Brazil's Banking Industry: BRB And Banco Master's Strategic Merger

Table of Contents

The Rationale Behind the BRB and Banco Master Merger

The merger between BRB and Banco Master is driven by a strategic vision focused on achieving significant synergies and expanding market share within the competitive Brazilian banking industry. Both institutions stand to gain considerably from this consolidation.

For BRB, the merger offers a pathway to accelerated growth and expansion beyond its existing regional stronghold. This bank merger in Brazil allows them to leverage Banco Master's expertise and infrastructure to reach new customer segments and geographical areas. Banco Master, on the other hand, gains access to BRB's extensive customer base and robust branch network, significantly boosting its market presence and operational capabilities.

- Increased market share in key Brazilian regions: The combined entity will command a larger share of the market, particularly in regions where both banks have a strong presence.

- Enhanced product offerings and diversification: By integrating their product portfolios, they can offer a wider range of financial services to cater to a broader customer base, from retail banking to specialized financial products.

- Cost synergies through operational efficiencies: Combining operations will lead to cost reductions through economies of scale, streamlining processes, and eliminating redundancies. This improved efficiency will contribute to higher profitability.

- Improved technological infrastructure and digital banking capabilities: The merger allows for investment in advanced technology and digital banking solutions, enhancing customer experience and operational efficiency.

- Access to a wider customer base: The combined entity gains access to a significantly larger pool of customers, providing opportunities for cross-selling and increased revenue streams.

- Strengthened competitive advantage against larger players in the Brazilian banking market: The merger creates a more powerful competitor capable of challenging the dominance of larger, established banks in the Brazilian banking sector.

Impact on the Brazilian Banking Landscape

The BRB and Banco Master merger will undoubtedly leave its mark on the competitive dynamics of Brazil's banking sector. The implications are multifaceted, affecting market competition, financial stability, and economic growth.

The increased market share of the merged entity will likely intensify competition, potentially leading to more innovative products, improved customer service, and potentially more competitive pricing for consumers. However, there is also a potential risk to smaller banks and credit unions, who might face increased pressure from this newly formed financial giant.

- Increased competition leading to better services and pricing for consumers: This is a positive outcome for the end consumer, fostering a more customer-centric approach within the market.

- Potential impact on smaller banks and credit unions: Smaller institutions may face challenges competing with the larger, more resource-rich merged entity.

- Increased financial stability due to a larger, more resilient institution: The combined entity will be better positioned to withstand economic downturns and financial shocks, contributing to overall stability within the Brazilian banking system.

- The role of regulatory bodies in overseeing the merger process: Regulatory bodies will play a crucial role in ensuring a smooth transition and maintaining fair competition within the market. Their oversight is vital for maintaining the stability of the Brazilian banking sector.

- Potential long-term effects on the Brazilian economy: The merger's long-term impact on the Brazilian economy will depend on its success in stimulating growth, innovation, and efficient resource allocation.

BRB and Banco Master's Individual Strengths and Synergies

The success of this bank merger in Brazil hinges on the complementary strengths of BRB and Banco Master. BRB brings a strong regional presence and established customer base, while Banco Master contributes expertise in specific financial niches.

- BRB's strong regional presence and customer base: This provides a solid foundation for expansion and market penetration.

- Banco Master's expertise in specific financial niches (e.g., SME lending, digital banking): This specialization enhances the combined entity's product offerings and market reach.

- Synergies in technology, operations, and human resources: These synergies will drive operational efficiencies and cost reductions.

- Creation of a more diversified and resilient financial institution: This reduces the impact of risks associated with relying on a single market segment.

- Enhanced capacity for innovation and expansion: The merger provides the resources and expertise necessary for further growth and innovation within the Brazilian banking sector.

Challenges and Potential Risks Associated with the Merger

While the merger presents significant opportunities, several challenges and potential risks need careful consideration. Successful integration will require meticulous planning and execution.

- Integrating disparate IT systems and operational processes: This is a complex undertaking requiring significant investment and expertise.

- Managing cultural differences between the two organizations: Merging two distinct corporate cultures can lead to friction and reduced efficiency if not managed effectively.

- Navigating complex regulatory requirements: The merger process will be subject to stringent regulatory scrutiny, requiring careful compliance.

- Potential customer attrition during the transition phase: Changes during the merger process might cause some customers to switch to other banks.

- The risk of unforeseen operational issues: Unforeseen complications during the integration phase can disrupt operations and negatively impact performance.

Conclusion

The merger of BRB and Banco Master represents a significant event in Brazil's banking industry, with the potential to reshape the competitive landscape and bring about significant benefits. This bank merger in Brazil holds the promise of increased efficiency, expanded financial services, and a stronger, more resilient player in the market. While challenges related to integration and regulatory compliance exist, the combined strengths of both entities suggest a promising future. Understanding the rationale, impact, and potential risks associated with this strategic merger is crucial for stakeholders across the Brazilian financial sector.

Call to Action: Stay informed about the ongoing developments in Brazil's banking industry and the impact of the BRB and Banco Master merger. Follow our blog for further analysis and insights into the Brazilian banking sector and other significant bank mergers in Brazil.

Featured Posts

-

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025 -

Demna Gvasalia Reshaping The Gucci Brand Identity

May 24, 2025

Demna Gvasalia Reshaping The Gucci Brand Identity

May 24, 2025 -

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc What You Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc What You Need To Know

May 24, 2025 -

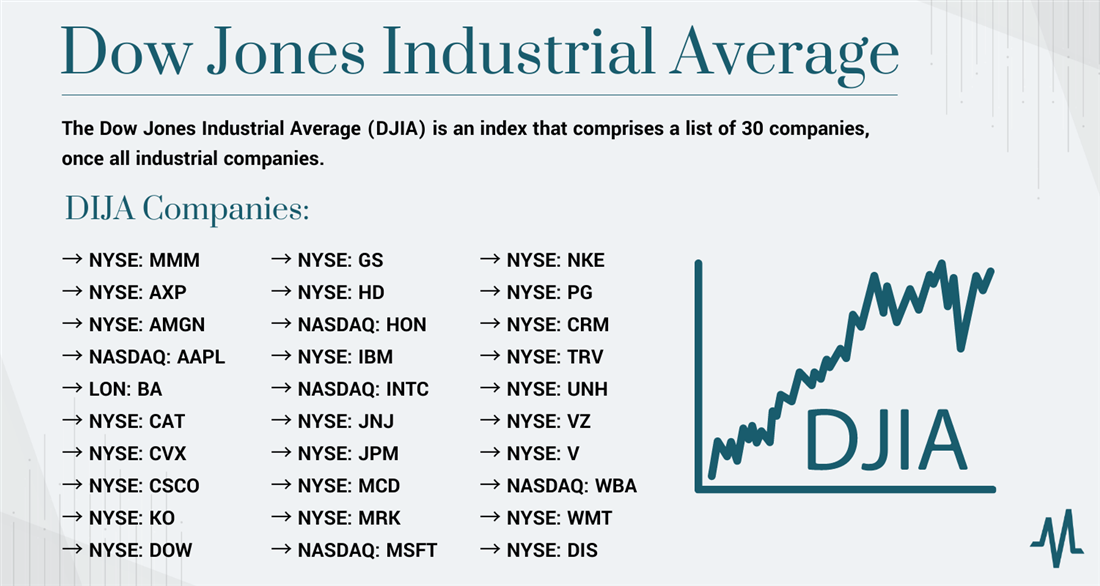

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Latest Posts

-

Exploring Growth Opportunities Bangladesh And Europes Collaborative Future

May 24, 2025

Exploring Growth Opportunities Bangladesh And Europes Collaborative Future

May 24, 2025 -

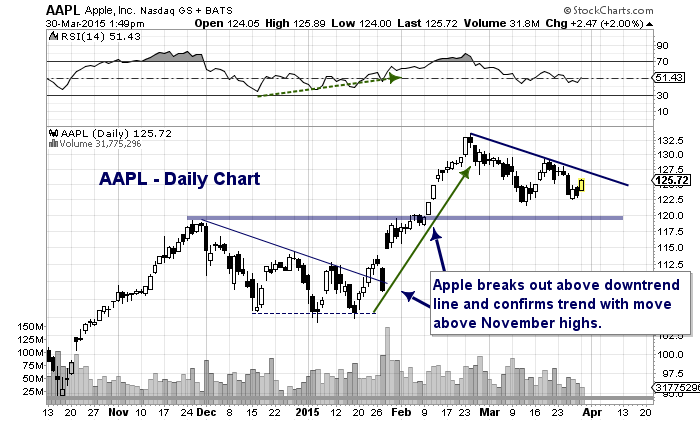

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025 -

Analyzing Wedbushs Apple Price Target Cut And Long Term Outlook

May 24, 2025

Analyzing Wedbushs Apple Price Target Cut And Long Term Outlook

May 24, 2025 -

New Opportunities Bangladesh And Europes Focus On Collaborative Growth

May 24, 2025

New Opportunities Bangladesh And Europes Focus On Collaborative Growth

May 24, 2025 -

The Woody Allen Controversy Sean Penns Support And The Publics Reaction

May 24, 2025

The Woody Allen Controversy Sean Penns Support And The Publics Reaction

May 24, 2025