XRP Legal Battle: Understanding The SEC's Commodity Debate

Table of Contents

The SEC's Case Against Ripple and XRP

The SEC's core argument centers on the assertion that XRP is an unregistered security, violating federal securities laws. The SEC defines a security using the Howey Test, a framework that determines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC alleges that Ripple's sale of XRP constitutes an unregistered securities offering, misleading investors about the nature of the asset and its regulatory status.

Key allegations by the SEC include:

- Unregistered securities offering: The SEC claims Ripple conducted an unregistered public offering of XRP, bypassing crucial regulatory processes designed to protect investors.

- Violation of federal securities laws: The SEC argues that Ripple violated various provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

- Misleading investors: The SEC alleges that Ripple misled investors about XRP's functionality and its regulatory compliance.

The SEC's case heavily relies on the application of the Howey Test, arguing that XRP investors reasonably expected profits based on Ripple's efforts in developing and promoting the cryptocurrency. [Link to relevant SEC filing 1] [Link to relevant SEC filing 2]

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's claims, arguing that XRP is a decentralized digital asset functioning as a currency or a utility token, not a security. They emphasize XRP's distinct characteristics, differentiating it from traditional securities.

Ripple's key defenses include:

- Emphasis on XRP's decentralized nature: Ripple highlights that XRP operates on a decentralized, public blockchain, distinct from assets controlled by a central entity.

- Highlighting XRP's use in payments and transactions: Ripple underscores XRP's utility in facilitating cross-border payments and transactions, emphasizing its practical functionality.

- Arguments against the Howey Test's applicability: Ripple argues that the Howey Test does not apply to XRP due to its decentralized nature and lack of reliance on Ripple's efforts for profit generation. The distinction between programmatic sales and direct sales to institutional investors is central to their argument.

Ripple’s legal team has presented extensive evidence to support their claims. [Link to Ripple's legal filings] [Link to Ripple's official statements]

The Significance of the "Commodity" Debate

The classification of XRP—as a security, a commodity, or a utility token—has profound implications for investors and the broader cryptocurrency market. If deemed a security, XRP's trading could be severely restricted, impacting its price and accessibility. This ruling could also set a significant legal precedent, affecting the regulatory landscape for other cryptocurrencies.

Potential consequences include:

- Impact on XRP trading and price: A security classification could lead to delisting from major exchanges and limit trading opportunities.

- Regulatory implications for other cryptocurrencies: The outcome could influence how other cryptocurrencies are regulated, creating uncertainty and potentially chilling innovation.

- Legal precedent for future cryptocurrency regulation: The court's decision will shape future regulatory efforts and legal interpretations of digital assets.

Furthermore, the case's outcome has significant implications for the development of decentralized finance (DeFi) and the global regulatory landscape surrounding crypto assets. Clarity on XRP’s classification is crucial for promoting investor confidence and fostering responsible innovation within the industry.

Potential Outcomes and Future Implications

The XRP legal battle could result in several outcomes. The court might side with the SEC, classifying XRP as a security, or rule in favor of Ripple, deeming it a non-security. A settlement is also possible. Regardless of the outcome, the decision will set a crucial precedent for future cryptocurrency regulation, potentially impacting how other digital assets are classified and regulated globally. The court's interpretation of the Howey Test and its applicability to decentralized cryptocurrencies will be closely scrutinized by regulators worldwide. This could lead to significant regulatory changes, both in the US and internationally, impacting the cryptocurrency market's future trajectory.

Conclusion: Understanding the XRP Legal Battle and its Implications

The XRP legal battle highlights the complexities surrounding the classification of cryptocurrencies and the need for clear regulatory frameworks. Both the SEC and Ripple present compelling arguments, with the court's decision having far-reaching consequences for the cryptocurrency industry. Understanding the SEC's arguments regarding XRP's commodity status is crucial for navigating the evolving regulatory landscape. The outcome of this case will significantly impact not only XRP but also the future of cryptocurrency regulation globally. To stay updated on the ongoing XRP legal battle and its implications, subscribe to our newsletter [Link to Newsletter Signup] or follow us on social media [Link to Social Media]. Stay informed and understand the ever-changing world of crypto regulations.

Featured Posts

-

Inter Beat Barcelona In A Champions League Classic To Reach The Final

May 08, 2025

Inter Beat Barcelona In A Champions League Classic To Reach The Final

May 08, 2025 -

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025 -

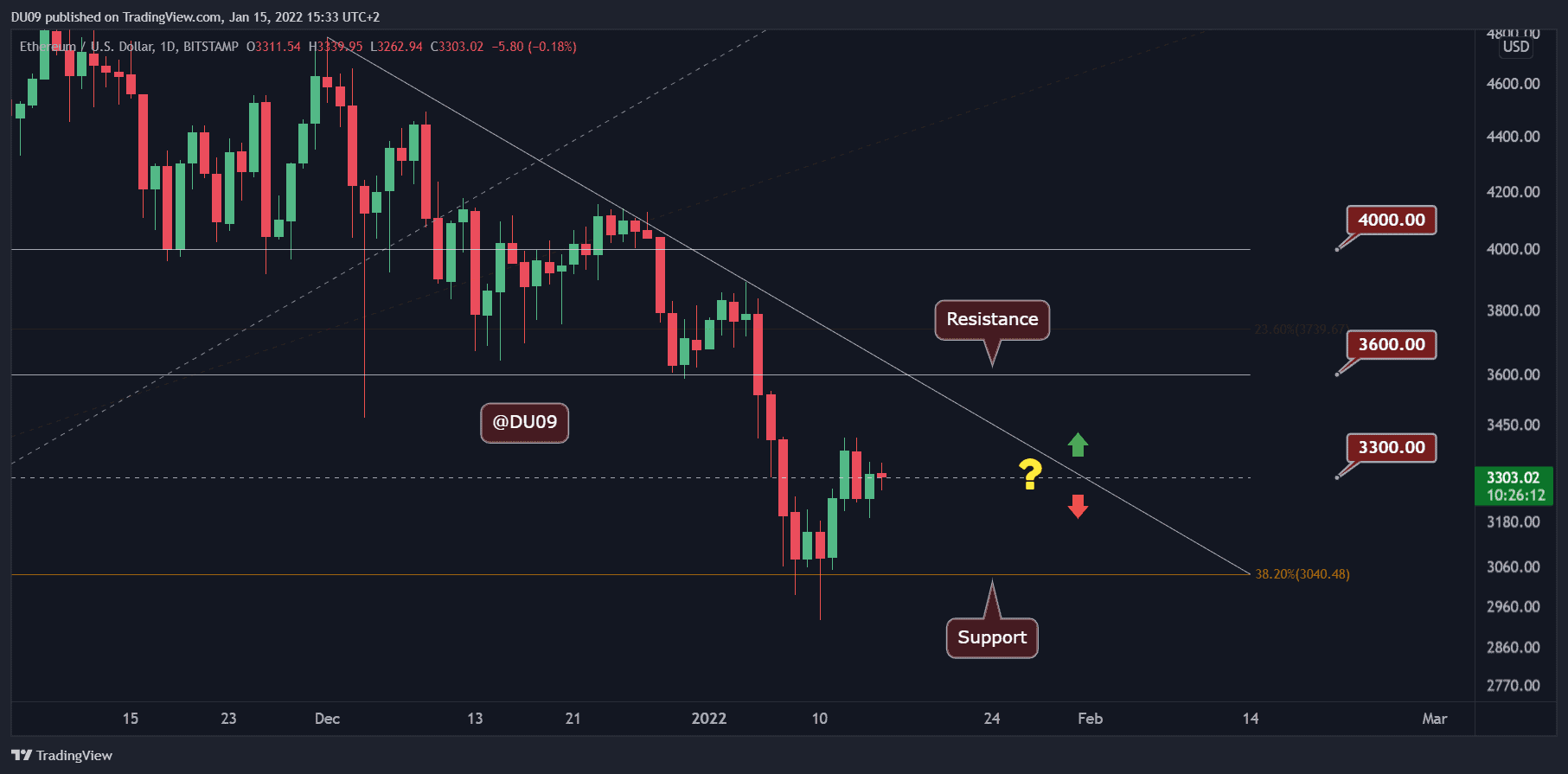

Is Ethereum Ready For A Price Breakout Bullish Signals And Market Analysis

May 08, 2025

Is Ethereum Ready For A Price Breakout Bullish Signals And Market Analysis

May 08, 2025 -

Trump On Cusma Good Deal For All But Termination Remains Possible

May 08, 2025

Trump On Cusma Good Deal For All But Termination Remains Possible

May 08, 2025 -

Elevated Gaming Ps 5 Pros Best Exclusive Titles

May 08, 2025

Elevated Gaming Ps 5 Pros Best Exclusive Titles

May 08, 2025

Latest Posts

-

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf

May 08, 2025

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf

May 08, 2025 -

Krachy Pwlys Ky Karkrdgy Pr Swalat Awdhw Ka Aetraf

May 08, 2025

Krachy Pwlys Ky Karkrdgy Pr Swalat Awdhw Ka Aetraf

May 08, 2025 -

Armghan Kys Krachy Pwlys Chyf Ne Naahly Tslym Ky

May 08, 2025

Armghan Kys Krachy Pwlys Chyf Ne Naahly Tslym Ky

May 08, 2025 -

Jawyd Ealm Awdhw Ka Armghan Kys Pr Bra Byan Pwlys Ky Nakamy Ka Aetraf

May 08, 2025

Jawyd Ealm Awdhw Ka Armghan Kys Pr Bra Byan Pwlys Ky Nakamy Ka Aetraf

May 08, 2025 -

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025