WestJet Stake Sale To International Carriers: Onex Investment Fully Recovered

Table of Contents

Onex Corporation's Successful Exit Strategy

Onex Corporation's initial investment in WestJet represented a long-term private equity strategy focused on building value and ultimately realizing a substantial return. Their involvement spanned several years, during which they actively supported WestJet's growth and development. This WestJet investment ultimately proved highly lucrative.

- Timeline: Onex's involvement began in [Insert Year], and their gradual divestment culminated in the recent stake sale. [Insert specific dates if available].

- Financial Return: The sale resulted in a full recovery of Onex's initial investment, along with a significant profit, demonstrating a highly successful exit strategy for the private equity firm. Precise figures, while potentially confidential, signify a strong ROI for Onex.

- Strategic Decision-Making: Onex's decision to divest was likely driven by a combination of factors, including the maximization of investment returns at a favorable market juncture and the belief that the new ownership structure would benefit WestJet's long-term prospects.

The successful conclusion of this WestJet investment highlights Onex Corporation's expertise in identifying and nurturing high-growth potential within the airline industry. This strategic decision underscores their prowess in private equity investments and their ability to navigate complex market dynamics.

International Carrier Acquisition and its Implications

The acquisition of a significant stake in WestJet involved [Insert Name(s) of International Carrier(s)]. Their strategic motivations likely include:

- North American Market Expansion: Gaining a foothold in the lucrative North American market, leveraging WestJet's established network and brand recognition.

- Code-Sharing Opportunities: Expanding code-sharing agreements to offer passengers more travel options and increased connectivity. This could significantly enhance route options for both WestJet and the acquiring carrier(s).

- Synergies and Collaborations: Exploring potential synergies in areas such as fleet maintenance, procurement, and operational efficiencies.

Benefits for Acquiring Carrier(s):

- Increased market share in North America.

- Enhanced global connectivity for passengers.

- Access to WestJet's strong domestic network and customer base.

- Potential cost savings through operational synergies.

This strategic WestJet stake sale allows for the creation of robust airline partnerships, fostering collaboration and potentially leading to improved services and expanded flight options for consumers.

Impact on WestJet's Future Operations and Growth

The new ownership structure will likely influence WestJet's future operations and growth trajectory in several ways:

- Strategic Direction: The acquiring carrier(s) may introduce changes to WestJet's strategic direction, potentially focusing on specific route expansions or fleet modernization initiatives.

- Route Expansion: New partnerships could lead to the addition of international routes, connecting WestJet's domestic network to the global networks of the acquiring carriers.

- Fleet Modernization: Investment in new aircraft could enhance fuel efficiency and improve passenger comfort.

- Passenger Experience: The potential integration of loyalty programs and enhanced services could create a more seamless and appealing passenger experience.

Positive Aspects: Access to new resources, expanded market reach, enhanced fleet and operational efficiency.

Negative Aspects: Potential for job displacement (unlikely but a potential concern), integration challenges, and potential changes in company culture.

Regulatory Approvals and Market Reactions

The WestJet stake sale required regulatory approvals from various bodies, including [Mention relevant regulatory bodies]. Market reaction to the news was largely positive, with [Mention specific stock price changes or analyst commentary, if available], reflecting investor confidence in the transaction's strategic merits. This positive market sentiment further supports the successful nature of this WestJet stake sale.

Conclusion

The WestJet stake sale represents a landmark transaction in the Canadian aviation industry. Onex Corporation's successful exit strategy showcases their astute investment and management capabilities. For the acquiring international carrier(s), the acquisition provides a significant entry point into the North American market and the opportunity to create strong airline partnerships. The long-term impact on WestJet's operations and growth remains to be seen but is anticipated to be largely positive. This WestJet stake sale has profound implications for the future of WestJet and its ability to compete on a global scale.

To stay informed about further developments regarding the WestJet stake sale and its impact on the airline industry, follow [Link to relevant news source or company website]. Learn more about successful WestJet stake sale strategies by [Link to further resources].

Featured Posts

-

Top 5 Indy 500 Drivers Facing Elimination In 2025

May 11, 2025

Top 5 Indy 500 Drivers Facing Elimination In 2025

May 11, 2025 -

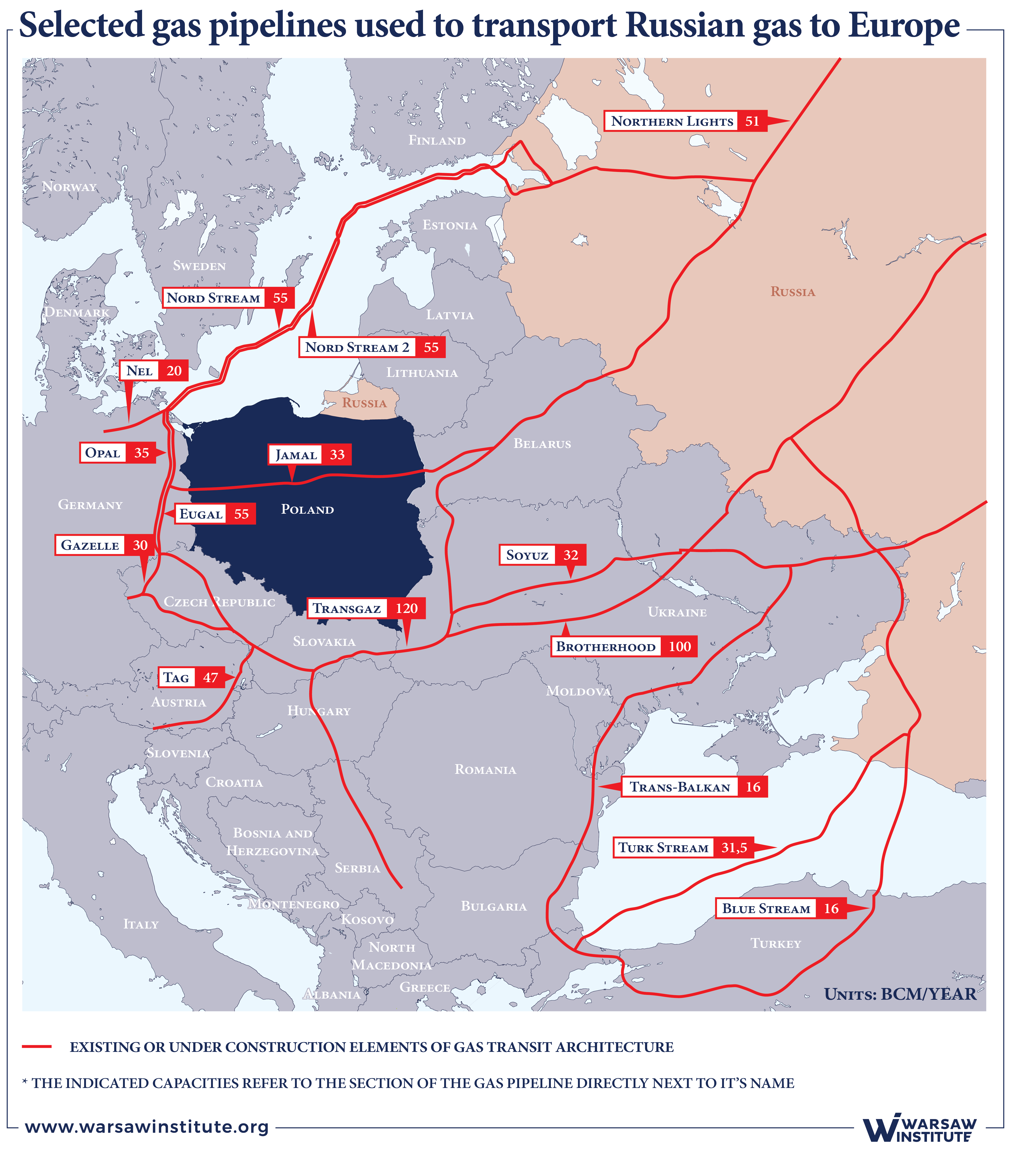

Exclusive Look Elliotts Investment In Russian Gas Pipeline

May 11, 2025

Exclusive Look Elliotts Investment In Russian Gas Pipeline

May 11, 2025 -

Rahals New Scholarship Fund For Aspiring Racers

May 11, 2025

Rahals New Scholarship Fund For Aspiring Racers

May 11, 2025 -

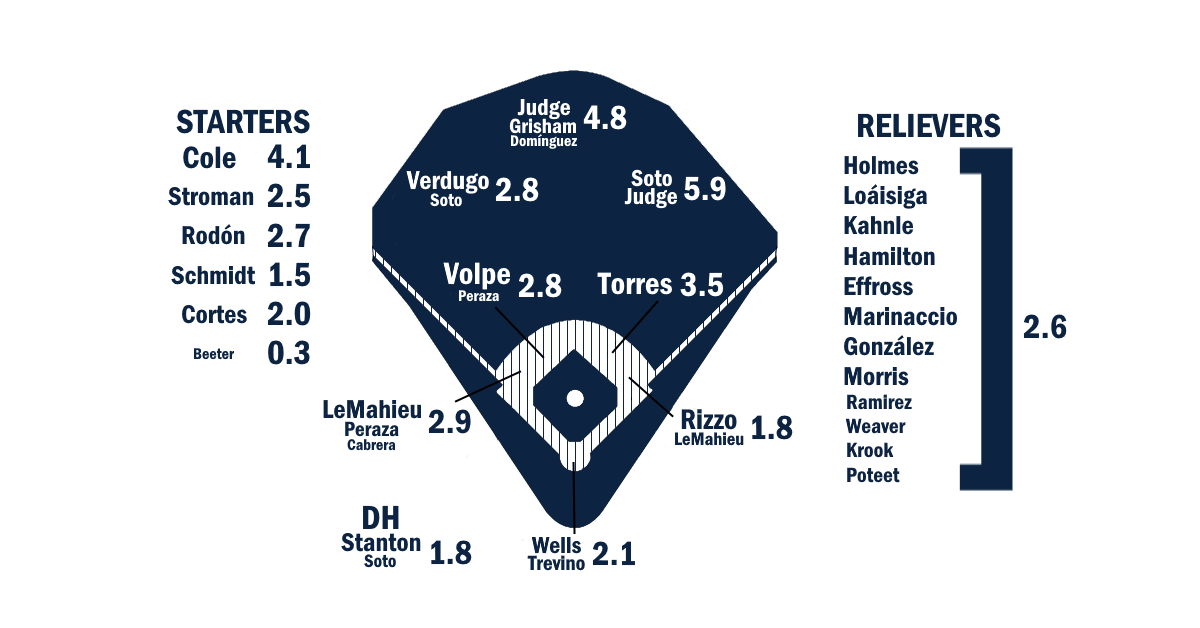

Key Aaron Judge Analytics A 2025 Yankees Preview

May 11, 2025

Key Aaron Judge Analytics A 2025 Yankees Preview

May 11, 2025 -

Can Colton Herta Find The Speed At Barber Paddock Buzz Analysis

May 11, 2025

Can Colton Herta Find The Speed At Barber Paddock Buzz Analysis

May 11, 2025

Latest Posts

-

Grown Ups 2 Review What Worked And What Didnt

May 11, 2025

Grown Ups 2 Review What Worked And What Didnt

May 11, 2025 -

Grown Ups 2 A Hilarious Sequel

May 11, 2025

Grown Ups 2 A Hilarious Sequel

May 11, 2025 -

Relay Presents Tales From The Track Win Tickets

May 11, 2025

Relay Presents Tales From The Track Win Tickets

May 11, 2025 -

Win Tickets For Tales From The Track Presented By Relay

May 11, 2025

Win Tickets For Tales From The Track Presented By Relay

May 11, 2025 -

Tales From The Track Win Tickets To The Sold Out Event

May 11, 2025

Tales From The Track Win Tickets To The Sold Out Event

May 11, 2025