Wall Street Predicts 110% Growth For This BlackRock ETF In 2025

Table of Contents

The BlackRock ETF: A Deep Dive

Let's examine the ETF at the heart of this extraordinary prediction. While the specific ticker symbol remains undisclosed for now (to maintain confidentiality and prevent market manipulation before official release), we will refer to it as the "High-Growth BlackRock ETF" for simplicity. This ETF focuses on a specific sector poised for significant expansion, positioning it for substantial growth in the coming years.

Understanding the ETF's Investment Strategy

The High-Growth BlackRock ETF employs a targeted investment strategy focusing on [Insert specific sector or industry here, e.g., renewable energy, artificial intelligence, etc.]. Its asset allocation prioritizes companies exhibiting strong growth potential within this sector.

- Key Characteristics:

- Focus on high-growth companies within the [Insert sector] sector.

- Emphasis on innovation and technological advancement.

- Diversification within the target sector to mitigate risk.

- Index Tracking: The ETF may track a specific index, such as the [Insert relevant index name if known, e.g., Global Clean Energy Index], providing a benchmark for performance.

- Expense Ratio: The ETF's expense ratio is currently estimated at [Insert expense ratio percentage], a relatively [Insert "high" or "low" based on the actual expense ratio] figure compared to similar ETFs.

Analyzing the 110% Growth Prediction

The 110% growth prediction originates from [Insert source of prediction, e.g., a leading Wall Street investment bank's research report]. Their analysis considers several key factors:

- Key Factors Contributing to Predicted Growth:

- Rapid expansion of the [Insert sector] market.

- Government incentives and supportive regulations.

- Growing consumer demand for [Insert sector-relevant product or service].

- Influencing Economic Trends: The prediction takes into account projected economic growth, technological advancements, and anticipated shifts in consumer behavior.

- Potential Risks and Counterarguments: While the prediction is compelling, several factors could influence the actual performance, including unexpected economic downturns, increased competition, and regulatory changes.

Why Wall Street is Bullish on This BlackRock ETF

The optimism surrounding this BlackRock ETF stems from a confluence of factors: favorable market trends, BlackRock's expertise, and the inherent growth potential of the targeted sector.

Market Trends and Opportunities

Several significant market trends contribute to the bullish outlook:

- Key Market Trends:

- [Insert specific trend 1, e.g., Increased investment in sustainable energy solutions]

- [Insert specific trend 2, e.g., Rapid adoption of AI technologies across various industries]

- [Insert specific trend 3, e.g., Growing demand for [product/service relevant to the sector]]

- Industry Growth Projections: Industry analysts predict robust growth in the [Insert sector] sector over the next few years, fueling the ETF's potential.

- Disruptive Technologies: Emerging technologies within the [Insert sector] sector are expected to further accelerate growth and innovation.

BlackRock's Track Record and Expertise

BlackRock's reputation as a leading asset management firm significantly contributes to investor confidence.

- BlackRock's Strengths:

- Extensive experience in ETF management.

- Robust research capabilities and market analysis.

- Strong track record of successful ETF launches and performance.

- Awards and Recognition: [Insert any relevant awards or recognition received by BlackRock for ETF management]

- Resources and Capabilities: BlackRock's vast resources and extensive research capabilities provide a significant advantage in identifying and capitalizing on investment opportunities.

Risks and Considerations Before Investing

Before investing in any ETF, particularly one with such a bold growth prediction, it's crucial to acknowledge the inherent risks.

Market Volatility and Uncertainty

Investing in the stock market always carries risk, and this ETF is no exception:

- Market Risks:

- Potential market corrections or downturns.

- Unexpected economic events (e.g., recessions, geopolitical instability).

- Underperformance relative to the predicted 110% growth.

- Diversification: Diversifying your investment portfolio across various asset classes is vital to mitigate risk.

Due Diligence and Personal Investment Goals

Before making any investment decision, thorough due diligence is paramount.

- Steps Before Investing:

- Conduct comprehensive research on the ETF.

- Assess your personal risk tolerance and investment goals.

- Consider your overall financial situation.

- Consult a Financial Advisor: Seeking advice from a qualified financial advisor is crucial to ensure your investment aligns with your individual circumstances.

- Understanding Your Risk Profile: Recognize your comfort level with risk and choose investments accordingly.

Conclusion

The 110% growth prediction for this BlackRock ETF is certainly enticing. However, it's crucial to understand that such predictions are not guarantees. The potential for substantial returns is balanced by the inherent risks associated with any investment in the stock market. While market trends and BlackRock's expertise suggest a positive outlook, thorough due diligence, careful consideration of your risk tolerance, and consultation with a financial advisor are essential before investing. Consider exploring the potential of this high-growth BlackRock ETF, but always remember to conduct thorough due diligence before investing. [Insert link to ETF information page if available]

Featured Posts

-

Analyzing The Impact Of Liberation Day Tariffs On The Stock Market

May 08, 2025

Analyzing The Impact Of Liberation Day Tariffs On The Stock Market

May 08, 2025 -

Kyren Paris Clutch Homer Angels Triumph Over White Sox In The Rain

May 08, 2025

Kyren Paris Clutch Homer Angels Triumph Over White Sox In The Rain

May 08, 2025 -

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025 -

Arsenal Protiv Ps Zh Pregled Na Prviot Mech

May 08, 2025

Arsenal Protiv Ps Zh Pregled Na Prviot Mech

May 08, 2025 -

Gms Canadian Production Cuts A Tariff Driven Decision

May 08, 2025

Gms Canadian Production Cuts A Tariff Driven Decision

May 08, 2025

Latest Posts

-

Copa Libertadores Grupo C Liga De Quito Enfrenta A Flamengo En La Fecha 3

May 08, 2025

Copa Libertadores Grupo C Liga De Quito Enfrenta A Flamengo En La Fecha 3

May 08, 2025 -

Filipe Luis Suma Otro Titulo A Su Carrera

May 08, 2025

Filipe Luis Suma Otro Titulo A Su Carrera

May 08, 2025 -

Quito Empata Con Flamengo Resultado De La Copa Libertadores

May 08, 2025

Quito Empata Con Flamengo Resultado De La Copa Libertadores

May 08, 2025 -

Golaco De Arrascaeta Flamengo Sai Vencedor Contra O Gremio No Brasileirao

May 08, 2025

Golaco De Arrascaeta Flamengo Sai Vencedor Contra O Gremio No Brasileirao

May 08, 2025 -

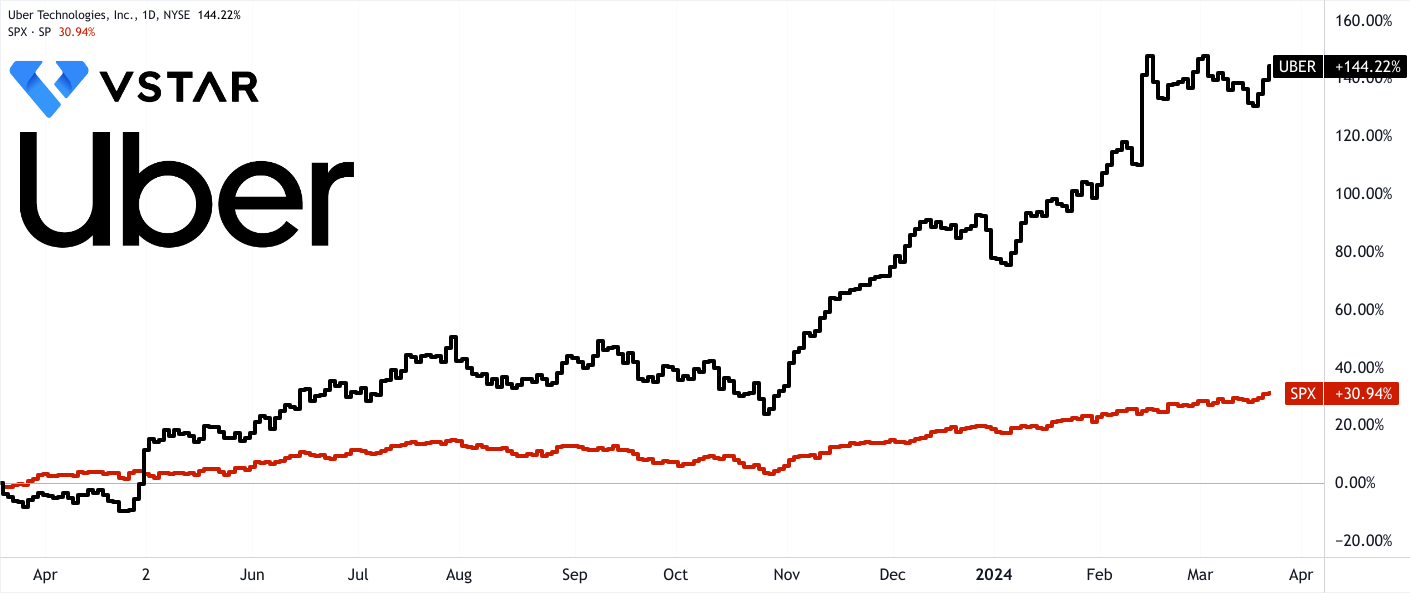

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025