Wall Street's Comeback: A Threat To Germany's DAX Rally?

Table of Contents

The Wall Street Comeback: Factors Driving the Surge

Several key factors are contributing to the impressive Wall Street comeback. Understanding these factors is crucial for assessing its potential impact on global markets, including the DAX.

Strong US Economic Indicators

Positive US economic data significantly boosts investor confidence and fuels the Wall Street comeback. Recent reports paint a picture of robust economic growth.

- GDP Growth: Q2 2024 saw a surprisingly strong GDP growth rate, exceeding initial projections.

- Employment Figures: Unemployment rates remain low, indicating a healthy labor market and strong consumer spending.

- Consumer Spending: Consumer confidence is high, driving robust retail sales and fueling economic expansion.

This positive economic news reinforces investor belief in the US economy's strength, leading to increased investment and driving up stock valuations. The robust economic indicators directly translate into higher corporate profits, further bolstering the Wall Street comeback.

Corporate Earnings Reports

Strong corporate earnings reports are another key driver of the Wall Street comeback. Many sectors are exceeding expectations, further fueling investor optimism.

- Technology Sector: Tech giants have reported impressive earnings growth, driven by strong demand for AI-related products and services.

- Energy Sector: High energy prices continue to benefit energy companies, contributing to their strong performance.

- Financial Sector: Banks have shown resilience, benefiting from rising interest rates.

These robust earnings translate into increased stock valuations, attracting further investment and driving the upward trend on Wall Street. The strong performance of these key sectors significantly contributes to the overall market sentiment, pushing the Wall Street comeback further.

Federal Reserve Policy

The Federal Reserve's monetary policies also play a significant role in the Wall Street comeback. While interest rate hikes initially caused some market volatility, the current stance of the Fed is contributing to stability.

- Interest Rate Decisions: While the Fed has indicated further rate hikes are possible, the pace of increases is slowing, indicating a more stable monetary policy environment.

- Inflation Control: The Fed's efforts to control inflation are viewed positively by investors, reducing uncertainty about future economic conditions.

The Fed's actions influence the US dollar and attract international investments, contributing to the Wall Street comeback. A stable and predictable monetary policy environment reduces risk and encourages investment, bolstering the US market's overall performance.

The DAX Rally: Sustaining Growth in Germany

The DAX rally, representing the German stock market's performance, benefits from several factors unique to the German economy and the broader European context.

Strong German Industrial Output

Germany's powerful industrial sector remains a core driver of the DAX rally. The strength of German manufacturing and exports supports economic growth.

- Automotive Industry: Despite challenges, the German automotive industry remains a significant contributor to the nation's GDP. Innovations in electric vehicles and related technologies are boosting the sector.

- Manufacturing Sector: Germany's highly skilled workforce and advanced manufacturing capabilities continue to contribute significantly to industrial output.

The robust performance of these industries directly impacts the DAX's performance, making it a resilient market despite global economic uncertainties.

European Union Economic Stability

The overall economic health of the European Union plays a crucial role in supporting the German economy and the DAX. EU stability is essential for German businesses operating within the EU single market.

- EU Economic Growth: Moderate growth within the EU provides a stable environment for German exports and economic activity.

- EU Trade Policies: The EU's trade policies and agreements provide access to significant global markets for German businesses.

The interdependency between the German and broader European economies means that the health of the EU directly influences the DAX's performance.

Government Policies and Investments

German government policies and investments play a significant role in supporting the DAX. Government initiatives aimed at boosting innovation and supporting businesses are crucial for long-term growth.

- Investment in Green Technologies: Government investment in renewable energy and green technologies is creating new opportunities for businesses and boosting economic growth.

- Support for Small and Medium-Sized Enterprises (SMEs): Government programs aimed at supporting SMEs contribute to economic diversification and resilience.

These policies foster business confidence and investment, positively impacting the DAX's performance and ensuring sustainable growth.

Interdependence and Potential Threats: Wall Street vs. DAX

While both markets can experience independent growth, there's a significant degree of interdependence, particularly concerning global capital flows and geopolitical events.

Global Capital Flows

The movement of capital between the US and European markets is a key factor influencing both the Wall Street comeback and the DAX rally.

- Investor Sentiment: If investor sentiment shifts towards the US market due to perceived higher returns, capital may flow out of Europe, potentially impacting the DAX.

- Risk Assessment: Changes in global risk assessment influence investor decisions; a perceived increase in risk in Europe could lead to capital flight towards the perceived safer US market.

A significant shift in global capital flows could negatively impact the DAX, even if the German economy remains fundamentally strong.

Currency Fluctuations

The Euro/US dollar exchange rate directly impacts investment decisions and the relative attractiveness of German assets.

- Exchange Rate Shifts: A strengthening US dollar relative to the Euro can make German assets less attractive to international investors.

- Import/Export Prices: Currency fluctuations affect the price of imports and exports, potentially impacting German businesses' competitiveness.

Significant currency fluctuations can significantly influence the relative performance of Wall Street and the DAX, making careful analysis of exchange rates crucial for investors.

Geopolitical Risks

Global political events can influence both markets, impacting investor sentiment and capital flows.

- Geopolitical Instability: Events like wars or major political crises can negatively impact both the US and European economies.

- Trade Wars: Escalation of trade tensions between major economies can disrupt global trade and impact both markets negatively.

These risks can significantly affect investor sentiment and capital flows, potentially impacting both the Wall Street comeback and the DAX rally.

Conclusion

The Wall Street comeback and the DAX rally are complex and intertwined phenomena. While a thriving US market can attract global investment, potentially drawing capital away from Europe, Germany's economic strength depends on its industrial sector and the stability of the European Union. Understanding the intricate interplay between these markets is vital for investors. Continue monitoring the Wall Street comeback and its potential impact on the DAX rally to make informed investment decisions. Stay informed about the latest developments affecting both markets to navigate the complexities of these interwoven global financial landscapes.

Featured Posts

-

Annie Kilners Solo Outing After Kyle Walkers Night With Two Women

May 25, 2025

Annie Kilners Solo Outing After Kyle Walkers Night With Two Women

May 25, 2025 -

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Aljmark Byn Washntn Wbkyn

May 25, 2025

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Aljmark Byn Washntn Wbkyn

May 25, 2025 -

Amsterdam Stock Market Crash Aex Index Hits 12 Month Low

May 25, 2025

Amsterdam Stock Market Crash Aex Index Hits 12 Month Low

May 25, 2025 -

Tik Tok Tourist Boom Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 25, 2025

Tik Tok Tourist Boom Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 25, 2025 -

Explore The 2025 Porsche Cayenne Interior And Exterior Designs

May 25, 2025

Explore The 2025 Porsche Cayenne Interior And Exterior Designs

May 25, 2025

Latest Posts

-

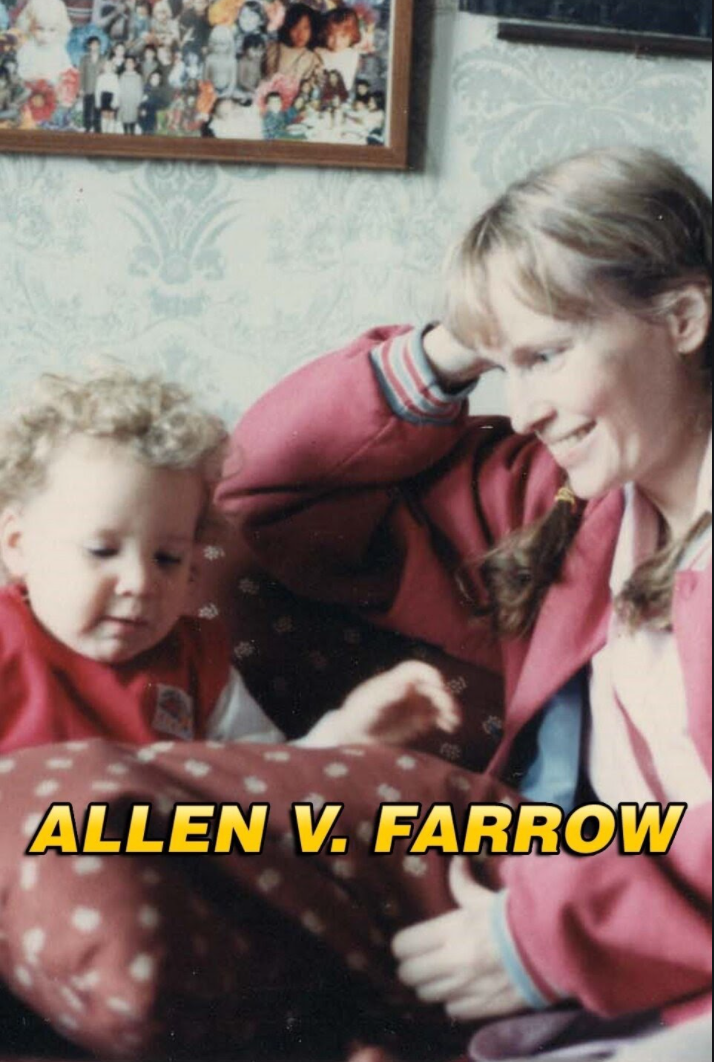

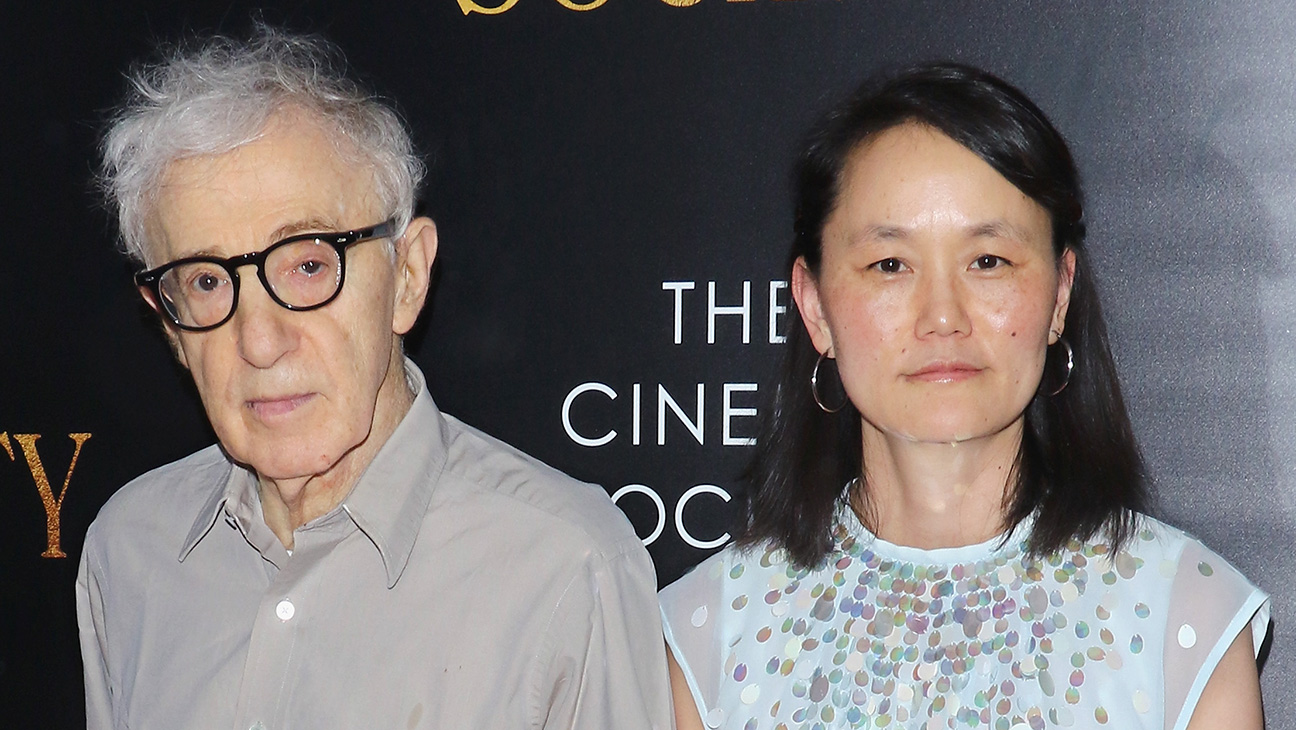

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

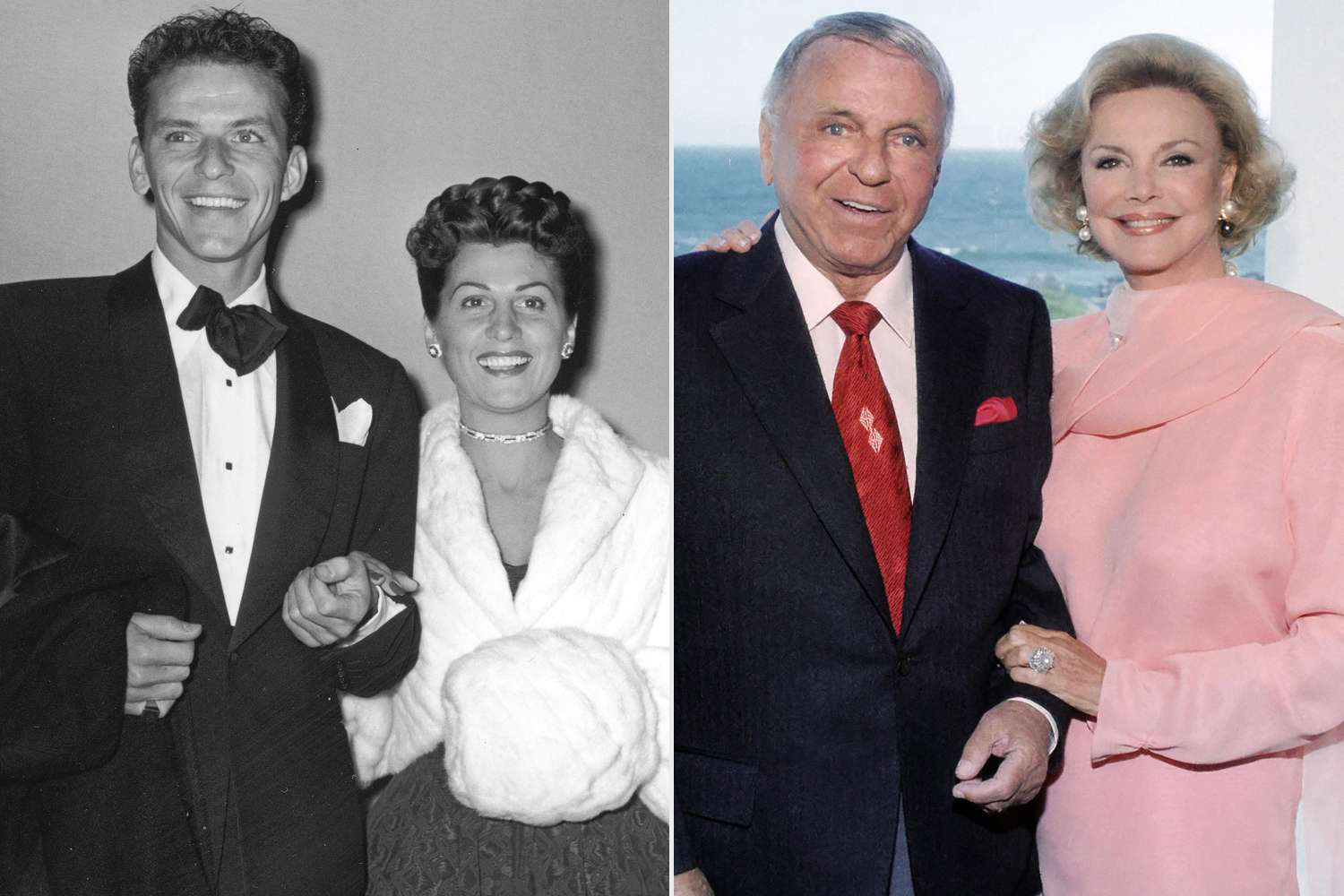

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025