Understanding Elevated Stock Market Valuations: A BofA Viewpoint

Table of Contents

The Role of Low Interest Rates in Inflated Stock Prices

Historically low interest rates have significantly influenced elevated stock market valuations. This section explores the impact of monetary policy and the yield curve on stock prices.

The Impact of Monetary Policy

The inverse relationship between interest rates and stock valuations is well-established. Lower interest rates reduce the attractiveness of traditional fixed-income investments like bonds, pushing investors towards higher-yielding assets, including equities. Quantitative easing (QE), a monetary policy tool used by central banks to inject liquidity into the market, further fuels this effect by increasing the money supply and lowering borrowing costs.

- Inverse Relationship: Lower interest rates = Higher stock valuations.

- Quantitative Easing (QE): Increases money supply, lowering borrowing costs and boosting asset prices.

- Prolonged Low Rates Risks: Can lead to asset bubbles, increased inflation, and potential market instability if rates rise suddenly.

Yield Curve and Valuation Implications

The shape of the yield curve – the graphical representation of interest rates across different maturities – offers insights into market expectations and valuations. A steep yield curve (long-term rates significantly higher than short-term rates) typically indicates strong economic growth and supports higher stock valuations. Conversely, a flat or inverted yield curve (short-term rates higher than long-term rates) often signals economic slowdown or recession, potentially leading to lower valuations.

- Steep Yield Curve: Suggests strong economic growth, supporting higher stock valuations.

- Flat/Inverted Yield Curve: Often precedes economic slowdowns, potentially indicating market corrections.

- Predictive Power: While the yield curve can offer valuable insights, its predictive power is not absolute. Other economic factors also play a significant role.

Analyzing Earnings Growth and its Relation to Stock Prices

Assessing the relationship between earnings growth and stock prices is crucial for understanding current valuations. The price-to-earnings (P/E) ratio and expectations regarding future earnings growth are key considerations.

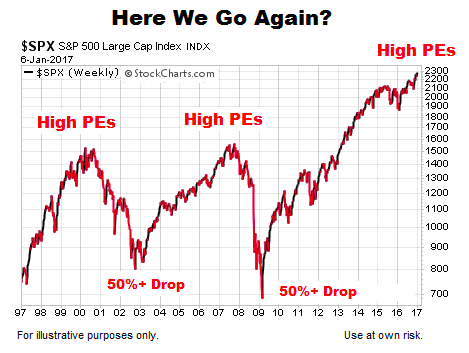

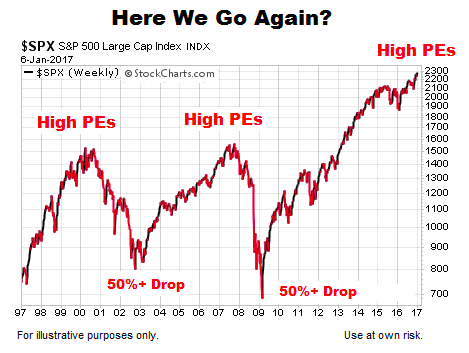

The Price-to-Earnings (P/E) Ratio

The P/E ratio, calculated by dividing a company's stock price by its earnings per share, is a widely used valuation metric. High P/E ratios suggest investors are willing to pay a premium for future growth, while low P/E ratios may indicate undervaluation or lower growth expectations. However, it's crucial to interpret P/E ratios in context.

- High P/E Ratio: Indicates investors expect high future earnings growth.

- Low P/E Ratio: May indicate undervaluation or lower growth expectations.

- Forward P/E Ratio: Uses projected future earnings, offering a more forward-looking valuation metric.

- Limitations: P/E ratios should not be used in isolation; industry comparisons and other valuation metrics are necessary.

Future Earnings Expectations

Market valuations are heavily influenced by expectations regarding future earnings growth. Positive forecasts often drive stock prices higher, while negative revisions can lead to corrections. However, analyst forecasts can be inaccurate, and unexpected economic events can significantly impact earnings and valuations.

- Analyst Forecasts: Provide insights into future earnings, but are not always accurate.

- Economic Uncertainty: Impacts earnings forecasts and market valuations.

- Market Sentiment: Plays a crucial role in shaping expectations and driving price movements.

The Influence of Investor Sentiment and Market Psychology

Investor sentiment, encompassing both fear and greed, plays a significant role in shaping stock market valuations. Speculation and momentum investing can further amplify these effects.

Fear and Greed in the Market

Market bubbles and crashes are often driven by extreme investor sentiment. Periods of irrational exuberance can lead to significantly elevated valuations, while panic selling can trigger sharp declines. Herd behavior, where investors mimic each other's actions, exacerbates these effects.

- Irrational Exuberance: Can create asset bubbles and unsustainable valuations.

- Panic Selling: Can trigger sharp market declines and amplify losses.

- Herd Behavior: Investors tend to follow the crowd, amplifying market trends.

The Role of Speculation and Momentum Investing

Speculation, investing based on anticipated price movements rather than fundamentals, and momentum trading, buying assets that are rising in price, can contribute to elevated valuations. These strategies can decouple prices from underlying fundamentals, increasing risk.

- Speculation: Investing based on anticipated price changes, not fundamentals.

- Momentum Investing: Buying assets that are rising in price.

- Technical Analysis: Used by momentum investors to identify trends and potential price movements.

- Risks: These strategies can amplify losses during market corrections.

BofA's Outlook and Investment Strategies for Elevated Valuations

Navigating markets with elevated valuations requires a cautious approach. BofA recommends a multi-faceted strategy incorporating risk management and sector-specific opportunities.

Risk Management Strategies

In an environment of elevated stock market valuations, risk management is paramount. A well-diversified portfolio, incorporating hedging strategies, and a long-term investment horizon can help mitigate potential losses. Defensive investment approaches, such as focusing on value stocks or lower-risk assets, may be considered.

- Diversification: Spreading investments across different asset classes and sectors.

- Hedging Strategies: Using derivatives to protect against potential losses.

- Long-Term Investment Horizon: Reduces the impact of short-term market volatility.

- Defensive Investments: Focusing on lower-risk assets and value stocks.

Sector-Specific Opportunities

While overall market valuations may be high, some sectors may offer better value or resilience. Identifying such opportunities requires careful analysis of industry trends and company-specific factors. BofA's research can highlight specific sectors or themes with potentially attractive risk-reward profiles.

- Value Stocks: Companies trading at lower valuations relative to their fundamentals.

- Specific Industry Trends: Identifying sectors poised for growth despite overall market conditions.

- Risk Assessment: Thoroughly analyzing potential risks within each sector.

Conclusion

Elevated stock market valuations are driven by a complex interplay of factors, including historically low interest rates, optimistic earnings growth expectations, and prevailing investor sentiment. Understanding these factors is crucial for making informed investment decisions. Careful risk management, diversification, and a long-term perspective are paramount in this environment. To learn more about how to manage your portfolio effectively within this environment of elevated stock market valuations, contact your BofA advisor today.

Featured Posts

-

Are Bmw And Porsche Losing Ground In China A Look At The Competitive Landscape

May 07, 2025

Are Bmw And Porsche Losing Ground In China A Look At The Competitive Landscape

May 07, 2025 -

Tigers Opening Win 9 6 Victory Against Mariners

May 07, 2025

Tigers Opening Win 9 6 Victory Against Mariners

May 07, 2025 -

Opinia Nawrockiego Zrownowazony Rozwoj Poprzez Inwestycje W Droge S8 I S16

May 07, 2025

Opinia Nawrockiego Zrownowazony Rozwoj Poprzez Inwestycje W Droge S8 I S16

May 07, 2025 -

Chinese Stocks Surge Following Us Talks And Economic Data Release

May 07, 2025

Chinese Stocks Surge Following Us Talks And Economic Data Release

May 07, 2025 -

Improving George Pickens Performance Addressing The Drop Problem In Pittsburgh

May 07, 2025

Improving George Pickens Performance Addressing The Drop Problem In Pittsburgh

May 07, 2025

Latest Posts

-

Cleveland Cavaliers Biggest Eastern Conference Playoff Rival After Boston

May 07, 2025

Cleveland Cavaliers Biggest Eastern Conference Playoff Rival After Boston

May 07, 2025 -

142 105 Blowout Mitchell And Mobley Fuel Cavaliers Victory Against Knicks

May 07, 2025

142 105 Blowout Mitchell And Mobley Fuel Cavaliers Victory Against Knicks

May 07, 2025 -

Learning From The Celtics A Cavaliers Stars Perspective

May 07, 2025

Learning From The Celtics A Cavaliers Stars Perspective

May 07, 2025 -

Cleveland Cavaliers Top Chicago Bulls Secure Easts Top Spot

May 07, 2025

Cleveland Cavaliers Top Chicago Bulls Secure Easts Top Spot

May 07, 2025 -

24 Point Performance By Banchero Fuels Magic Win Over Cavaliers

May 07, 2025

24 Point Performance By Banchero Fuels Magic Win Over Cavaliers

May 07, 2025