XRP Regulatory Uncertainty: SEC's Classification And Market Impact

Table of Contents

The SEC's Case Against Ripple and its Classification of XRP

The SEC filed a lawsuit against Ripple Labs in December 2020, alleging that XRP is an unregistered security. This action has cast a long shadow over the cryptocurrency, creating substantial XRP regulatory uncertainty. The core of the SEC's argument rests on the application of the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security.

-

The SEC's Arguments:

- The SEC argues that Ripple's sales and distribution of XRP constituted the offer and sale of unregistered securities, violating federal securities laws. They point to Ripple's various sales programs, arguing these involved an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

- The Howey Test is central to the SEC's case. They contend that XRP investors reasonably expected profits based on Ripple's efforts to increase XRP's value and adoption.

- Potential penalties for Ripple, if found guilty, include significant fines and potential injunctions against future sales of XRP.

-

Ripple's Defense:

- Ripple counters that XRP is a currency and not a security, arguing it operates independently of Ripple's efforts. They emphasize its decentralized nature and widespread use on various exchanges.

- Ripple highlights the significant differences between XRP and traditional securities, focusing on its transactional utility and decentralized governance.

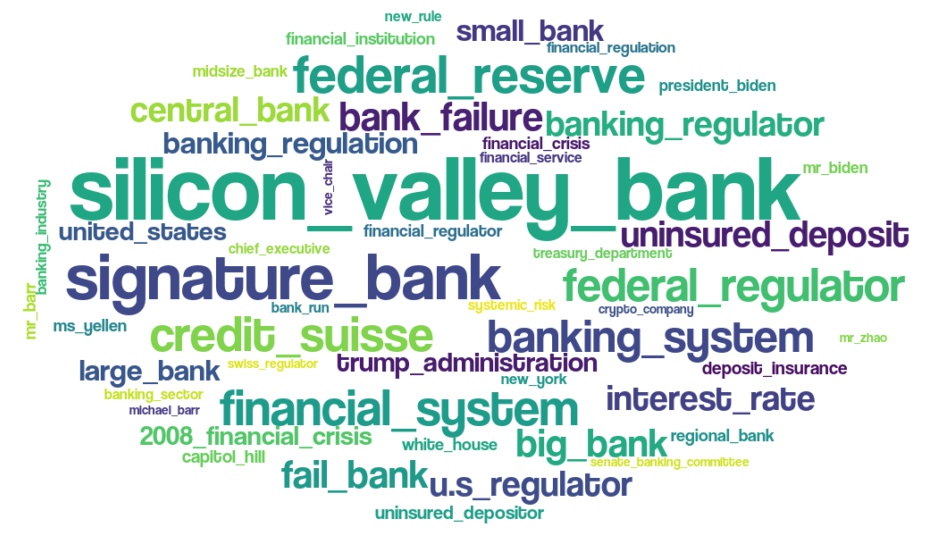

Market Impact of the XRP Regulatory Uncertainty

The SEC lawsuit has significantly impacted XRP's market performance, creating considerable XRP price volatility. This XRP regulatory uncertainty has rippled through the broader cryptocurrency market.

-

Price Fluctuations and Market Metrics:

- Since the lawsuit began, XRP's price has experienced dramatic swings, often correlating with significant developments in the legal proceedings.

- Trading volume has fluctuated considerably, reflecting the uncertainty surrounding XRP's future.

- Market capitalization has also seen significant changes, directly reflecting investor sentiment and confidence.

-

Investor Confidence and Exchange Listings:

- The ongoing legal battle has undeniably eroded investor confidence in XRP. Many investors have either sold their holdings or are hesitant to invest further.

- Several exchanges delisted XRP following the SEC lawsuit, further limiting its accessibility and liquidity. This highlights the XRP regulatory uncertainty and the cautionary approach taken by many exchanges.

International Regulatory Landscape and its Influence on XRP

The regulatory landscape surrounding XRP is not uniform globally. Different jurisdictions have taken varying approaches to classifying cryptocurrencies, creating a complex international regulatory landscape and significant XRP regulatory uncertainty.

-

Varying Regulatory Approaches:

- Some countries, like Japan, have relatively clearer regulatory frameworks for cryptocurrencies, offering a contrasting approach to the SEC's stance.

- Others, like the UK, are still developing their regulatory frameworks, resulting in a period of uncertainty for assets like XRP.

-

Challenges of a Fragmented Environment:

- This global fragmentation presents challenges for XRP's adoption and usage. Inconsistencies in regulatory treatment create hurdles for cross-border transactions and investment.

- A lack of international regulatory harmonization adds to the XRP regulatory uncertainty and creates complexities for businesses operating in the crypto space.

Future Outlook and Potential Scenarios

The outcome of the SEC lawsuit will significantly shape the future of XRP. Several potential scenarios exist, each with significant implications.

-

Potential Outcomes and their Consequences:

- If XRP is deemed a security, Ripple could face substantial penalties, and XRP's future could be severely impacted, potentially leading to a significant market correction.

- If XRP is not deemed a security, it could experience a surge in price and adoption, boosting investor confidence.

-

Impact on the Broader Crypto Market:

- The ruling will have broader implications for the entire cryptocurrency market, setting a precedent for the regulation of other digital assets. This underscores the importance of the case and the associated XRP regulatory uncertainty.

- The outcome could influence how other jurisdictions approach the regulation of similar digital assets.

Conclusion

The SEC's classification of XRP as a security remains a significant source of XRP regulatory uncertainty, significantly impacting its market performance and investor confidence. The ongoing legal battle highlights the challenges of regulating cryptocurrencies and the need for clearer, more consistent regulatory frameworks globally. Understanding the complexities surrounding XRP regulatory uncertainty is crucial for navigating the cryptocurrency market. Stay informed about developments in the Ripple vs. SEC case and continue to research XRP regulatory uncertainty to make informed investment decisions.

Featured Posts

-

Major Xrp Whale Accumulates 20 Million Tokens Market Impact Analysis

May 08, 2025

Major Xrp Whale Accumulates 20 Million Tokens Market Impact Analysis

May 08, 2025 -

The Carney Trump Meeting A Discussion Of Canadas Economic Sovereignty

May 08, 2025

The Carney Trump Meeting A Discussion Of Canadas Economic Sovereignty

May 08, 2025 -

Ps Zh Aston Villa Statistika Ta Rezultati Yevrokubkovikh Zustrichey

May 08, 2025

Ps Zh Aston Villa Statistika Ta Rezultati Yevrokubkovikh Zustrichey

May 08, 2025 -

Are Ps 5 Pro Sales Disappointing Comparing Performance To Its Predecessor

May 08, 2025

Are Ps 5 Pro Sales Disappointing Comparing Performance To Its Predecessor

May 08, 2025 -

Xrp And Ripple Recent Developments And Market Analysis

May 08, 2025

Xrp And Ripple Recent Developments And Market Analysis

May 08, 2025

Latest Posts

-

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025 -

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025 -

9 4000 2 360

May 08, 2025

9 4000 2 360

May 08, 2025