Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Bullish Outlook Despite High Valuations

Despite elevated valuations, BofA maintains a generally positive outlook on the stock market. This bullish stance isn't blind optimism; it's supported by a careful analysis of macroeconomic indicators and specific sector performance. BofA analysts point to several key factors underpinning their confidence.

-

Specific Sectors: BofA is particularly bullish on sectors poised for continued growth, such as technology, healthcare, and select areas within the consumer discretionary sector. These sectors are seen as benefiting from ongoing technological innovation and a resilient consumer base.

-

Key Economic Indicators: BofA's positive outlook is further bolstered by favorable economic indicators, including steady job growth, controlled inflation (in certain periods), and continued consumer spending. These factors suggest a robust economic foundation capable of supporting higher stock valuations.

-

BofA Reports and Publications: Numerous BofA research reports and publications substantiate their positive outlook. These in-depth analyses provide granular data and projections to support their conclusions. (Note: Links to specific BofA reports would be included here in a published article).

Understanding the Factors Driving High Valuations

The high valuations we see aren't simply a result of irrational exuberance. Several fundamental factors contribute to this phenomenon:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies, fueling investment and growth. This also makes stocks relatively more attractive than bonds, driving up demand and valuations.

-

Strong Corporate Earnings: Many companies have reported strong earnings, justifying higher price-to-earnings (P/E) ratios. This robust corporate performance supports the belief that current valuations are at least partially sustainable.

-

Technological Innovation: Breakthroughs in technology continue to drive market growth and create new opportunities for investment. The rapid pace of technological advancement is a major factor contributing to high valuations in technology-related sectors and beyond.

The Importance of Long-Term Investing in a High-Valuation Market

Even with high valuations, a long-term investment strategy remains paramount. Short-term market fluctuations, while potentially unsettling, shouldn't deter investors with a long-term horizon.

-

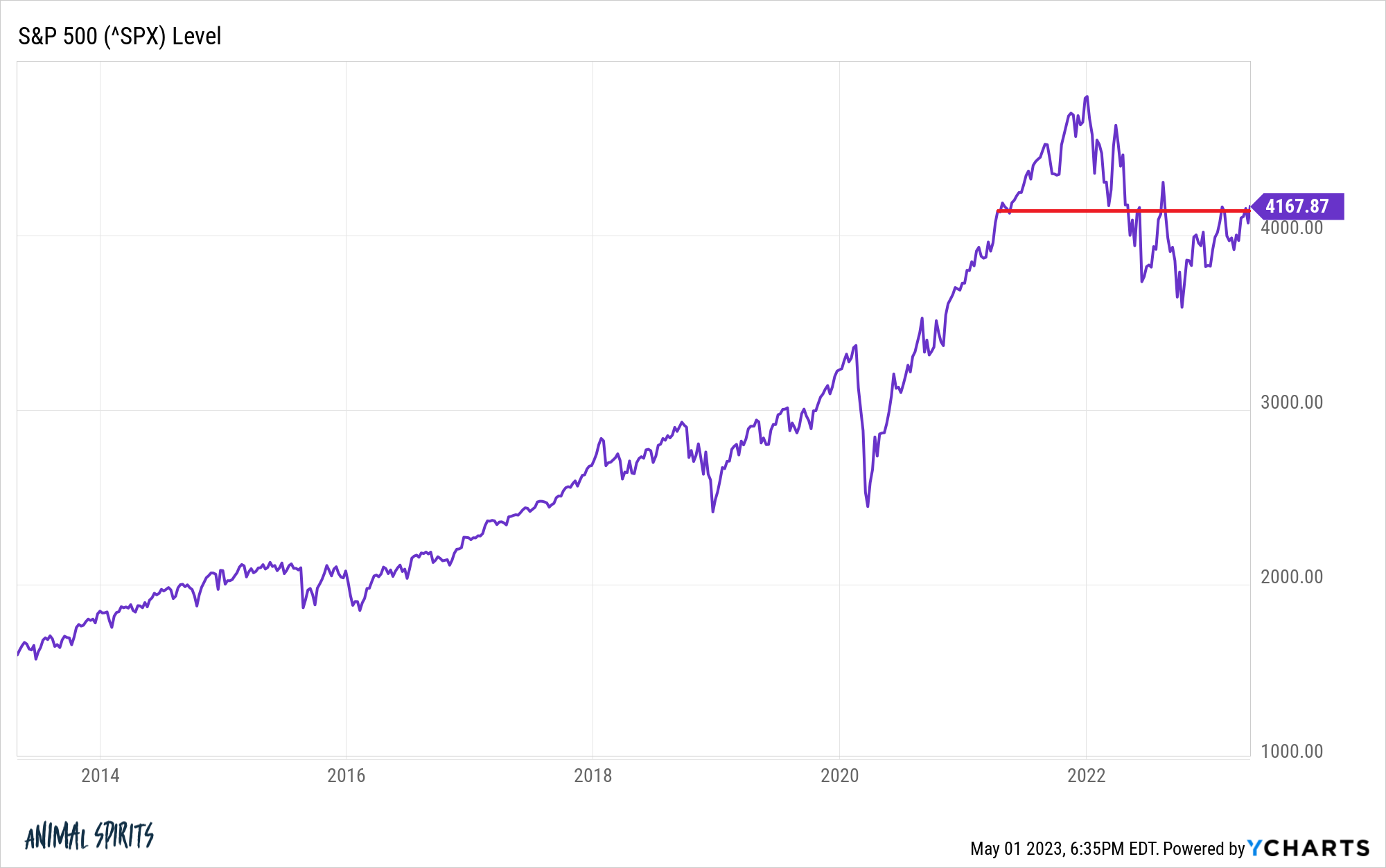

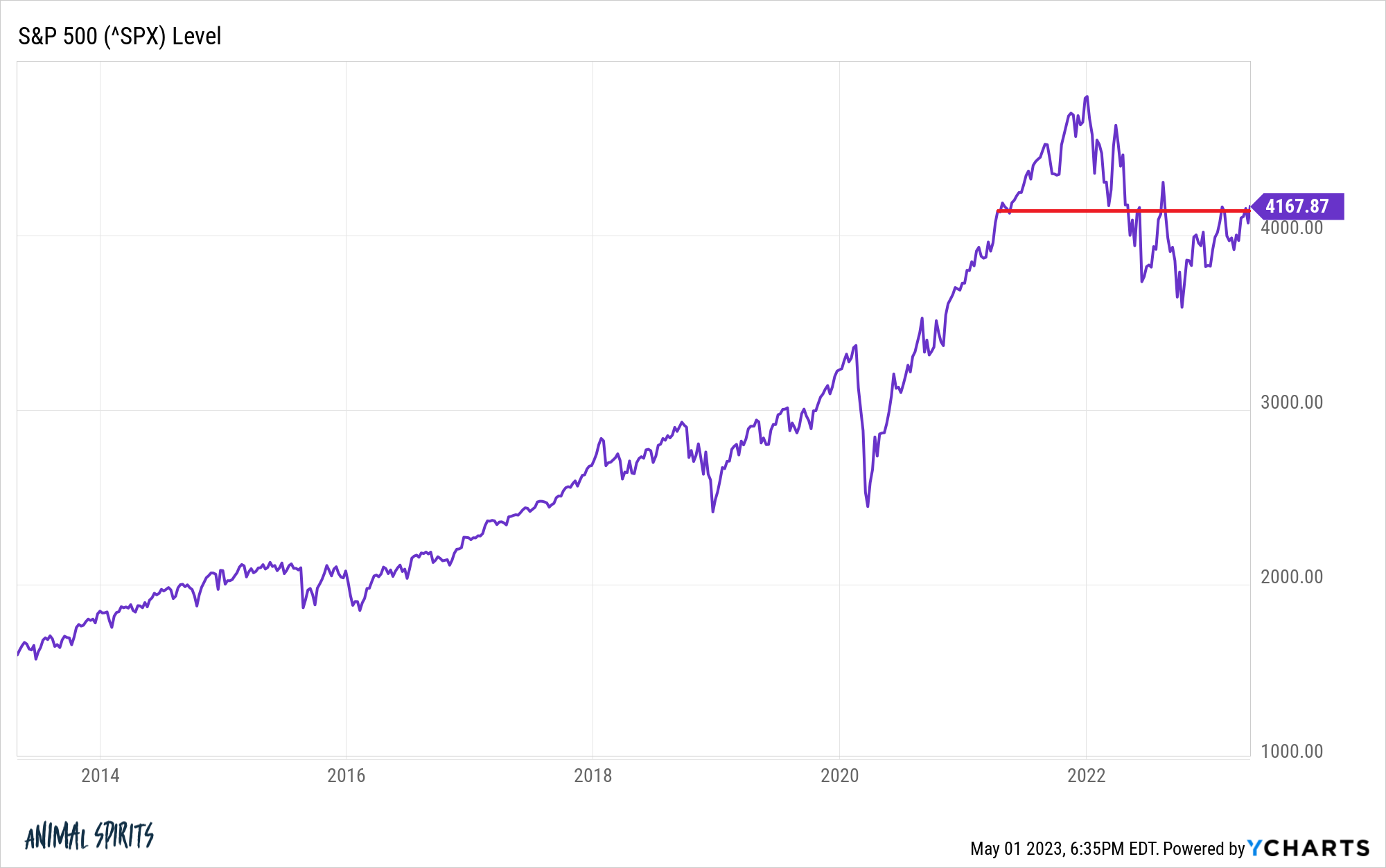

Historical Performance: Historically, the stock market has consistently delivered positive returns over the long term, despite experiencing periodic corrections and bear markets. Long-term investors have often profited from these dips.

-

Dollar-Cost Averaging: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can help mitigate the risk associated with market volatility. This reduces the impact of buying high and selling low.

-

Diversification: A diversified portfolio, spread across different asset classes and sectors, is crucial for reducing risk and maximizing long-term returns. This strategy helps to cushion the blow from any single sector or market downturn.

Addressing Investor Concerns About a Potential Market Correction

It's natural for investors to worry about a potential market correction. BofA acknowledges this concern but doesn't view a correction as necessarily catastrophic.

-

BofA's Risk Analysis: BofA's analysis considers potential risks, including inflation, geopolitical instability, and interest rate hikes. However, their analysis also points to mitigating factors that could limit the severity of any correction.

-

Counterarguments to Market Bubble Concerns: BofA offers counterarguments to claims that the current market represents a speculative bubble. Their analysis suggests that the underlying fundamentals, such as corporate earnings and economic growth, provide a degree of support for current valuations.

-

Preparing for Volatility: Investors can prepare for market volatility by maintaining a diversified portfolio, sticking to a disciplined investment plan, and avoiding emotional decision-making. Having a long-term perspective is key to weathering market storms.

Why Investors Shouldn't Fear High Stock Market Valuations: A Summary and Call to Action

BofA's analysis suggests that high stock market valuations, while noticeable, don't automatically signal an impending crash. The firm's positive outlook is rooted in strong corporate earnings, favorable economic indicators, and ongoing technological innovation. While acknowledging the potential for market corrections, BofA emphasizes the importance of a long-term investment strategy incorporating diversification and dollar-cost averaging.

To navigate the complexities of a market with high stock valuations, consult with a financial advisor. Develop a sound investment strategy aligned with your risk tolerance and long-term financial goals. Remember, even in a market with high valuations, prudent planning and a long-term focus can lead to success. Don't let fear of high stock market valuations dictate your investment decisions. Instead, work with a professional to chart a course toward your financial future. (Note: A link to relevant BofA resources would be included here). High stock market valuations don't necessarily equate to imminent market crash, according to BofA's perspective.

Featured Posts

-

El Hijo De Floridalma Roque Denuncia Injusticia Q6 Millones En Juego

Apr 25, 2025

El Hijo De Floridalma Roque Denuncia Injusticia Q6 Millones En Juego

Apr 25, 2025 -

Why Is The Canadian Dollar Falling Against Some Currencies An Economic Perspective

Apr 25, 2025

Why Is The Canadian Dollar Falling Against Some Currencies An Economic Perspective

Apr 25, 2025 -

Bayern Munich Vs Vf L Bochum Preview Team News And Predicted Lineup

Apr 25, 2025

Bayern Munich Vs Vf L Bochum Preview Team News And Predicted Lineup

Apr 25, 2025 -

Man Transforms After 30 Stone Weight Loss A Pals Harsh Words Sparked Change

Apr 25, 2025

Man Transforms After 30 Stone Weight Loss A Pals Harsh Words Sparked Change

Apr 25, 2025 -

Is Trump The Elephant In The Room Of Canadas Election

Apr 25, 2025

Is Trump The Elephant In The Room Of Canadas Election

Apr 25, 2025

Latest Posts

-

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025 -

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025 -

Russia Closes 62 Miles Of Black Sea Beaches Following Oil Spill

Apr 30, 2025

Russia Closes 62 Miles Of Black Sea Beaches Following Oil Spill

Apr 30, 2025 -

Trumps Presidency A 39 Approval Rating At The 100 Day Mark

Apr 30, 2025

Trumps Presidency A 39 Approval Rating At The 100 Day Mark

Apr 30, 2025 -

Low Approval For Trump 39 And The Challenges Of The First 100 Days

Apr 30, 2025

Low Approval For Trump 39 And The Challenges Of The First 100 Days

Apr 30, 2025