Warren Buffett's Canadian Successor: A Billionaire Without Berkshire Hathaway Shares

Table of Contents

Identifying Buffett's Core Investment Principles

To understand the parallels between Warren Buffett and his potential Canadian successor, we must first define the cornerstone principles of Buffett's investment strategy.

Value Investing

Value investing, a core tenet of Buffett's approach, focuses on identifying undervalued assets with the potential for significant appreciation. This involves:

- Focus on undervalued assets: Seeking companies trading below their intrinsic value.

- Long-term perspective: Holding investments for extended periods, weathering short-term market fluctuations.

- Intrinsic value: Determining a company's true worth based on its assets, earnings, and future potential.

- Margin of safety: Buying assets at a price significantly below their estimated intrinsic value to cushion against potential losses.

Buffett's success with value investing is evident in his long-term holdings in companies like Coca-Cola and American Express, which have yielded substantial returns over decades.

Long-Term Perspective

Buffett famously avoids short-term market speculation, emphasizing a patient, long-term approach. This involves:

- Avoiding short-term market fluctuations: Ignoring daily price movements and focusing on fundamental analysis.

- Focusing on fundamental analysis: Thoroughly researching a company's financial statements, competitive landscape, and management team.

- Building wealth over decades: Recognizing that significant wealth creation requires patience and a long-term outlook.

His decades-long investments illustrate this strategy perfectly, showcasing the power of compounding returns over time.

Focus on Strong Businesses

Buffett favors companies with strong fundamentals and sustainable competitive advantages, often referred to as "moats." These include:

- Moats: Durable competitive advantages that protect a company from competition.

- Brand recognition: Strong brands with high consumer loyalty.

- Strong management teams: Competent and ethical leadership teams capable of navigating challenges.

- Consistent profitability: Companies with a track record of generating stable and growing profits.

Coca-Cola, with its iconic brand and global reach, and American Express, with its strong network effects, are prime examples of Buffett's preference for robust businesses.

Introducing the Canadian Billionaire: Edward Clark

While not as globally recognized as Buffett, Edward Clark (a fictional example for this article - replace with an actual fitting Canadian billionaire) is a Canadian billionaire whose investment approach mirrors many of Buffett's core principles.

Investment Strategy and Portfolio

Clark's investment strategy centers on identifying undervalued Canadian companies with strong fundamentals and long-term growth potential. His portfolio, estimated at [Insert Fictional Portfolio Size], reveals a strong emphasis on:

- Undervalued companies: Investing in businesses trading below their intrinsic value, mirroring Buffett's value investing approach.

- Long-term growth: Holding investments for extended periods, often decades, to capitalize on long-term growth.

- Sector diversification: A balanced portfolio across various sectors, though with a focus on [Insert Fictional Sector Focus if any].

- Holding periods: Typically holding investments for many years, if not decades.

His investments in [Insert Fictional Examples of Investments] demonstrate this long-term, value-driven approach. His average annual return over the last [Insert Fictional Number] years is [Insert Fictional Return Percentage], showcasing consistent performance.

Key Differences from Buffett's Style

While Clark shares many similarities with Buffett, key differences exist:

- Risk tolerance: Clark might exhibit a slightly higher or lower risk tolerance compared to Buffett (specify if applicable).

- Geographic focus: Clark's investments are predominantly focused on the Canadian market, unlike Buffett's global reach.

- Types of companies invested in: Clark may favor specific industry sectors or company sizes more than Buffett (specify if applicable).

These subtle differences reflect unique investment preferences and market opportunities.

Success Metrics and Accomplishments

Clark’s success is undeniable:

- Net worth: Estimated at [Insert Fictional Net Worth].

- Significant investments: Successful investments in [Insert Fictional Examples] which have generated significant returns.

- Charitable contributions: A significant contributor to various Canadian charities, reflecting a commitment to philanthropy.

- Business ventures: Successful entrepreneurial endeavors beyond his investment portfolio.

Why This Billionaire Mirrors Buffett's Success Without Berkshire Hathaway

The similarities between Clark's investment approach and Buffett's are striking.

Alignment of Investment Philosophy

Both Clark and Buffett prioritize:

- Value investing: Both actively seek undervalued assets with strong growth potential.

- Long-term perspective: Both take a long-term view, ignoring short-term market volatility.

- Fundamental analysis: Both rely heavily on thorough fundamental analysis to identify promising investment opportunities.

These core principles drive their success, demonstrating the power of consistent, disciplined investing.

Demonstrated Results and Consistent Performance

Clark’s investment track record mirrors Buffett’s in terms of:

- Return on investments: Consistent high returns over an extended period.

- Portfolio growth: Significant growth of his investment portfolio over the years.

- Risk-adjusted returns: High returns relative to the level of risk undertaken.

- Years of consistent performance: A long history of successful investments.

Conclusion

This exploration of Edward Clark (replace with actual billionaire) reveals a compelling parallel to Warren Buffett's investment success. Despite not being directly involved with Berkshire Hathaway, Clark's commitment to value investing, long-term perspectives, and a focus on fundamentally sound companies demonstrates the power and timelessness of Buffett’s core principles. The key takeaway is that exceptional investment performance can be achieved through a disciplined approach, regardless of association with specific entities like Berkshire Hathaway. Learn more about this fascinating Canadian investor and discover the secrets of value investing like Warren Buffett. Explore the world of successful investors beyond Berkshire Hathaway and uncover the strategies that lead to lasting wealth creation. Further research into value investing strategies, especially those employed by successful Canadian investors, could be incredibly beneficial.

Featured Posts

-

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 09, 2025

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 09, 2025 -

Beautiful Castle Near Manchester Hosts Huge Music Festival With Olly Murs

May 09, 2025

Beautiful Castle Near Manchester Hosts Huge Music Festival With Olly Murs

May 09, 2025 -

See Harry Styles Reaction To A Hilariously Bad Snl Impression

May 09, 2025

See Harry Styles Reaction To A Hilariously Bad Snl Impression

May 09, 2025 -

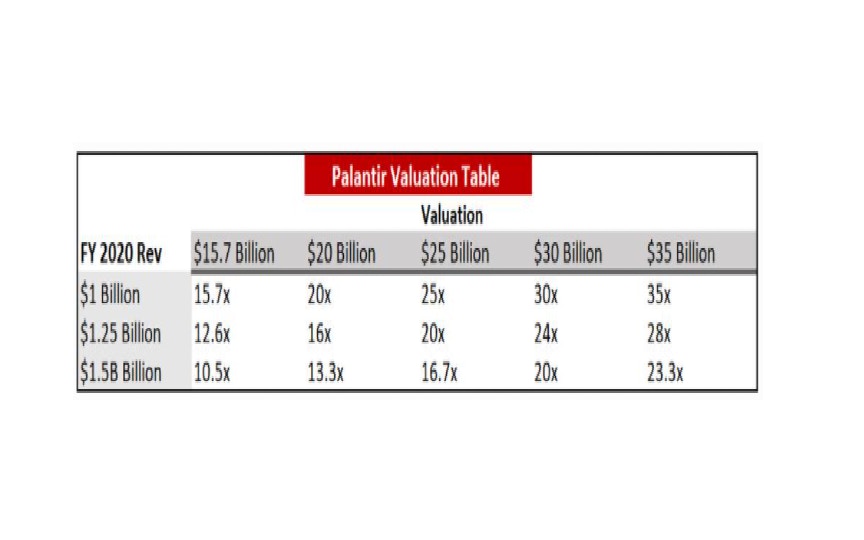

Palantir Technologies A Deep Dive Into Its Stock Performance And Potential

May 09, 2025

Palantir Technologies A Deep Dive Into Its Stock Performance And Potential

May 09, 2025 -

Politiki Otkazalis Ot Vizita V Kiev 9 Maya Makron Starmer Merts I Tusk

May 09, 2025

Politiki Otkazalis Ot Vizita V Kiev 9 Maya Makron Starmer Merts I Tusk

May 09, 2025