Understanding The Gold Price Spike Following Trump's Comments

Table of Contents

Trump's Comments and their Market Impact

On [Date], Donald Trump [Specifically mention the comment or policy announcement, e.g., announced new trade tariffs on [Country], tweeted about a potential devaluation of the dollar, etc.]. This statement immediately triggered a substantial increase in gold prices. The market reacted with astonishing speed and magnitude, showcasing the significant influence of presidential pronouncements on precious metal markets.

- Percentage Increase: Gold prices increased by approximately [Percentage]% within [Timeframe, e.g., 24 hours].

- Timeframe: The price surge occurred primarily between [Start Time] and [End Time] on [Date].

- Comparison: This increase significantly outpaced the average daily fluctuation observed in the previous [Number] trading days, indicating a strong market reaction specifically tied to Trump's statement.

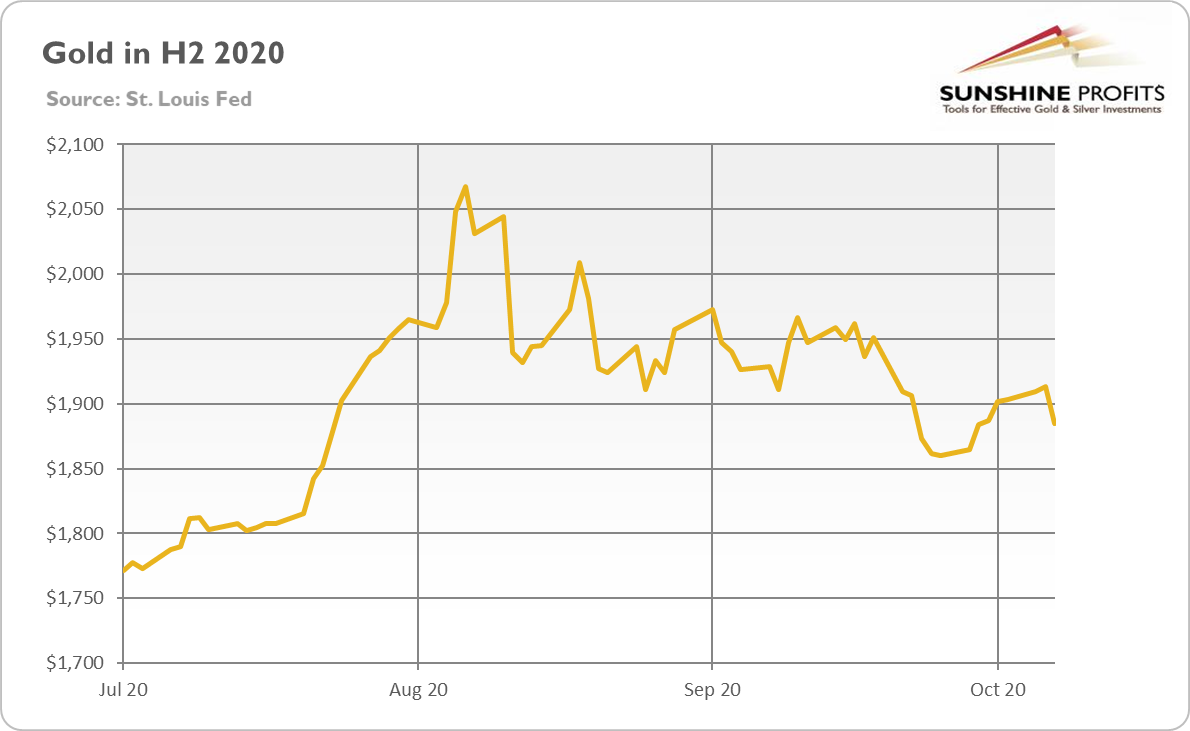

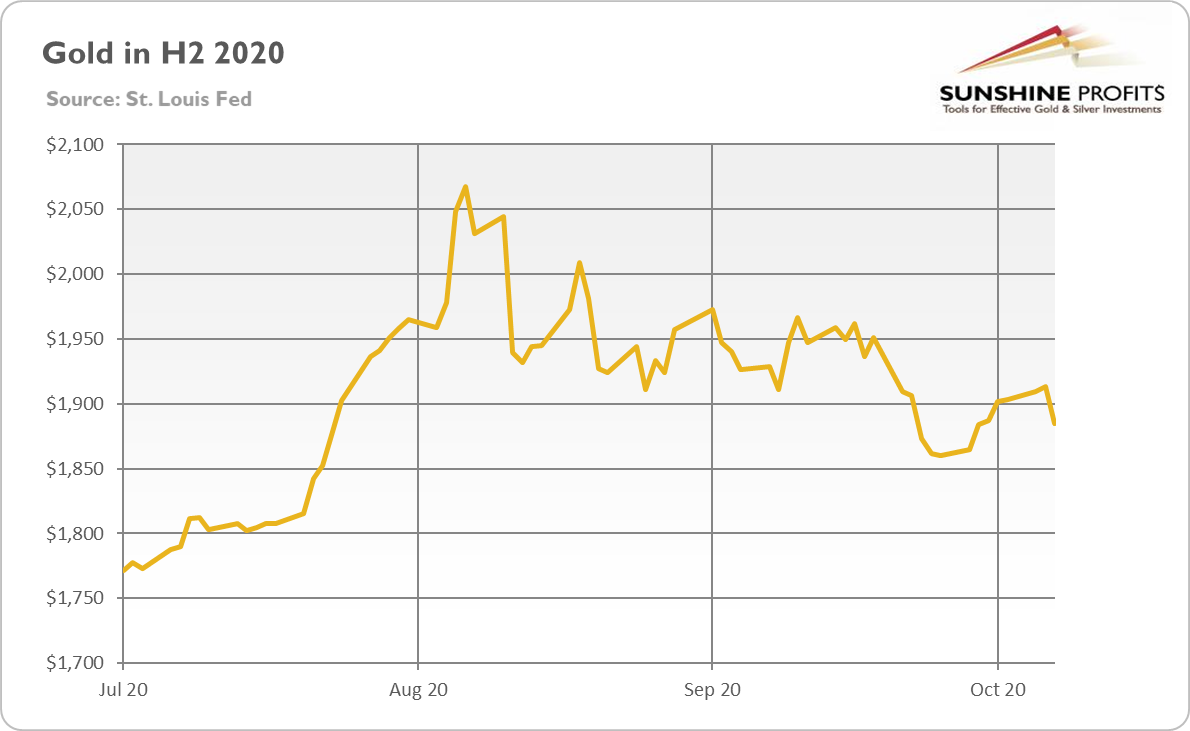

[Insert relevant chart or graph visualizing the gold price movement during this period. Clearly label the axes and highlight the spike.]

Geopolitical Factors Influencing the Gold Price

Trump's comments were made against a backdrop of significant geopolitical uncertainty. [Explain the geopolitical context, e.g., rising tensions with [Country], escalating trade wars, etc.]. This environment fueled increased demand for gold, a traditional safe haven asset, as investors sought to protect their portfolios from potential market volatility.

- International Tensions: The ongoing [Conflict or tension] heightened concerns about global stability, driving investors towards gold as a hedge against risk.

- Global Market Uncertainty: The ambiguous nature of Trump's statement, coupled with existing geopolitical risks, created significant market uncertainty, boosting gold's appeal.

- Currency Fluctuations: Concerns over potential currency devaluation further strengthened the demand for gold, viewed as a store of value independent of fiat currencies.

Economic Factors Contributing to the Gold Price Increase

Beyond the geopolitical backdrop, underlying economic factors likely amplified the gold price spike. Fears of [e.g., rising inflation, an economic slowdown, etc.] contributed to the increased attractiveness of gold as an investment.

- Inflation Rates: [Explain the current inflation rate and its potential impact on gold prices. E.g., Rising inflation erodes the purchasing power of fiat currencies, making gold, an inflation hedge, more desirable.]

- Interest Rate Policies: [Explain the current interest rate environment and its effect on gold. E.g., Low interest rates reduce the opportunity cost of holding non-yielding assets like gold, increasing its appeal].

- Economic Forecasts: Negative economic forecasts often lead investors to seek refuge in safe-haven assets like gold, increasing demand and driving up prices.

Investor Sentiment and Market Speculation

Trump's comments significantly impacted investor sentiment. The uncertainty generated by the statement triggered increased buying pressure, fueled by speculation and a flight to safety.

- Investor Behavior: Analysis of trading activity reveals a surge in gold purchases following Trump's announcement, indicative of a rapid shift in investor behavior.

- News Media Coverage: Extensive media coverage of Trump's statement and its potential market implications further amplified investor anxieties and contributed to the buying frenzy.

- Market Speculation: Speculative trading activities likely exacerbated the price increase, as traders anticipated further price movements based on the perceived impact of Trump's comments.

Conclusion

The gold price spike following Trump's comments resulted from a complex interplay of factors. Geopolitical uncertainty, underlying economic anxieties, and shifts in investor sentiment all converged to create a perfect storm for increased gold demand. Understanding this interplay is crucial for navigating the gold market effectively. Staying informed about factors influencing gold prices, particularly those related to significant political statements and their potential market impact, is vital for making informed investment decisions. Continue monitoring news related to gold price spikes following Trump's comments and similar events to better anticipate future market movements. [Insert link to further resources on gold market analysis or investment strategies].

Featured Posts

-

Huntsville Father Sues After Sons Accidental Shooting Death

Apr 25, 2025

Huntsville Father Sues After Sons Accidental Shooting Death

Apr 25, 2025 -

Sextortion Charges Against Meteorologist Josh Fitzpatrick Case Overview

Apr 25, 2025

Sextortion Charges Against Meteorologist Josh Fitzpatrick Case Overview

Apr 25, 2025 -

South Africas Coalition Faces Tax Hike Defeat

Apr 25, 2025

South Africas Coalition Faces Tax Hike Defeat

Apr 25, 2025 -

Walton Goggins Bold Fashion Statement The Fluoro Speedo Look

Apr 25, 2025

Walton Goggins Bold Fashion Statement The Fluoro Speedo Look

Apr 25, 2025 -

Ankara Da Yeni Emniyet Mueduerluegue Yerleskesi Faaliyete Gecti

Apr 25, 2025

Ankara Da Yeni Emniyet Mueduerluegue Yerleskesi Faaliyete Gecti

Apr 25, 2025

Latest Posts

-

Kareena Kapoor And Gillian Anderson Discuss Aging Honest Talk About Beauty And Cosmetic Surgery

Apr 30, 2025

Kareena Kapoor And Gillian Anderson Discuss Aging Honest Talk About Beauty And Cosmetic Surgery

Apr 30, 2025 -

Dzilijan Anderson Ikona Stila U Retro Haljini

Apr 30, 2025

Dzilijan Anderson Ikona Stila U Retro Haljini

Apr 30, 2025 -

50

Apr 30, 2025

50

Apr 30, 2025 -

Is Age Just A Number Perspectives On Aging And Relationships

Apr 30, 2025

Is Age Just A Number Perspectives On Aging And Relationships

Apr 30, 2025 -

Elegantna Dzilijan Anderson U Novoj Retro Kreaciji

Apr 30, 2025

Elegantna Dzilijan Anderson U Novoj Retro Kreaciji

Apr 30, 2025