Understanding The Treasury Market After April 8th

Table of Contents

Impact of Recent Economic Data on Treasury Yields

Economic indicators released after April 8th significantly affected Treasury yields. Understanding this correlation is crucial for investors seeking to optimize their strategies within the Treasury market. The interplay between economic data and Treasury yields is complex but predictable, allowing for informed investment decisions.

-

Specific examples of economic data released: Post-April 8th, data points like the March Consumer Price Index (CPI) inflation report, the April employment report (Nonfarm Payrolls), and various manufacturing PMI indices all influenced market sentiment and, consequently, Treasury yields.

-

Correlation between data and yield movements: Higher-than-expected inflation figures, for instance, generally push Treasury yields upward. Investors demand higher returns to compensate for the erosion of purchasing power caused by inflation. Conversely, weaker-than-expected employment numbers might signal economic slowdown, leading to lower yields as investors seek safer havens like Treasury bonds.

-

Specific Treasury securities affected: The impact varies across the yield curve. The 10-year Treasury note and the 30-year Treasury bond are particularly sensitive to changes in long-term inflation expectations, often showing more dramatic yield movements than shorter-term securities.

Analysis of Treasury Auction Results Post-April 8th

Treasury auctions held after April 8th provided further insights into investor demand and market sentiment within the Treasury market. Analyzing these results is crucial for understanding shifts in risk appetite and potential future trends.

-

Specific auction results: Bid-to-cover ratios, a key indicator of demand, should be analyzed for each auction. High bid-to-cover ratios suggest strong demand, often resulting in lower yields. Conversely, lower ratios indicate weaker demand and potentially higher yields. Specific yields achieved at these auctions should also be noted.

-

Interpretation of results: A consistently high bid-to-cover ratio across multiple auctions might indicate a flight to safety, suggesting investors are seeking the perceived security of Treasury bonds. Conversely, lower ratios might signal increasing risk tolerance, potentially leading to higher yields as investors seek higher returns in other asset classes.

-

Mention any anomalies or surprises: Any unexpected auction outcomes, such as significantly lower-than-expected demand or unexpectedly high yields, warrant close attention and analysis. These anomalies can often reveal underlying market shifts that are not immediately apparent.

Shifts in Investor Sentiment and Trading Strategies

Investor behavior and trading strategies in the Treasury market have evolved since April 8th. Understanding these shifts is critical for adapting your own approach. Geopolitical events can also play a significant role.

-

Discussion of risk-on vs. risk-off sentiment: Post-April 8th, has there been a prevailing risk-on or risk-off sentiment? Risk-on suggests investors are comfortable taking on more risk, often leading to lower demand for Treasury bonds (and potentially higher yields). A risk-off environment, typically driven by uncertainty, sees increased demand for safe-haven assets like Treasuries, potentially leading to lower yields.

-

Changes in investment allocations: Have investors increased or decreased their holdings of Treasuries? This shift can be a reflection of changing risk appetite, economic expectations, or other market factors impacting the Treasury market.

-

Impact of geopolitical events: Geopolitical instability can significantly impact investor sentiment. Events like international conflicts or trade tensions can drive investors towards the perceived safety of the Treasury market, impacting yields and prices.

Future Outlook and Predictions for the Treasury Market

Based on post-April 8th observations, predicting future trends in the Treasury market requires careful consideration of various factors.

-

Predictions for yield movements: Forecasting yield movements requires analyzing the interplay of economic data, inflation expectations, and investor sentiment. Will yields continue their upward or downward trajectory? The yield curve provides crucial insights into the market's expectations for future interest rates.

-

Potential impact of future economic data releases: Upcoming economic data releases will continue to shape the Treasury market. Pay close attention to inflation reports, employment figures, and other key indicators.

-

Considerations for investors: Investors need to carefully consider their risk tolerance and investment goals when navigating the Treasury market. Diversification and a well-defined investment strategy are crucial.

Conclusion

The Treasury market's performance after April 8th reveals significant shifts influenced by various economic and geopolitical factors. Understanding these changes—the impact of economic data on Treasury yields, the results of post-April 8th auctions, and shifts in investor sentiment—is crucial for effective navigation of this important market. By closely monitoring these factors and adapting your investment strategies accordingly, you can effectively manage your portfolio within the evolving landscape of the Treasury market. For continued insights and analysis of the Treasury market, stay tuned for our future updates and research.

Featured Posts

-

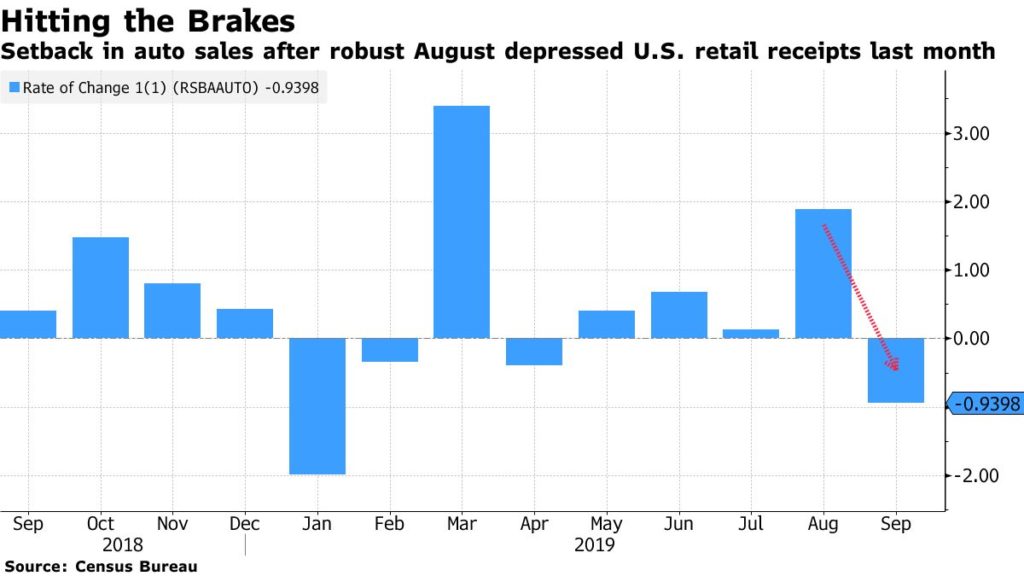

Economists Predict Rate Cuts Amid Weak Retail Sales

Apr 29, 2025

Economists Predict Rate Cuts Amid Weak Retail Sales

Apr 29, 2025 -

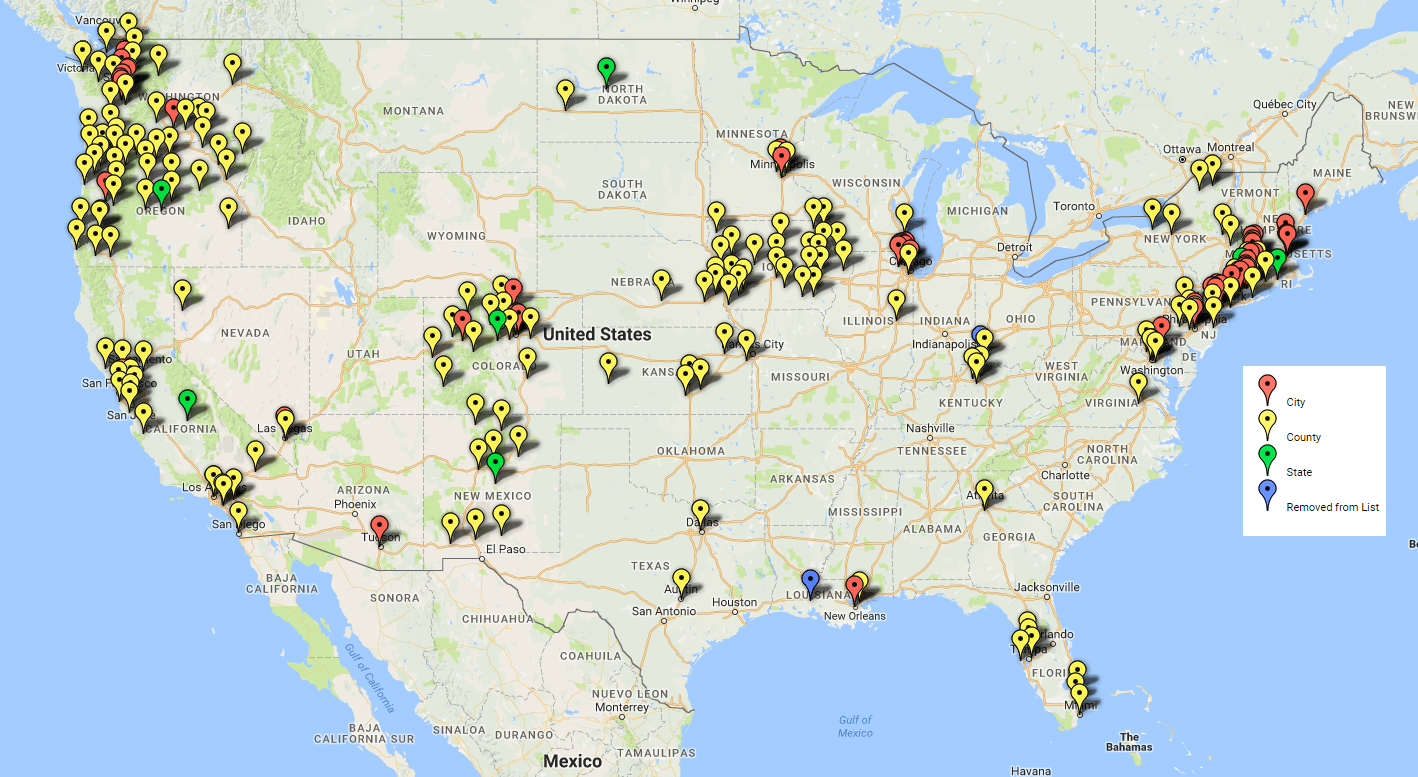

Sanctuary Cities And States Trumps Planned Nationwide Database

Apr 29, 2025

Sanctuary Cities And States Trumps Planned Nationwide Database

Apr 29, 2025 -

New Report Details The Horrifying D C Blackhawk Passenger Jet Crash

Apr 29, 2025

New Report Details The Horrifying D C Blackhawk Passenger Jet Crash

Apr 29, 2025 -

Exclusive Universities A Collective Resistance To Trumps Policies

Apr 29, 2025

Exclusive Universities A Collective Resistance To Trumps Policies

Apr 29, 2025 -

Anchor Brewing Company Shuts Down Impact On The Craft Beer Industry

Apr 29, 2025

Anchor Brewing Company Shuts Down Impact On The Craft Beer Industry

Apr 29, 2025

Latest Posts

-

Social Medias Role In Misinformation Following D C Air Crash

Apr 29, 2025

Social Medias Role In Misinformation Following D C Air Crash

Apr 29, 2025 -

Remembering Past Tragedies Louisville Residents Under Shelter In Place

Apr 29, 2025

Remembering Past Tragedies Louisville Residents Under Shelter In Place

Apr 29, 2025 -

Louisvilles Shelter In Place A Time For Reflection And Remembrance

Apr 29, 2025

Louisvilles Shelter In Place A Time For Reflection And Remembrance

Apr 29, 2025 -

Inaccurate Social Media Posts Following Deadly D C Plane Crash

Apr 29, 2025

Inaccurate Social Media Posts Following Deadly D C Plane Crash

Apr 29, 2025 -

Severe Weather Emergency In Louisville Tornado And Major Flooding Expected

Apr 29, 2025

Severe Weather Emergency In Louisville Tornado And Major Flooding Expected

Apr 29, 2025