11% Drop In Three Days: Amsterdam Stock Exchange Faces Continued Losses

Table of Contents

The Amsterdam Stock Exchange (AEX) has suffered a shocking 11% decline in just three trading days, sending shockwaves through the Dutch and European markets. This unprecedented fall has left investors reeling and sparked urgent questions about the underlying causes and the potential for further losses. This article delves into the factors contributing to this dramatic downturn, examining its impact and exploring potential future scenarios for the AEX. Keywords: Amsterdam Stock Exchange, AEX, stock market crash, stock market decline, investment losses, market volatility, Dutch economy, European markets, economic downturn

The Severity of the 11% Drop and its Immediate Impact

The 11% plunge represents a significant blow to the AEX, marking one of its steepest declines in recent memory. Let's assume, for illustrative purposes, that the AEX index fell from 750 points to 667.5 points over this three-day period. This dramatic shift has had immediate and far-reaching consequences:

- Impact on individual investors: Many investors have experienced substantial portfolio losses, leading to decreased confidence and prompting some to consider withdrawing their investments. The fear of further stock market decline is palpable.

- Impact on major Dutch companies listed on the AEX: Companies listed on the AEX, including major players in sectors like finance, energy, and technology, have seen their share prices plummet, impacting their valuations and potentially hindering future growth plans. This stock market crash has real-world implications for these businesses.

- Short-term consequences for the Dutch economy: The AEX decline reflects broader concerns about the health of the Dutch economy. Decreased investor confidence can lead to reduced investment and slower economic growth. The ripple effects of this stock market decline are yet to be fully assessed.

- Comparison to previous market drops in the AEX: While market volatility is normal, this 11% drop significantly surpasses the average fluctuations seen in recent years, raising concerns about the severity and potential duration of this downturn. Historical comparisons can help put the current situation in perspective.

Potential Causes Behind the Amsterdam Stock Exchange Decline

Several interconnected factors likely contributed to the AEX's sharp decline. Understanding these causes is crucial for navigating this period of market volatility:

- Global economic slowdown and its effect on European markets: A global economic slowdown, characterized by high inflation and rising interest rates, has dampened investor sentiment worldwide, impacting European markets, including the AEX. This global economic uncertainty is a significant contributing factor.

- Rising interest rates and their impact on stock valuations: Central banks' efforts to combat inflation through interest rate hikes have increased borrowing costs, reducing corporate profitability and making stocks less attractive to investors. This has significantly contributed to the stock market decline.

- Geopolitical factors (e.g., war in Ukraine, energy crisis) influencing investor sentiment: The ongoing war in Ukraine and the resulting energy crisis have heightened uncertainty and negatively affected investor confidence, leading to risk aversion and market sell-offs. These geopolitical factors play a crucial role in market instability.

- Specific sector downturns within the Dutch economy: Specific sectors within the Dutch economy might be experiencing unique challenges, contributing to the overall AEX decline. A detailed sectoral analysis is necessary for a complete understanding.

- Analysis of specific companies showing significant losses: Examining the performance of individual companies within the AEX can reveal specific vulnerabilities and provide a more granular understanding of the market downturn. Identifying these weaknesses is vital for future investment strategies.

The Role of Investor Sentiment and Market Volatility

The psychological aspect of market behavior plays a significant role in exacerbating downturns.

- Panic selling and its contribution to the rapid decline: Fear and panic selling by investors amplified the speed and severity of the AEX's decline, creating a self-fulfilling prophecy. Understanding this psychological element is crucial.

- Analysis of trading volume during the three-day period: High trading volumes during the three-day period suggest significant investor activity and a heightened level of market anxiety.

- Role of news and media coverage in shaping investor perceptions: News reports and media coverage can influence investor perceptions and exacerbate market volatility, contributing to both positive and negative feedback loops.

Analyzing the Long-Term Implications for the Amsterdam Stock Exchange

Predicting the future of the AEX is challenging, but a cautious outlook is warranted.

- Potential for further losses or a market recovery: The potential for further losses remains, depending on the evolution of the global economic situation and investor sentiment. A recovery is possible, but the timeline remains uncertain.

- Strategies for investors to manage risk and mitigate losses: Investors should diversify their portfolios, consider hedging strategies, and avoid impulsive decision-making. Professional financial advice is highly recommended.

- Expert opinions and predictions from financial analysts: Tracking the analysis and forecasts of financial experts can provide valuable insights into potential future scenarios for the AEX.

- Government interventions and possible policy responses: Government interventions to stimulate the economy or support specific sectors could influence the AEX's recovery trajectory.

Comparison to Other European Stock Exchanges

It's crucial to contextualize the AEX's performance within the broader European market.

- Comparison with similar indices like the DAX (Germany) or CAC 40 (France): Comparing the AEX's performance to other major European indices can reveal whether the decline is unique to the Netherlands or reflects broader European market trends.

- Identification of any shared factors or unique challenges facing the AEX: Identifying factors specific to the Dutch economy and the AEX can help understand the specific vulnerabilities and inform future strategies.

- Discussion on whether the AEX is underperforming or performing in line with European trends: Determining if the AEX is underperforming or aligning with general European market trends provides critical context and informs future investment decisions.

Conclusion

The 11% drop in the Amsterdam Stock Exchange over three days highlights significant market volatility and underscores the impact of global economic slowdown, investor sentiment, and geopolitical factors. The potential for further losses or a recovery remains uncertain, emphasizing the need for careful monitoring and considered investment strategies. The future trajectory of the AEX hinges on various interconnected factors, requiring close attention and informed decision-making.

Call to Action: Stay informed about the ongoing situation with the Amsterdam Stock Exchange. Monitor the AEX index closely and consider seeking professional financial advice before making any investment decisions. Further research on Amsterdam Stock Exchange performance is crucial for navigating this period of market volatility and making informed investment choices.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Key Considerations

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Key Considerations

May 25, 2025 -

Top 10 Fastest Production Ferraris Fiorano Track Times

May 25, 2025

Top 10 Fastest Production Ferraris Fiorano Track Times

May 25, 2025 -

Strong Dax Performance Frankfurt Equities Market Opening Update

May 25, 2025

Strong Dax Performance Frankfurt Equities Market Opening Update

May 25, 2025 -

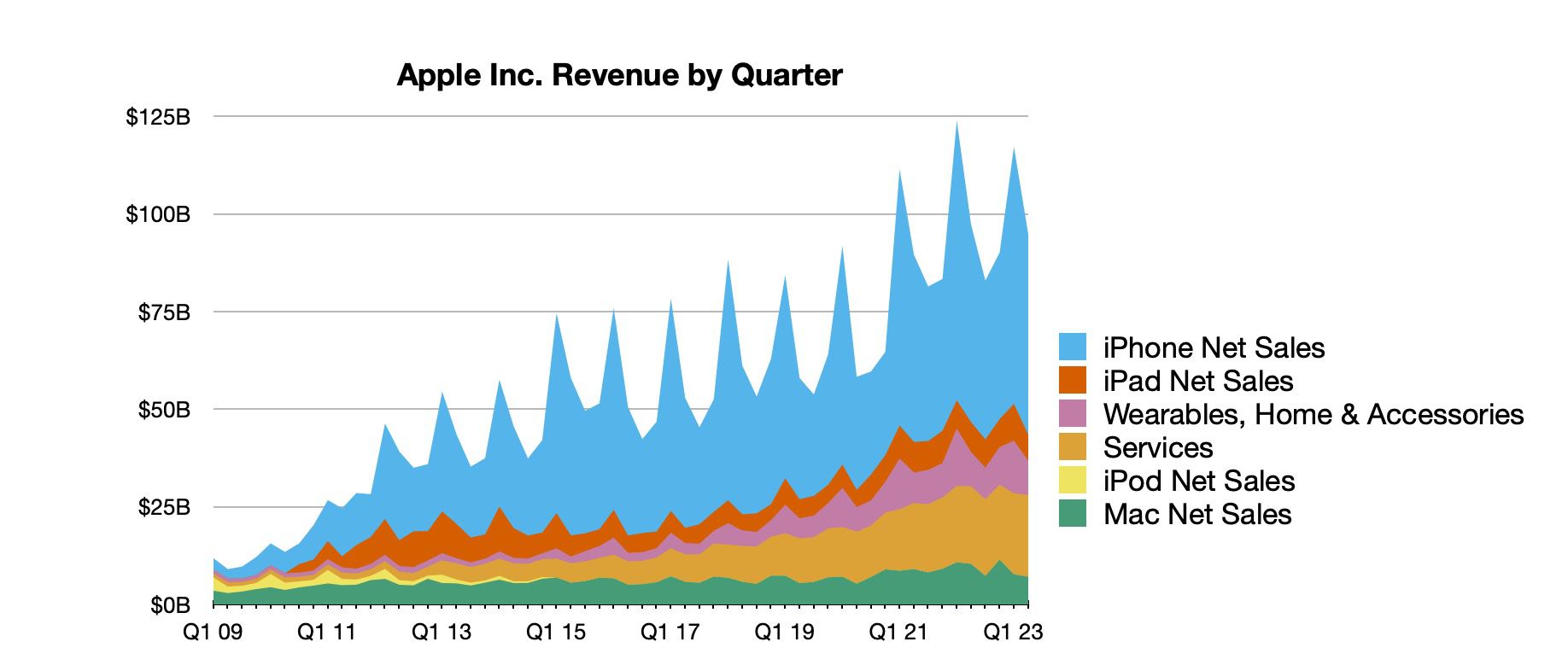

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025 -

Naujausias Porsche Elektromobiliu Ikrovimo Centras Vieta Ir Galimybes

May 25, 2025

Naujausias Porsche Elektromobiliu Ikrovimo Centras Vieta Ir Galimybes

May 25, 2025

Latest Posts

-

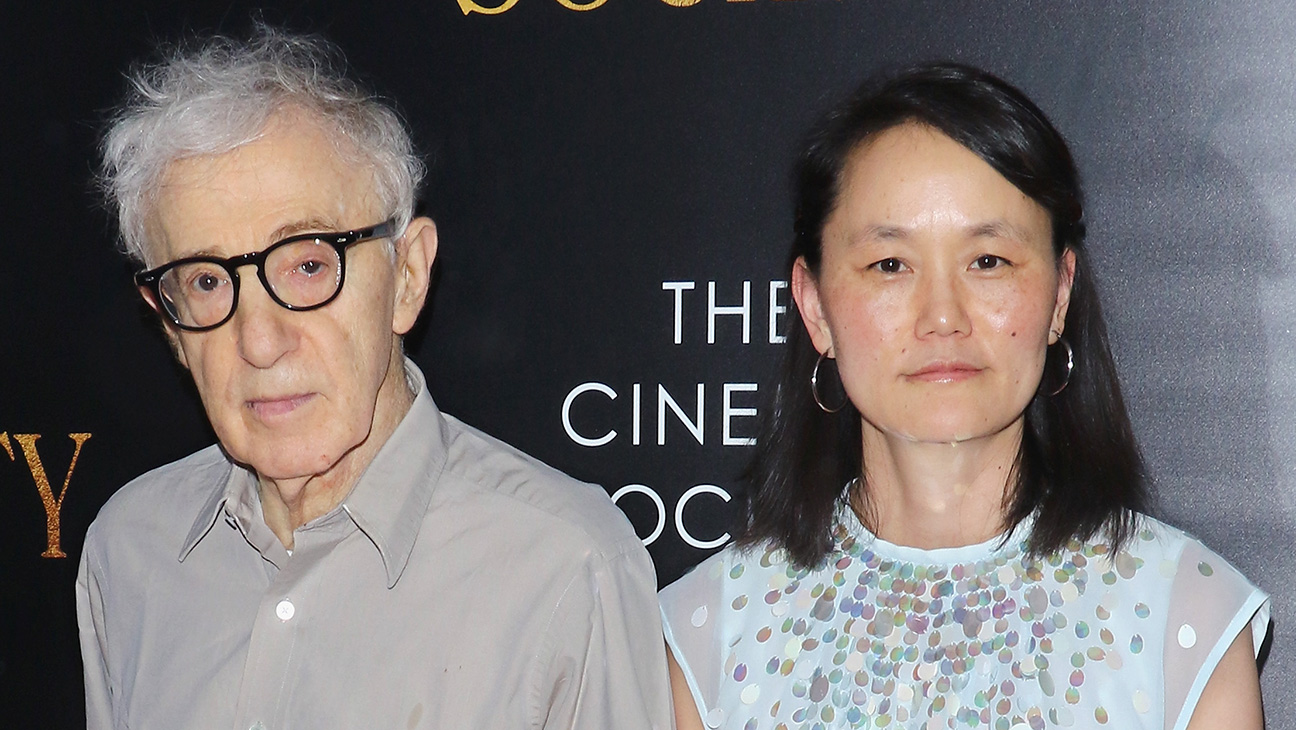

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

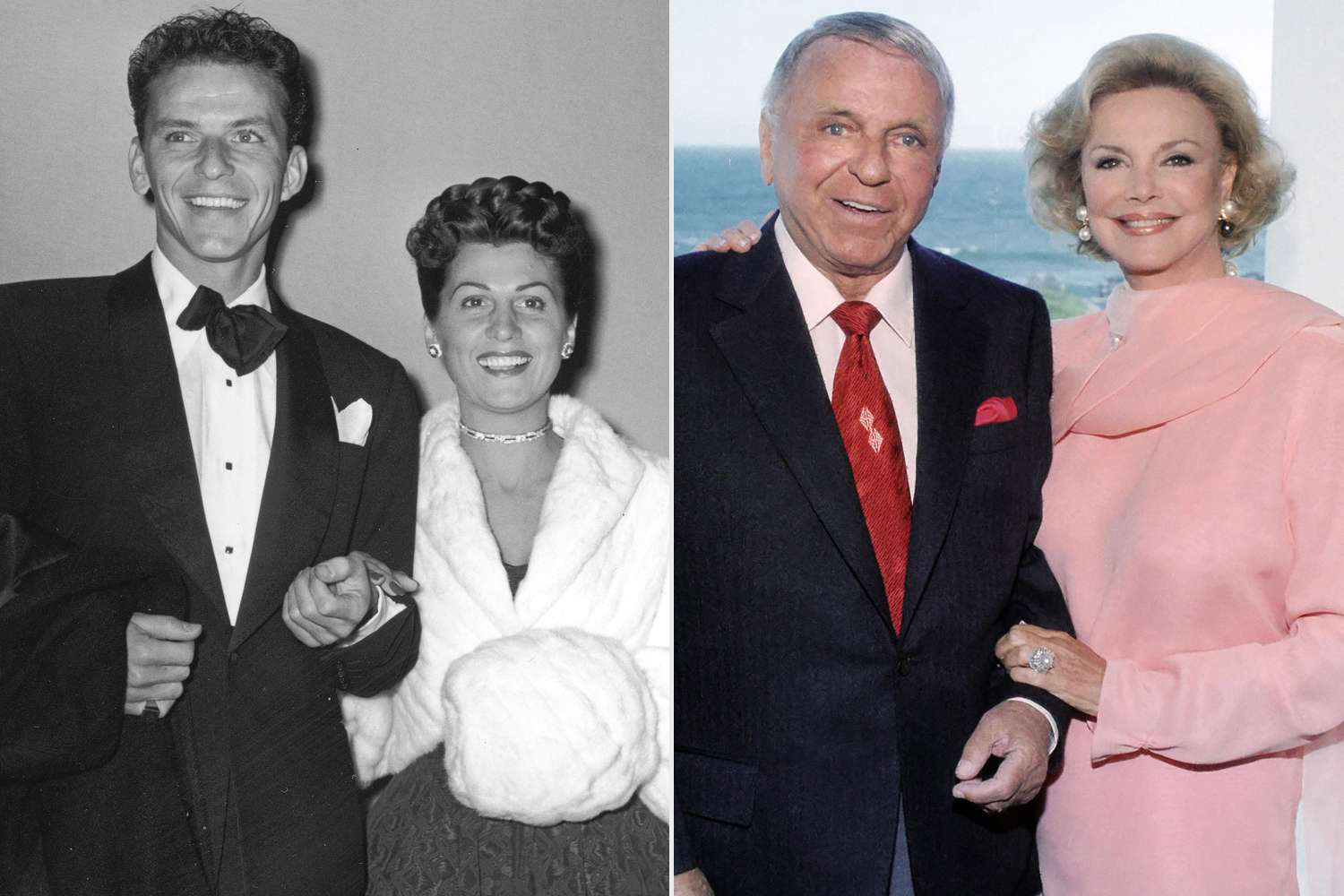

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025