Understanding High Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

BofA's Assessment of Current Market Conditions

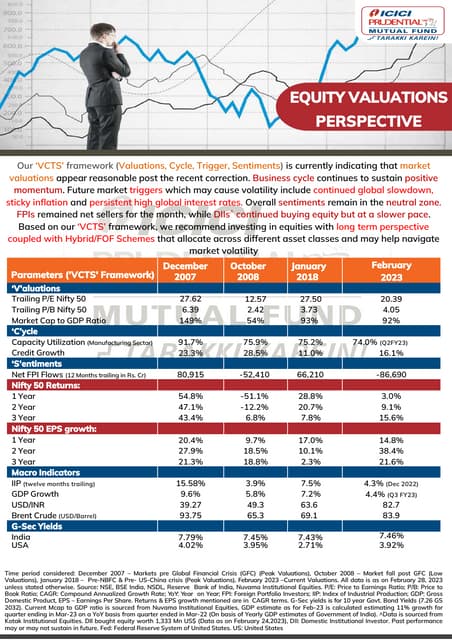

BofA's stance on current high valuations is often nuanced, shifting between cautious optimism and measured concern depending on the specific market conditions and economic indicators. While they haven't explicitly declared a universally "bullish," "bearish," or "neutral" outlook, their recent reports reflect a cautious approach. They frequently analyze valuation metrics like the cyclically adjusted price-to-earnings ratio (CAPE ratio) and the market cap to GDP ratio to gauge market health. These ratios often reveal whether the market is overvalued or undervalued relative to historical norms and economic output.

-

Indices Analyzed: BofA's analysis typically includes major indices like the S&P 500, Nasdaq Composite, and various sector-specific indices to gain a comprehensive view of market performance and valuations across different sectors. Their assessments consider the performance and valuation of both large-cap and small-cap stocks.

-

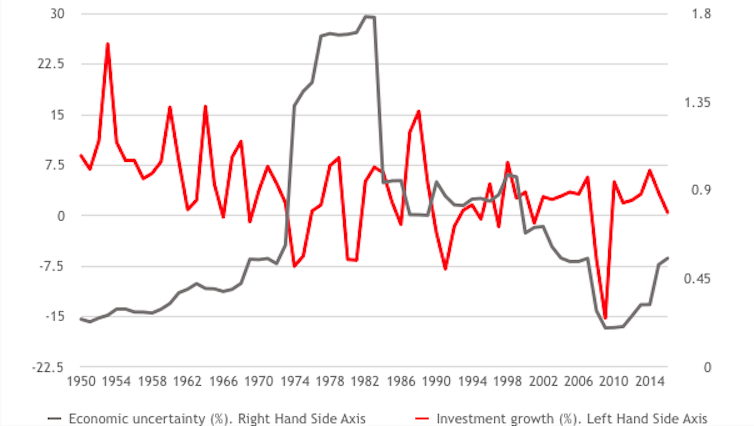

Influencing Economic Factors: Several factors influence BofA's assessment, including:

- Interest Rates: The Federal Reserve's monetary policy significantly impacts interest rates, influencing borrowing costs and investor sentiment. Higher interest rates generally make bonds more attractive, potentially drawing investment away from stocks.

- Inflation: High inflation erodes purchasing power and can lead to uncertainty in corporate earnings, impacting stock valuations. BofA closely monitors inflation indicators and their potential impact on corporate profitability.

- Geopolitical Events: Global events, such as conflicts or trade tensions, can create market volatility and affect investor confidence, influencing stock prices and valuations.

-

BofA Reports: To stay up-to-date on BofA's current assessment, refer to their regularly published research reports and investor notes available on their website. These reports provide detailed analysis, data, and charts supporting their viewpoints on high stock market valuations.

Key Factors Driving High Stock Market Valuations

According to BofA's analysis, several factors contribute to the elevated valuations observed in the stock market:

-

Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, boosting demand and driving up prices. This increased risk appetite pushes valuations higher.

-

Corporate Earnings Growth: Strong corporate earnings growth, particularly in certain sectors, can justify higher valuations. BofA analysts analyze earnings reports and forecasts to determine whether current valuations are supported by future earnings potential.

-

Technological Advancements and Disruptive Innovations: The emergence of new technologies and innovative companies can lead to significant growth and higher valuations, especially in the technology sector. BofA acknowledges the impact of these disruptive forces on market dynamics.

-

Quantitative Easing and Monetary Policy: Central banks' policies, such as quantitative easing (QE), have injected significant liquidity into the market, contributing to higher asset prices, including stocks. BofA closely scrutinizes these policies and their influence on market valuations.

-

Investor Sentiment and Market Psychology: Market psychology plays a critical role. Periods of optimism and confidence can lead to higher valuations, while fear and uncertainty can push prices down. BofA analyzes investor sentiment through various metrics to understand its impact on market behavior and valuations.

Analyzing Valuation Metrics from a BofA Perspective

BofA likely utilizes a range of valuation metrics to assess the market's health. Understanding these metrics is crucial for investors:

-

P/E Ratio (Price-to-Earnings Ratio): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating overvaluation.

-

Price-to-Sales Ratio: This compares a company's stock price to its revenue per share. It's particularly useful for companies with little or no earnings.

-

PEG Ratio (Price/Earnings to Growth Ratio): This adjusts the P/E ratio by considering the company's expected earnings growth rate. A lower PEG ratio might suggest the stock is undervalued relative to its growth potential.

BofA likely uses these metrics in conjunction with other qualitative factors to gauge market valuations. However, it's crucial to understand that relying solely on these metrics can be misleading. Economic conditions, industry trends, and company-specific factors also influence valuations.

BofA's Recommendations for Investors

Navigating high stock market valuations requires a strategic approach. BofA likely recommends several strategies:

-

Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can reduce overall portfolio risk.

-

Sector-Specific Recommendations: BofA may suggest focusing on sectors with strong fundamentals and potential for future growth, even in a high-valuation environment. These recommendations could vary based on their ongoing analysis.

-

Defensive Investment Options: Consider allocating a portion of your portfolio to defensive investments, such as high-quality bonds or dividend-paying stocks, to provide stability during market downturns.

-

Long-Term Investment Horizons: Maintaining a long-term investment perspective can help mitigate the impact of short-term market fluctuations.

-

Risk Management: Implement risk management strategies, such as stop-loss orders or hedging techniques, to protect your portfolio from significant losses during periods of high valuations.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions. BofA's analysis highlights the complex interplay of economic factors, corporate earnings, investor sentiment, and valuation metrics influencing current market conditions. Their approach often emphasizes a cautious yet adaptable strategy, advising investors to diversify, consider defensive options, and maintain a long-term perspective. While there is no single “right” answer, understanding the nuances of high stock market valuations is vital for navigating uncertain markets. Stay updated on BofA's analysis and other market insights to effectively navigate these challenging market conditions. Learn more about managing your portfolio during periods of high stock market valuations by [linking to relevant resources, BofA website, etc.]. Don't hesitate to consult with a financial advisor to discuss your specific investment strategy concerning these high stock market valuations.

Featured Posts

-

Current Top Tv Streaming The Skinny Jab Revolution Black 47 And Roosters

May 26, 2025

Current Top Tv Streaming The Skinny Jab Revolution Black 47 And Roosters

May 26, 2025 -

Sinners New Horror Movie Filmed In Louisiana Coming Soon To Theaters

May 26, 2025

Sinners New Horror Movie Filmed In Louisiana Coming Soon To Theaters

May 26, 2025 -

Analysis Of Sses 3 Billion Spending Cut Amidst Economic Uncertainty

May 26, 2025

Analysis Of Sses 3 Billion Spending Cut Amidst Economic Uncertainty

May 26, 2025 -

Raphael Enthoven Decryptage De Sa Critique De Marine Le Pen Et Tariq Ramadan

May 26, 2025

Raphael Enthoven Decryptage De Sa Critique De Marine Le Pen Et Tariq Ramadan

May 26, 2025 -

Rtbf Et Rtl Belgium Contre Le Piratage Iptv Quelles Consequences Pour Les Utilisateurs

May 26, 2025

Rtbf Et Rtl Belgium Contre Le Piratage Iptv Quelles Consequences Pour Les Utilisateurs

May 26, 2025