Amsterdam Exchange Suffers Significant Losses

Table of Contents

The Amsterdam stock exchange has recently suffered significant losses, sending shockwaves through the financial markets. This unprecedented downturn raises serious concerns about market stability and investor confidence. This article will analyze the key factors contributing to these losses, explore their implications, and discuss potential recovery strategies. Understanding the complexities surrounding these Amsterdam exchange losses is crucial for investors and economists alike.

Causes of the Amsterdam Exchange Losses

Global Market Volatility

The current instability in the global economy has significantly impacted the Amsterdam exchange. Rising inflation, geopolitical tensions particularly stemming from the ongoing war in Ukraine, an energy crisis, and aggressive interest rate hikes by central banks worldwide have created a perfect storm of uncertainty. This uncertainty has led to significant capital flight from riskier assets, impacting the Amsterdam exchange's performance.

- Rising inflation: Eroding purchasing power and decreasing consumer spending.

- Geopolitical tensions (e.g., war in Ukraine): Disrupting supply chains and increasing energy prices.

- Energy crisis: Leading to higher production costs and reduced economic activity.

- Interest rate hikes: Increasing borrowing costs and dampening investment.

Data from the Euronext Amsterdam index shows a [insert percentage]% drop in the last [insert timeframe], reflecting the severity of the global market downturn.

Specific Sectoral Downturns

Several sectors listed on the Amsterdam exchange have been disproportionately affected. The technology sector, for example, has experienced significant losses due to decreased investor appetite for high-growth stocks in a rising interest rate environment. Similarly, the energy sector has faced challenges due to volatile energy prices and increased regulatory scrutiny.

- Technology sector: Companies reliant on venture capital funding have seen valuations plummet. For example, [Company A] experienced a [percentage]% loss, largely attributed to [reason]. [Link to relevant news article].

- Energy sector: Fluctuating oil and gas prices have severely impacted profitability for energy companies listed on the Amsterdam exchange. [Company B] reported a [percentage]% decline due to [reason]. [Link to relevant financial report].

Decreased Investor Confidence

Reduced investor confidence has played a significant role in exacerbating the losses on the Amsterdam exchange. Negative news coverage surrounding global economic uncertainty and regulatory changes has led to a decrease in trading volume and a flight to safety among investors. This lack of confidence has created a vicious cycle, where declining prices further erode investor sentiment.

- Negative news coverage: Amplifying fears and anxieties among investors.

- Regulatory changes: Creating uncertainty and impacting investor decisions.

- Decreased trading volume: Reducing liquidity and increasing price volatility.

Impacts of the Amsterdam Exchange Losses

Impact on Individual Investors

The losses on the Amsterdam exchange have had a direct and substantial impact on individual investors who hold assets listed on the exchange. Many have experienced a significant decrease in the value of their portfolios, potentially affecting their savings and retirement plans.

- Potential loss of savings: Eroding the value of investments and savings held in the market.

- Decreased retirement fund values: Impacting long-term financial security for retirees.

Impact on the Dutch Economy

The downturn on the Amsterdam exchange has broader implications for the Dutch economy. Decreased market capitalization can lead to reduced GDP growth, potential job losses in related sectors (finance, technology), and a decline in government revenue through reduced corporate taxes.

- Decreased GDP growth: Reflecting a slowdown in economic activity.

- Potential job losses: Especially in sectors heavily reliant on the stock market's performance.

- Impact on government revenue: Reducing tax revenues and potentially impacting government spending.

Impact on International Markets

The losses on the Amsterdam exchange are not isolated; they have a ripple effect on other global financial markets. The decreased investor confidence and potential contagion effect can spread to other exchanges, impacting global market stability.

- Potential contagion effect: Spreading uncertainty and impacting other markets.

- Impact on investor confidence worldwide: Creating a more cautious and risk-averse investment environment.

Potential Recovery Strategies

Government Intervention

The Dutch government may need to implement fiscal stimulus measures to boost economic activity and support businesses affected by the downturn. This could involve tax cuts, increased government spending on infrastructure projects, or direct financial aid to struggling companies.

Central Bank Actions

The Dutch central bank (De Nederlandsche Bank) may consider implementing measures to stimulate the economy, such as lowering interest rates to encourage borrowing and investment. However, this must be carefully balanced with inflation concerns.

Long-Term Market Adjustments

Long-term stability requires structural reforms and adjustments. This could involve regulatory changes to improve market transparency and investor protection, as well as initiatives to promote sustainable and responsible investment practices.

Conclusion

The significant losses suffered by the Amsterdam exchange are a result of a complex interplay of global market volatility, sectoral downturns, and decreased investor confidence. These losses have far-reaching consequences for individual investors, the Dutch economy, and international markets. Addressing these challenges requires a multifaceted approach, including government intervention, central bank actions, and long-term market adjustments.

Call to Action: Stay informed about the evolving situation on the Amsterdam exchange. Continue to monitor news and analyses related to the Amsterdam exchange losses to make informed investment decisions and understand the potential impact on the broader global economy. Understanding the factors contributing to the Amsterdam exchange losses is crucial for navigating the current financial climate.

Featured Posts

-

Avrupa Borsalarinda Karisik Seyir

May 24, 2025

Avrupa Borsalarinda Karisik Seyir

May 24, 2025 -

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup Details

May 24, 2025

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup Details

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025 -

Konchita Vurst Kak Se Promeni Bradatata Pobeditelka Ot Evroviziya

May 24, 2025

Konchita Vurst Kak Se Promeni Bradatata Pobeditelka Ot Evroviziya

May 24, 2025 -

French Elections 2027 Bardellas Path To Power

May 24, 2025

French Elections 2027 Bardellas Path To Power

May 24, 2025

Latest Posts

-

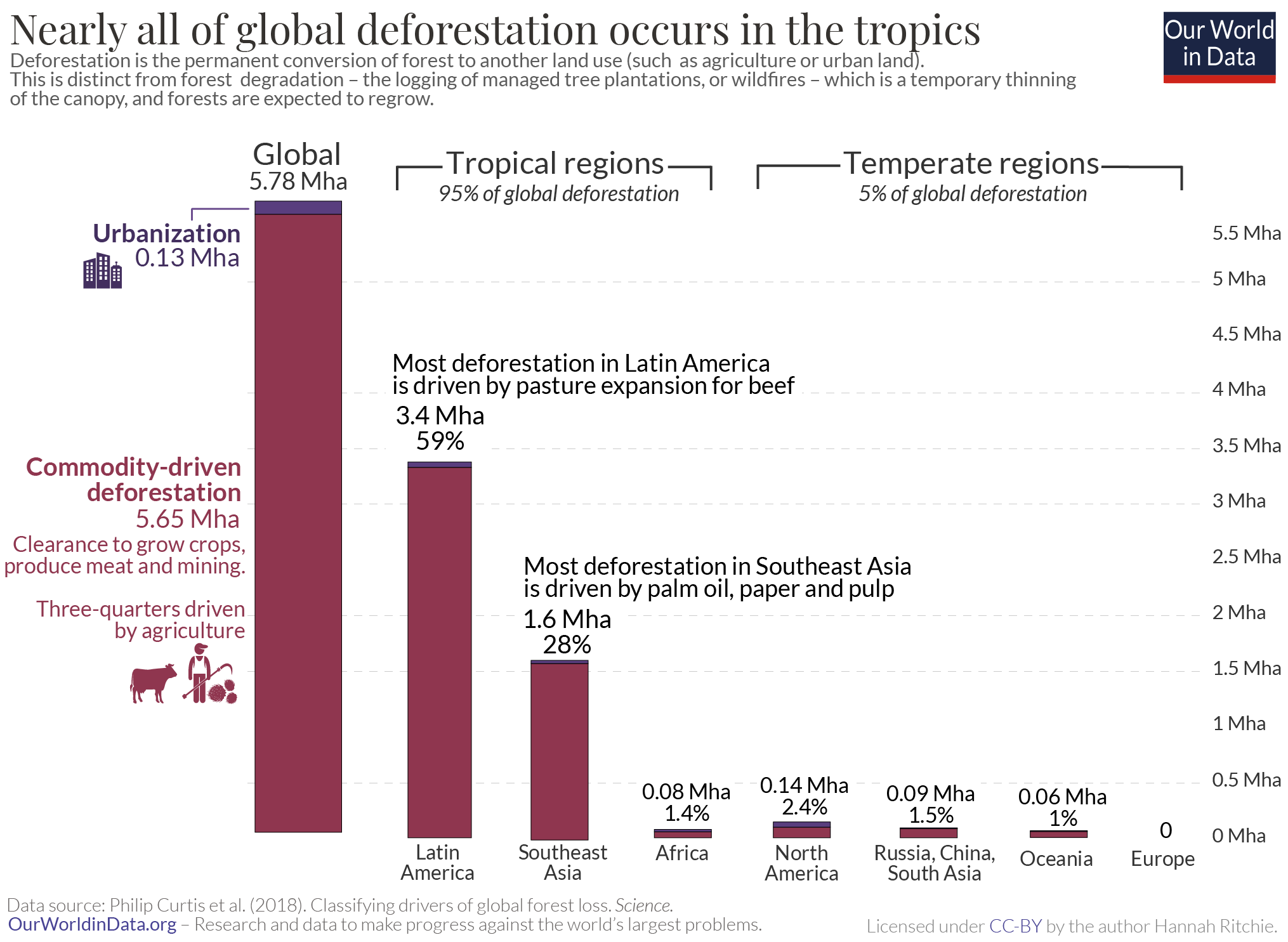

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025 -

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025 -

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025 -

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025 -

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025