7% Drop: Amsterdam Stock Market Hit Hard By Trade War Fears

Table of Contents

The Impact of Trade War Uncertainty on Investor Confidence

Trade war uncertainty significantly undermines investor confidence and drastically alters decision-making processes. The unpredictable nature of tariffs, sanctions, and retaliatory measures creates a climate of fear and uncertainty, making it challenging for investors to accurately assess risk and potential returns. This leads to several negative consequences:

- Increased market volatility: The Amsterdam stock market, along with global markets, has become significantly more volatile, experiencing sharp price swings as investors react to each new development in the trade war.

- Reduced investment in riskier assets: Investors are shifting away from riskier assets, such as stocks, and moving towards safer havens like government bonds and gold. This capital flight further exacerbates the downward pressure on the Amsterdam stock market.

- Capital flight to safer havens: Money is flowing out of the Amsterdam stock market and into perceived safer investments, contributing to the 7% drop. This is a common reaction to global uncertainty.

- Negative impact on consumer confidence: The uncertainty surrounding the trade war also negatively impacts consumer confidence, leading to decreased spending and potentially slowing economic growth in the Netherlands.

Specific concerns related to Dutch exports, particularly agricultural products and high-tech manufacturing, are fueling this anxiety. The potential for increased tariffs on Dutch goods in key export markets creates a significant threat to Dutch businesses and the overall economy, adding further pressure on the Amsterdam stock market.

Specific Sectors Hit Hardest by the 7% Drop

The 7% drop in the Amsterdam stock market didn't affect all sectors equally. Several industries are particularly vulnerable to trade war disruptions:

- Technology: Companies reliant on global supply chains and international trade are experiencing significant losses. Semiconductor manufacturers and technology firms are particularly exposed.

- Manufacturing: Dutch manufacturing companies, heavily reliant on exports, are facing increased costs and reduced demand due to trade tariffs and global uncertainty.

- Agriculture: The agricultural sector, a significant part of the Dutch economy, is vulnerable to trade disputes and potential retaliatory measures from other countries.

Analysis of stock performance within each sector reveals significant losses across the board. For instance, [Insert Example: Company X in the technology sector experienced a 10% drop], illustrating the sector's vulnerability. The imposition of tariffs and disruptions to global supply chains explain these sector-specific vulnerabilities. Charts and graphs detailing the sector-specific performance would further illustrate this point.

The Role of the Euro and Global Market Reactions

The weakening Euro has further exacerbated the pressure on the Amsterdam stock market. The correlation between Euro fluctuations and stock market performance is undeniable. A weaker Euro makes Dutch exports more competitive but also reduces the value of foreign investments held by Dutch companies and investors.

- Correlation between Euro fluctuations and stock market performance: Data clearly shows a negative correlation between the Euro's value and the Amsterdam stock market's performance.

- Comparison with other European stock markets’ reactions: While other European stock markets also experienced declines, the 7% drop in Amsterdam is significantly higher, indicating unique vulnerabilities.

- Analysis of global market reactions to trade war escalations: Global markets reacted negatively to escalating trade tensions, with widespread declines across major indices. This global trend clearly influenced the Amsterdam market's decline.

Government and Central Bank Responses to the 7% Stock Market Drop

The Dutch government and the European Central Bank (ECB) are actively monitoring the situation and considering potential responses to mitigate the impact of the trade war.

- Potential fiscal stimulus measures: The government may consider fiscal stimulus measures, such as tax cuts or increased government spending, to boost economic activity.

- Monetary policy adjustments: The ECB might adjust its monetary policy, potentially lowering interest rates further to encourage borrowing and investment.

- Statements from government officials and central bankers: Statements from officials will offer clues to the likely policy response.

The effectiveness of these responses will depend on the severity and duration of the trade war and its impact on investor confidence and consumer spending.

Potential Long-Term Consequences of the Amsterdam Stock Market Decline

The 7% drop in the Amsterdam stock market and the ongoing trade uncertainty could have significant long-term economic repercussions:

- Impact on economic growth: A prolonged period of uncertainty could stifle economic growth in the Netherlands, leading to lower GDP figures.

- Job losses and unemployment: Companies affected by the trade war may be forced to reduce their workforce, resulting in job losses and increased unemployment.

- Potential for further market corrections: The current drop could be just the beginning of further market corrections if trade tensions continue to escalate.

Expert opinions suggest a cautious outlook. The future of the Amsterdam stock market remains uncertain, depending heavily on the resolution of global trade disputes.

Navigating the Uncertainties: The Future of the Amsterdam Stock Market After the 7% Drop

In summary, the 7% drop in the Amsterdam stock market is a direct consequence of escalating trade war fears and their impact on investor confidence, specifically impacting sectors like technology, manufacturing, and agriculture. The weakening Euro and global market reactions have further amplified this decline. While government and central bank responses are being considered, the potential long-term consequences, including reduced economic growth and job losses, remain significant concerns.

The key takeaway is the significant impact of trade war uncertainty on the Amsterdam stock market and global markets. This event highlights the interconnectedness of the global economy and the vulnerability of even strong economies to external shocks.

Stay updated on developments affecting the Amsterdam stock market and global trade to mitigate risks associated with future market volatility. Careful monitoring of investments and diversification are crucial strategies in navigating the uncertainties presented by the ongoing trade war and its potential impact on the Amsterdam stock market.

Featured Posts

-

Matt Maltese Discusses His Sixth Album Her And Themes Of Intimacy And Growth

May 24, 2025

Matt Maltese Discusses His Sixth Album Her And Themes Of Intimacy And Growth

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Escape To The Country Top Destinations And Hidden Gems

May 24, 2025

Escape To The Country Top Destinations And Hidden Gems

May 24, 2025 -

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025 -

Dazi Stati Uniti Proiezioni Sui Prezzi Del Tessile E Dell Abbigliamento

May 24, 2025

Dazi Stati Uniti Proiezioni Sui Prezzi Del Tessile E Dell Abbigliamento

May 24, 2025

Latest Posts

-

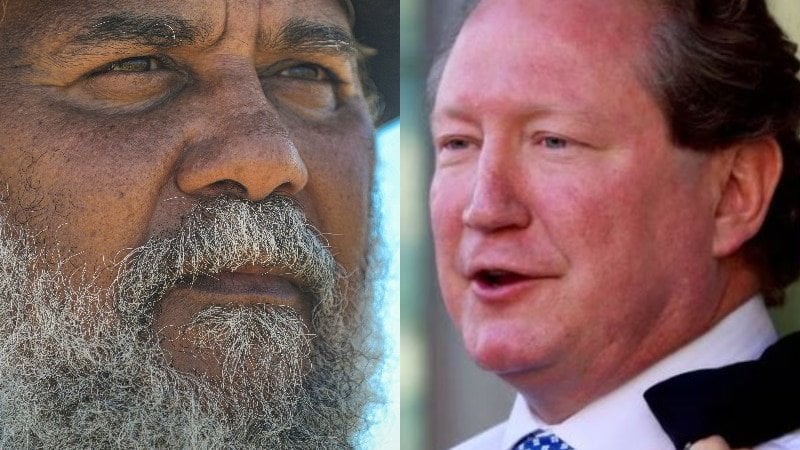

Rio Tinto And The Pilbara A Clash Over Environmental Stewardship

May 24, 2025

Rio Tinto And The Pilbara A Clash Over Environmental Stewardship

May 24, 2025 -

Slowing Growth Forces Sse To Cut 3 Billion From Spending Budget

May 24, 2025

Slowing Growth Forces Sse To Cut 3 Billion From Spending Budget

May 24, 2025 -

Andrew Forrests Pilbara Concerns Rio Tintos Counterarguments

May 24, 2025

Andrew Forrests Pilbara Concerns Rio Tintos Counterarguments

May 24, 2025 -

Analysis Sses 3 Billion Spending Reduction And Its Consequences

May 24, 2025

Analysis Sses 3 Billion Spending Reduction And Its Consequences

May 24, 2025 -

Pilbaras Future Rio Tinto Responds To Environmental Concerns Raised By Andrew Forrest

May 24, 2025

Pilbaras Future Rio Tinto Responds To Environmental Concerns Raised By Andrew Forrest

May 24, 2025