XRP Market Moves: Whale's 20 Million Token Purchase Analyzed

Table of Contents

The cryptocurrency world recently witnessed a significant event: a whale—a large-scale investor—purchased a staggering 20 million XRP tokens. This massive transaction sent ripples through the market, highlighting the crucial role of whale activity in influencing XRP market moves. This article delves into the impact of this substantial purchase, analyzing its potential motivations and implications for both short-term and long-term XRP price fluctuations. Understanding whale activity is paramount for anyone invested in or considering investing in XRP, and this analysis aims to provide valuable insight for navigating this dynamic market.

2. Main Points:

H2: Understanding the Significance of Whale Activity in the XRP Market

In the cryptocurrency realm, a "whale" refers to an entity holding a substantial amount of a particular cryptocurrency, often enough to significantly influence its price. These massive holdings give whales the power to trigger considerable market shifts. Large XRP transactions executed by whales can dramatically impact price volatility. Their actions, whether buying or selling, often create significant short-term price swings that can affect smaller investors.

- Whales can manipulate short-term price movements: A large, sudden buy order can artificially inflate the price, while a large sell-off can rapidly depress it. This is often short-lived, however, and the underlying value of the asset usually reasserts itself.

- Large purchases can signal confidence in the asset: A whale's significant investment can be interpreted as a positive signal, potentially attracting other investors and driving up demand. This is especially true if the purchase aligns with positive news or developments.

- Sudden sell-offs can create significant downward pressure: Conversely, a whale unloading a large portion of their XRP holdings can trigger a sell-off, causing a sharp decrease in price as other investors react to the perceived negative signal. This creates a ripple effect, impacting the overall market sentiment.

H2: Analyzing the 20 Million XRP Purchase: Potential Motivations

The 20 million XRP purchase raises several questions regarding the whale's motivations. Several potential scenarios exist:

-

Accumulation for long-term holding: The whale might be accumulating XRP for long-term investment, believing in the long-term prospects of Ripple and its technology. This strategy focuses on accumulating tokens at a favorable price, anticipating future price appreciation.

-

Strategic investment based on upcoming news or developments: The purchase could be a strategic move based on anticipated positive news, such as developments in the ongoing Ripple legal battle or the adoption of XRP by new financial institutions. A positive legal outcome or increased adoption would likely significantly impact XRP's price.

-

Market manipulation (although this is highly speculative and should be presented cautiously): While less likely, the possibility of market manipulation cannot be entirely ruled out. This would involve artificially inflating the price to sell at a higher point, but it carries significant legal risks.

-

Examine the timing of the purchase and any related news: A careful analysis of the purchase date and any accompanying news or announcements can offer clues about the whale's motivations.

-

Analyze the whale's past trading history (if publicly available): Understanding the whale's previous trading patterns can provide insights into their investment strategy and risk tolerance. This information is often difficult to obtain, however.

-

Discuss the potential impact on XRP's price and trading volume: The 20 million XRP purchase almost certainly had a notable impact on both price and trading volume, although the extent of the effect is difficult to determine with certainty without additional data.

H2: The Ripple Effect: Short-Term and Long-Term Implications on XRP Price

The immediate price reaction to the 20 million XRP purchase likely involved a short-term price surge, driven by increased demand. However, the sustainability of this price increase depends on several factors.

- Examine price charts before, during, and after the purchase: Analyzing price charts using technical analysis tools can help determine the short-term and long-term effects of this transaction on XRP's price.

- Consider the broader market context (overall crypto market sentiment): The overall sentiment in the broader cryptocurrency market can also significantly influence XRP's price, regardless of whale activity. A positive market trend will generally amplify the effect of whale purchases, while a negative trend will likely dampen the effect.

- Discuss the potential for sustained price increases or corrections: While the initial price jump might be short-lived, sustained price increases are possible if the purchase is viewed as a positive sign by other investors, leading to increased buying pressure. Conversely, corrections are also possible, especially if the broader market trend turns negative.

H2: Further Research and Considerations: Monitoring XRP Market Trends

For a deeper understanding of XRP market moves, continuous monitoring and research are crucial.

- Follow reputable crypto news outlets and analysts: Staying informed about XRP news, regulatory updates, and market analyses from reliable sources is essential for making informed decisions.

- Use price tracking tools and charting software: Utilizing tools that provide real-time price data and charting capabilities allows for effective tracking of XRP price movements and identification of potential trends.

- Engage with the XRP community and forums (cautiously): Community forums can provide insights, but it's crucial to approach information with critical thinking, as opinions can be subjective and potentially biased.

3. Conclusion: Navigating the XRP Market After the Whale's Purchase

The 20 million XRP purchase by a whale underscores the significant impact of large-scale investors on XRP market moves. Analyzing such events requires considering various factors, including the whale's potential motivations, short-term and long-term market implications, and the broader crypto market context. Informed decision-making is key for anyone involved in the XRP market. To navigate the complexities of XRP market moves effectively, continue monitoring future whale activity and its potential effects. Further reading on XRP analysis and investment strategies is strongly recommended to bolster your understanding and enhance your investment decisions.

Featured Posts

-

Sufian Applauds Gcci President For Successful Expo 2025 Organization

May 08, 2025

Sufian Applauds Gcci President For Successful Expo 2025 Organization

May 08, 2025 -

Three Minutes Of Brilliance Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025

Three Minutes Of Brilliance Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025 -

Is Artetas Arsenal Job At Risk Collymore Weighs In

May 08, 2025

Is Artetas Arsenal Job At Risk Collymore Weighs In

May 08, 2025 -

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025 -

Easing Trade Tensions Upcoming Meeting Between U S And Chinese Officials

May 08, 2025

Easing Trade Tensions Upcoming Meeting Between U S And Chinese Officials

May 08, 2025

Latest Posts

-

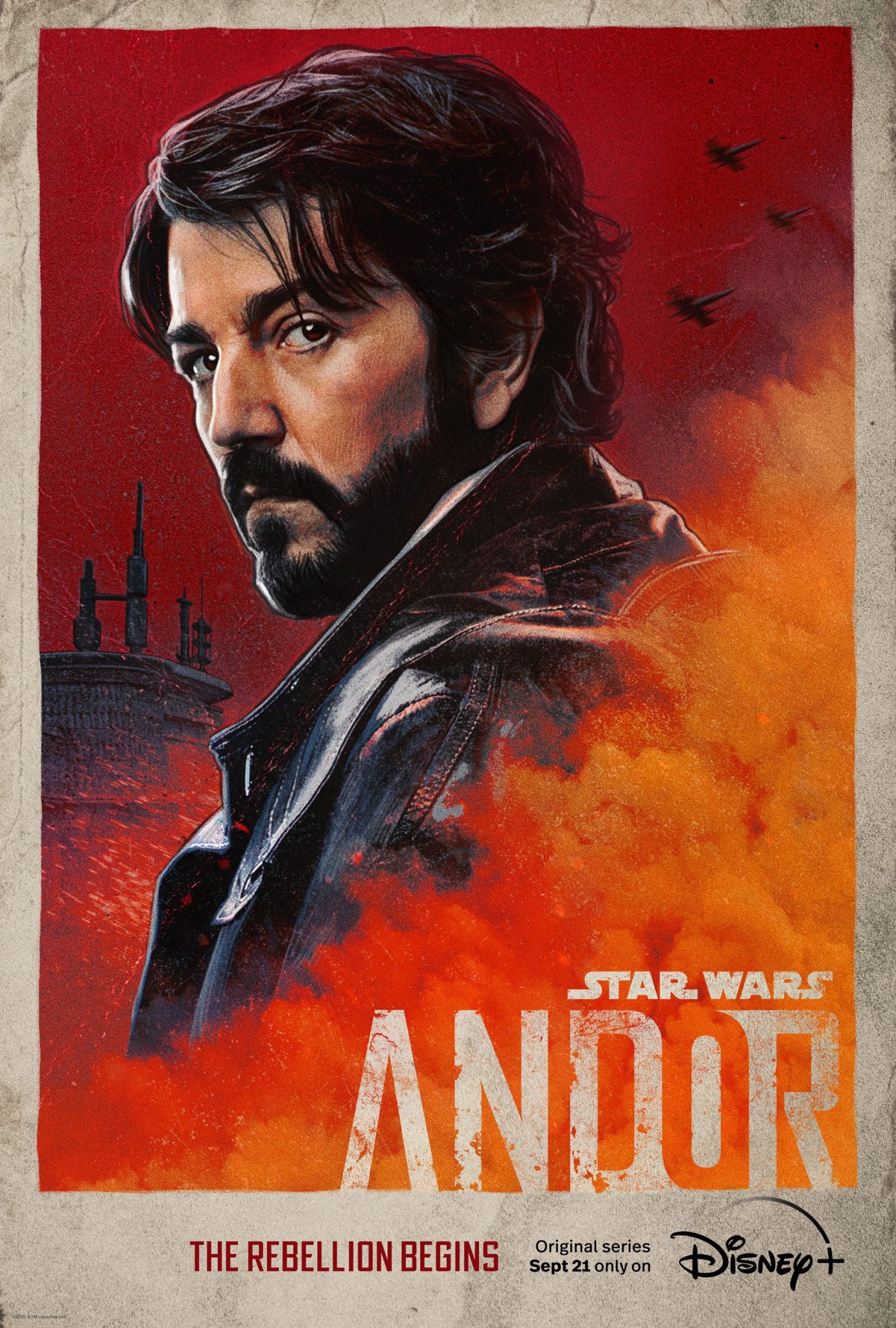

Andor Season 2 Trailer Delay Fuels Fan Frustration And Theories

May 08, 2025

Andor Season 2 Trailer Delay Fuels Fan Frustration And Theories

May 08, 2025 -

First Look At Andor The Star Wars Event 31 Years In The Making

May 08, 2025

First Look At Andor The Star Wars Event 31 Years In The Making

May 08, 2025 -

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025 -

Andors First Look Everything We Hoped For And More

May 08, 2025

Andors First Look Everything We Hoped For And More

May 08, 2025 -

Andor First Look A 31 Year Old Star Wars Tease Finally Revealed

May 08, 2025

Andor First Look A 31 Year Old Star Wars Tease Finally Revealed

May 08, 2025