Wall Street's Resurgence: The Implications For Bear Market Investors

Table of Contents

Understanding the Drivers of Wall Street's Resurgence

The recent resurgence on Wall Street isn't a random event; it's the result of a confluence of factors impacting investor sentiment and market behavior. Understanding these drivers is key to formulating a successful investment strategy.

Economic Indicators and Positive Market Sentiment

Several key economic indicators point towards a healthier market environment. Stronger-than-expected GDP growth, coupled with declining inflation rates and sustained employment figures, contribute to a more optimistic outlook. This improved economic data fuels positive investor sentiment, encouraging increased investment activity and driving stock prices higher. Positive news releases and improved economic forecasts further reinforce this upward trend.

- Improved corporate earnings: Many companies are reporting better-than-anticipated profits, boosting investor confidence.

- Reduced inflation concerns: Easing inflation pressures reduce the risk of aggressive interest rate hikes by central banks.

- Easing geopolitical tensions: Reduced global uncertainty creates a more favorable environment for investment.

The Role of Federal Reserve Policy

The Federal Reserve's monetary policy plays a significant role in shaping market dynamics. Interest rate adjustments, quantitative easing (QE), and quantitative tightening (QT) directly impact borrowing costs, liquidity, and investor risk appetite. While previous interest rate hikes aimed to curb inflation, a potential shift towards future rate cuts could further stimulate economic growth and boost market performance. Understanding the Fed's evolving stance is crucial for anticipating market reactions.

- Interest rate hikes: Previous increases aimed to control inflation, impacting borrowing costs and investment decisions.

- Quantitative tightening: The reduction of the Fed's balance sheet affects market liquidity and interest rates.

- Potential for future rate cuts: A shift towards lower rates could inject more liquidity into the market, boosting stock prices.

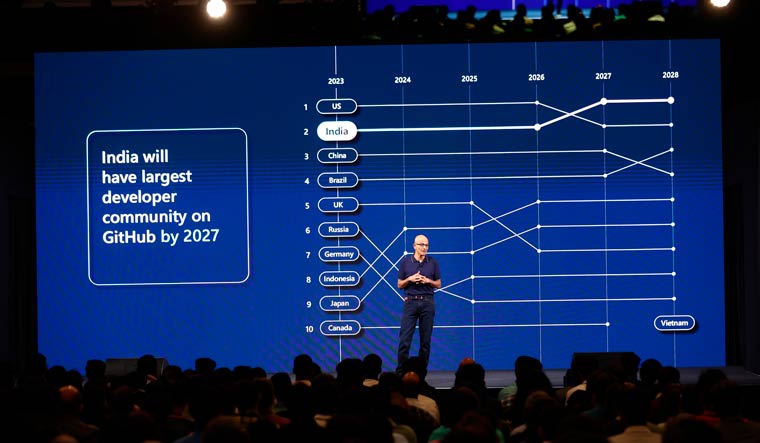

Technological Advancements and Sector-Specific Growth

Technological innovation is a powerful engine driving the current market resurgence. Specific sectors, such as artificial intelligence (AI), renewable energy, and biotechnology, are experiencing explosive growth, attracting significant investment. These advancements create new opportunities for investors seeking high-growth potential. Understanding the impact of these emerging technologies on various sectors is vital for identifying promising investment avenues.

- Artificial intelligence boom: The rapid advancement of AI is transforming multiple industries, creating lucrative investment opportunities.

- Sustainable energy investments: Growing concerns about climate change are fueling substantial investment in renewable energy technologies.

- Advancements in biotechnology: Breakthroughs in biotechnology and pharmaceuticals are leading to exciting new treatments and therapies.

Strategies for Bear Market Investors During a Resurgence

For investors who navigated the bear market, the resurgence presents a chance to reassess their strategies and capitalize on emerging opportunities. However, a cautious and informed approach remains crucial.

Reassessing Investment Portfolios

The market shift necessitates a thorough review of your investment portfolio. Identify underperforming assets, reassess your risk tolerance, and consider rebalancing your portfolio to align with your revised investment goals. Shifting from a predominantly defensive strategy to incorporate more growth-oriented investments may be appropriate, depending on your risk profile and time horizon.

- Portfolio diversification: Maintain a diversified portfolio across different asset classes to mitigate risk.

- Risk tolerance assessment: Re-evaluate your comfort level with risk given the changing market conditions.

- Adjusting asset allocation: Rebalance your portfolio to reflect your updated risk tolerance and investment objectives.

Capitalizing on Emerging Opportunities

The resurgence opens doors to new investment opportunities. Identify sectors poised for growth, such as those driven by technological advancements, and conduct thorough due diligence on potential investments. Value investing and growth stock opportunities are worth exploring. However, remember that managing risk during this transition period is paramount.

- Value investing: Identify undervalued companies with strong fundamentals and long-term growth potential.

- Growth stock opportunities: Invest in companies with high growth potential in emerging sectors.

- Sector-specific ETFs: Utilize exchange-traded funds (ETFs) to gain diversified exposure to specific sectors.

Managing Risk and Volatility

Even during a market resurgence, volatility can persist. Maintain a long-term investment horizon, avoiding impulsive decisions based on short-term market fluctuations. Implement a robust risk management strategy, utilizing tools like stop-loss orders to limit potential losses. Dollar-cost averaging and hedging strategies can help manage risk and protect your portfolio.

- Diversification: Spread your investments across various asset classes to reduce overall portfolio risk.

- Dollar-cost averaging: Invest a fixed amount at regular intervals, regardless of market fluctuations.

- Hedging strategies: Use options or other financial instruments to protect against potential losses.

Conclusion

Wall Street's resurgence presents a dynamic landscape for investors. By understanding the factors driving this recovery and adopting strategic approaches to portfolio management and risk mitigation, bear market investors can navigate this shift successfully. A long-term perspective and careful analysis are crucial for capitalizing on the opportunities presented by Wall Street's resurgence. Continue to research and refine your investment strategy to successfully navigate the evolving market conditions and take advantage of the potential upswing. Don't hesitate to consult with a financial advisor to further discuss your options related to the Wall Street resurgence and its implications for your bear market investments.

Featured Posts

-

Britannian Kruununperimysjaerjestys Muutokset Ja Nykyinen Jaerjestys

May 10, 2025

Britannian Kruununperimysjaerjestys Muutokset Ja Nykyinen Jaerjestys

May 10, 2025 -

Nyt Spelling Bee April 4th 2025 Hints And Strategies For The Daily Puzzle

May 10, 2025

Nyt Spelling Bee April 4th 2025 Hints And Strategies For The Daily Puzzle

May 10, 2025 -

The Edmonton Unlimited Strategy Accelerating Tech And Innovation Globally

May 10, 2025

The Edmonton Unlimited Strategy Accelerating Tech And Innovation Globally

May 10, 2025 -

Trump Tariffs Devastate Billionaire Net Worth Buffett Bezos Among Losers

May 10, 2025

Trump Tariffs Devastate Billionaire Net Worth Buffett Bezos Among Losers

May 10, 2025 -

Analysis Of Pam Bondis Laughter Following James Comers Epstein Claims

May 10, 2025

Analysis Of Pam Bondis Laughter Following James Comers Epstein Claims

May 10, 2025