Understanding ING Group's 2024 Performance: A Look At The Form 20-F

Table of Contents

Main Points: Key Insights from ING Group's 2024 Form 20-F

Revenue and Profitability Analysis

Revenue Growth in Key Sectors

Analyzing ING Group's revenue streams across various sectors is essential to understanding its 2024 financial performance. The Form 20-F will detail revenue figures for key areas such as:

- Retail Banking: This segment likely includes revenue from personal loans, mortgages, savings accounts, and other consumer banking products. Year-over-year growth in this sector will indicate the success of ING Group's consumer-focused strategies. Look for details on the growth rate of specific products within retail banking to assess market share and performance trends.

- Wholesale Banking: This encompasses revenue generated from serving corporate and institutional clients, including investment banking activities, trading, and lending. Performance in this sector is highly sensitive to global economic conditions and market volatility. Analyzing this area requires examining key performance indicators linked to specific transactions, and trading volumes.

- Investment Management: This segment likely includes revenue from managing assets for institutional and individual clients. Analyzing this section of the report will highlight performance related to investment strategies and market conditions.

- Other Operating Segments: ING Group's Form 20-F may also break down revenue from other operational areas that significantly impact its overall financial performance. Understanding these areas helps establish a full picture of ING Group's revenue streams.

Keyword integration: ING Group revenue, 2024 financial performance, revenue growth analysis, Retail Banking revenue, Wholesale Banking revenue, Investment Management revenue.

Profitability Margins and Net Income

Examining ING Group's profitability is key to assessing its 2024 performance. The Form 20-F will contain vital metrics:

- Net Interest Margin: This metric reflects the difference between the interest income earned and the interest expense paid, a crucial indicator of profitability for a bank like ING Group. A higher net interest margin generally signals greater profitability. Analyze any fluctuations and compare them to previous years to assess any trends.

- Return on Equity (ROE): This metric measures how efficiently ING Group is using shareholder investments to generate profit. A higher ROE indicates better profitability and efficient use of capital. Compare the ROE to industry benchmarks and prior years' performance to determine the effectiveness of ING Group's business strategy.

- Net Income: This is the ultimate measure of profitability, representing the bottom line after all expenses are deducted. Analyzing year-over-year changes in net income, paired with an analysis of revenue, will help to determine the company's overall financial health.

Keyword integration: ING Group profitability, net income, profit margin analysis, return on equity, net interest margin.

Asset Quality and Risk Management

Non-Performing Loans (NPLs)

Assessing the level of Non-Performing Loans (NPLs) is critical for understanding ING Group's asset quality and potential risks. The Form 20-F will provide details on:

- NPL Ratio: This is the percentage of loans that are 90 days or more past due. A rising NPL ratio indicates increasing credit risk and potential losses. Careful analysis of this ratio compared to previous years and industry benchmarks is necessary.

- Provisioning for Loan Losses: ING Group will likely disclose the amount of money set aside to cover potential losses from NPLs. A higher provisioning level shows a more cautious approach to managing credit risk. Assessing this aspect allows for a better prediction of future profitability.

- Geographic Distribution of NPLs: Analyzing the concentration of NPLs in specific geographic regions or sectors helps to identify potential vulnerabilities and risks.

Keyword integration: ING Group NPLs, asset quality, credit risk, risk management, provisioning for loan losses.

Capital Adequacy Ratio (CAR)

The Capital Adequacy Ratio (CAR) indicates ING Group's ability to absorb potential losses and maintain financial stability. The Form 20-F will reveal:

- CAR Level: This ratio shows the percentage of a bank's capital relative to its risk-weighted assets. Regulations typically mandate minimum CAR levels. Analyzing ING Group's CAR against regulatory requirements and industry benchmarks will establish its resilience.

- Capital Composition: The Form 20-F will also detail the composition of ING Group's capital, including common equity tier 1 (CET1) capital, which is the highest quality form of capital. A strong CET1 ratio indicates significant financial strength.

- Stress Testing Results: ING Group might report stress test results, simulating the impact of adverse economic scenarios on its capital adequacy. This provides valuable information about its resilience to potential shocks.

Keyword integration: ING Group capital adequacy, capital ratio, financial stability, CET1 capital, stress testing.

Liquidity and Funding

Liquidity Position

ING Group's liquidity position, its ability to meet short-term obligations, is crucial for its financial health. The Form 20-F will provide:

- Cash and Cash Equivalents: This indicates the readily available funds to meet immediate obligations.

- Short-Term Borrowings: This shows the level of short-term debt, providing a view on the company's reliance on borrowing to fund its operations.

- Liquidity Coverage Ratio (LCR): This ratio shows the ability of the bank to withstand a short-term liquidity stress event.

Keyword integration: ING Group liquidity, short-term funding, cash flow, liquidity coverage ratio.

Funding Sources and Diversification

The diversification of ING Group's funding sources is key to its long-term stability. The Form 20-F will show:

- Deposit Base: The size and stability of ING Group's customer deposit base is essential to its funding strategy.

- Wholesale Funding: This includes borrowing from other financial institutions. Analyzing the extent of this funding reveals dependence on external sources.

- Debt Markets: Accessing the debt market can provide significant funding. The mix of short-term and long-term debt illustrates ING Group's funding strategy risk profile.

Keyword integration: ING Group funding, funding diversification, financial stability, deposit base, wholesale funding.

Conclusion: Key Takeaways and Next Steps for Understanding ING Group's 2024 Performance

This analysis of ING Group's 2024 performance, based on its Form 20-F, highlights several key aspects of its financial health. Understanding revenue growth across key sectors, profitability margins, asset quality, risk management strategies, and liquidity positions provides a comprehensive overview. The analysis of NPLs, capital adequacy ratio, and funding diversification offers valuable insights into ING Group's overall financial stability.

Key takeaways include the importance of monitoring ING Group's revenue streams across various sectors, maintaining robust asset quality by managing NPLs, ensuring sufficient capital adequacy for financial stability, and maintaining diversified funding sources.

To continue your analysis of ING Group's 2024 performance and gain a comprehensive understanding of its financial health, download the full Form 20-F from the official SEC website or ING Group's investor relations page. Further analysis could involve comparing ING Group's performance to its competitors and forecasting future trends based on the data provided in the Form 20-F.

Featured Posts

-

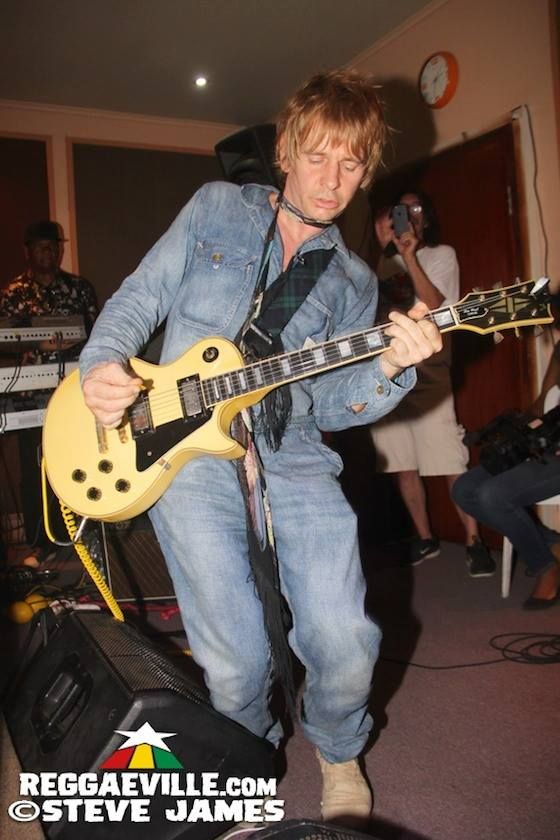

Zak Starkey Back With The Who After Sudden Dismissal

May 23, 2025

Zak Starkey Back With The Who After Sudden Dismissal

May 23, 2025 -

Deadly Attack Israeli Embassy Staffers Die In Washington Museum Shooting

May 23, 2025

Deadly Attack Israeli Embassy Staffers Die In Washington Museum Shooting

May 23, 2025 -

This Morning Style Cat Deeleys Affordable Chic Midi Skirt

May 23, 2025

This Morning Style Cat Deeleys Affordable Chic Midi Skirt

May 23, 2025 -

Finaleto Na Ln Shpani A Protiv Khrvatska Pobeda Za Shpani A Po Penali

May 23, 2025

Finaleto Na Ln Shpani A Protiv Khrvatska Pobeda Za Shpani A Po Penali

May 23, 2025 -

Pmi Data Drives European Stock Market Movement Midday Briefing

May 23, 2025

Pmi Data Drives European Stock Market Movement Midday Briefing

May 23, 2025

Latest Posts

-

Zekanin Astrolojideki Yeri En Zeki Burclar Ve Oezellikleri

May 23, 2025

Zekanin Astrolojideki Yeri En Zeki Burclar Ve Oezellikleri

May 23, 2025 -

March 20 2025 The 5 Luckiest Zodiac Signs

May 23, 2025

March 20 2025 The 5 Luckiest Zodiac Signs

May 23, 2025 -

Burclar Ve Zeka Hangi Burclar Daha Zekidir

May 23, 2025

Burclar Ve Zeka Hangi Burclar Daha Zekidir

May 23, 2025 -

En Akilli Burclar Zeka Ve Yeteneklerin Astrolojik Analizi

May 23, 2025

En Akilli Burclar Zeka Ve Yeteneklerin Astrolojik Analizi

May 23, 2025 -

Mayys Ta Athka Acylan 3 Burc Hazyrlanmys Olun

May 23, 2025

Mayys Ta Athka Acylan 3 Burc Hazyrlanmys Olun

May 23, 2025