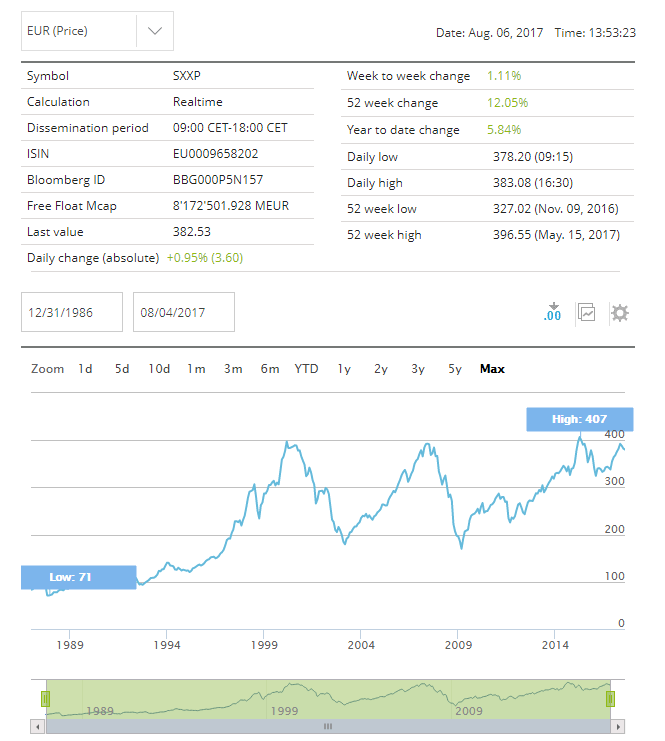

7% Plunge: Amsterdam Stock Market Reeling From Trade War Intensification

Table of Contents

Trade War's Impact on Dutch Exports

The escalating trade war has dealt a heavy blow to the Dutch economy, significantly impacting its export-oriented sectors. The Netherlands, known for its highly developed and specialized industries, is particularly vulnerable to global trade disruptions.

Decline in Semiconductor and Technology Exports

The Netherlands is a major player in semiconductor manufacturing and technology exports. The current trade tensions are severely impacting this crucial sector.

- Decreased demand from China and the US: Major markets for Dutch semiconductor and technology products are experiencing reduced demand due to tariffs and trade restrictions.

- Supply chain disruptions: The complex global supply chains for these products are being disrupted, leading to delays and increased costs.

- Loss of market share to competitors: Companies in countries not subject to the same trade restrictions are gaining market share, putting pressure on Dutch firms.

The impact is substantial. Preliminary estimates suggest a 15% decrease in semiconductor export volume in Q3 2023, affecting major players like ASML and NXP Semiconductors. This translates to millions of Euros in lost revenue and threatens thousands of jobs within the Amsterdam Stock Market's technology sector.

Agricultural Sector Vulnerability

The Dutch agricultural sector, renowned for its efficiency and high-quality produce, is also feeling the pinch. Tariffs and trade disputes are limiting access to key markets and increasing production costs.

- Reduced access to key markets: Tariffs imposed by trading partners are making Dutch agricultural products less competitive.

- Increased production costs: Trade disputes are driving up the cost of inputs, such as fertilizers and feed, impacting profitability.

- Price volatility: Uncertainty in the global market is causing price fluctuations, making it difficult for farmers to plan and invest.

Specifically, the dairy and horticultural sectors are experiencing the most significant impact, with a projected 10% decrease in export value for dairy products and a 5% decrease for horticultural exports in the coming quarter. These impacts are directly reflected in the performance of companies within the Amsterdam Stock Market linked to these sectors.

Investor Sentiment and Market Volatility

The escalating trade war has profoundly impacted investor sentiment, leading to increased market volatility and a "flight to safety."

Flight to Safety

The uncertainty surrounding the trade war is causing investors to move their capital away from riskier assets, including Amsterdam-listed stocks, towards safer havens.

- Reduced investor confidence: The ongoing trade tensions have eroded confidence in the global economy, impacting investment decisions.

- Increased market uncertainty: The unpredictable nature of the trade war makes it difficult for investors to forecast future market performance.

- Capital flight to safer assets: Investors are shifting their funds to less volatile assets like government bonds and gold.

This "flight to safety" is evident in the increased trading volume of government bonds and a significant drop in trading volume for Amsterdam Stock Market equities, indicating a risk-averse market sentiment.

Impact on Foreign Investment

The market downturn is likely to deter foreign investment in the Netherlands, further hindering economic growth and impacting the Amsterdam Stock Market.

- Decreased attractiveness of Dutch assets: The current market volatility makes Dutch assets less appealing to foreign investors.

- Reduced foreign direct investment: Companies are less likely to invest in countries facing economic uncertainty.

- Impact on future economic prospects: Reduced foreign investment could negatively impact long-term economic growth and job creation.

This potential decrease in foreign direct investment poses a significant threat to the long-term health of the Amsterdam Stock Market and the Dutch economy as a whole.

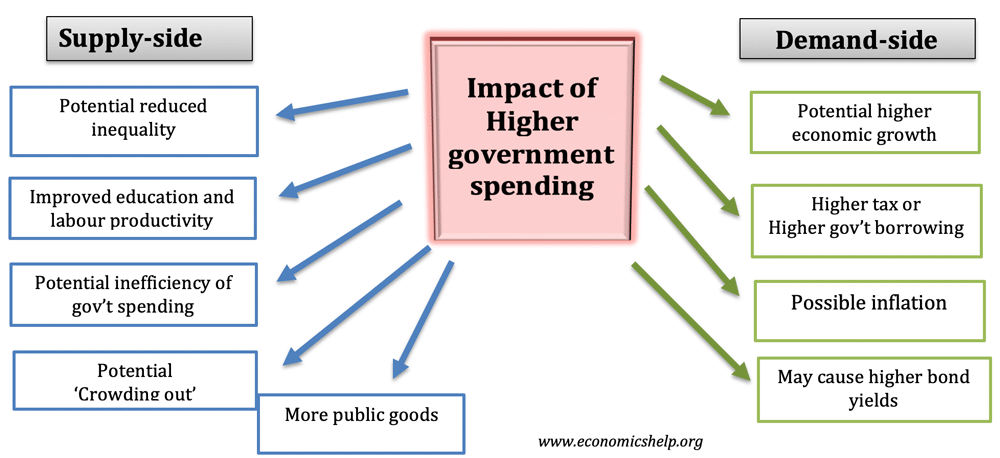

Government Response and Potential Mitigation Strategies

The Dutch government is likely to take steps to stabilize the market and support affected businesses. The central bank may also intervene to manage liquidity and interest rates.

Government Intervention Measures

The government could implement various measures to alleviate the negative impact of the trade war on the Amsterdam Stock Market.

- Potential tax breaks: Tax incentives could be offered to businesses to encourage investment and job creation.

- Financial aid packages: Government aid packages could support struggling businesses in export-oriented sectors.

- Support for export-oriented industries: Targeted programs could help Dutch companies adapt to the changing global trade landscape.

Central Bank Actions

The Dutch central bank (De Nederlandsche Bank) might take steps to inject liquidity into the market or adjust interest rates to mitigate the negative impact on the Amsterdam Stock Market.

- Interest rate adjustments: Lowering interest rates could stimulate borrowing and investment.

- Quantitative easing measures: The central bank could purchase government bonds to increase the money supply.

- Liquidity injections: The central bank could inject liquidity into the financial system to ensure market stability.

These actions, while potentially effective, also carry risks and need to be carefully considered within the context of the overall economic environment.

Conclusion

The 7% plunge in the Amsterdam Stock Market underscores the significant impact of the intensifying trade war on even the most robust economies. The decline in exports, investor uncertainty, and potential for reduced foreign investment present considerable challenges. While the Dutch government and central bank may implement mitigating strategies, navigating this volatile period requires careful monitoring and strategic planning. Stay informed about developments in the Amsterdam Stock Market and consider diversifying your investment portfolio to mitigate risks associated with escalating trade tensions. Understanding the intricacies of the Amsterdam stock market’s response to global events is crucial for informed decision-making in these uncertain times.

Featured Posts

-

Trogatelniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Trogatelniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025 -

Avrupa Piyasalarinda Gerileme Stoxx Europe 600 Ve Dax 40 In Performansi 16 Nisan 2025

May 24, 2025

Avrupa Piyasalarinda Gerileme Stoxx Europe 600 Ve Dax 40 In Performansi 16 Nisan 2025

May 24, 2025 -

Brazils Banking Industry Brb And Banco Masters Strategic Merger

May 24, 2025

Brazils Banking Industry Brb And Banco Masters Strategic Merger

May 24, 2025 -

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025 -

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025

Latest Posts

-

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 24, 2025

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 24, 2025 -

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025 -

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025 -

Discover The Countrys Top New Business Locations A Geographic Overview

May 24, 2025

Discover The Countrys Top New Business Locations A Geographic Overview

May 24, 2025