What Warren Buffett's Apple Investment Teaches Us About Long-Term Investing

Table of Contents

Understanding Buffett's Investment Philosophy and its Application to Apple

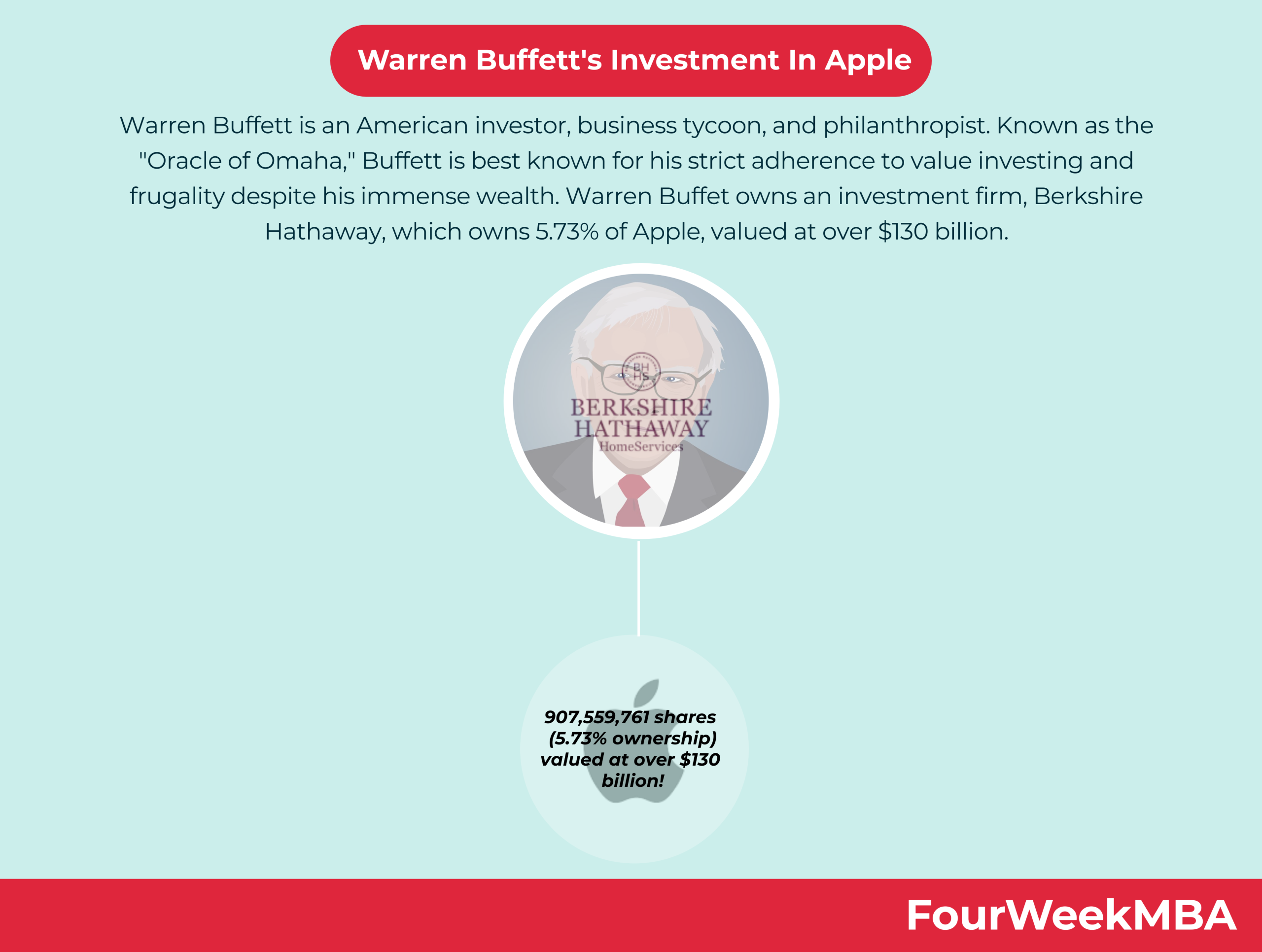

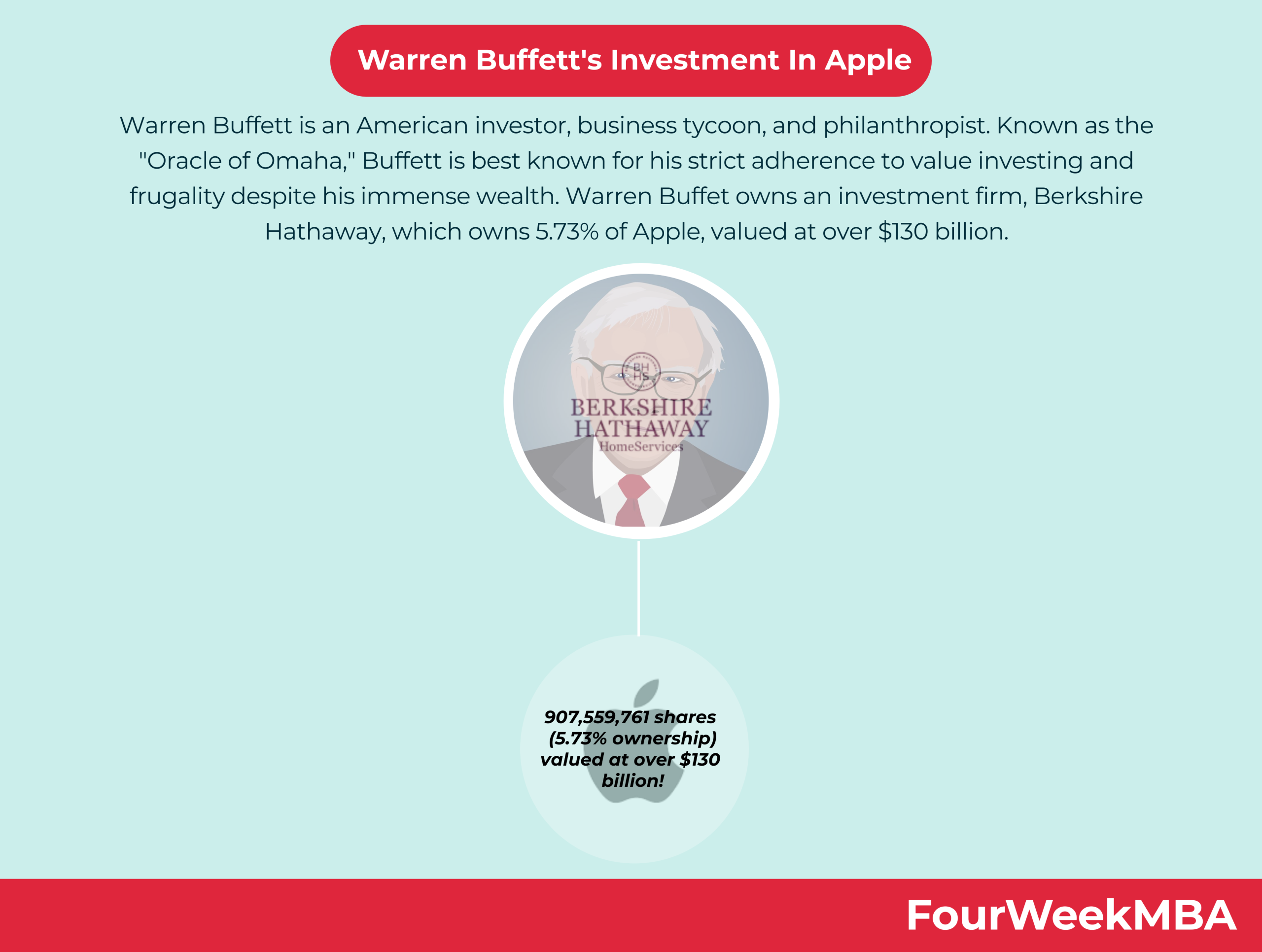

Warren Buffett's investment philosophy centers on value investing, identifying undervalued companies with strong intrinsic value and holding them for the long term. He seeks companies with a durable competitive advantage, often referred to as a "moat," that protects them from competition and ensures sustained profitability and long-term growth.

-

Buffett's Value Investing Principles:

- Focus on intrinsic value, not market price.

- Invest in companies with strong fundamentals and a sustainable competitive advantage.

- Adopt a long-term perspective, resisting short-term market fluctuations.

- Seek management teams with integrity and competence.

-

Apple and the Value Investing Framework: At first glance, Apple might seem at odds with traditional value investing principles. Its high price-to-earnings ratio (P/E) in the past didn't always align with the classic value investor's search for bargains. However, Buffett recognized Apple's extraordinary long-term growth potential.

-

Apple's Competitive Advantages: Apple possesses a powerful "moat" built on several key factors:

- Strong Brand: An unparalleled brand reputation for quality and design.

- Loyal Customer Base: A fiercely loyal customer base that consistently upgrades to new products.

- Recurring Revenue Streams: A robust ecosystem of services (like iCloud and Apple Music) generates consistent recurring revenue.

The contrast between short-term market noise and Apple's long-term value creation is striking. While the stock price fluctuates, Apple's consistent revenue growth and profitability have demonstrated the power of long-term growth and a focus on intrinsic value. Since Berkshire Hathaway began accumulating Apple shares in 2016, the stock price has substantially increased, showcasing the rewards of a patient investment strategy.

The Power of Patience and Long-Term Vision in Investing

A crucial lesson from Buffett's Apple investment is the power of patience and a long-term perspective in investing. Successfully navigating the stock market demands emotional discipline and a willingness to withstand market volatility.

-

Resisting Panic Selling: The stock market experiences periodic downturns. A long-term investor resists the urge to panic sell during these periods, understanding that market corrections are a normal part of the investment cycle.

-

Buffett's Long-Term Hold: Buffett's decision to hold Apple shares for an extended period demonstrates the rewards of patience. This showcases the buy-and-hold strategy, a cornerstone of long-term investing.

-

Time in the Market vs. Timing the Market: Trying to "time the market" – buying low and selling high – is notoriously difficult. A better approach is to focus on "time in the market," remaining invested over the long term to benefit from compounding returns.

-

Emotional Discipline: Long-term investing requires emotional discipline. It's crucial to avoid impulsive decisions driven by fear or greed. Sticking to a well-defined investment plan, even during market turbulence, is vital.

Charts illustrating Apple's stock price growth over the past decade clearly demonstrate the benefits of a long-term approach. Ignoring short-term fluctuations and focusing on the long-term picture is essential to successful long-term investing.

Identifying Quality Companies for Long-Term Growth

Buffett's success stems from his ability to identify high-quality companies poised for long-term growth. This requires meticulous fundamental analysis.

-

Fundamental Analysis: Before investing, thoroughly analyze a company's financial statements, including:

- Revenue Growth: Consistent revenue growth signifies a healthy and expanding business.

- Profit Margins: High and stable profit margins indicate efficient operations and strong pricing power.

- Debt Levels: Low debt levels reduce financial risk.

-

Competitive Landscape: Assess the competitive landscape. A company's ability to maintain a sustainable competitive advantage is crucial.

-

Durable Business Model: Identify companies with durable business models capable of adapting to changing market conditions. A strong business model provides a foundation for future growth.

Analyzing Apple's financial statements reveals key indicators of its long-term growth potential: consistent revenue growth, strong profit margins, and a healthy balance sheet. These are the hallmarks of a quality company suitable for a long-term investment strategy.

Diversification and Risk Management in a Long-Term Portfolio

While Apple has been a remarkably successful investment for Berkshire Hathaway, concentrating a significant portion of your portfolio in a single stock, even a seemingly stable one, carries risk. Therefore, diversification is crucial.

-

Portfolio Diversification: Diversification involves spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

-

Apple within a Diversified Portfolio: Apple can be a valuable component of a diversified portfolio, but it shouldn't be the sole focus.

-

Balancing Risk and Reward: Investors must balance risk and reward. A diversified portfolio can help reduce overall portfolio volatility while still achieving long-term growth.

-

Asset Allocation Strategies: Different asset allocation strategies cater to varying risk tolerances and investment goals. Understanding your risk tolerance is crucial when creating a balanced investment portfolio.

Examples of how to diversify a portfolio include investing in various sectors like technology, healthcare, and consumer goods. This approach helps reduce the impact of any single investment underperforming.

Conclusion

Warren Buffett's Apple investment serves as a powerful case study illustrating the principles of successful long-term investing. Patience, a focus on quality companies like Apple, diligent research using fundamental analysis, and a well-diversified portfolio are crucial elements. The key takeaway is that long-term investing, while requiring patience, can lead to significant financial success.

Call to Action: Ready to learn more about applying Warren Buffett's investment philosophy to build your own successful long-term investment strategy? Start researching quality companies, analyze their fundamentals, and develop a long-term plan to achieve your financial goals. Embrace the power of long-term investing today!

Featured Posts

-

Le Depart De Popovich Les Mots Touchants De Victor Wembanyama

May 06, 2025

Le Depart De Popovich Les Mots Touchants De Victor Wembanyama

May 06, 2025 -

New Music Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestra Release I Dont Know Why I Just Do

May 06, 2025

New Music Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestra Release I Dont Know Why I Just Do

May 06, 2025 -

Sabrina Carpenter Fortnite Guide Complete Character Overview And Tips

May 06, 2025

Sabrina Carpenter Fortnite Guide Complete Character Overview And Tips

May 06, 2025 -

The Lesson In Buffetts Winning Apple Bet

May 06, 2025

The Lesson In Buffetts Winning Apple Bet

May 06, 2025 -

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

May 06, 2025

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

May 06, 2025