Understanding Bitcoin's Rebound: Risks And Opportunities

Table of Contents

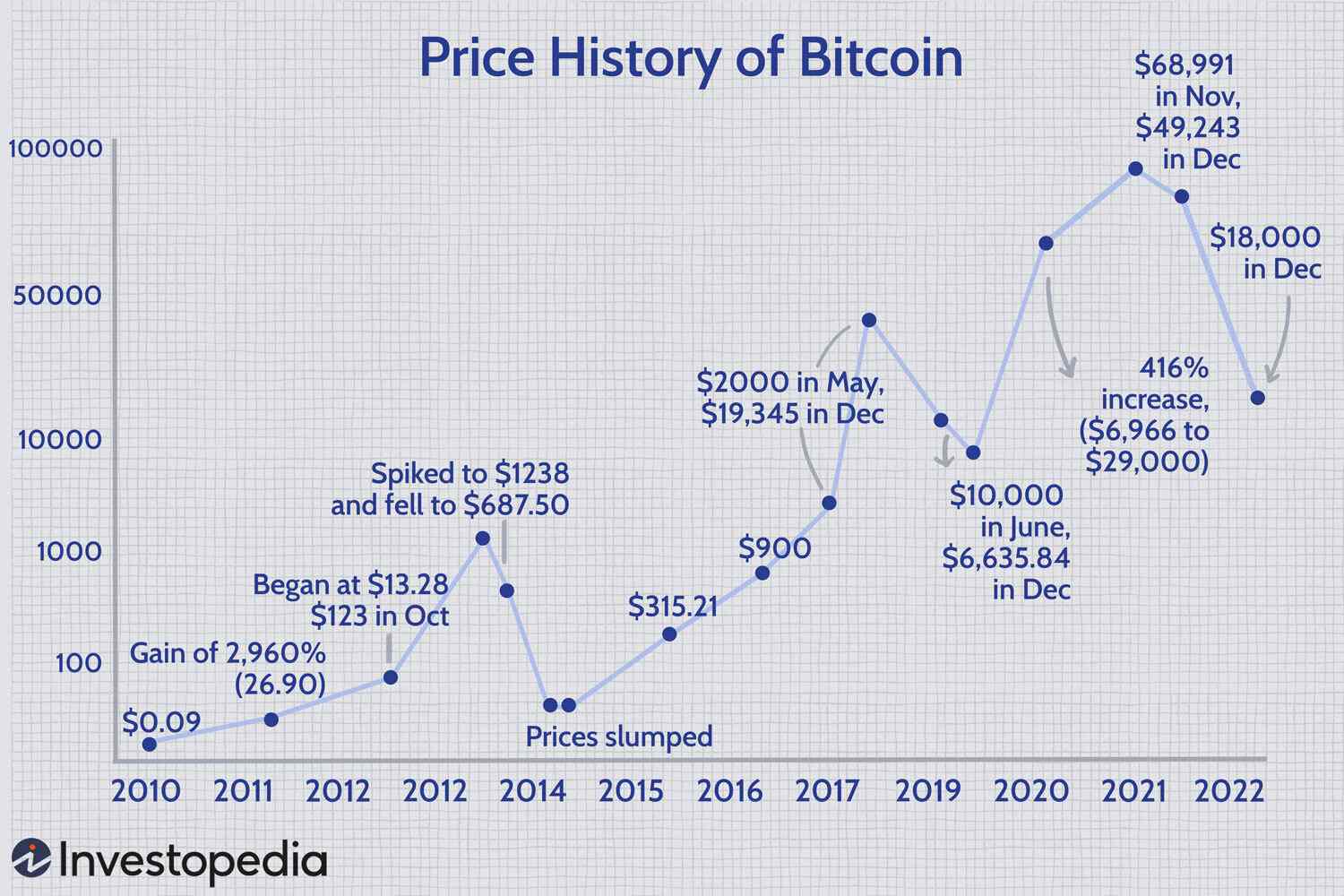

Bitcoin has experienced significant price fluctuations, and understanding its recent rebound is crucial for investors. This article explores the factors contributing to Bitcoin's resurgence, alongside the inherent risks and potential opportunities presented by this volatile digital asset. We'll delve into the complexities of the crypto market to help you navigate this exciting yet unpredictable landscape.

Factors Contributing to Bitcoin's Rebound

Several factors have contributed to the recent Bitcoin rebound, creating a complex interplay of macroeconomic forces, institutional interest, and technological advancements.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin's price. Its performance often correlates inversely with traditional markets, acting as a potential safe haven asset.

- Inflation hedges: During periods of high inflation, investors often seek assets that retain their value. Bitcoin's limited supply (21 million coins) makes it an attractive inflation hedge for some.

- Geopolitical uncertainty: Geopolitical instability and uncertainty in traditional financial systems can drive investors toward decentralized assets like Bitcoin, which are less susceptible to government control.

- Correlation with traditional markets: While Bitcoin is often touted as a decentralized asset, its price does show some correlation with traditional markets. A downturn in the stock market can sometimes lead to Bitcoin price declines, while positive market sentiment can boost Bitcoin's value.

Institutional Adoption and Investment

The growing acceptance of Bitcoin by institutional investors and large corporations is a key driver of its price appreciation.

- Increased institutional holdings: Major companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, signaling increased confidence in the asset and driving demand.

- Regulatory clarity: While regulations remain nascent in many jurisdictions, increasing clarity around Bitcoin's legal status is encouraging institutional investment. The emergence of Bitcoin ETFs (Exchange-Traded Funds) in some markets is a prime example.

- Development of Bitcoin-related financial products: The development of Bitcoin futures, options, and ETFs provides investors with more sophisticated ways to access the market and manage risk. This further enhances the institutional appeal of Bitcoin.

Technological Advancements and Network Growth

Ongoing technological improvements and the expanding Bitcoin network continue to strengthen its value proposition.

- Lightning Network scalability improvements: The Lightning Network, a layer-2 scaling solution, is improving transaction speeds and reducing fees, making Bitcoin more practical for everyday transactions.

- Increased adoption of Bitcoin as a payment method: While still limited, the growth in merchant acceptance and the usability of Bitcoin as a payment method is gradually increasing its relevance in the real world.

- Development of layer-2 solutions: Ongoing development of layer-2 solutions, such as the Lightning Network and others, continues to address scalability issues and enhance the overall efficiency of the Bitcoin network.

Risks Associated with Bitcoin Investment

Despite the potential for significant returns, investing in Bitcoin carries substantial risks.

Volatility and Price Fluctuations

Bitcoin's price is notoriously volatile, subject to dramatic swings.

- Price swings and their potential impact on investment returns: Significant price drops can lead to substantial losses, potentially wiping out a large portion of an investor's portfolio.

- Risk management strategies for mitigating volatility: Strategies like dollar-cost averaging (DCA), where investors invest a fixed amount at regular intervals regardless of price, can help mitigate some of the volatility risk.

- Importance of diversification in a cryptocurrency portfolio: Diversification is crucial. Don't put all your eggs in one basket; spread your investments across different cryptocurrencies or asset classes.

Regulatory Uncertainty and Legal Risks

The regulatory landscape for cryptocurrencies is still evolving, presenting considerable uncertainty.

- Government regulations and their effect on Bitcoin adoption and price: Government regulations can significantly impact Bitcoin's price and adoption rate. Favorable regulations can boost the market, while restrictive ones can suppress it.

- Legal considerations for Bitcoin ownership and trading: Understanding the legal implications of owning and trading Bitcoin is crucial, particularly regarding taxation and compliance.

- Risks associated with scams and fraudulent activities within the crypto market: The crypto market has its share of scams and fraudulent activities. Investors need to be vigilant and exercise caution when dealing with unfamiliar exchanges or investment opportunities.

Security Risks and Hacks

Security breaches and hacks targeting Bitcoin exchanges and wallets are a recurring concern.

- Importance of secure storage and best practices for protecting Bitcoin holdings: Using secure hardware wallets and adhering to best practices for online security are crucial to protect Bitcoin holdings.

- Risks associated with using unregulated exchanges: Unregulated exchanges pose a higher risk of hacks and scams, potentially resulting in the loss of funds.

- Impact of hacking incidents on investor confidence: Major hacking incidents can negatively impact investor confidence and lead to price drops.

Opportunities Presented by Bitcoin's Rebound

Despite the risks, Bitcoin's rebound presents significant long-term opportunities.

Long-Term Growth Potential

Many believe Bitcoin has significant long-term growth potential, driven by its scarcity and increasing adoption.

- Bitcoin's scarcity and its implications for long-term price appreciation: The limited supply of Bitcoin (21 million coins) is often cited as a factor supporting long-term price appreciation.

- Potential for Bitcoin to become a mainstream financial asset: As Bitcoin gains wider acceptance and adoption, its potential to become a mainstream financial asset increases.

- Future adoption and its influence on Bitcoin's value: Increased adoption by institutions and individuals will likely drive up demand and, consequently, the value of Bitcoin.

Investment Strategies for Capitalizing on Opportunities

Several investment strategies can help investors capitalize on Bitcoin's potential, while mitigating the inherent risks.

- Dollar-cost averaging and its benefits in mitigating risk: Dollar-cost averaging (DCA) is a popular strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Trading strategies: Long and short-term approaches: Investors can employ various trading strategies, ranging from long-term "hodling" (holding onto Bitcoin) to short-term trading based on price analysis.

- Importance of conducting thorough research before investing: Thorough research and understanding of the risks are paramount before investing in Bitcoin or any cryptocurrency.

Conclusion

Bitcoin's recent rebound presents both significant opportunities and considerable risks. Understanding the factors driving this resurgence, along with the potential pitfalls, is critical for informed investment decisions. By carefully weighing the macroeconomic factors, institutional adoption, technological advancements, and inherent volatility, investors can develop a robust strategy to navigate the exciting but unpredictable world of Bitcoin. Remember to conduct thorough research and carefully assess your risk tolerance before investing in Bitcoin or any other cryptocurrency. Don't miss out on understanding Bitcoin's rebound – start your research today!

Featured Posts

-

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025 -

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025 -

Seged Slavi Tri Umf Nad Pariz Sent Zhermen U Chetvrtfinalu Lige Shampiona

May 08, 2025

Seged Slavi Tri Umf Nad Pariz Sent Zhermen U Chetvrtfinalu Lige Shampiona

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025 -

Lyon Vs Psg Victoria Contundente Del Psg En Lyon

May 08, 2025

Lyon Vs Psg Victoria Contundente Del Psg En Lyon

May 08, 2025

Latest Posts

-

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025 -

Brezilya Bitcoin Yasal Maas Oedeme Yoentemi Olarak Kabul Edildi

May 08, 2025

Brezilya Bitcoin Yasal Maas Oedeme Yoentemi Olarak Kabul Edildi

May 08, 2025 -

Brezilya Da Bitcoin Ile Maas Oedemek Avantajlar Ve Dezavantajlar

May 08, 2025

Brezilya Da Bitcoin Ile Maas Oedemek Avantajlar Ve Dezavantajlar

May 08, 2025 -

Bitcoin Maas Oedemeleri Brezilya Da Yeni Bir Doenem

May 08, 2025

Bitcoin Maas Oedemeleri Brezilya Da Yeni Bir Doenem

May 08, 2025 -

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025