XRP Price Surge: Outperforming Bitcoin Post-SEC Grayscale ETF Filing Announcement

Table of Contents

Grayscale's Win and its Ripple Effect on XRP

The landmark court ruling against the SEC in the Grayscale Bitcoin Trust case has profoundly impacted the cryptocurrency market, injecting a much-needed dose of optimism and investor confidence. This positive sentiment has rippled across the crypto landscape, but XRP's response has been especially significant.

The SEC's Decision and its Impact on Market Sentiment

The Grayscale victory marked a turning point in the SEC's approach to cryptocurrency regulation. The court's decision to compel the SEC to approve the Grayscale Bitcoin Trust's application for a spot Bitcoin ETF signaled a potential shift towards a more favorable regulatory environment.

- Details of the Grayscale vs. SEC case: Grayscale's legal challenge argued that the SEC's rejection of its Bitcoin ETF application was arbitrary and capricious. The court agreed, forcing the SEC to reconsider its stance.

- Positive market reaction: The ruling triggered a widespread rally in the cryptocurrency market, with Bitcoin and other cryptocurrencies experiencing significant price gains.

- Increased institutional interest: The decision is seen as a catalyst for increased institutional investment in the cryptocurrency market, further boosting investor confidence.

XRP's Unique Position Compared to Other Altcoins

While many altcoins benefited from the positive market sentiment following the Grayscale ruling, XRP's performance has been exceptionally strong. Several factors contribute to this disproportionate surge:

- XRP's distinct use cases (payments): XRP's primary use case lies in facilitating fast, low-cost cross-border payments, a feature that resonates with institutions and businesses seeking efficient payment solutions. Ripple's On-Demand Liquidity (ODL) network leverages XRP to enable instant settlements.

- Ripple's ongoing legal battles (and their potential resolution): While Ripple's ongoing legal battle with the SEC casts some uncertainty, a positive outcome could significantly boost XRP's price. The positive market sentiment post-Grayscale ruling may indicate a lessening of broader regulatory concerns.

- Reduced regulatory uncertainty: The Grayscale decision may indirectly alleviate some regulatory uncertainty surrounding other cryptocurrencies, including XRP, thereby increasing investor appetite.

Technical Analysis of the XRP Price Surge

Analyzing XRP's price charts reveals a compelling picture of the recent surge. Technical indicators strongly suggest a bullish trend.

Chart Patterns and Trading Volume

The XRP price chart shows clear signs of a significant upward trend.

- Specific chart patterns (e.g., breakout, bullish engulfing): We've witnessed a clear breakout from a period of consolidation, followed by bullish engulfing candlestick patterns, confirming the upward momentum.

- Trading volume increase: The increase in trading volume accompanying the price surge validates the strength of the buying pressure.

- Support and resistance levels: Previous resistance levels have been decisively broken, indicating a sustained uptrend.

Potential Price Targets and Future Predictions

While predicting future cryptocurrency prices is inherently speculative, based on the current technical and fundamental analysis, a cautiously optimistic outlook is warranted.

- Short-term and long-term price targets: Short-term price targets could reach [insert cautious short-term price target], while long-term targets, depending on market conditions and regulatory developments, could be significantly higher.

- Factors influencing future price movements (market conditions, regulatory developments): Future price movements will depend on various factors, including the overall cryptocurrency market conditions, the outcome of Ripple's legal case, and broader regulatory developments.

Risks and Considerations for XRP Investors

Despite the positive momentum, investors must remain aware of the inherent risks associated with cryptocurrency investments.

Remaining Regulatory Uncertainty

While the Grayscale ruling is positive, regulatory uncertainty remains a significant risk factor.

- Ongoing Ripple lawsuit: The outcome of Ripple's ongoing legal battle with the SEC remains uncertain and could significantly impact XRP's price.

- Potential for future regulatory actions: Regulatory landscapes are constantly evolving, and future actions by the SEC or other regulatory bodies could negatively affect XRP.

- Risks associated with cryptocurrency investments: Cryptocurrencies are highly volatile, and investors can experience significant losses.

Market Volatility and Risk Management

The cryptocurrency market is notoriously volatile, and effective risk management is crucial.

- Diversification: Diversifying your investment portfolio across different asset classes can help mitigate risk.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals helps reduce the impact of market volatility.

- Stop-loss orders: Setting stop-loss orders can limit potential losses.

- Importance of thorough research: Conducting thorough research and understanding the risks before investing is essential.

Conclusion

The recent XRP price surge, fueled by the positive market sentiment surrounding the Grayscale ETF filing, presents a compelling opportunity for investors. However, it's crucial to acknowledge the risks involved. The Grayscale victory injected significant confidence into the crypto market, boosting altcoins like XRP, but regulatory uncertainty and market volatility remain. Thorough research and a robust risk management strategy are crucial before investing in XRP. Stay informed on the latest developments regarding XRP price and market trends to make informed investment decisions.

Featured Posts

-

Xrp Price Analysis Assessing The Path To 3 40

May 08, 2025

Xrp Price Analysis Assessing The Path To 3 40

May 08, 2025 -

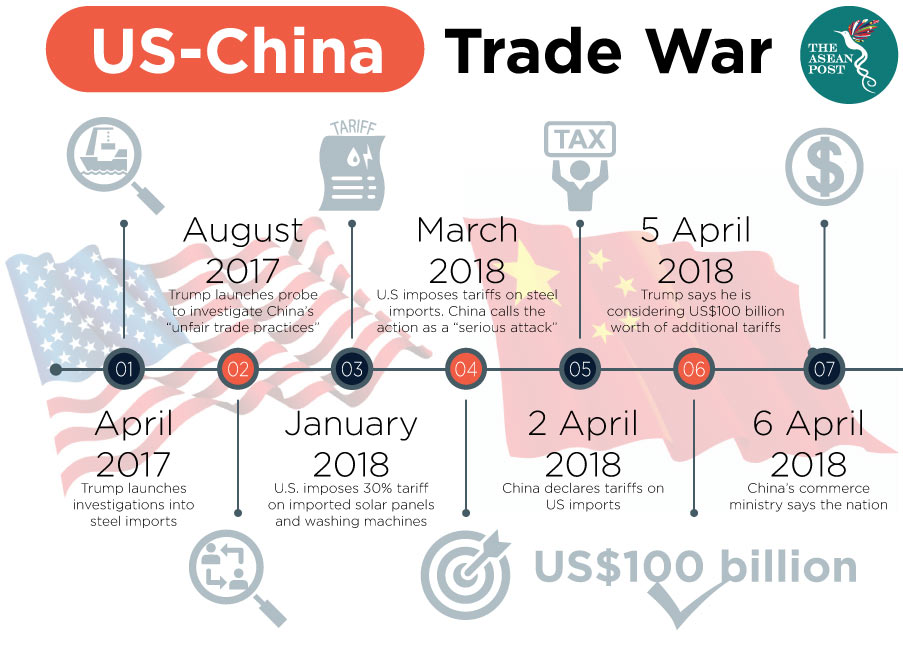

The Trade Wars Impact On Crypto One Cryptocurrency That Could Still Thrive

May 08, 2025

The Trade Wars Impact On Crypto One Cryptocurrency That Could Still Thrive

May 08, 2025 -

Ripples Xrp Three Factors Pointing To Potential Growth Plus Remittix Ico Update

May 08, 2025

Ripples Xrp Three Factors Pointing To Potential Growth Plus Remittix Ico Update

May 08, 2025 -

Bitcoin At A Critical Juncture Key Price Levels To Watch

May 08, 2025

Bitcoin At A Critical Juncture Key Price Levels To Watch

May 08, 2025 -

Okc Thunder Vs Indiana Pacers Injury Report For March 29th

May 08, 2025

Okc Thunder Vs Indiana Pacers Injury Report For March 29th

May 08, 2025

Latest Posts

-

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025 -

Bitcoin Seoul 2025 The Future Of Cryptocurrency In Asia

May 08, 2025

Bitcoin Seoul 2025 The Future Of Cryptocurrency In Asia

May 08, 2025 -

Seoul To Host Asias Leading Bitcoin Conference In 2025

May 08, 2025

Seoul To Host Asias Leading Bitcoin Conference In 2025

May 08, 2025 -

2025 Bitcoin Conference In Seoul Industry Leaders Announced

May 08, 2025

2025 Bitcoin Conference In Seoul Industry Leaders Announced

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025