Amsterdam Stock Market Opens Down 7% Amidst Intensifying Trade War Concerns

Table of Contents

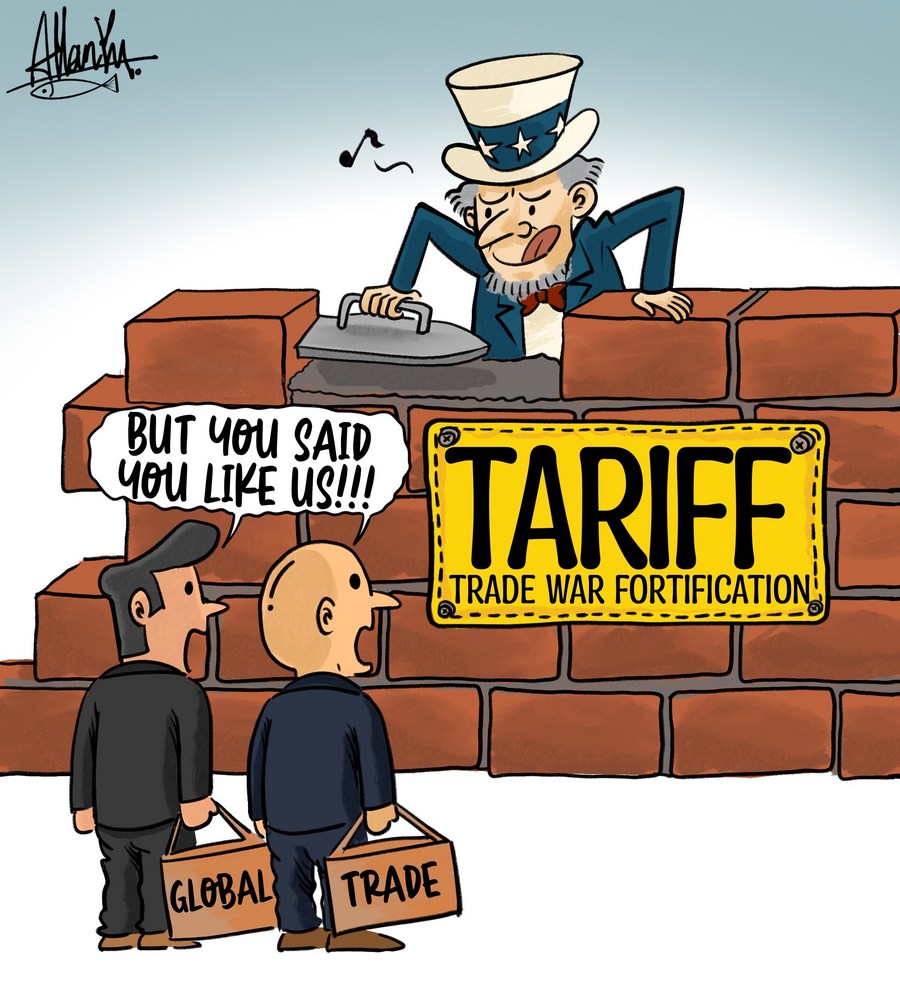

Trade War as the Primary Catalyst

The ongoing global trade war, characterized by escalating tariffs and trade restrictions between major economic powers, is the primary catalyst for the Amsterdam stock market's sharp decline. This uncertainty significantly impacts global markets, and the Netherlands, with its export-oriented economy, is particularly vulnerable.

-

Rising tariffs impacting Dutch exports: Sectors like Dutch agriculture (especially dairy and flowers), technology, and manufacturing are experiencing significant challenges due to increased tariffs imposed by trading partners. These tariffs increase the cost of Dutch goods, making them less competitive in the global marketplace.

-

Uncertainty surrounding future trade agreements deterring investment: The lack of clarity regarding future trade deals creates an environment of uncertainty, discouraging both domestic and foreign investment in the Netherlands. Businesses are hesitant to commit to long-term projects when the future trading landscape remains unclear.

-

Reduced consumer confidence due to trade war anxieties: The trade war's negative impact on global economic growth has led to reduced consumer confidence. This translates into decreased spending, impacting businesses reliant on domestic consumption.

-

Negative impact on supply chains affecting Dutch businesses: Many Dutch companies rely on global supply chains. Trade disruptions caused by the trade war lead to delays, increased costs, and potential shortages of essential raw materials and components, further impacting profitability.

Impact on Specific Amsterdam-Listed Companies

The 7% drop wasn't evenly distributed across all sectors. Several Amsterdam-listed companies were hit harder than others.

-

Examples of companies with significant drops in share price: (While specific company data requires real-time information, examples could include companies heavily involved in export-oriented sectors like ASML Holding (technology), Unilever (consumer goods with international operations), or companies with significant exposure to the agricultural sector). These are hypothetical examples; real-time data should be substituted here.

-

Analysis of the industries most affected: Technology, manufacturing, and export-oriented industries have been disproportionately affected due to their heavy reliance on international trade. Companies with significant exposure to the US or Chinese markets experienced particularly sharp declines.

-

Comparison to previous market reactions to trade war developments: This recent drop reflects a pattern seen in previous instances of trade war escalation. Past episodes have shown similar market volatility and negative impacts on specific sectors.

Analysis of Investor Sentiment

The market downturn reflects a shift in investor sentiment.

-

Increased volatility in trading activity: The uncertainty surrounding the trade war has led to increased volatility in the Amsterdam stock market, with sharp price swings becoming more common.

-

Shift in investor confidence and risk appetite: Investors are becoming more risk-averse, moving away from higher-risk investments and seeking safer alternatives.

-

Flight to safety assets (e.g., gold, government bonds): Investors are shifting their portfolios towards assets considered "safe havens," such as gold and government bonds, which are typically less susceptible to market fluctuations.

-

Predictions from market analysts and financial experts: Many market analysts predict continued volatility until greater clarity emerges regarding the future direction of trade policy.

Potential Long-Term Consequences for the Dutch Economy

The Amsterdam stock market downturn carries potential long-term consequences for the Dutch economy.

-

Potential impact on GDP growth: A prolonged period of market uncertainty and decreased investment could negatively impact GDP growth.

-

Effects on employment and consumer spending: Reduced business activity can lead to job losses and decreased consumer spending, potentially creating a negative feedback loop.

-

Government response and potential policy interventions: The Dutch government may implement fiscal or monetary policies to mitigate the negative effects of the downturn. These could include stimulus packages or measures to support affected industries.

-

Comparison to historical economic downturns related to trade disputes: Historical data on previous trade disputes can offer insights into the potential long-term economic effects of the current situation.

Strategies for Investors Navigating Market Volatility

Navigating the current market volatility requires careful planning and strategy.

-

Diversification strategies to mitigate risk: Diversifying investments across different asset classes and geographical regions can help reduce the impact of market fluctuations.

-

Importance of long-term investment planning: Maintaining a long-term investment perspective is crucial, avoiding impulsive reactions to short-term market swings.

-

Monitoring economic indicators and geopolitical developments: Staying informed about economic data and geopolitical events impacting the Amsterdam stock market and global trade is essential for making informed investment decisions.

-

Seeking advice from financial advisors: Consulting with a qualified financial advisor can provide personalized guidance and support in navigating market uncertainty.

Conclusion

The 7% drop in the Amsterdam stock market underscores the significant impact of the intensifying trade war on global and European economies. The decline highlights the interconnectedness of international markets and the crucial role of trade in economic stability. Specific sectors and companies within the Amsterdam exchange have been disproportionately affected, resulting in uncertainty for investors and potential longer-term economic ramifications for the Netherlands. The volatility of the Amsterdam stock market underlines the need for careful monitoring and strategic decision-making.

Call to Action: Stay informed about the developments in the Amsterdam stock market and the ongoing trade war to make informed decisions regarding your investments. Regularly monitor news and analysis surrounding the Amsterdam stock market to mitigate risks and seize opportunities. Understanding the complexities of the Amsterdam stock market and its vulnerability to global trade issues is crucial for navigating the current volatile climate.

Featured Posts

-

Frances Ruling Party Moves To Restrict Hijab Wearing Among Minors

May 25, 2025

Frances Ruling Party Moves To Restrict Hijab Wearing Among Minors

May 25, 2025 -

Your Escape To The Country Financial Considerations And Planning

May 25, 2025

Your Escape To The Country Financial Considerations And Planning

May 25, 2025 -

Kyle Walker Peters Transfer West Ham Makes Formal Bid

May 25, 2025

Kyle Walker Peters Transfer West Ham Makes Formal Bid

May 25, 2025 -

Kerings Financial Report Sales Down Guccis Demna Collection Coming In September

May 25, 2025

Kerings Financial Report Sales Down Guccis Demna Collection Coming In September

May 25, 2025 -

Elon Musks Return To Angry Persona Impact On Tesla

May 25, 2025

Elon Musks Return To Angry Persona Impact On Tesla

May 25, 2025

Latest Posts

-

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025 -

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025 -

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025 -

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025