Weak Retail Sales Signal Potential Bank Of Canada Rate Cuts

Table of Contents

Declining Retail Sales: A Deeper Dive

The recent decline in Canadian retail sales is a significant economic indicator that cannot be ignored. The numbers paint a concerning picture: a [Insert Percentage]% drop in [Month, Year], representing the sharpest decline in [Number] months. This isn't just a minor fluctuation; it reflects a broader weakening in consumer spending. Several sectors have been particularly hard hit, with sales of automobiles and furniture experiencing particularly steep falls.

-

Specific Numbers and Percentages: [Insert Specific Data with Source Citations, e.g., Statistics Canada]. Visual representations, such as charts and graphs displaying the data over time, can further clarify the trend.

-

Sectors Most Affected: Beyond automobiles and furniture, sectors like [List other affected sectors, e.g., electronics, clothing] are also showing signs of weakness. This suggests a broader downturn in consumer spending, extending beyond specific luxury goods.

-

Reasons for the Decline: The primary drivers behind this retail sales decline seem to be threefold:

-

High Inflation: Persistent high inflation has eroded consumer purchasing power, forcing many Canadians to cut back on non-essential spending.

-

Rising Interest Rates: The Bank of Canada's previous interest rate hikes have increased borrowing costs, making it more expensive for consumers to finance purchases and impacting consumer confidence.

-

Reduced Consumer Confidence: Surveys show a decline in consumer confidence, indicating that Canadians are increasingly pessimistic about the economic outlook and are therefore less inclined to spend.

-

Impact on Consumer Confidence and Spending

The correlation between weak retail sales and declining consumer confidence is undeniable. Reduced purchasing power, coupled with rising living costs, is leaving many Canadians with less disposable income. This directly impacts spending habits, forcing many to prioritize essential purchases over discretionary items.

-

Consumer Sentiment Data: [Cite data from sources like the Conference Board of Canada's Consumer Confidence Index]. These indexes provide valuable insights into the prevailing sentiment among consumers.

-

Inflation's Impact on Real Wages: While nominal wages may be increasing, inflation is outpacing wage growth, resulting in a decline in real wages and disposable income.

-

Shift in Spending Habits: Consumers are increasingly focusing on essential goods and services, while delaying or foregoing purchases of non-essential items. This shift in spending priorities is a clear indicator of economic strain.

The Bank of Canada's Response: Potential Rate Cuts

Given the weak retail sales figures and the broader economic slowdown, the Bank of Canada is under pressure to respond. The Bank's mandate is to maintain price stability and full employment. With inflation still above its target of 2%, but showing signs of easing, and the economy slowing, the possibility of interest rate cuts is being seriously considered. The decision will be complex, balancing the need to combat inflation with the desire to stimulate economic growth.

-

Bank of Canada's Inflation Target: The Bank of Canada's current inflation target is 2%. Any deviation from this target, whether above or below, influences its monetary policy decisions.

-

Potential Economic Consequences of Rate Cuts: Rate cuts could stimulate economic activity by lowering borrowing costs and encouraging investment and spending. However, they also risk fueling inflation if implemented too aggressively.

-

Timing and Magnitude of Potential Rate Cuts: Experts are divided on the timing and scale of potential rate cuts. Some predict cuts as early as [Date], while others anticipate a more cautious approach. The actual decision will depend on upcoming economic data releases.

Implications for the Canadian Economy

The ramifications of weak retail sales and potential Bank of Canada rate cuts extend far beyond consumer spending. The entire Canadian economy will feel the ripple effects, impacting various sectors.

-

Impact on Employment Rates: A prolonged period of weak retail sales could lead to job losses in the retail sector and related industries, potentially impacting the overall unemployment rate.

-

Effects on the Housing Market: Rate cuts could potentially offer some relief to homeowners with variable-rate mortgages, lowering their monthly payments. However, the impact on house prices is complex and depends on several factors.

-

Implications for the Canadian Dollar: Interest rate cuts typically weaken a country's currency. A weaker Canadian dollar could make imports more expensive but boost exports.

Conclusion

Weak retail sales signal a concerning trend in the Canadian economy, reflecting the impact of high inflation, rising interest rates, and declining consumer confidence. The potential response from the Bank of Canada, namely interest rate cuts, represents a delicate balancing act between stimulating growth and controlling inflation. The implications are far-reaching, affecting employment rates, the housing market, and the Canadian dollar. To understand the full impact of these developments and stay informed on potential Bank of Canada rate cuts, it's crucial to stay updated on economic news and analyses. Stay updated on the latest developments regarding Bank of Canada rate cuts by subscribing to our newsletter! Understanding the implications of weak retail sales on the Canadian economy and the potential for Bank of Canada rate cuts is crucial for informed decision-making. Learn more today!

Featured Posts

-

Texas Resident Killed In Wrong Way Car Accident Near Minnesota North Dakota

Apr 29, 2025

Texas Resident Killed In Wrong Way Car Accident Near Minnesota North Dakota

Apr 29, 2025 -

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 29, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 29, 2025 -

Louisville Restaurants Struggle Amid River Road Construction

Apr 29, 2025

Louisville Restaurants Struggle Amid River Road Construction

Apr 29, 2025 -

Bof As Take Are High Stock Market Valuations A Cause For Concern

Apr 29, 2025

Bof As Take Are High Stock Market Valuations A Cause For Concern

Apr 29, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 29, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 29, 2025

Latest Posts

-

Older Viewers And You Tube A Growing Trend

Apr 29, 2025

Older Viewers And You Tube A Growing Trend

Apr 29, 2025 -

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025 -

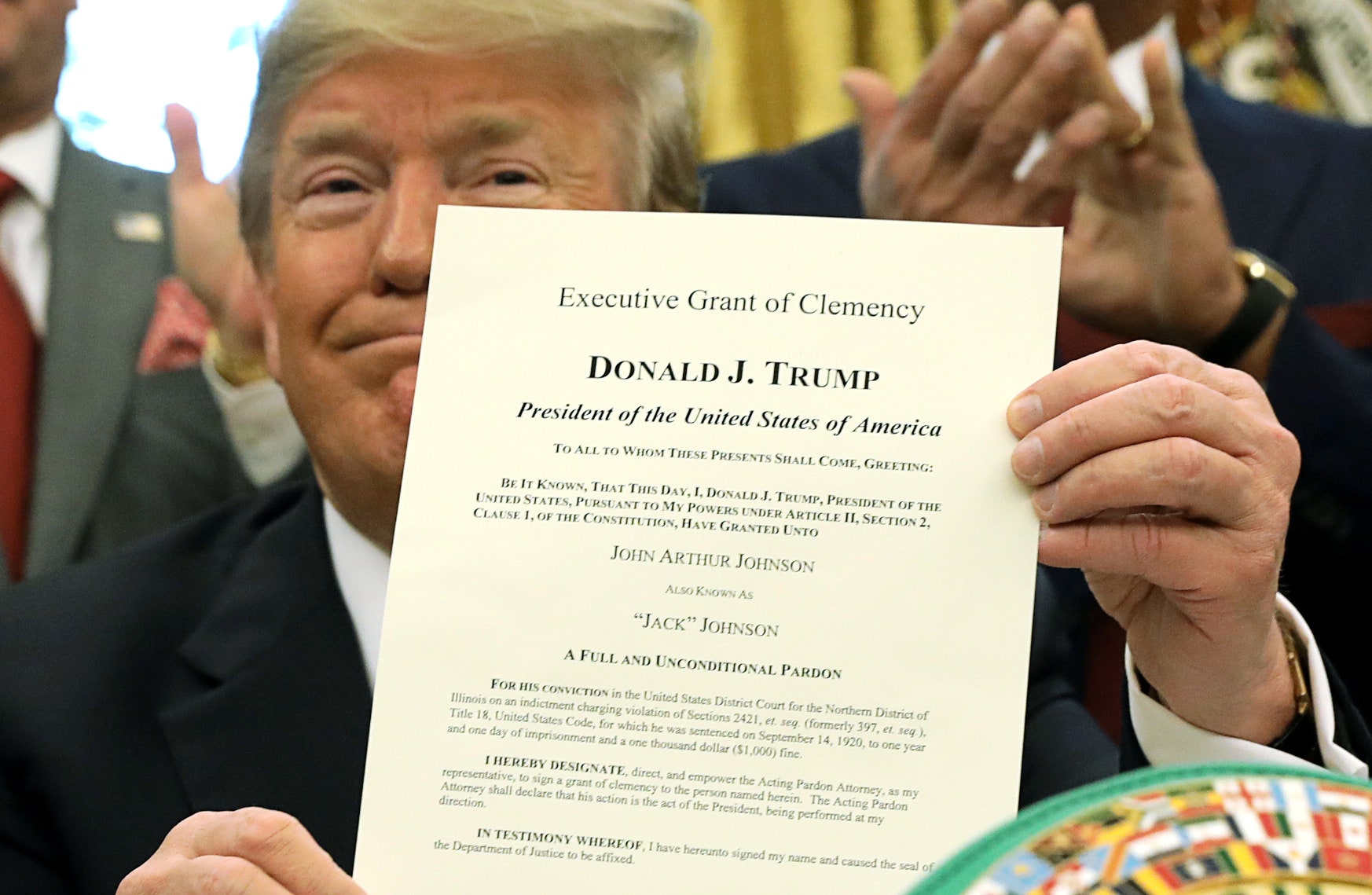

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025 -

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025