XRP Price Soars: Outperforming Bitcoin Post-SEC Grayscale ETF Filing Recognition

Table of Contents

XRP's Unexpected Outperformance

XRP's recent price surge is a complex story with multiple contributing factors. While Bitcoin's price increase was largely driven by the Grayscale ETF filing, XRP's outperformance suggests other forces are at play.

Ripple's Legal Victory Contributing Factors

The ongoing Ripple vs. SEC lawsuit has cast a long shadow over XRP's price. Any positive development in this case significantly impacts investor sentiment.

- Potential Settlement: A favorable settlement could remove much of the uncertainty surrounding XRP, potentially leading to a massive price surge.

- Partial Victory: Even a partial win for Ripple could be interpreted as a positive sign, boosting investor confidence and driving up the XRP price.

- Dismissal of Charges: A complete dismissal of the charges would likely be the most bullish outcome for XRP, potentially leading to exponential price growth.

The impact of these legal developments is undeniable. For instance, positive news from the court often correlates with immediate and substantial increases in XRP trading volume and price. Expert opinions vary, but many analysts believe a positive resolution to the lawsuit is crucial for XRP's long-term success.

Increased Institutional Interest in XRP

Beyond the legal battles, growing institutional interest in XRP is another factor contributing to its recent price jump. This interest stems from several key advantages XRP offers compared to Bitcoin:

- Faster Transaction Speeds: XRP boasts significantly faster transaction times than Bitcoin, making it attractive for businesses needing quick and efficient payments.

- Lower Transaction Fees: XRP's transaction fees are typically much lower than Bitcoin's, further enhancing its appeal to businesses.

- Energy Efficiency: XRP's consensus mechanism is significantly more energy-efficient than Bitcoin's proof-of-work system, aligning with growing environmental concerns.

Several new partnerships and integrations involving XRP have recently been announced, signaling increased adoption by businesses and institutions. While specific investment figures from major institutional players haven't always been publicly disclosed, the increased trading volume and price action strongly suggest a growing institutional presence in the XRP market.

Grayscale's ETF Filing Influence on XRP

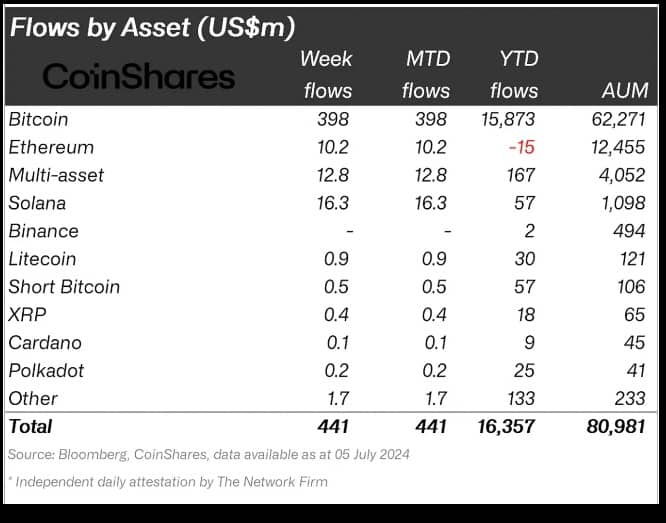

The Grayscale ETF filing, while primarily focused on Bitcoin, has had a ripple effect across the cryptocurrency market, indirectly boosting XRP and other altcoins.

Ripple Effect on Altcoins

The positive sentiment surrounding the potential approval of a Bitcoin ETF has a broader impact on investor confidence in the entire crypto market. This increased confidence spills over into altcoins like XRP, leading to increased investment and higher prices.

- Increased Market Confidence: Successful ETF approval would likely signify greater regulatory clarity and acceptance of cryptocurrencies, benefiting the entire sector.

- FOMO (Fear Of Missing Out): The potential for significant gains from a Bitcoin ETF could trigger FOMO, prompting investors to seek exposure to other cryptocurrencies, including XRP.

Data comparing XRP's price movement against other altcoins following the Grayscale news shows a clear correlation. Many altcoins experienced significant gains alongside XRP, reinforcing the idea of a broader market sentiment shift.

The ETF Approval Process and its Implications

The Grayscale ETF application's progress is crucial. Approval would likely further enhance the positive sentiment around the crypto market, potentially benefiting XRP significantly.

- Approval Scenario: A successful approval could lead to a substantial inflow of institutional money into the Bitcoin market, potentially triggering a domino effect and impacting altcoins positively.

- Rejection Scenario: Rejection, on the other hand, could trigger a market correction, although the impact on XRP might be less severe than on Bitcoin given its independent factors.

Expert predictions are mixed, with some predicting approval and others remaining cautious. The outcome will undoubtedly influence XRP's price in the short-term, though its long-term prospects remain tied to factors beyond the Grayscale ETF.

Technical Analysis of XRP Price Movement

Analyzing XRP's recent price charts reveals key trends and potential future directions.

Chart Patterns and Indicators

Recent XRP price charts show strong upward momentum. Key support and resistance levels are constantly shifting, influenced by news and market sentiment.

- RSI (Relative Strength Index): The RSI indicator suggests the XRP price might be overbought in the short term, hinting at potential consolidation or minor corrections.

- MACD (Moving Average Convergence Divergence): The MACD currently shows a bullish signal, suggesting continued upward momentum, although this should be interpreted cautiously.

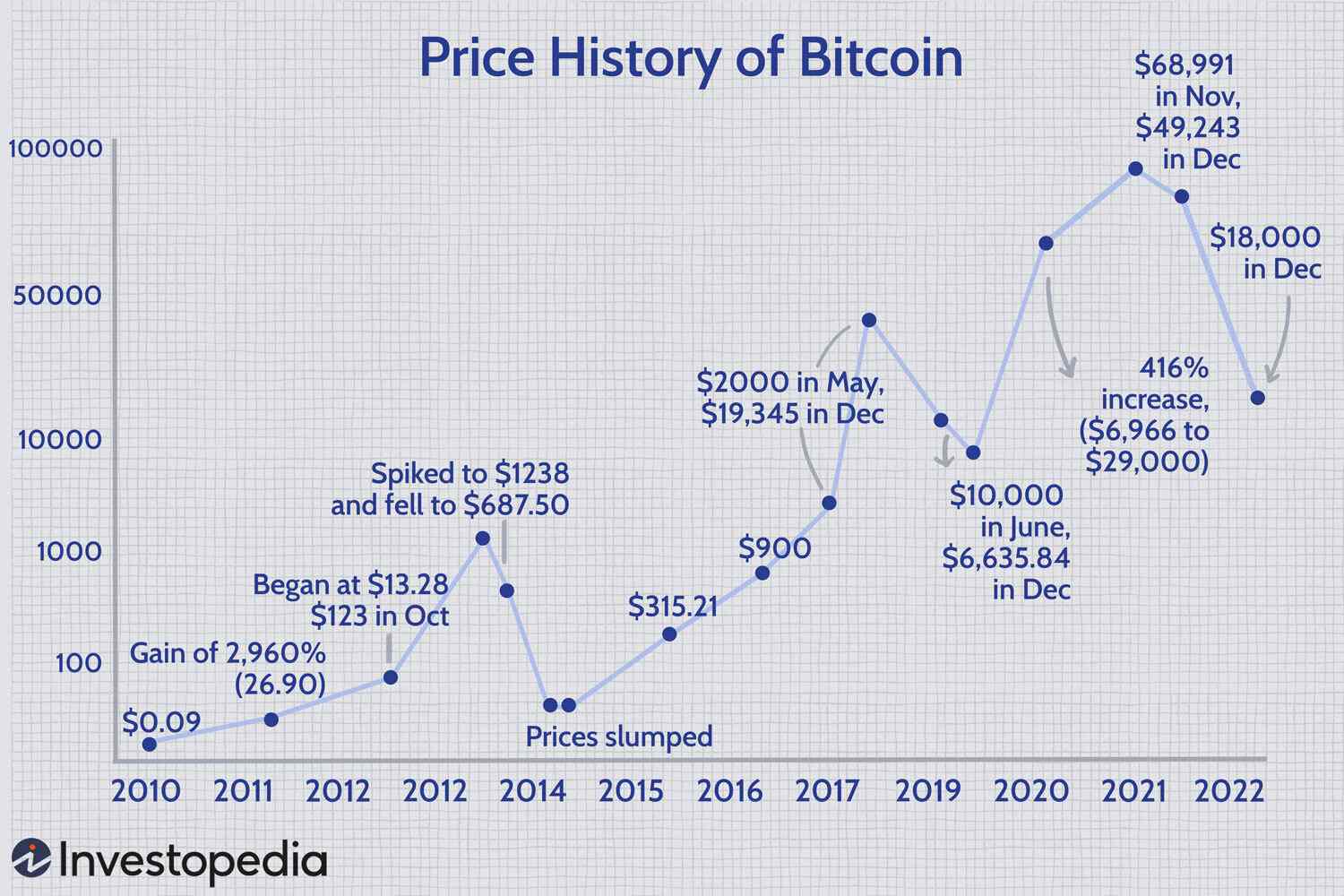

[Insert relevant charts and graphs here].

Predicting Future Price Trends

Predicting future XRP price trends is inherently challenging. Several factors could influence its price:

- Outcome of the Ripple Lawsuit: A positive outcome would likely propel XRP's price significantly higher.

- Continued Institutional Adoption: Growing institutional interest could sustain upward price momentum.

- Overall Market Sentiment: General market conditions and the performance of other cryptocurrencies will influence XRP’s price.

While the current trends are positive, it's essential to remember that investing in cryptocurrencies is inherently risky. The XRP price is highly volatile and subject to sudden changes.

Conclusion

XRP's recent price surge is a result of several converging factors: a potentially favorable resolution to the Ripple lawsuit, growing institutional interest in its unique features, and the indirect positive impact of the Grayscale Bitcoin ETF filing. While the recent surge in XRP price is encouraging, remember that investing in cryptocurrencies carries inherent risks. Conduct thorough research and consider your risk tolerance before investing in XRP or any other cryptocurrency. Stay informed on the latest developments surrounding the Ripple lawsuit and the Grayscale ETF filing to make informed decisions about your XRP price investment strategy. Learn more about XRP price prediction and XRP price charts for a comprehensive understanding.

Featured Posts

-

Pik Seged Shokantna Pobeda Nad Pariz Za Chetvrtfinale Lige Shampiona

May 08, 2025

Pik Seged Shokantna Pobeda Nad Pariz Za Chetvrtfinale Lige Shampiona

May 08, 2025 -

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025 -

Cute Krypto Scenes A Sneak Peek From Upcoming Superman Movie

May 08, 2025

Cute Krypto Scenes A Sneak Peek From Upcoming Superman Movie

May 08, 2025 -

Ripple Xrp Sees Significant Investment 20 Million Token Whale Buy

May 08, 2025

Ripple Xrp Sees Significant Investment 20 Million Token Whale Buy

May 08, 2025 -

Is War Inevitable Examining The Kashmir Factor In India Pakistan Relations

May 08, 2025

Is War Inevitable Examining The Kashmir Factor In India Pakistan Relations

May 08, 2025

Latest Posts

-

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025 -

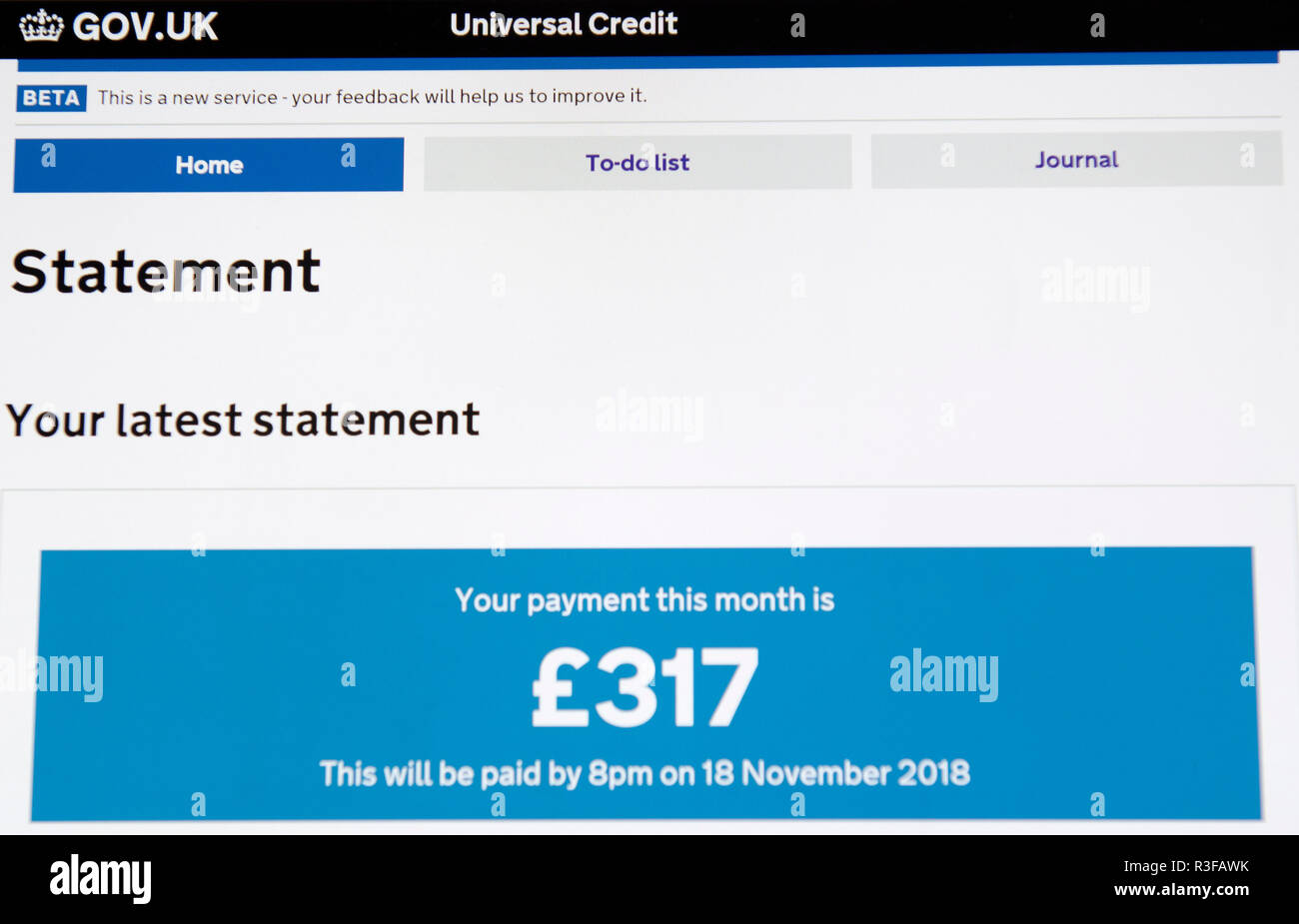

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025 -

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025