Understanding High Stock Market Valuations: A BofA Investor Guide

Table of Contents

Key Metrics for Assessing Stock Market Valuations

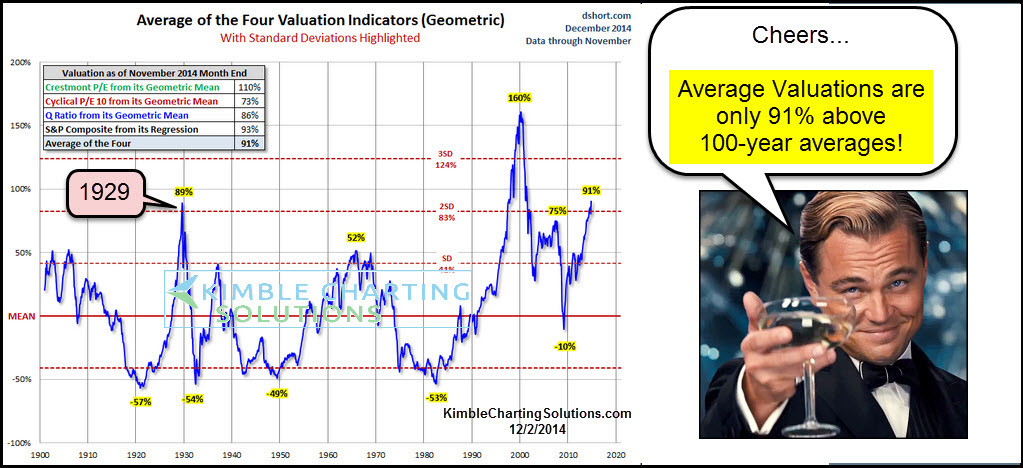

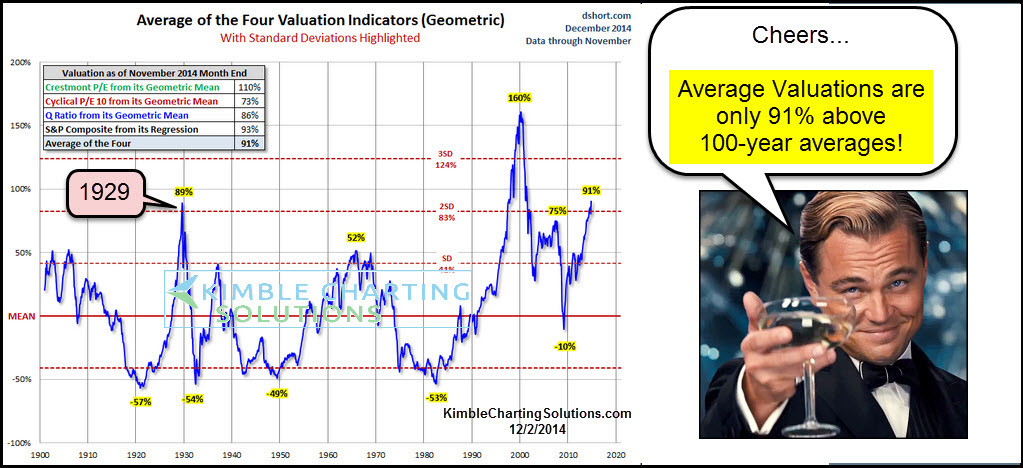

Understanding high stock market valuations requires a thorough analysis of various key metrics. These metrics provide a crucial framework for assessing whether current market prices are justified by underlying company fundamentals or driven by speculation.

Price-to-Earnings Ratio (P/E):

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS). It's calculated by dividing the market price per share by the earnings per share. A high P/E ratio generally suggests that investors are willing to pay a premium for each dollar of earnings, potentially indicating high growth expectations or overvaluation. Comparing a company's P/E to its historical average, industry peers, and the overall market helps determine whether its valuation is high or low.

- Forward P/E vs. Trailing P/E: The forward P/E uses projected future earnings, while the trailing P/E uses past earnings. Forward P/E is often preferred for growth stocks but relies on potentially inaccurate earnings estimates.

- Limitations of Using P/E in Isolation: P/E ratios should not be interpreted in isolation. Factors like industry growth rates, debt levels, and future earnings potential must be considered.

- Sector-Specific P/E Considerations: P/E ratios vary significantly across different sectors. Comparing a technology company's P/E to that of a utility company might be misleading due to inherent differences in growth potential and risk profiles.

Price-to-Sales Ratio (P/S):

The Price-to-Sales ratio (P/S) is another crucial valuation metric, especially useful for valuing companies with no earnings or negative earnings. It compares a company's market capitalization to its revenue. A higher P/S ratio might indicate that investors expect higher revenue growth in the future.

- Usefulness of P/S for Growth Stocks: P/S is particularly relevant for high-growth companies that may not yet be profitable, allowing investors to assess valuation relative to revenue generation.

- Comparing P/S Ratios Across Different Sectors: Similar to P/E, P/S ratios vary significantly across sectors, and cross-sector comparisons should be made cautiously.

- Potential Limitations: P/S doesn't account for profitability or expenses, making it less comprehensive than P/E in some cases.

Other Valuation Metrics:

Several other valuation metrics offer additional insights:

- Price-to-Book (P/B): Compares market value to book value of assets. Useful for valuing asset-heavy companies but less reliable for service-based businesses.

- PEG Ratio: Adjusts the P/E ratio for earnings growth, providing a more nuanced view of valuation. A lower PEG ratio generally suggests a more attractive valuation.

- Dividend Yield: The annual dividend payment per share relative to the stock price. Provides insight into income potential, but high yields can also signal underlying issues.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to periods of high stock market valuations. Understanding these drivers is crucial for informed investment decisions.

Low Interest Rates:

Low interest rates reduce the cost of borrowing, making it cheaper for companies to invest and expand. This also encourages investors to seek higher returns in the stock market, driving up prices.

- Impact of Quantitative Easing (QE): Central bank policies like QE inject liquidity into the financial system, further lowering interest rates and boosting asset prices, including stocks.

- Potential Risks Associated with Low Interest Rate Environments: While low interest rates can stimulate economic growth, prolonged periods of low rates can lead to asset bubbles and increased inflation risk.

Strong Corporate Earnings:

Robust corporate earnings can justify higher valuations as investors have confidence in companies' ability to generate profits and future growth. Strong economic growth often accompanies this phenomenon.

- Importance of Analyzing Earnings Quality: Investors should carefully examine the quality of earnings, considering factors like one-time gains, accounting practices, and sustainability of future earnings.

- Potential for Future Earnings Growth: Analyzing future earnings expectations and growth prospects is crucial to determine whether current valuations are sustainable.

Investor Sentiment and Speculation:

Market psychology, including investor sentiment and speculative trading, significantly influences stock prices. Periods of heightened optimism and "fear of missing out" (FOMO) can drive prices to unsustainable levels.

- Role of Market Momentum and FOMO: Positive market momentum often exacerbates investor enthusiasm, leading to self-reinforcing price increases driven by speculative trading.

- Risks Associated with Speculative Bubbles: Speculative bubbles can lead to sharp corrections when investor sentiment shifts, causing significant losses for those who entered the market at inflated prices.

Navigating High Valuations: Strategies for BofA Investors

Navigating high stock market valuations requires a thoughtful and strategic approach. The following strategies can help BofA investors mitigate risk and potentially capitalize on opportunities.

Diversification:

Diversifying your portfolio across different asset classes (stocks, bonds, real estate) and sectors helps reduce the overall risk of your investment portfolio.

- Specific Diversification Strategies: Consider diversifying geographically by investing in international markets and across different market capitalizations (large-cap, mid-cap, small-cap).

- Benefits of International Diversification: International diversification can reduce dependence on a single market's performance and provide exposure to different economic cycles.

Value Investing:

Value investing involves identifying and investing in undervalued companies whose intrinsic value is higher than their current market price. This strategy can be particularly effective during periods of high valuations.

- Identifying Undervalued Companies: Thorough fundamental analysis, examining financial statements, and assessing management quality are critical for identifying undervalued stocks.

- Importance of Fundamental Analysis: Fundamental analysis helps determine a company's intrinsic value, allowing investors to identify opportunities when market prices deviate from true worth.

Long-Term Perspective:

Maintaining a long-term investment horizon is crucial for weathering market fluctuations and benefiting from long-term growth. Short-term market movements should not dictate long-term investment strategies.

- Strategies for Long-Term Investing: Dollar-cost averaging, reinvesting dividends, and focusing on companies with sustainable competitive advantages are key aspects of long-term investing.

- Psychological Benefits of a Long-Term Approach: A long-term perspective reduces emotional decision-making, preventing impulsive actions driven by short-term market volatility.

Conclusion

High stock market valuations require careful analysis using various metrics like the P/E ratio, P/S ratio, and others. Several factors, including low interest rates, strong corporate earnings, and investor sentiment, contribute to these valuations. Investors need well-defined strategies, such as diversification, value investing, and maintaining a long-term perspective, to navigate this complex environment effectively. Understanding these key valuation metrics and their implications is vital for making informed investment decisions. Understand high stock market valuations better with further resources from BofA. Contact us today to discuss your investment strategy.

Featured Posts

-

Deutsche Bank Head Of Distressed Sales Resigns Joins Morgan Stanley

May 30, 2025

Deutsche Bank Head Of Distressed Sales Resigns Joins Morgan Stanley

May 30, 2025 -

French Rape Survivors Story Gisele Pelicots Book Headed To Hbo

May 30, 2025

French Rape Survivors Story Gisele Pelicots Book Headed To Hbo

May 30, 2025 -

Five Major Lng Projects In British Columbia Progress Challenges And Future Outlook

May 30, 2025

Five Major Lng Projects In British Columbia Progress Challenges And Future Outlook

May 30, 2025 -

London Hosts Gorillazs 25th Anniversary Celebration Concerts And Exhibition Details

May 30, 2025

London Hosts Gorillazs 25th Anniversary Celebration Concerts And Exhibition Details

May 30, 2025 -

Deutsche Banks Saudi Arabia Investment Push Wooing Global Investors

May 30, 2025

Deutsche Banks Saudi Arabia Investment Push Wooing Global Investors

May 30, 2025

Latest Posts

-

Tigers Notebook Update On Parker Meadows Injury

May 31, 2025

Tigers Notebook Update On Parker Meadows Injury

May 31, 2025 -

Detroit Tigers Vs Minnesota Twins Friday Nights Road Trip Opener

May 31, 2025

Detroit Tigers Vs Minnesota Twins Friday Nights Road Trip Opener

May 31, 2025 -

Tigers Open Road Trip Against Twins In Friday Night Matchup

May 31, 2025

Tigers Open Road Trip Against Twins In Friday Night Matchup

May 31, 2025 -

Parker Meadows Return Detroit Tigers Notebook

May 31, 2025

Parker Meadows Return Detroit Tigers Notebook

May 31, 2025 -

Kctv 5 And Cbs Your Home For Kansas City Royals Baseball This Season

May 31, 2025

Kctv 5 And Cbs Your Home For Kansas City Royals Baseball This Season

May 31, 2025