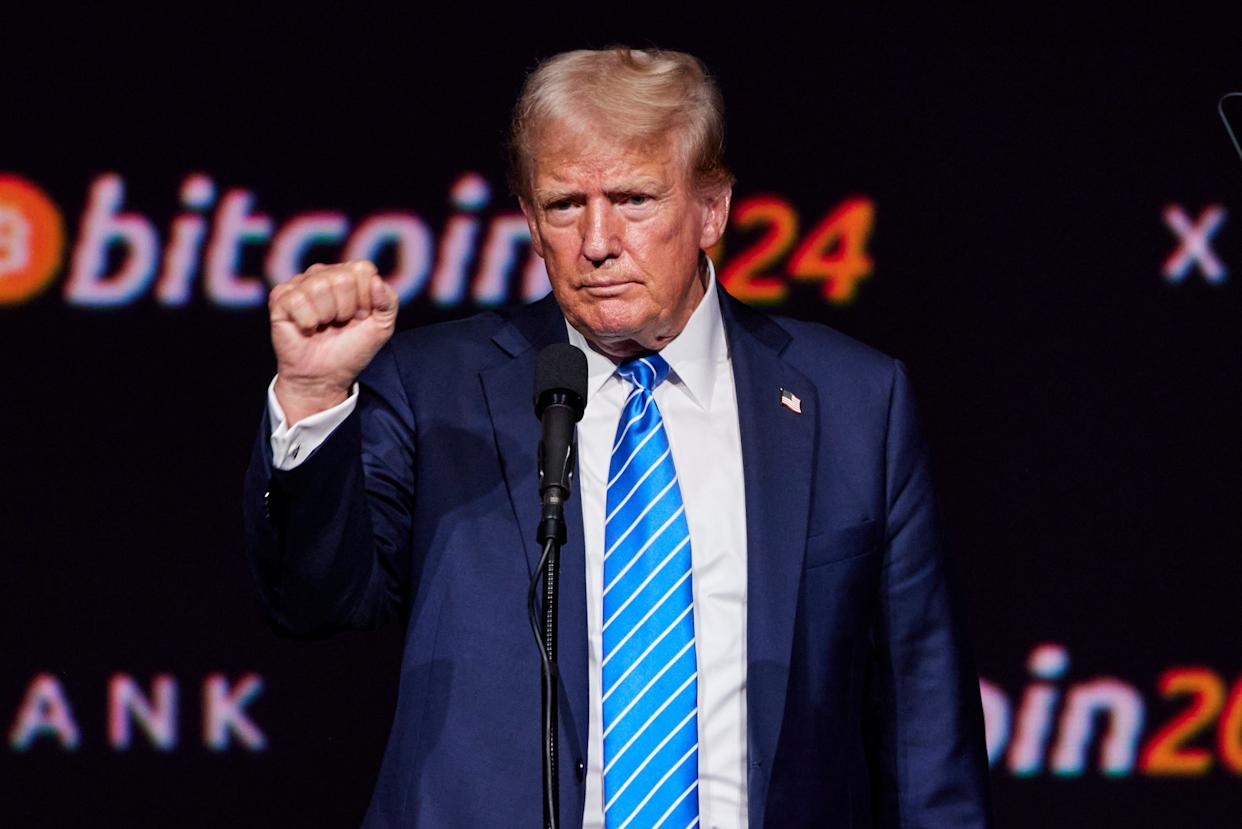

$100,000 Bitcoin? Trump's Speech And The Future Price Of BTC

Table of Contents

Trump's Influence on Cryptocurrency Markets

Trump's opinions, whether directly stated or indirectly implied through policy decisions, can significantly influence market sentiment towards Bitcoin and the broader cryptocurrency market.

Direct Statements and Their Impact

Any direct mention of Bitcoin or cryptocurrency by Trump has historically caused immediate and often dramatic price fluctuations. The cryptocurrency market is highly sensitive to news and statements from powerful figures.

- Example 1: [Insert date and a specific example of a Trump statement regarding crypto, and the resulting price action. Include a link to a relevant news article or chart]. This event resulted in a [percentage]% price increase/decrease within [timeframe].

- Example 2: [Insert date and another example, with link to source and chart illustrating price movement]. This shows a [percentage]% price movement within [timeframe].

Analyzing social media sentiment surrounding these statements offers valuable insights into the market's reaction. Tools that monitor social media trends can reveal whether the overall sentiment was positive or negative, further correlating this with Bitcoin's price movements. [Include a chart or graph visualizing social media sentiment alongside Bitcoin price action].

Indirect Policy Changes and their Ripple Effect

Beyond direct mentions, Trump's economic policies (and any future policies from similar figures) can indirectly impact Bitcoin's value.

- US Dollar Influence: Changes in US monetary policy can affect the value of the dollar, influencing Bitcoin's price as a safe haven asset or alternative investment. A weakening dollar could potentially drive up Bitcoin's price.

- Regulatory Landscape: Trump's administration's approach to cryptocurrency regulation (or the approach of future administrations) significantly impacts investor confidence and institutional adoption. Clearer, more favorable regulations could lead to increased investment and price appreciation.

- Institutional Investment: Trump's economic policies can influence the appetite of institutional investors for Bitcoin. A positive business climate might encourage larger investments, driving up demand and price.

Market Analysis: Factors Beyond Trump's Influence

While Trump's words hold weight, numerous other factors significantly contribute to Bitcoin's price movements.

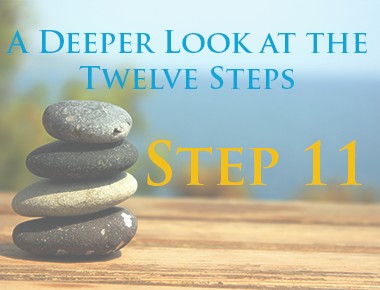

Adoption Rates and Technological Advancements

Growing adoption by both institutional and individual investors fuels demand and subsequently, price appreciation. Technological advancements also play a crucial role.

- Key Adoption Drivers:

- Lightning Network: This technology enhances Bitcoin's scalability and transaction speed, making it more user-friendly.

- DeFi Integration: The integration of Bitcoin into decentralized finance (DeFi) platforms expands its use cases and potential applications.

- Institutional Investment: Large-scale investments from corporations and hedge funds increase demand and overall market capitalization.

Bitcoin's fixed supply of 21 million coins is a significant factor contributing to its potential for long-term price appreciation. As demand increases with limited supply, the price naturally tends to rise.

Macroeconomic Factors

Global economic conditions heavily influence Bitcoin's performance.

- Inflation Hedge: Many view Bitcoin as a hedge against inflation. During periods of high inflation, investors may flock to Bitcoin as a store of value, driving up its price.

- Recession Fears: Economic uncertainty often leads investors to seek alternative assets, including Bitcoin. This increased demand can lead to price appreciation.

- Correlation with Traditional Markets: While Bitcoin is often touted as a decentralized asset, it still exhibits some correlation with traditional markets. A downturn in the stock market may negatively impact Bitcoin's price, and vice-versa.

Technical Analysis: Predicting the $100,000 Threshold

Technical analysis uses charts and indicators to predict future price movements.

Chart Patterns and Price Predictions

Analyzing historical price data using technical indicators can offer clues about future price movements.

- Moving Averages: These indicators smooth out price fluctuations, helping identify trends. [Insert chart showing moving averages].

- RSI (Relative Strength Index): This indicator measures the momentum of price changes, helping identify overbought or oversold conditions. [Insert chart showing RSI].

- Support and Resistance Levels: These are price levels where the price has historically struggled to break through. Identifying these levels helps predict future price movements. [Insert chart showing support and resistance levels].

- Price Prediction Models: Various models, including those based on adoption rates, network growth, and historical price data, offer forecasts for Bitcoin's future price. These models suggest different timelines for reaching $100,000.

On-Chain Metrics and Network Activity

Analyzing on-chain data offers a deeper understanding of the Bitcoin network's health and growth.

- Transaction Volume: Higher transaction volume often indicates increased demand and potential price appreciation. [Insert chart showing transaction volume].

- Hash Rate: The hash rate reflects the computational power securing the Bitcoin network. A higher hash rate generally suggests a more secure and robust network. [Insert chart showing hash rate].

- Miner Revenue: Analyzing miner revenue can indicate profitability and network health, providing insights into future price potential.

Conclusion: The Future of Bitcoin and the $100,000 Question

While Trump's statements can undeniably influence Bitcoin's price in the short term, the path to $100,000 depends on a confluence of factors. Market adoption, technological advancements, macroeconomic conditions, and technical indicators all play significant roles. While a bullish scenario is certainly possible, it's essential to acknowledge the potential for bearish corrections. Reaching $100,000 Bitcoin is not guaranteed, but the possibility remains a significant driver for the cryptocurrency market.

Stay tuned for more updates on the potential of a $100,000 Bitcoin! Continue your Bitcoin journey by researching further into the technical indicators that influence its price. Share this article and join the conversation in the comments below!

Featured Posts

-

Rogues Cyclops Like Power Surge In New X Men Comics

May 08, 2025

Rogues Cyclops Like Power Surge In New X Men Comics

May 08, 2025 -

Analyst Sees Bitcoin Entering Rally Zone Chart Analysis May 6 2024

May 08, 2025

Analyst Sees Bitcoin Entering Rally Zone Chart Analysis May 6 2024

May 08, 2025 -

Bitcoins Recovery A Deeper Look At The Market Trend

May 08, 2025

Bitcoins Recovery A Deeper Look At The Market Trend

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Altering Appearance

May 08, 2025

Saturday Night Live And Counting Crows A Career Altering Appearance

May 08, 2025 -

Sve Opcije Na Stolu Grbovic O Formiranju Prelazne Vlade

May 08, 2025

Sve Opcije Na Stolu Grbovic O Formiranju Prelazne Vlade

May 08, 2025

Latest Posts

-

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025 -

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising This Week

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising This Week

May 08, 2025 -

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind This Weeks Rally

May 08, 2025

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind This Weeks Rally

May 08, 2025 -

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025 -

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025