025

Kering Stock Drops 6 On Weak First Quarter Results

May 24, 2025 -

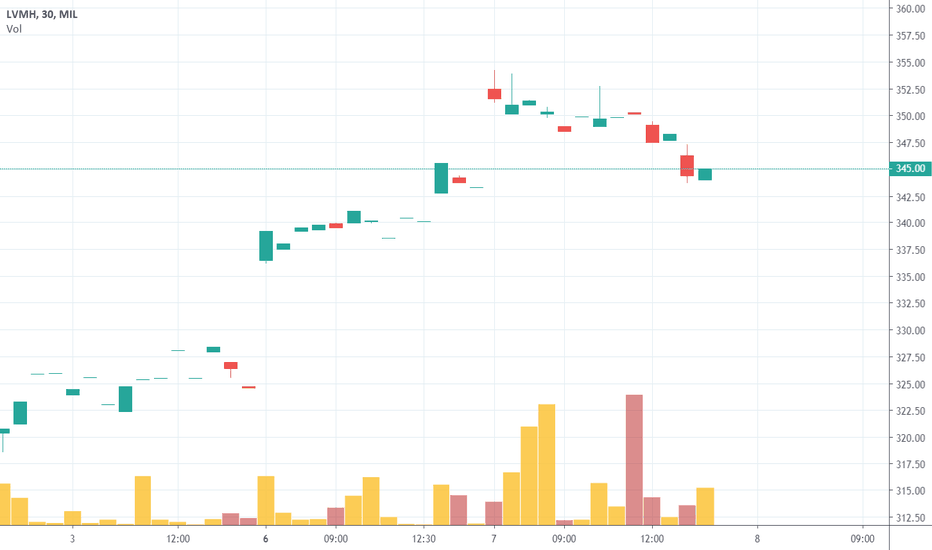

Lvmh Stock Falls 8 2 Following Weak Q1 Sales Report

May 24, 2025

Lvmh Stock Falls 8 2 Following Weak Q1 Sales Report

May 24, 2025 -

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025 -

Lvmh Q1 Sales Miss Expectations Shares Drop 8 2

May 24, 2025

Lvmh Q1 Sales Miss Expectations Shares Drop 8 2

May 24, 2025