XRP News: SEC Commodity Classification & Regulatory Uncertainty

Table of Contents

The SEC's Case Against Ripple Labs

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleges that Ripple illegally sold XRP as an unregistered security. This action has significantly impacted the XRP price and the broader cryptocurrency market. The SEC’s argument hinges on the application of the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security.

-

Key arguments presented by the SEC: The SEC contends that Ripple conducted unregistered offers and sales of XRP, violating federal securities laws. They argue that XRP sales involved an investment of money in a common enterprise with a reasonable expectation of profit derived from the efforts of others.

-

Significance of the Howey Test: The Howey Test is central to the SEC's case. The SEC argues that XRP purchasers reasonably anticipated profits based on Ripple's efforts to develop and promote the XRP ecosystem.

-

Potential penalties faced by Ripple Labs: Ripple Labs faces significant financial penalties and potential injunctions against future sales of XRP.

-

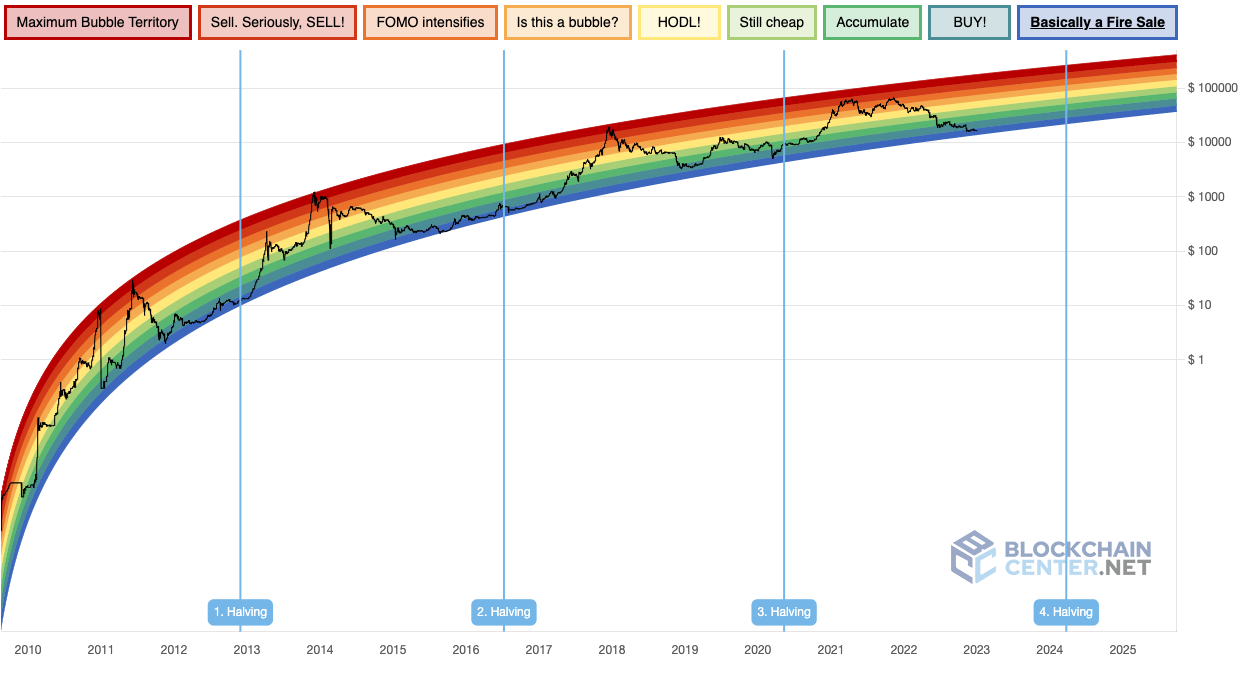

Impact of the lawsuit on XRP's price: The lawsuit has caused significant volatility in XRP's price, with periods of sharp declines interspersed with rallies fueled by positive court developments or community sentiment.

The lawsuit's timeline includes numerous court filings, including Ripple's motion to dismiss and the SEC's response. Key legal arguments revolve around the definition of a "security" and whether XRP meets the criteria outlined in the Howey Test. Legal experts offer diverse interpretations, highlighting the complexity of applying traditional securities law to the novel context of cryptocurrencies. Some argue that XRP functions more like a currency or utility token, while others maintain that its sale and distribution align with the characteristics of a security. The ongoing legal battle underscores the need for clearer regulatory frameworks in the cryptocurrency space.

XRP's Classification as a Security: Implications for Investors

The SEC's classification of XRP as a security carries significant implications for investors who traded the asset.

-

Potential legal risks for individuals who traded XRP: Individuals who purchased XRP during the period identified by the SEC might face legal repercussions depending on their level of knowledge and participation in the alleged unregistered sales.

-

Implications for exchanges listing XRP: Exchanges listing XRP face potential regulatory scrutiny and legal challenges. Many exchanges delisted XRP following the SEC's lawsuit, reflecting the heightened regulatory risk.

-

Impact on future XRP development and adoption: The regulatory uncertainty surrounding XRP hampers its development and mainstream adoption. Uncertainty inhibits investments in projects related to XRP and its underlying technology.

-

Potential investor recourse: Investors affected by the SEC's actions may explore legal options to recover losses. However, the success of such actions depends on the specifics of each investor's situation and the outcome of the Ripple-SEC lawsuit.

The potential legal liabilities for XRP investors depend heavily on when they acquired the asset and their understanding of the potential risks. Delisting from major exchanges severely reduces liquidity and access for investors. The SEC's stance casts a shadow on XRP's future utility and adoption, potentially hindering its growth and integration into broader financial systems.

Ongoing Regulatory Uncertainty and the Future of XRP

The future of XRP remains shrouded in regulatory uncertainty. The outcome of the Ripple-SEC lawsuit will significantly influence its trajectory.

-

Impact of differing regulatory approaches globally: Different jurisdictions are adopting varying approaches to cryptocurrency regulation, creating a fragmented and complex regulatory landscape. Some countries are more receptive to cryptocurrencies than others, leading to potential jurisdictional arbitrage and complicating the overall regulatory picture.

-

Potential for future legal challenges and appeals: Regardless of the immediate outcome of the Ripple-SEC case, further legal challenges and appeals are highly probable, prolonging the uncertainty.

-

Possibility of a settlement between Ripple and the SEC: A settlement between Ripple and the SEC is a possibility, although the terms of such a settlement could still have significant consequences for the XRP ecosystem.

-

Potential for future regulatory clarity in the crypto space: The Ripple-SEC case highlights the urgent need for clearer and more comprehensive regulatory frameworks for cryptocurrencies worldwide.

Global regulatory fragmentation creates a complex environment for XRP and other cryptocurrencies. A settlement might offer a degree of certainty, but it may also establish precedents that affect other cryptocurrencies. The ultimate outcome will shape not only the future of XRP but also the development of the broader cryptocurrency industry. The need for comprehensive and consistent regulatory clarity is paramount for fostering innovation and trust in the crypto space.

Conclusion

The SEC's classification of XRP as a security has created significant uncertainty for the cryptocurrency market. The ongoing legal battle between Ripple and the SEC has far-reaching consequences for investors and the future development of XRP. Understanding the complexities of the SEC's case and its implications is crucial for navigating the evolving regulatory landscape. Staying informed about the latest XRP news and developments is essential for making informed decisions regarding this digital asset. Keep following reputable sources for up-to-date information on the XRP legal battle and its impact on the crypto space. By staying informed on XRP regulatory developments, you can better manage your risks and opportunities within this dynamic market.

Featured Posts

-

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025 -

Oklahoma City Thunder Vs Memphis Grizzlies A Tough Matchup Ahead

May 08, 2025

Oklahoma City Thunder Vs Memphis Grizzlies A Tough Matchup Ahead

May 08, 2025 -

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025 -

March 7th Thunder Vs Trail Blazers Game Time Tv Broadcast And Live Stream Info

May 08, 2025

March 7th Thunder Vs Trail Blazers Game Time Tv Broadcast And Live Stream Info

May 08, 2025 -

Bitcoin Price Prediction Analyzing The Impact Of Trumps 100 Day Speech On Btc

May 08, 2025

Bitcoin Price Prediction Analyzing The Impact Of Trumps 100 Day Speech On Btc

May 08, 2025

Latest Posts

-

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025 -

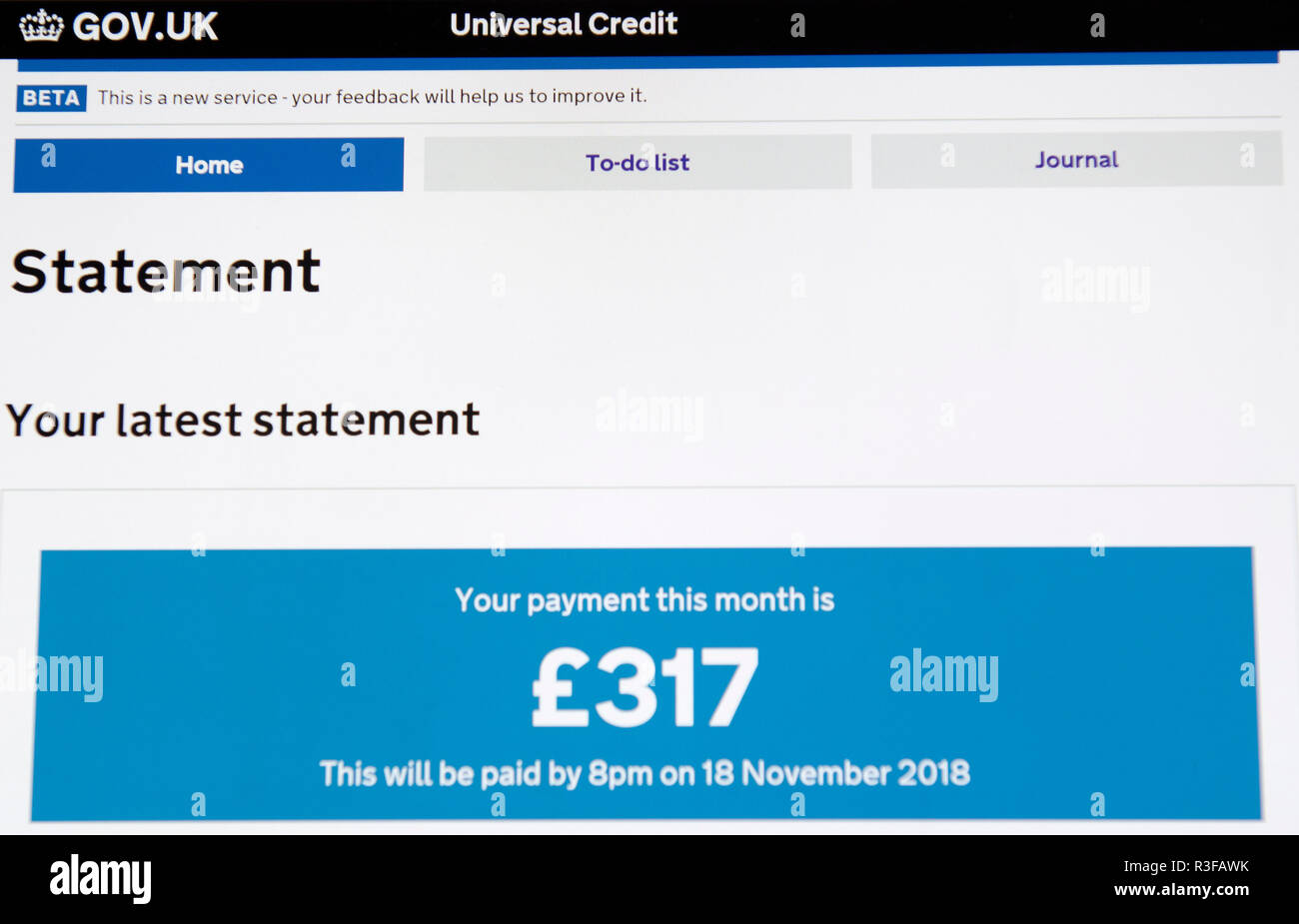

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025 -

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025