XRP Future Price: Analyzing The Post-SEC Lawsuit Market

Table of Contents

Ripple's Legal Victory and its Impact on XRP Price

The SEC Lawsuit and its Resolution:

The SEC lawsuit against Ripple Labs, filed in December 2020, alleged that Ripple’s sale of XRP constituted an unregistered securities offering. The case centered on whether XRP should be classified as a security or a currency. The ruling, delivered in July 2023, partially favored Ripple, declaring that programmatic sales of XRP did not constitute securities offerings. However, the court ruled that sales of XRP to institutional investors did constitute securities offerings.

- Key aspects of the ruling: Partial victory for Ripple, clarifying that not all XRP sales are securities. This creates a complex regulatory landscape for XRP.

- Impact on investor sentiment: The ruling initially caused a surge in XRP price, reflecting positive investor sentiment. However, ongoing legal uncertainty continues to influence market behavior.

- Impact on trading volume: Trading volume experienced significant fluctuations following the ruling, indicating increased market activity and interest in XRP's future.

- [Link to official court documents]

- [Link to relevant news articles]

Short-Term Price Volatility and Market Reactions:

Following the partial victory, XRP's price experienced considerable short-term volatility. Initial gains were followed by periods of consolidation and further price movements.

- Factors driving short-term movements: News cycles surrounding the Ripple case, overall cryptocurrency market trends, and trading algorithm reactions all play a part.

- Chart patterns and technical analysis: Technical indicators like RSI and MACD can provide insights into short-term price trends, although these should be interpreted cautiously.

- XRP price prediction (short-term): Short-term predictions remain highly speculative due to the ongoing legal and market uncertainties. Analyzing trading volume and market sentiment provides some insight, but it is crucial to remember these are short-lived signals.

- XRP trading volume: Increased trading volume often accompanies periods of high volatility, reflecting heightened investor interest and activity.

- XRP market cap: The market capitalization of XRP has shown considerable fluctuation alongside price movements, indicating changes in overall market valuation.

Long-Term Price Projections for XRP

Fundamental Analysis of XRP:

XRP's fundamental value proposition rests on its utility within the RippleNet payment system. Designed for fast, low-cost cross-border transactions, XRP offers a potential alternative to traditional banking systems.

- Cross-border payments: XRP's speed and efficiency in facilitating international transactions are key strengths.

- Widespread adoption: The extent of RippleNet's future adoption will significantly influence XRP's long-term price. Growing partnerships and integration with financial institutions are crucial factors.

- Technological advancements: Continuous development and upgrades to the XRP Ledger technology will further enhance its capabilities and attractiveness.

- Key partnerships: Collaborations with banks and financial institutions worldwide will contribute to XRP's utility and adoption.

Factors Influencing Long-Term Price:

Several factors beyond Ripple's legal battles will influence XRP's long-term price.

- Regulatory developments: Clear regulatory frameworks in major jurisdictions are crucial for broader adoption. Uncertainty about XRP’s regulatory status in different countries remains a risk.

- Competition: XRP faces competition from other cryptocurrencies and payment solutions. Its ability to differentiate itself and establish a dominant market position will affect its long-term prospects.

- Macroeconomic factors: Global economic conditions, interest rates, and inflation can impact investor sentiment towards all cryptocurrencies, including XRP.

- XRP future price prediction (long-term): Long-term price projections are inherently uncertain. However, analysts consider factors like widespread adoption, regulatory clarity, and technological advancements to gauge potential price appreciation.

Predictive Modeling and Price Scenarios:

Predicting XRP’s future price requires considering various scenarios. This is highly speculative, and no prediction is guaranteed.

- Bullish scenario: Widespread adoption, positive regulatory developments, and technological advancements could lead to significant price appreciation.

- Bearish scenario: Negative regulatory actions, increased competition, or a general downturn in the cryptocurrency market could depress XRP's price.

- Neutral scenario: Stable growth in line with overall cryptocurrency market performance.

- XRP price forecast: Different models and assumptions lead to varied forecasts. It's critical to consider multiple scenarios and their underlying assumptions.

- XRP long-term outlook: The long-term outlook for XRP depends on several interacting factors. A cautious, diversified approach is advisable for investors.

Risk Assessment and Investment Strategies for XRP

Understanding the Risks Involved:

Investing in cryptocurrencies, including XRP, involves significant risks.

- Volatility: XRP's price is highly volatile and susceptible to sudden and dramatic changes.

- Regulatory uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain, posing risks to XRP's future.

- Technological risks: Technological vulnerabilities or failures within the XRP Ledger could negatively impact the value of XRP.

- XRP investment risks: Investors should fully understand and accept the inherent risks before investing in XRP.

- XRP volatility: The high volatility of XRP necessitates a cautious investment strategy.

- Cryptocurrency investment advice: Always conduct thorough research and seek professional advice before making investment decisions.

Strategies for Managing Risk:

Mitigate risks through informed decision-making and a strategic approach.

- Diversification: Spread investments across different asset classes to reduce the impact of any single asset's performance.

- Dollar-cost averaging: Invest a fixed amount regularly, regardless of price fluctuations, to reduce risk.

- Stop-loss orders: Set stop-loss orders to limit potential losses.

- Risk tolerance: Only invest amounts you can afford to lose.

- Realistic investment goals: Set realistic goals and avoid chasing unrealistic returns.

Conclusion:

The XRP future price remains uncertain, influenced by the interplay of legal developments, technological advancements, and market forces. While the partial victory in the SEC lawsuit provides some clarity, ongoing regulatory uncertainty and competition remain significant risks. Short-term price volatility is likely to continue, while long-term price projections depend heavily on the degree of adoption, regulatory clarity, and further technological improvements. This analysis highlights the potential for both significant growth and substantial loss.

Call to Action: Before investing in XRP, stay informed on the latest XRP news and analyze the XRP market thoroughly. Consider the potential risks and rewards of XRP before making any investment decisions. The future price of XRP remains dependent on numerous complex factors, making thorough due diligence essential. Remember, only invest what you can afford to lose.

Featured Posts

-

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Numbers

May 02, 2025

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Numbers

May 02, 2025 -

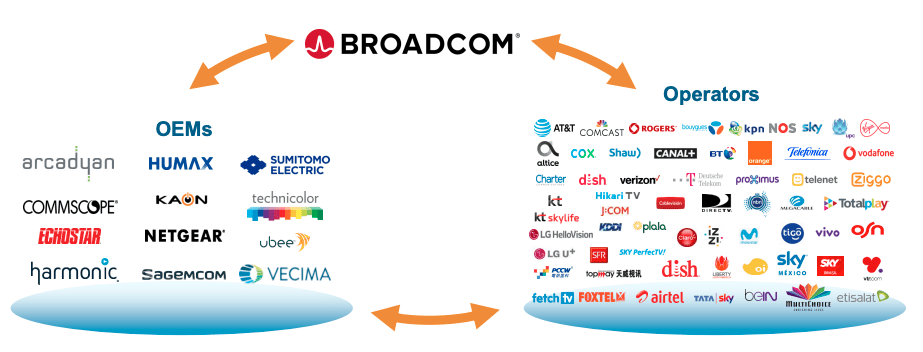

Broadcoms V Mware Acquisition At And T Exposes A Staggering 1 050 Price Hike

May 02, 2025

Broadcoms V Mware Acquisition At And T Exposes A Staggering 1 050 Price Hike

May 02, 2025 -

Fortnite Issues Refunds A Sign Of Cosmetic Policy Shifts

May 02, 2025

Fortnite Issues Refunds A Sign Of Cosmetic Policy Shifts

May 02, 2025 -

Aventure A Velo 8000 Km Pour Trois Jeunes Du Bocage Ornais

May 02, 2025

Aventure A Velo 8000 Km Pour Trois Jeunes Du Bocage Ornais

May 02, 2025 -

Minnesota Special Election Key Takeaways From Ap Decision Notes

May 02, 2025

Minnesota Special Election Key Takeaways From Ap Decision Notes

May 02, 2025

Latest Posts

-

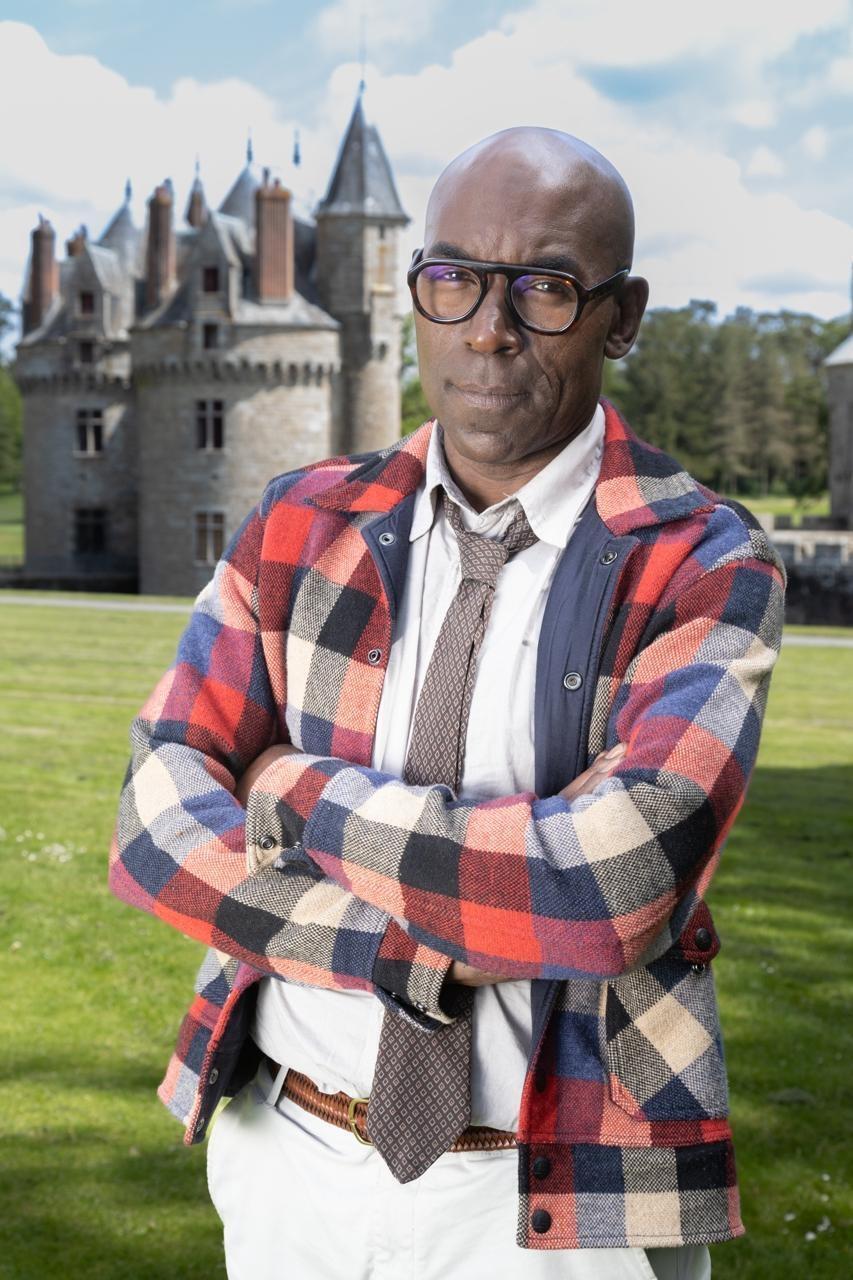

Lucien Jean Baptiste Dans Joseph Sur Tf 1 Une Serie Policiere A La Hauteur

May 03, 2025

Lucien Jean Baptiste Dans Joseph Sur Tf 1 Une Serie Policiere A La Hauteur

May 03, 2025 -

Joseph La Nouvelle Serie Policiere De Tf 1 Vaut Elle Le Detour

May 03, 2025

Joseph La Nouvelle Serie Policiere De Tf 1 Vaut Elle Le Detour

May 03, 2025 -

Mauritius And Donor Country Notes On Grant Assistance Exchanged

May 03, 2025

Mauritius And Donor Country Notes On Grant Assistance Exchanged

May 03, 2025 -

Mauritius Receives Grant Assistance Signing Ceremony Details

May 03, 2025

Mauritius Receives Grant Assistance Signing Ceremony Details

May 03, 2025 -

Joseph Sur Tf 1 Avis Complet Sur La Nouvelle Serie Policiere

May 03, 2025

Joseph Sur Tf 1 Avis Complet Sur La Nouvelle Serie Policiere

May 03, 2025