Understanding Crypto Exchange Compliance Requirements In India

Table of Contents

Know Your Customer (KYC) and Anti-Money Lauinting (AML) Regulations in India

KYC/AML compliance is paramount for crypto exchanges operating in India. These regulations aim to prevent money laundering, terrorist financing, and other illicit activities. Non-compliance can lead to severe penalties, including hefty fines and even legal repercussions.

Specific KYC/AML Requirements:

- Customer Due Diligence (CDD): Crypto exchanges must verify the identity of their customers through robust processes, including but not limited to, verifying addresses, government-issued IDs, and potentially additional documentation depending on risk assessment.

- Record-Keeping: Meticulous record-keeping is essential. Exchanges must maintain detailed transaction records, customer identification data, and other relevant information for a specified period, as defined by regulatory guidelines.

- Suspicious Activity Reporting (SAR): Exchanges are obligated to report any suspicious transactions or activities to the Financial Intelligence Unit – India (FIU-IND), the country's central agency for combating money laundering. This includes transactions that seem unusual or might indicate illicit activity.

Penalties for Non-Compliance: Failure to comply with KYC/AML regulations can result in significant penalties, ranging from substantial fines to the suspension or closure of the exchange's operations. The FIU-IND actively monitors compliance and enforces the relevant laws.

Taxation of Cryptocurrency Transactions in India

The Indian government currently taxes cryptocurrency transactions at a flat rate of 30%. This applies to any profit made from trading cryptocurrencies. Furthermore, Tax Deducted at Source (TDS) provisions are also in place, impacting both the trader and the exchange.

Tax Implications for Crypto Exchanges:

- TDS on Crypto Transactions: Crypto exchanges are required to deduct TDS at the prescribed rate from the profits earned by their users on cryptocurrency transactions. This TDS is then remitted to the relevant tax authorities.

- Reporting Requirements: Exchanges must maintain detailed records of all transactions and submit regular reports to the Income Tax Department, outlining the TDS deducted and other relevant financial information.

- Accurate Record Keeping: Maintaining accurate and transparent records is critical for both the exchange and its users to comply with tax regulations and avoid potential disputes.

Future Changes: The tax landscape for cryptocurrencies in India is constantly evolving. It’s crucial to stay updated on any changes or new regulations that might affect the tax liabilities of both crypto exchanges and their users.

GST implications for Crypto Exchanges

The Goods and Services Tax (GST) also applies to certain services offered by crypto exchanges in India. Specifically, services like facilitating cryptocurrency transactions or providing related services are typically subject to GST. The specific GST rate applicable might vary depending on the nature of the service provided. It is crucial to consult with tax professionals to ensure accurate GST compliance.

Data Protection and Privacy Regulations for Crypto Exchanges

Protecting user data and ensuring privacy are crucial aspects of crypto exchange compliance in India. Relevant laws include the Information Technology Act, 2000, and the upcoming Digital Personal Data Protection Bill, 2023. These regulations mandate secure data handling practices, user consent for data collection, and data transparency.

Key Considerations:

- Secure Data Storage: Exchanges must employ robust security measures to protect user data from unauthorized access, loss, or theft. This includes encryption, secure servers, and regular security audits.

- User Consent: Obtaining explicit and informed consent from users before collecting and processing their data is mandatory.

- Data Transparency: Exchanges should be transparent about their data collection and usage practices, clearly outlining how user data is collected, used, and protected in their privacy policies.

Reserve Bank of India (RBI) Guidelines and Notifications

The RBI's stance on cryptocurrencies has been cautious. While not explicitly banning cryptocurrencies, the RBI has issued warnings and guidelines that impact crypto exchange operations, primarily focusing on compliance with AML and KYC standards. Staying updated on RBI circulars and notifications is crucial for all crypto exchanges operating in India. The RBI's guidelines often influence and impact other compliance requirements, making adherence essential.

Cybersecurity and Fraud Prevention Measures

Robust cybersecurity measures are non-negotiable for crypto exchanges. Protecting user assets and data from cyber threats, including hacking and fraud, is paramount.

Essential Measures:

- Multi-Factor Authentication (MFA): Implementing MFA significantly enhances security by requiring multiple verification steps before granting access.

- Regular Security Audits: Conducting regular security audits helps identify vulnerabilities and strengthens the exchange's overall security posture.

- Insurance and Risk Mitigation: Securing appropriate insurance coverage and implementing risk mitigation strategies are essential for safeguarding against potential financial losses.

Conclusion

This article has highlighted the essential compliance requirements for crypto exchanges operating in India, emphasizing KYC/AML, tax regulations (including TDS and GST), data protection, RBI guidelines, and cybersecurity measures. Staying compliant is crucial for long-term sustainability and avoiding legal repercussions. Understanding crypto exchange compliance requirements in India is paramount. By staying informed and adhering to these regulations, you can ensure the safe and legal operation of your crypto exchange, fostering trust and growth within the Indian cryptocurrency market. Further research and consultation with legal and financial experts are highly recommended to stay updated on the constantly evolving regulatory landscape.

Featured Posts

-

New York City Fc Kicks Off Mls Season Against Real Salt Lake

May 15, 2025

New York City Fc Kicks Off Mls Season Against Real Salt Lake

May 15, 2025 -

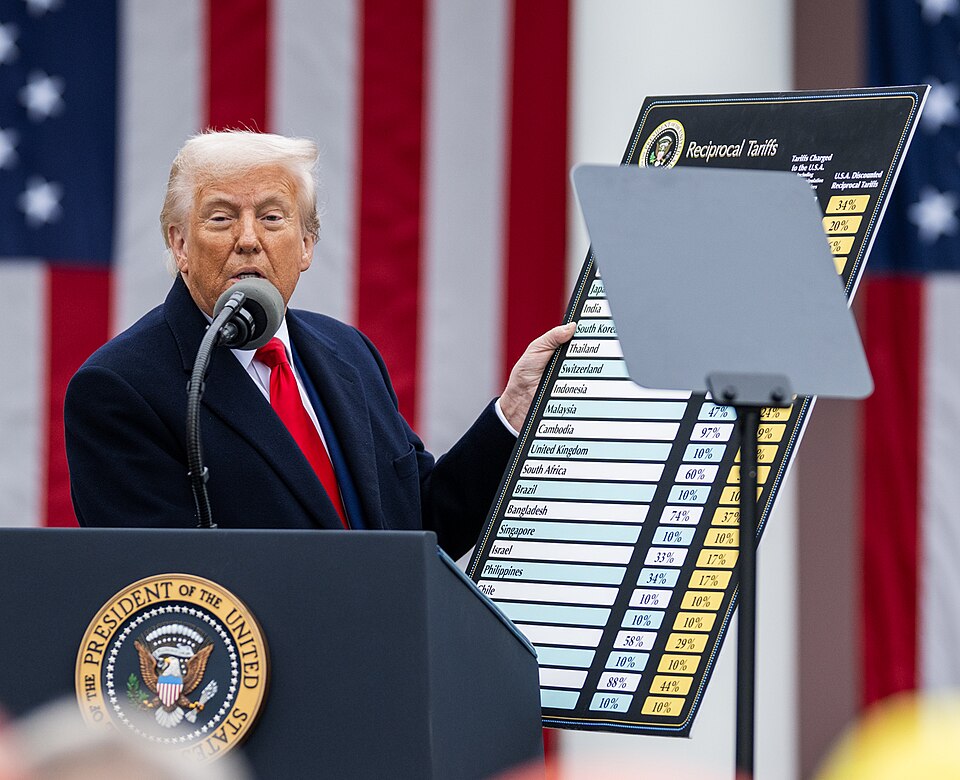

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025 -

High Bids For Kid Cudis Personal Effects At Recent Auction

May 15, 2025

High Bids For Kid Cudis Personal Effects At Recent Auction

May 15, 2025 -

Tatum Brown Ready For Game 3 Holiday Out

May 15, 2025

Tatum Brown Ready For Game 3 Holiday Out

May 15, 2025 -

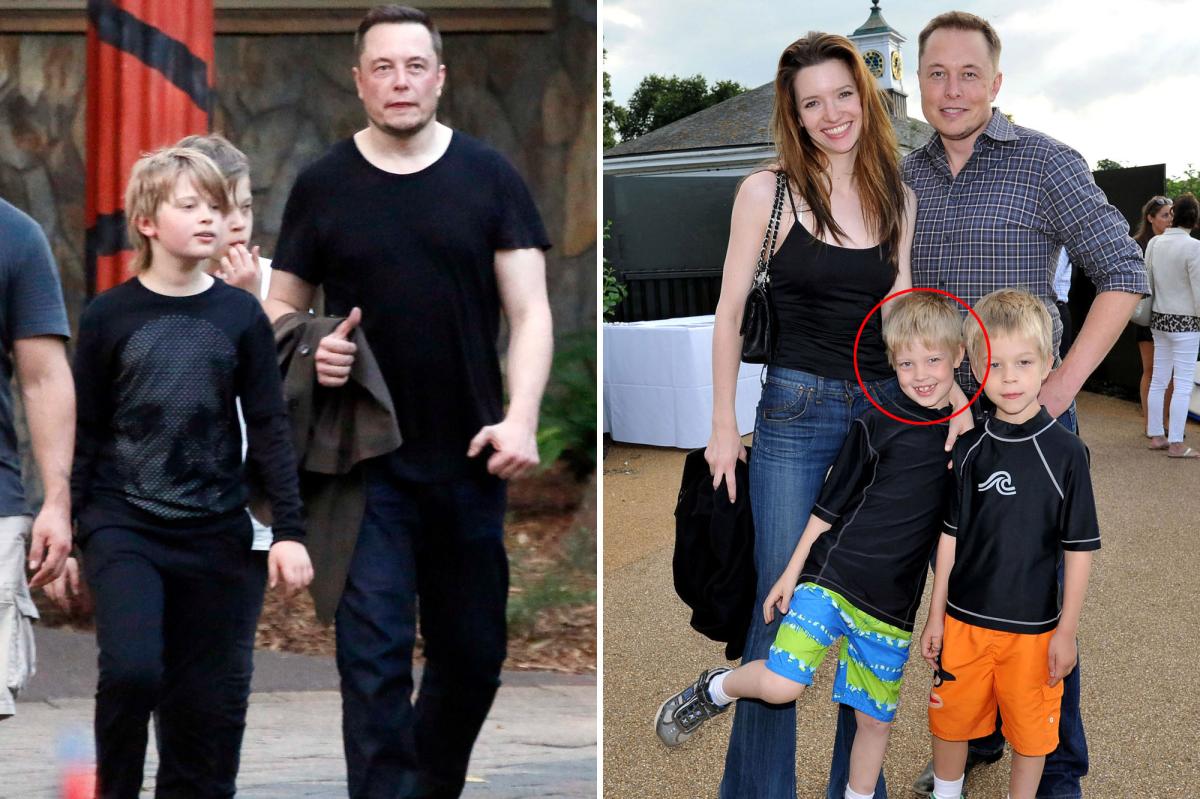

Understanding Elon Musks Gorklon Rust Rebranding Of X

May 15, 2025

Understanding Elon Musks Gorklon Rust Rebranding Of X

May 15, 2025