US Middle Class Income: A State-by-State Breakdown

Table of Contents

Defining the US Middle Class

Understanding the variations in US middle class income requires a clear definition of what constitutes the middle class. This is not a universally agreed-upon metric, but we will use a common approach for consistency.

Income Ranges and Methodology

For this analysis, we'll define the middle class based on household income, using data from the U.S. Census Bureau's American Community Survey (ACS) for the most recent available year (please specify the year here, e.g., 2022). Specifically, we'll focus on the income range encompassing the middle 60% of the income distribution in each state. This methodology provides a relative measure, considering the cost of living variations across states.

- Income Brackets: The specific income brackets for the middle class will vary by state due to differing cost of living and income distributions. This analysis will present these ranges for each state individually.

- Data Year: (Insert the year of the data used, e.g., 2022) is the year for all data presented in this analysis. It’s crucial to understand that income data fluctuates yearly.

- Data Limitations: It's important to note that these figures represent household income and don't fully capture the complexities of individual financial situations. Factors such as wealth, assets, and debt are not considered in this analysis.

Highest Average Middle Class Incomes by State

Several states consistently boast higher average middle-class incomes than others. This is often linked to a combination of factors, including strong local economies and a high concentration of specific, well-paying industries.

Top 10 States

(Insert a numbered list here of the top 10 states with the highest average middle-class income, including specific data points. For example:

- Maryland: $110,000 (Illustrative Data - Replace with actual data)

- California: $105,000 (Illustrative Data - Replace with actual data)

- New Jersey: $100,000 (Illustrative Data - Replace with actual data) ... and so on)

- Reasons for High Income: The high average middle-class income in these states is often attributed to robust technology sectors (California, Washington), strong government employment (Maryland, Virginia), and a high concentration of finance and professional services (New York, Connecticut). These industries typically offer higher salaries and better job security.

- Supporting Statistics: (Include relevant statistics for each state, such as unemployment rates and job growth data from reliable sources like the Bureau of Labor Statistics.)

Lowest Average Middle Class Incomes by State

Conversely, some states report significantly lower average middle-class incomes. While lower cost of living can sometimes mitigate the impact, it's crucial to understand the broader economic and social factors at play.

Bottom 10 States

(Insert a numbered list here of the bottom 10 states with the lowest average middle-class income, including specific data points. For example:

- Mississippi: $60,000 (Illustrative Data - Replace with actual data)

- West Virginia: $62,000 (Illustrative Data - Replace with actual data)

- Arkansas: $65,000 (Illustrative Data - Replace with actual data) ... and so on)

- Reasons for Lower Income: Factors such as a higher concentration of lower-paying industries (agriculture, manufacturing), limited job opportunities, and higher unemployment rates contribute to lower average middle-class incomes in these states. Social and economic factors, such as historical inequalities and lack of access to quality education, also play a crucial role.

- Social and Economic Factors: (Discuss specific examples of such factors relevant to the listed states.)

Factors Influencing Middle Class Income by State

Several interconnected factors influence state-level income variations. Understanding these is vital for developing effective policies and strategies to improve economic mobility.

Cost of Living

The cost of living, encompassing housing, transportation, healthcare, and groceries, significantly impacts the financial well-being of the middle class. A high cost of living can negate the benefits of a higher income, reducing purchasing power and affordability. Comparing the average middle-class income with the cost of living index for each state provides a more accurate picture of the financial realities faced by middle-class families.

Employment and Industry

The dominant industries within a state significantly impact average income levels. States with a concentration of high-paying industries like technology, finance, and healthcare tend to exhibit higher average middle-class incomes than those reliant on lower-paying sectors like agriculture or manufacturing.

Education and Skills

Education and job skills are strongly correlated with income levels. Higher levels of education and specialized skills often lead to access to higher-paying jobs. This highlights the importance of investments in education and workforce development programs to improve economic mobility and boost middle-class income.

- Examples: (Provide specific examples of states with high-paying vs. low-paying industries and their impact on middle-class income.)

- Policy Impacts: (Discuss the role of government policies and social programs in promoting education and skills development.)

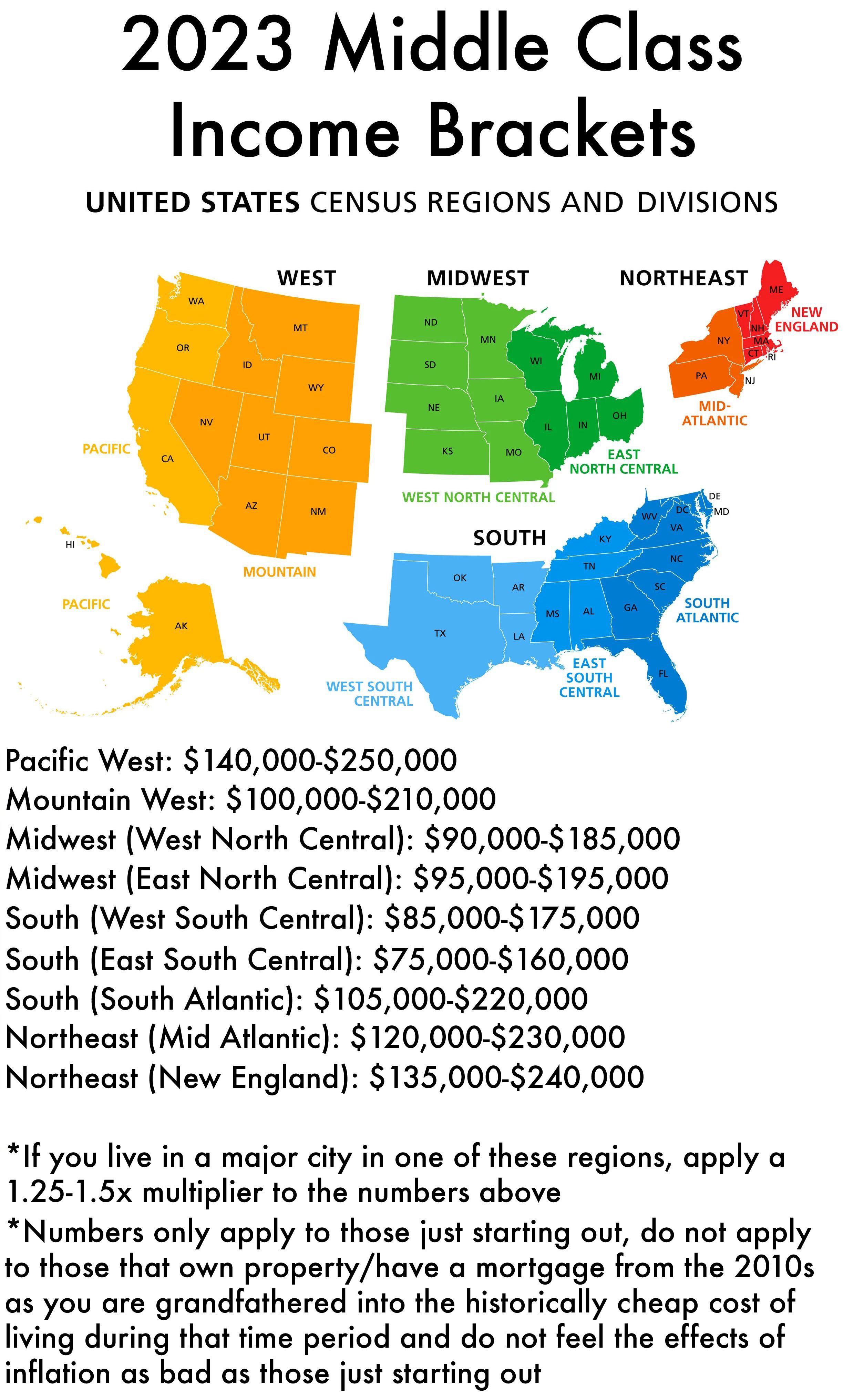

Visual Representation of Data

(Include a map of the United States with a color-coded representation of average middle-class income by state. Consider including additional charts and graphs to visually compare income levels across different regions or states.)

Conclusion

This state-by-state analysis reveals significant disparities in US middle class income. Factors such as cost of living, employment opportunities within specific industries, and the educational attainment of the workforce profoundly influence these variations. Understanding these nuances is critical for both personal financial planning and informed policymaking.

Understanding your state's average US middle class income is crucial for effective financial planning. Use this data to inform your decisions and start building a stronger financial future. Further research into individual state economic reports and resources dedicated to financial literacy can help you gain a deeper understanding and make the most of your financial situation.

Featured Posts

-

6 556 Bitcoin Purchase By Strategy Investment Details And Analysis

Apr 30, 2025

6 556 Bitcoin Purchase By Strategy Investment Details And Analysis

Apr 30, 2025 -

Nebraskas Destination Act Reshaping The Future Of The Rod Yates Project In Gretna

Apr 30, 2025

Nebraskas Destination Act Reshaping The Future Of The Rod Yates Project In Gretna

Apr 30, 2025 -

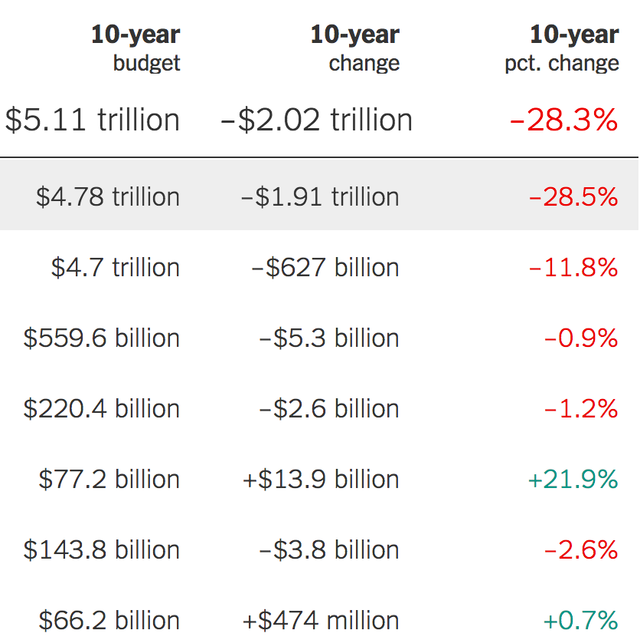

Analysis Federal Funding Cuts And Their Consequences In Trump Country

Apr 30, 2025

Analysis Federal Funding Cuts And Their Consequences In Trump Country

Apr 30, 2025 -

Is A Cotswolds Move On The Cards For Beyonce And Jay Z

Apr 30, 2025

Is A Cotswolds Move On The Cards For Beyonce And Jay Z

Apr 30, 2025 -

Managing Adhd Naturally Holistic Approaches And Lifestyle Changes

Apr 30, 2025

Managing Adhd Naturally Holistic Approaches And Lifestyle Changes

Apr 30, 2025

Latest Posts

-

The Chinese Auto Market A Case Study Of Bmw And Porsches Performance

Apr 30, 2025

The Chinese Auto Market A Case Study Of Bmw And Porsches Performance

Apr 30, 2025 -

Pierre Poilievres Election Loss A Shock For Canadas Conservatives

Apr 30, 2025

Pierre Poilievres Election Loss A Shock For Canadas Conservatives

Apr 30, 2025 -

Analyzing The China Market Why Luxury Carmakers Face Headwinds

Apr 30, 2025

Analyzing The China Market Why Luxury Carmakers Face Headwinds

Apr 30, 2025 -

Navigating The Chinese Market The Struggles And Strategies Of Bmw Porsche And Other Automakers

Apr 30, 2025

Navigating The Chinese Market The Struggles And Strategies Of Bmw Porsche And Other Automakers

Apr 30, 2025 -

The China Factor How Market Conditions Affect Luxury Car Brands Like Bmw And Porsche

Apr 30, 2025

The China Factor How Market Conditions Affect Luxury Car Brands Like Bmw And Porsche

Apr 30, 2025