Strong DAX Performance: Frankfurt Equities Market Opening Update

Table of Contents

Key Factors Driving Strong DAX Performance

Several converging factors have contributed to the impressive performance of the DAX today. Let's break down the most significant contributors:

Positive Corporate Earnings

The current earnings season has delivered robust results from many major DAX companies. Several key players have exceeded analysts' expectations, boosting investor confidence.

- Siemens: Reported significantly higher-than-expected revenue growth, driven by strong demand in its energy and industrial sectors.

- SAP: Announced impressive quarterly profits, exceeding forecasts thanks to robust cloud software sales.

- Volkswagen: Benefited from strong sales figures and positive industry trends, contributing to their positive earnings report.

These positive corporate profits showcase the underlying strength of the German economy and fuel optimism for future growth, directly impacting the DAX's upward trajectory. This strong showing in corporate profits during earnings season is a crucial driver of the current market sentiment.

Global Economic Indicators

Positive global economic indicators are further contributing to the DAX's strength. Easing inflation concerns in major economies and positive GDP growth reports have improved investor sentiment.

- The recent decrease in the inflation rate in several key economies has reduced concerns about aggressive interest rate hikes.

- Positive GDP growth projections for the Eurozone are boosting investor confidence in the region's economic outlook.

- Announcements from major central banks suggesting a more moderate approach to monetary policy have also contributed to the positive market mood.

These positive global economic indicators create a favorable environment for the DAX, fostering a more risk-on appetite amongst investors.

Investor Sentiment and Market Confidence

The overall market sentiment is undeniably bullish. Decreasing geopolitical risks and improved consumer confidence in Germany have played a significant role in this positive outlook. Investors are showing increased risk appetite, driving investments into the DAX.

- Reduced geopolitical uncertainty has alleviated some of the anxieties that have previously weighed on the market.

- Rising consumer confidence points to a healthy domestic demand, boosting the prospects of German companies.

- This combination of factors has created a virtuous cycle, encouraging further investment and driving the DAX's upward momentum.

Sector-Specific Performance within the DAX

The DAX's strong performance is not uniform across all sectors. Let's analyze the winners and losers:

Outperforming Sectors

Several sectors have significantly contributed to the DAX's gains:

- Technology Stocks: Companies in the technology sector have seen strong performance, driven by continued growth in software and digital services.

- Automotive Industry: The automotive sector has experienced a boost, largely due to positive sales figures and ongoing investments in electric vehicle technology.

- Industrial Stocks: Companies in the industrial sector have also performed well, reflecting positive global demand and supply chain improvements.

These sectors' robust performance highlights the diversification of the German economy and its capacity for sustained growth.

Underperforming Sectors

While most sectors are experiencing growth, some have lagged behind the overall market performance. These underperforming sectors provide valuable context for the overall DAX strength, illustrating a nuanced market performance rather than uniform growth.

Implications for Investors and Trading Strategies

The strong DAX performance presents both opportunities and risks for investors:

Opportunities and Risks

- Opportunities: The current market conditions present attractive investment opportunities for those seeking exposure to the German economy. However, careful risk management is essential.

- Risks: While the outlook is positive, investors should be aware of potential risks, including geopolitical instability, inflation fluctuations, and global economic slowdowns. Portfolio diversification is crucial.

Short-Term vs. Long-Term Outlook

The short-term outlook for the DAX remains positive, given the current market momentum. However, the long-term outlook will depend on various factors, including global economic conditions and the performance of German companies. Expert predictions suggest sustained, but potentially moderated, growth in the coming months.

Conclusion: Capitalizing on Strong DAX Performance in Frankfurt

The strong DAX performance today is driven by a confluence of factors: positive corporate earnings, favorable global economic indicators, and strong investor sentiment. This creates a positive outlook for German equities, with several sectors exhibiting robust growth. However, investors should approach the market with a balanced perspective, acknowledging both opportunities and inherent risks. Monitor DAX performance closely and consider incorporating DAX-related investments into your portfolio as part of a well-diversified strategy. Stay informed about market trends and consult with a financial advisor to make informed investment decisions related to the strong DAX and the Frankfurt equities market.

Featured Posts

-

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025 -

Pobeda Na Evrovidenii 2025 Prognoz Konchity Vurst I Chetyre Potentsialnykh Triumfatora

May 25, 2025

Pobeda Na Evrovidenii 2025 Prognoz Konchity Vurst I Chetyre Potentsialnykh Triumfatora

May 25, 2025 -

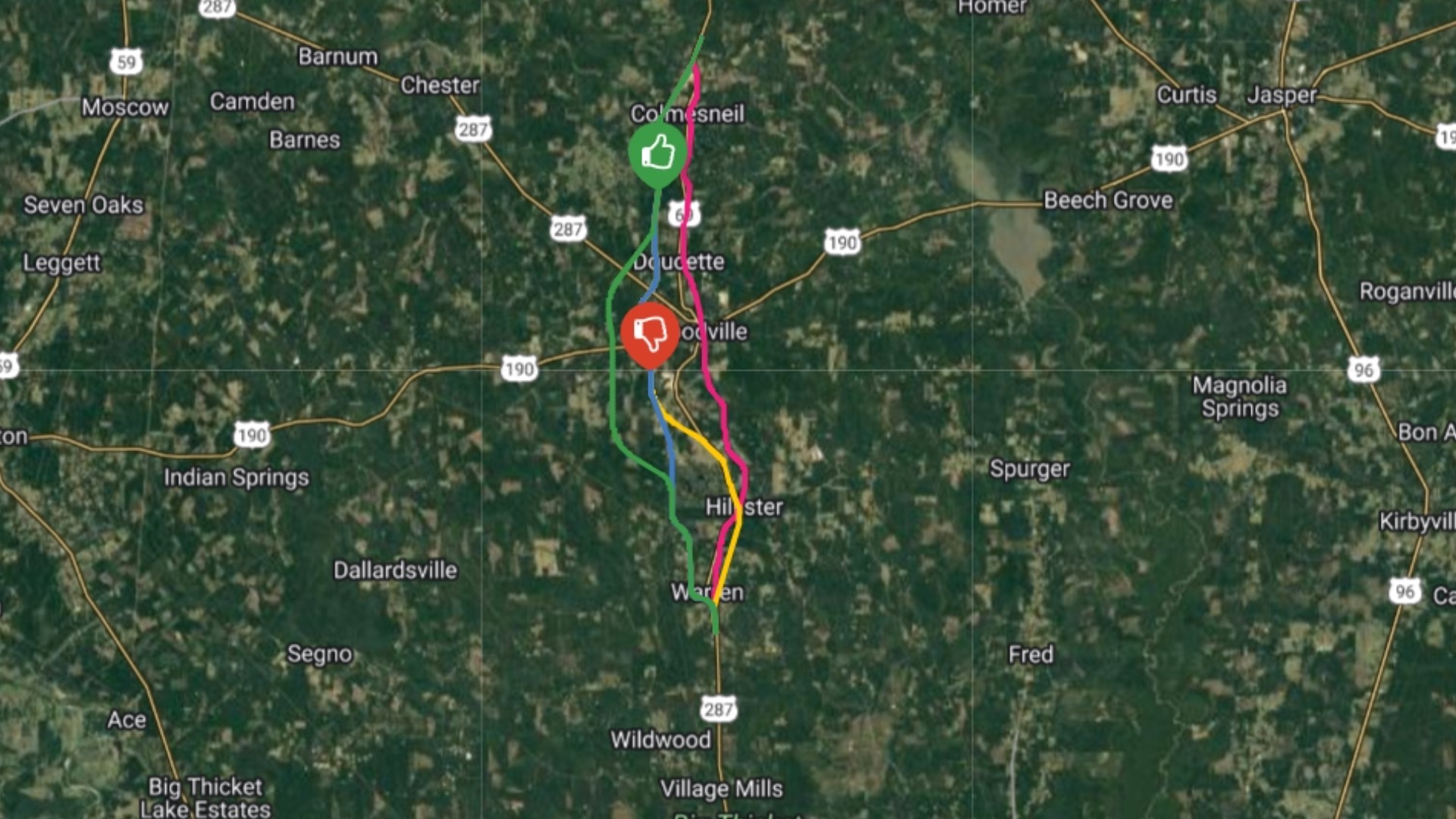

Unbuilt Roads Exploring The Proposed M62 Relief Route Through Bury

May 25, 2025

Unbuilt Roads Exploring The Proposed M62 Relief Route Through Bury

May 25, 2025 -

Planning Your Memorial Day Trip Smartest Days To Fly In 2025

May 25, 2025

Planning Your Memorial Day Trip Smartest Days To Fly In 2025

May 25, 2025 -

I Dazi Di Trump Come La Moda Italiana E Non Solo Ha Subito Le Conseguenze

May 25, 2025

I Dazi Di Trump Come La Moda Italiana E Non Solo Ha Subito Le Conseguenze

May 25, 2025

Latest Posts

-

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025 -

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025 -

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025 -

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025