XRP Up 400% In Three Months: A Detailed Investment Analysis

Table of Contents

Factors Contributing to XRP's Price Surge

Several interconnected factors have contributed to XRP's recent price surge. Let's break down the key elements driving this impressive rally.

The Ripple Case Resolution

The partial legal victory for Ripple Labs in the SEC lawsuit played a pivotal role in boosting XRP's price. The court ruling, while not a complete win, significantly reduced the regulatory uncertainty surrounding XRP. This positive development rekindled investor confidence, leading to a surge in buying pressure and a subsequent price increase.

- Reduced regulatory uncertainty: The partial victory lessened the fear of a complete ban or harsh regulatory action against Ripple and XRP.

- Increased institutional investment interest: The clearer regulatory landscape attracted institutional investors who were previously hesitant due to the ongoing legal battle.

- Positive market sentiment: The positive news surrounding the Ripple case fueled overall positive sentiment towards XRP within the cryptocurrency community.

However, it's crucial to remember that legal uncertainties remain. The SEC’s appeal and ongoing legal battles could still impact XRP's future price. This uncertainty highlights the inherent risk involved in investing in XRP.

Increased Adoption and Utility

Beyond the legal developments, the increasing adoption and utility of XRP within the RippleNet network have also contributed to its price appreciation. RippleNet, Ripple's payment network, facilitates faster and cheaper cross-border transactions.

- Expanding RippleNet network: The network continues to onboard new financial institutions, increasing the demand for XRP as a bridging currency.

- New partnerships and integrations: Strategic partnerships and integrations with various payment providers expand XRP's reach and utility.

- Increased transaction volume: Higher transaction volume on the RippleNet network directly reflects the growing adoption and use of XRP.

XRP's low transaction fees and fast transaction speeds offer a competitive advantage over other payment solutions, further fueling its adoption.

Overall Market Sentiment and Bitcoin's Influence

The broader cryptocurrency market sentiment and Bitcoin's performance significantly influence XRP's price. As a prominent altcoin, XRP often exhibits a correlation with Bitcoin's price movements.

- Positive correlation with Bitcoin: When Bitcoin's price rises, XRP often follows suit, reflecting the overall positive sentiment in the crypto market.

- Impact of general market optimism: Periods of broader market optimism tend to benefit altcoins like XRP, leading to price appreciation.

- Altcoin season influence: During periods known as "altcoin season," where altcoins outperform Bitcoin, XRP often sees significant price gains.

Potential Risks and Challenges

Despite the recent price surge, several risks and challenges remain for XRP. Investors need to carefully assess these factors before making any investment decisions.

Remaining Legal Uncertainty

The ongoing legal battles between Ripple and the SEC represent a significant risk to XRP's future. A negative outcome could lead to a substantial price correction.

- Uncertain legal outcomes: The SEC's appeal and potential future legal actions create significant uncertainty.

- Potential for further regulatory scrutiny: Increased regulatory scrutiny could hinder XRP's growth and adoption.

- Risk of price volatility: The ongoing legal battles contribute to significant price volatility, making XRP a high-risk investment.

Market Volatility and Correction Risks

The cryptocurrency market is inherently volatile, and XRP is no exception. A significant price correction is always a possibility.

- High-risk investment: XRP, like other cryptocurrencies, carries a high degree of investment risk.

- Potential for sharp price drops: Negative news or broader market downturns could trigger sharp price drops.

- Importance of diversification: Diversifying your investment portfolio is crucial to mitigate the risk associated with XRP's volatility.

Competition from Other Cryptocurrencies

XRP faces stiff competition from other cryptocurrencies offering similar functionalities, particularly in the cross-border payment space.

- Competition from other payment solutions: Several other cryptocurrencies and traditional payment systems compete with XRP.

- Technological advancements by competitors: Continuous technological advancements by competitors could erode XRP's competitive advantage.

- Market share considerations: Maintaining market share in a competitive landscape is a challenge for XRP.

Conclusion

XRP's recent 400% price surge is a testament to the positive impact of the partial Ripple Labs legal victory and increased adoption. However, significant risks remain, including ongoing legal uncertainties and the inherent volatility of the cryptocurrency market. Careful consideration of these factors is crucial for any investor contemplating exposure to XRP.

Call to Action: Before making any investment decisions regarding XRP, conduct thorough research and consider consulting a financial advisor. Understanding the potential risks and rewards associated with XRP is essential for navigating this dynamic and volatile cryptocurrency market. Remember, this analysis is for informational purposes only and not financial advice. Further research into XRP price prediction, Ripple, and the broader crypto market is crucial before investing in this or any other cryptocurrency.

Featured Posts

-

Dallas And Carrie Legend Dead Amy Irving Pays Tribute

May 01, 2025

Dallas And Carrie Legend Dead Amy Irving Pays Tribute

May 01, 2025 -

Phipps Australian Rugbys Dominance Questioned

May 01, 2025

Phipps Australian Rugbys Dominance Questioned

May 01, 2025 -

Stage And Screen Veteran Priscilla Pointer Dies At 100

May 01, 2025

Stage And Screen Veteran Priscilla Pointer Dies At 100

May 01, 2025 -

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala

May 01, 2025

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala

May 01, 2025 -

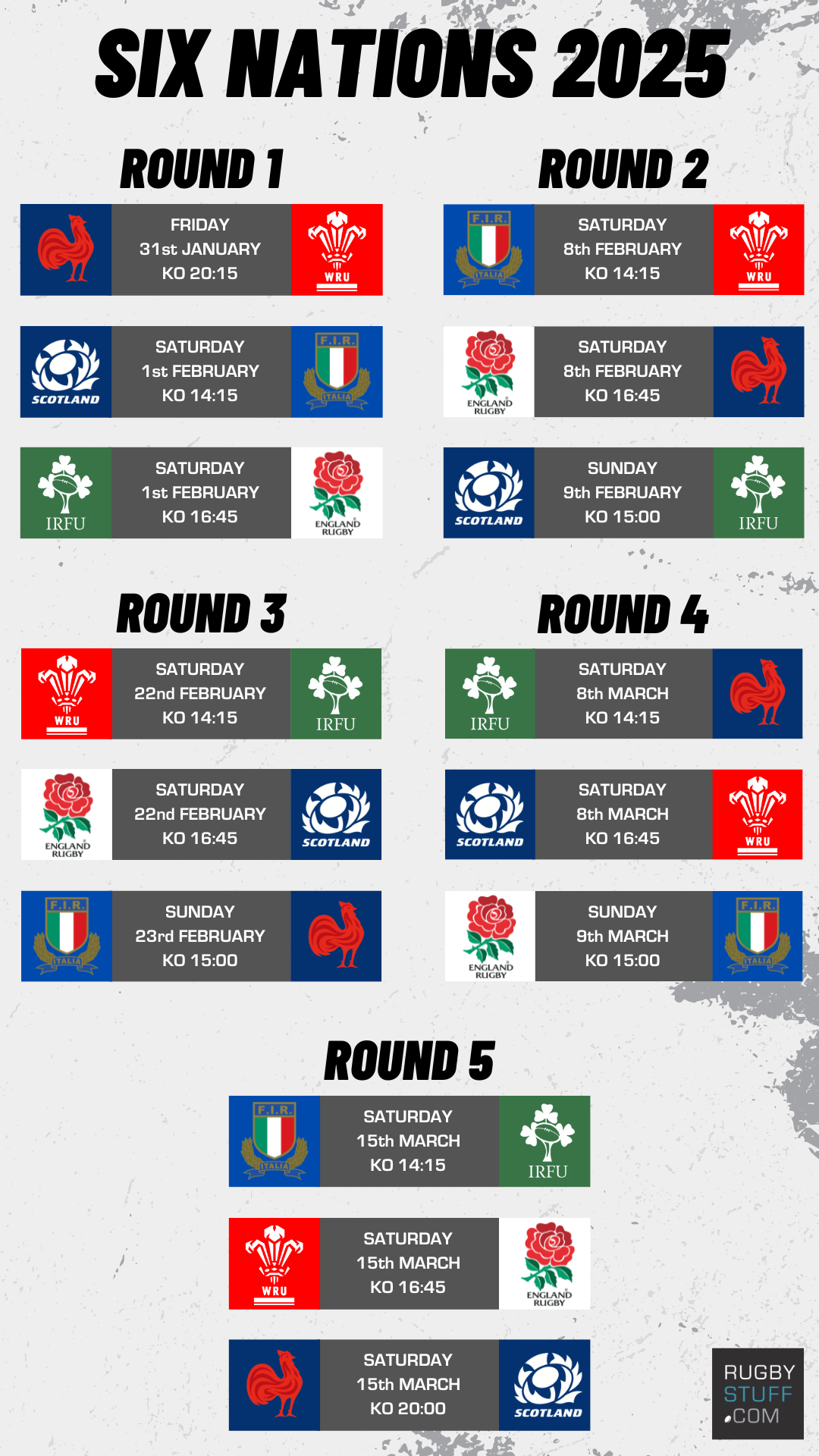

Six Nations 2025 Assessing Scotlands Rugby Performance

May 01, 2025

Six Nations 2025 Assessing Scotlands Rugby Performance

May 01, 2025

Latest Posts

-

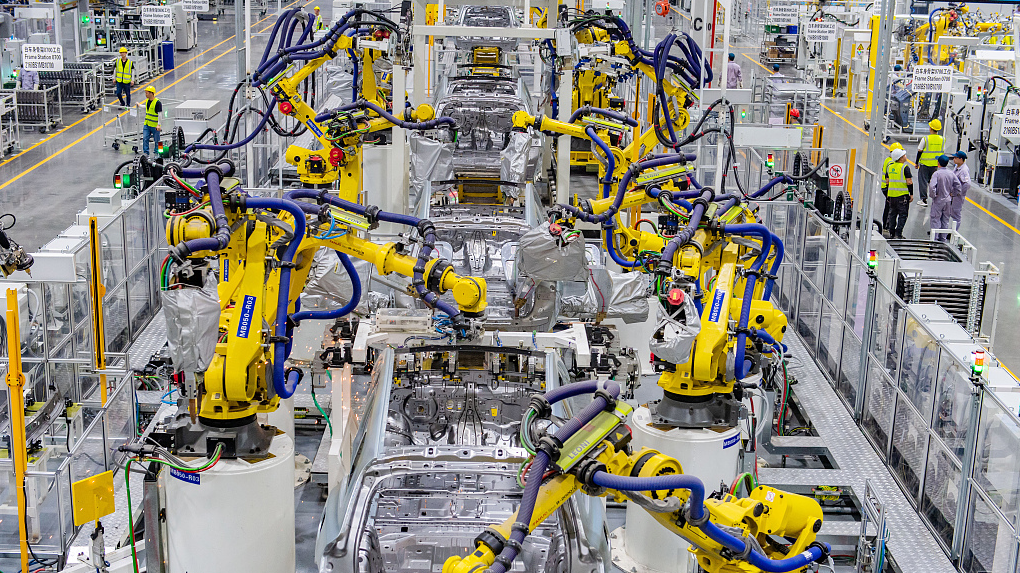

Increased Profits At China Life A Result Of Robust Investments

May 01, 2025

Increased Profits At China Life A Result Of Robust Investments

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025 -

China Lifes Profits Soar Amidst Strong Investment Performance

May 01, 2025

China Lifes Profits Soar Amidst Strong Investment Performance

May 01, 2025 -

China Life Investment Strength Fuels Profit Increase

May 01, 2025

China Life Investment Strength Fuels Profit Increase

May 01, 2025 -

President Trumps First 100 Days 39 Approval And The Travel Ban Effect

May 01, 2025

President Trumps First 100 Days 39 Approval And The Travel Ban Effect

May 01, 2025