Unlocking Profitable Dividends: A Simple Approach

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's earnings distributed to those who own its stock. Understanding key terminology is crucial:

- Dividend Yield: This is the annual dividend per share divided by the stock price, expressed as a percentage. It indicates the return on investment from dividends alone.

- Payout Ratio: This is the percentage of a company's earnings paid out as dividends. A high payout ratio can be a concern if the company's earnings are not stable.

- Ex-Dividend Date: This is the date on or after which a buyer of a stock will not receive the next dividend payment.

Types of Dividend Stocks

Different types of dividend stocks cater to various investment strategies:

-

High-Yield Dividend Stocks: These stocks offer a high dividend yield, but often come with higher risk. Examples include some real estate investment trusts (REITs) and energy companies.

-

Growth Dividend Stocks: These companies reinvest a larger portion of their earnings for growth, paying out smaller but potentially increasing dividends over time. Many technology companies fall into this category.

-

Blue-Chip Dividend Stocks: These are stocks of large, well-established companies with a long history of paying consistent dividends. Examples include Coca-Cola and Johnson & Johnson.

-

Define dividend yield and explain how to calculate it: Dividend Yield = (Annual Dividend per Share / Stock Price) x 100

-

Explain the difference between a regular dividend and a special dividend: Regular dividends are consistent payouts, while special dividends are one-time payments, often made when a company has excess cash.

-

Highlight the importance of understanding a company's financial health before investing: Analyze financial statements to assess profitability, debt levels, and future growth potential. Don't chase high yields without understanding the underlying company's health.

Building a Profitable Dividend Portfolio

Diversification Strategies

Diversification is key to mitigating risk and maximizing returns. Don't put all your eggs in one basket! Diversify your portfolio across different sectors (e.g., technology, healthcare, consumer staples) and market caps (large-cap, mid-cap, small-cap). This strategy helps to cushion against losses in any single sector.

Screening for Dividend Stocks

Numerous online tools can help you screen for potential dividend stocks. Consider these key metrics:

-

Dividend Yield: Look for yields that are attractive but not excessively high, which may signal higher risk.

-

Payout Ratio: A sustainable payout ratio (typically below 70%) is preferable.

-

Earnings Growth: Companies with consistent earnings growth are more likely to sustain their dividend payments.

-

Provide examples of reputable online screening tools: Many brokerage platforms offer stock screeners; others include Finviz and Yahoo Finance.

-

List key financial ratios to analyze when evaluating dividend stocks: Payout ratio, price-to-earnings (P/E) ratio, return on equity (ROE).

-

Suggest a sample portfolio diversification strategy: A sample strategy might include allocating 25% each to utilities, REITs, consumer staples, and technology stocks.

Managing Your Dividend Income

Reinvesting Dividends

Dividend reinvestment plans (DRIPs) allow you to automatically reinvest your dividend payments to buy more shares. This accelerates wealth growth through the power of compounding. Over time, this snowball effect can significantly increase your overall returns.

Tax Implications of Dividend Income

Dividend income is generally taxable. The tax rate depends on your income bracket and the type of dividend (qualified or non-qualified). Seeking professional financial advice is crucial for managing tax implications effectively.

- Explain the benefits of DRIPs: Automatic reinvestment, compounding returns, lower transaction fees.

- Mention different tax brackets and how they affect dividend income: Higher income brackets typically face higher tax rates on dividend income.

- Recommend consulting a tax advisor or financial planner: Professionals can provide personalized guidance based on your specific financial situation.

Avoiding Common Dividend Investing Mistakes

Chasing High Yields Blindly

Don't fall into the trap of solely chasing high dividend yields. A high yield might indicate underlying financial problems or unsustainable dividend policies. Always thoroughly research the company's financial health before investing.

Ignoring Dividend Cuts

Companies can cut dividends due to financial difficulties. Stay informed by monitoring company news and financial reports. A sudden dividend cut can significantly impact your investment returns.

- Provide examples of companies that have cut dividends: Research past instances of dividend cuts to understand the potential risks.

- Explain the impact of dividend cuts on investors: Dividend cuts can lead to immediate drops in stock prices and reduced income.

- Stress the importance of due diligence: Thorough research and careful analysis are essential for successful dividend investing.

Conclusion

Unlocking profitable dividends involves a strategic approach that combines diversification, careful stock selection, dividend reinvestment, and risk management. By understanding the basics of dividend investing, employing effective screening techniques, and avoiding common pitfalls, you can build a sustainable income stream and secure your financial future. Start unlocking profitable dividends today! Use these simple strategies to build a sustainable income stream and take control of your investment strategy. Begin researching dividend stocks and embark on your journey towards financial independence.

Featured Posts

-

Diamondbacks Vs Yankees Injured Players April 1 3 Series

May 11, 2025

Diamondbacks Vs Yankees Injured Players April 1 3 Series

May 11, 2025 -

Brewers Vs Yankees Updated Injury List March 27 30

May 11, 2025

Brewers Vs Yankees Updated Injury List March 27 30

May 11, 2025 -

White House Minimizes Auto Industry Concerns Over Uk Trade Deal

May 11, 2025

White House Minimizes Auto Industry Concerns Over Uk Trade Deal

May 11, 2025 -

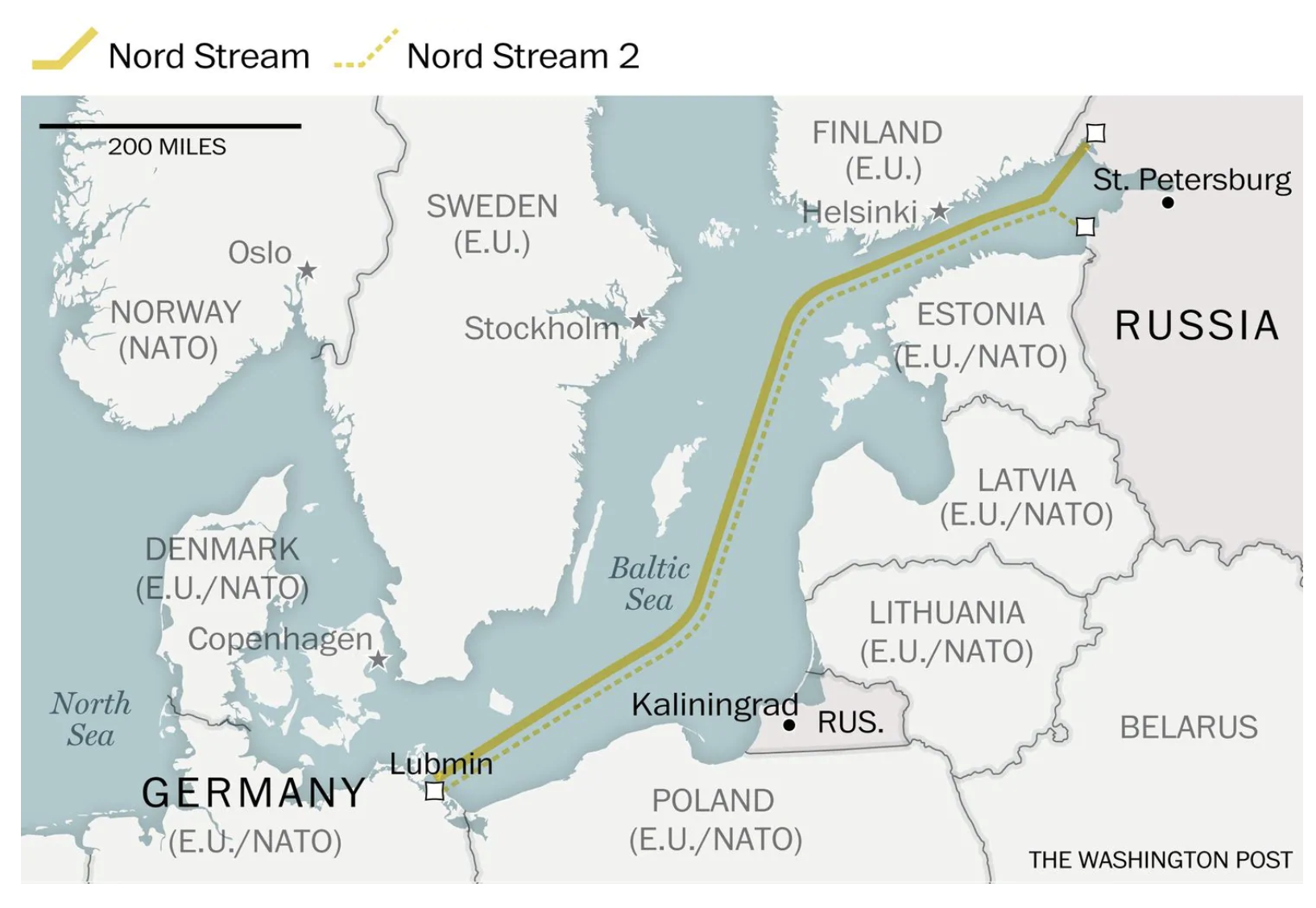

Russias Gas Pipeline An Exclusive Elliott Investment

May 11, 2025

Russias Gas Pipeline An Exclusive Elliott Investment

May 11, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Increase For At And T

May 11, 2025

Broadcoms V Mware Acquisition A 1 050 Price Increase For At And T

May 11, 2025

Latest Posts

-

Mlb Legend Status Aaron Judges Electrifying Yankees Performance

May 11, 2025

Mlb Legend Status Aaron Judges Electrifying Yankees Performance

May 11, 2025 -

Rob Manfred On The Speedway Classic A Discussion With Mlbs Commissioner

May 11, 2025

Rob Manfred On The Speedway Classic A Discussion With Mlbs Commissioner

May 11, 2025 -

April 17 20 Rays Vs Yankees Key Injuries And Their Impact

May 11, 2025

April 17 20 Rays Vs Yankees Key Injuries And Their Impact

May 11, 2025 -

Rays And Yankees Injured Players April 17 20 Series Preview

May 11, 2025

Rays And Yankees Injured Players April 17 20 Series Preview

May 11, 2025 -

Yankee Star Aaron Judges Record Breaking Season

May 11, 2025

Yankee Star Aaron Judges Record Breaking Season

May 11, 2025